Report Overview

Steel Market - Strategic Highlights

Steel Market Size:

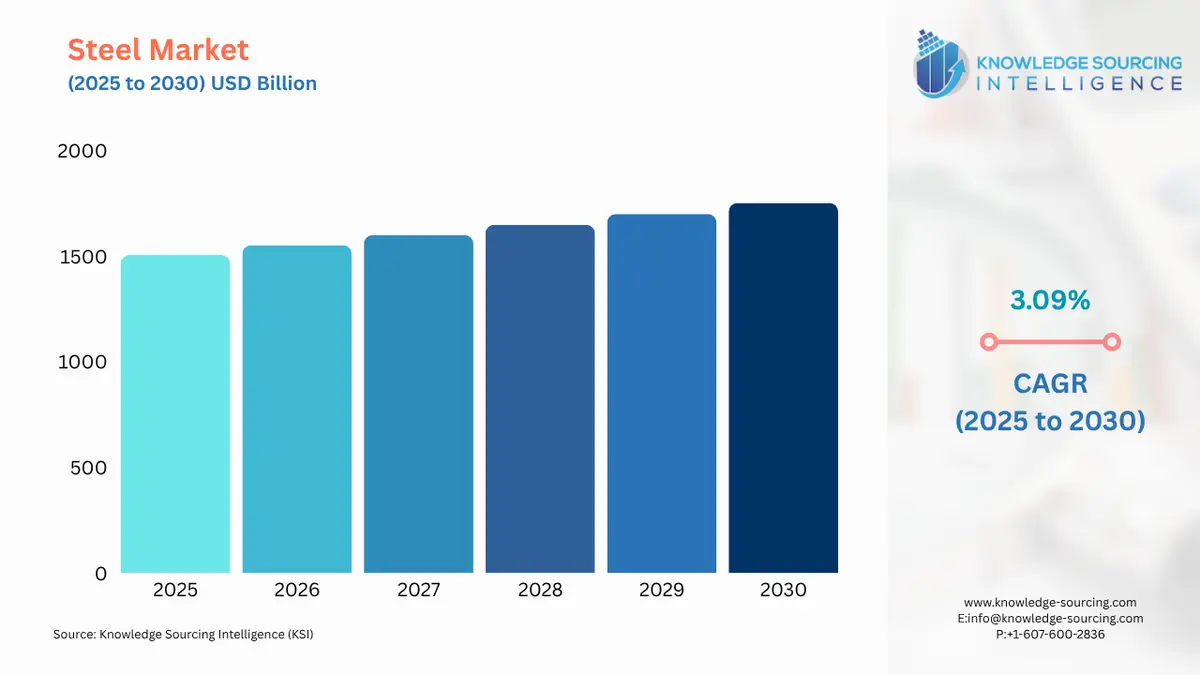

The Steel Market is expected to grow at a CAGR of 3.09%, reaching a market size of USD 1,752 billion in 2030 from USD 1,505 billion in 2025.

The steel market operates as a fundamental barometer of global industrial and economic health, its output an essential component across a spectrum of sectors from construction and automotive to consumer goods and energy. The market's trajectory is directly tied to macroeconomic forces, including urbanization, industrialization, and infrastructure development. Consequently, shifts in these underlying drivers translate to immediate impacts on steel consumption patterns. Recent years have seen the industry navigate a complex confluence of supply-side innovations, geopolitical trade tensions, and an increasingly urgent imperative for environmental sustainability, all of which are redefining the competitive landscape and strategic priorities of market participants.

Steel Market Analysis

- Growth Drivers

Infrastructure and construction industry growth serves as a primary catalyst for the steel market. Steel is an indispensable material for buildings, bridges, roads, and railways. Rapid urbanization in emerging economies fuels demand for residential and commercial structures, while modernization and reconstruction efforts in developed nations require high-performance steel products. According to the U.S. Geological Survey, the construction sector accounted for approximately 30% of net steel shipments, highlighting its substantial role in steel consumption. The expansion of industrial construction, including new factories and warehouses, further contributes to this upward demand trend.

The automotive sector's evolving landscape, driven by the increasing production of electric vehicles (EVs), also acts as a significant demand driver. While some lightweighting trends may reduce the per-vehicle steel requirement, the overall growth in global vehicle production, especially in Asia, and the specific needs for high-strength steel in EV battery casings and structures, counteract this. High-strength steel is crucial for enhancing the safety and structural integrity of modern vehicles, a demand amplified by more stringent crash safety standards globally.

- Challenges and Opportunities

The steel market confronts a series of persistent challenges, with price volatility of raw materials and geopolitical trade tensions presenting significant headwinds. Fluctuations in the cost of iron ore and coking coal, coupled with supply chain disruptions, directly impact production costs and compress profit margins for steel manufacturers. This unpredictability creates a complex procurement environment. Furthermore, a rise in protectionist trade policies, such as tariffs and quotas, constrains cross-border commerce, leading to localized oversupply in some regions and higher prices in others. This fragmented global market adds a layer of complexity for international players.

Amid these challenges, substantial opportunities are emerging, primarily centered on technological and environmental shifts. The global push for decarbonization and the transition to a low-carbon economy present a compelling opportunity for "green steel" and hydrogen-based production methods. Companies that invest in these advanced, cleaner technologies can secure a competitive advantage by meeting the demand from sustainability-conscious customers in sectors like automotive and construction. Additionally, the development of high-performance steel grades for specialized applications, such as wind turbines and advanced manufacturing, provides an avenue for growth and differentiation. The digital transformation of the supply chain, incorporating automation and data analytics, offers a pathway to improve operational efficiency and mitigate logistical complexities.

- Raw Material and Pricing Analysis

The pricing and supply dynamics of key raw materials are fundamental to the operational viability of the steel industry. Iron ore, as the primary input for blast furnace steelmaking, and coking coal, used to produce coke for the same process, dictate a significant portion of the final product's cost. The prices of these commodities are subject to a high degree of volatility, influenced by global mining production, inventory levels, and demand signals from the world's largest steel-producing countries, particularly China. This dependency on volatile commodity markets makes long-term strategic planning challenging for integrated steel mills.

The alternative production route, using electric arc furnaces (EAFs), relies predominantly on steel scrap as its primary raw material. The availability and price of scrap are also subject to market fluctuations, but the EAF route allows for a more flexible and environmentally friendly production process. The increasing global focus on sustainability is driving investments in EAF technology, which in turn elevates the demand for and value of high-quality steel scrap. This shift creates a bifurcated raw material market, where integrated producers are exposed to iron ore and coking coal price risks, while EAF-based producers navigate the dynamics of the global scrap market.

- Supply Chain Analysis

The global steel supply chain is a complex network spanning raw material extraction, primary production, and distribution to end-users. Key production hubs are concentrated in Asia, with China, India, and Japan leading the global output. These nations serve as the major sources for both semi-finished and finished steel products. The supply chain is characterized by a high degree of vertical integration among major producers, who often control mining operations for iron ore and coal. However, logistical complexities, including shipping costs, port congestion, and trade policy-induced bottlenecks, create significant vulnerabilities. The chain is highly dependent on global shipping routes and is susceptible to disruptions from geopolitical events or environmental disasters. End-users, such as automotive manufacturers and construction firms, often rely on a network of service centers and distributors to manage inventory and provide just-in-time delivery of finished steel products.

- Government Regulations

Government regulations are a critical force reshaping the steel market. These policies directly impact the demand for specific materials and production practices.

- European Union: Carbon Border Adjustment Mechanism (CBAM)

The CBAM imposes a carbon tariff on imported goods, including steel, to equalize the price of carbon between domestic products and imports. This regulation directly increases the cost of steel imported from jurisdictions with less stringent environmental policies, creating a competitive advantage for EU-based steel producers who are compliant with the bloc's carbon reduction targets. This fundamentally changes the economic calculus of steel trade, incentivizing global producers to decarbonize their operations to maintain market access to the EU. - United States: Section 232 Tariffs

Enacted under the Trade Expansion Act of 1962, these tariffs on steel imports are designed to protect domestic steel producers by increasing the price of foreign steel. This measure reduces the volume of steel imports, thereby stimulating domestic production and raising prices for U.S. steel consumers. The policy has a direct impact on demand for domestic steel but can lead to supply chain disruptions and higher costs for industries that rely on imported steel, such as manufacturing and construction. - India: Goods and Services Tax (GST) Rationalization

The rationalization of the GST regime on steel products aims to create a more uniform and efficient tax structure. This policy can reduce the cost of steel production and improve the competitiveness of Indian steel producers. By lowering the tax burden, it can stimulate domestic demand by making steel products more affordable for end-users, particularly in the secondary steel sector. It also serves to streamline the logistics and distribution of steel within the country.

Steel Market Segment Analysis

- By Application: Building & Construction

The building and construction sector represents the single largest application for steel, driving a significant portion of global demand. This segment's consumption is directly tied to urban and rural development, with demand generated by residential, commercial, and public infrastructure projects. Steel is integral to the structural framework of high-rise buildings, bridges, and tunnels due to its superior strength, durability, and high strength-to-weight ratio. The demand profile within this segment is highly influenced by government infrastructure spending, which acts as a powerful demand-side lever. The increasing global focus on sustainable and resilient infrastructure further propels the demand for high-strength, earthquake-resistant steel grades. Technological advancements in construction, such as pre-fabricated steel components, also streamline construction timelines and reduce on-site waste, driving a shift towards customized and value-added steel products.

- By End-User: Automotive

The automotive industry is a critical end-user of steel, consuming a diverse range of products from flat-rolled sheets for body panels to high-strength alloys for structural components. Demand from this sector is a direct function of global vehicle production volumes, consumer purchasing power, and evolving regulatory standards. As vehicle manufacturers strive to meet more stringent fuel efficiency and safety regulations, the demand for advanced high-strength steels (AHSS) and ultra-high-strength steels (UHSS) has intensified. These specialized steel grades enable lightweighting without compromising safety, which is a core imperative for both internal combustion engine (ICE) and electric vehicle (EV) platforms. The expansion of EV production, in particular, generates a specific demand for electrical steel for motors and high-strength steel for chassis and battery enclosures, which directly influences the product mix required from steel suppliers.

Steel Market Geographical Analysis

- US Market Analysis: The US steel market is characterized by a strong domestic production base and a strategic focus on tariffs and trade policy to safeguard its industry. The market is driven primarily by the construction and automotive sectors, with significant consumption also stemming from the energy and machinery industries. Government initiatives like the Bipartisan Infrastructure Law and the Inflation Reduction Act act as powerful catalysts, directly fueling demand for steel in public works projects, renewable energy infrastructure, and manufacturing. The market operates with a significant reliance on electric arc furnaces, which makes it less susceptible to the same iron ore price volatility as integrated producers, but more sensitive to the price of steel scrap. This structural characteristic influences the US market’s competitive dynamics and its demand for raw materials.

- Brazil Market Analysis: The Brazilian steel market is a linchpin of the South American industry, leveraging its vast natural resources, particularly iron ore. Its demand is largely influenced by domestic economic performance, which is cyclical and tied to investment in infrastructure and construction projects. Brazil is a net exporter of steel products, with its exports primarily destined for other South American nations and the United States. The demand profile is also shaped by the country’s significant agricultural and mining sectors, which require steel for machinery and equipment. The market faces domestic challenges, including logistical bottlenecks and a need for greater technological modernization to compete with global leaders.

- German Market Analysis: Germany's steel market is a cornerstone of the European industry, distinguished by its high-tech, quality-oriented production. This market is heavily concentrated in the country’s world-renowned automotive and machinery manufacturing sectors. As a key player in the European Green Deal, the German steel industry is at the forefront of the decarbonization movement, with significant investments in hydrogen-based direct reduced iron (DRI) and other low-carbon steelmaking technologies. This focus on sustainability and innovation creates a distinct demand for advanced, high-performance steel products. The market's expansion is highly sensitive to the health of the broader European economy and the competitive pressures from imported steel, particularly those from non-EU countries.

- South Africa Market Analysis: South Africa represents a significant portion of the Middle East & Africa steel market. The country's steel demand is intrinsically linked to its domestic mining, construction, and manufacturing sectors. Infrastructure development, particularly in rail and port logistics, serves as a crucial demand driver. The market, however, contends with challenges such as a fragmented domestic industry, rising energy costs, and an influx of low-priced imports, which suppress local demand and production. The need for steel is directly influenced by the government's ability to execute large-scale infrastructure projects and attract foreign direct investment into heavy industries.

- Chinese Market Analysis: China stands as the single most dominant force in the global steel market, acting as the world's largest producer and consumer. Its demand profile is directly correlated with its massive infrastructure build-out, real estate development, and manufacturing output. The government's economic policies, including stimulus packages and industrial planning, have an outsized impact on global steel demand and pricing. The country's steel industry is undergoing a significant transformation, driven by an imperative to rationalize capacity, address oversupply, and implement stringent environmental controls. This shift in policy and strategic focus will directly impact the volume and type of steel consumed, with a growing emphasis on higher-quality, specialized steels for high-tech manufacturing and green energy applications.

List of Top Automotive Logistics Companies:

The global steel market is dominated by a few large, multinational corporations that possess extensive production capacities, diverse product portfolios, and vertically integrated operations. The competitive landscape is defined by a fierce rivalry for market share, driven by price, product quality, and geographical presence. Companies are increasingly differentiating themselves through technological innovation, particularly in low-carbon steel production, and strategic partnerships to secure raw materials and expand their market reach.

- ArcelorMittal: ArcelorMittal is one of the world's leading steel and mining companies, with a global footprint and a diverse product portfolio. The company's strategy is centered on geographical diversification, operational excellence, and a commitment to decarbonization. ArcelorMittal produces a wide array of steel products, including flat steel for the automotive, construction, and appliance sectors, and long steel for the construction and infrastructure industries. A core element of its strategic positioning is its XCarb brand, which encompasses low-carbon products, green steel, and an innovation fund. This initiative directly responds to the demand from customers seeking to reduce their supply chain's carbon footprint. The company's integrated operations, spanning from mining to distribution, provide a significant cost advantage and supply chain resilience.

- Nippon Steel Corporation: As a premier Japanese steel producer, Nippon Steel is renowned for its high-quality, high-performance steel products. The company's strategic focus is on developing advanced materials for demanding applications in the automotive, energy, and infrastructure sectors. Nippon Steel has invested heavily in research and development to create specialized steels, such as ultra-high-tensile steel sheets for lightweighting in automobiles and high-grade electrical steel for motors. Its global strategy involves both domestic capacity rationalization and strategic international partnerships to access new markets and technologies. The company is actively pursuing carbon-neutral steelmaking through the development of technologies like hydrogen-based steel production.

- POSCO: POSCO, a South Korean steelmaker, maintains its competitive edge through continuous technological innovation and a strong focus on high-value products. The company is a global leader in producing advanced materials, including GIGA Steel for automotive applications and electrical steel for transformers and motors. POSCO’s long-term strategy, termed "POSCO the Great Transformation," is centered on becoming a leader in the hydrogen and battery materials sectors. This involves developing hydrogen-based direct reduced iron technology and expanding its presence in the production of anode and cathode materials for EV batteries. This strategic pivot directly addresses the evolving demands of the energy and automotive industries, positioning POSCO for growth in emerging, high-margin segments.

Steel Market Developments

- August 2025: POSCO Future M made its first shipment of supply chain-independent cathode materials to the United States. This development signifies a strategic move to capitalize on the growing demand for electric vehicle battery materials and to strengthen its global supply chain, diversifying its business beyond traditional steel production.

- June 2025: Nippon Steel and U.S. Steel finalized a historic partnership. This strategic move aims to combine their expertise and resources to enhance their competitive position in the global market, particularly in the United States. The partnership is a direct response to global market dynamics, including trade regulations and the need for operational synergy.

- May 2025: Nippon Steel announced its decision to invest in the conversion from the blast furnace steelmaking process to the electric arc furnace (EAF) steelmaking process. The project was selected for a government support program based on Japan's GX Promotion Act. This development reflects the company's commitment to decarbonization and positions it to meet future demand for lower-carbon steel products.

Steel Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Steel Market Size in 2025 | USD 1,505 billion |

| Steel Market Size in 2030 | USD 1,752 billion |

| Growth Rate | CAGR of 3.09% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Steel Market |

|

| Customization Scope | Free report customization with purchase |

Steel Market Segmentation:

- By Product

- Flat Steel

- Coated Steel

- Sheet Steel

- Plates

- Long Steel

- Rebars

- Wire Rods

- Sections

- Others

- Tubes

- Pipes

- Others

- Flat Steel

- By Application

- Building & Construction

- Automotive

- Mechanical Equipment

- Home Appliances

- Others

- By End-User

- Automotive

- Construction

- Manufacturing

- Oil & Gas

- Others

- By Manufacturing Process

- Basic Oxygen Furnace (BOF)

- Electric Arc Furnace (EAF)

- Others

- By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

- North America

Our Best-Performing Industry Reports:

Navigation:

- Steel Market Size:

- Steel Market Key Highlights:

- Steel Market Analysis

- Steel Market Segment Analysis

- Steel Market Geographical Analysis

- List of Top Automotive Logistics Companies:

- Steel Market Developments

- Steel Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 19, 2025