Report Overview

Sweden Plant Protein Market Highlights

Sweden Plant Protein Market Size:

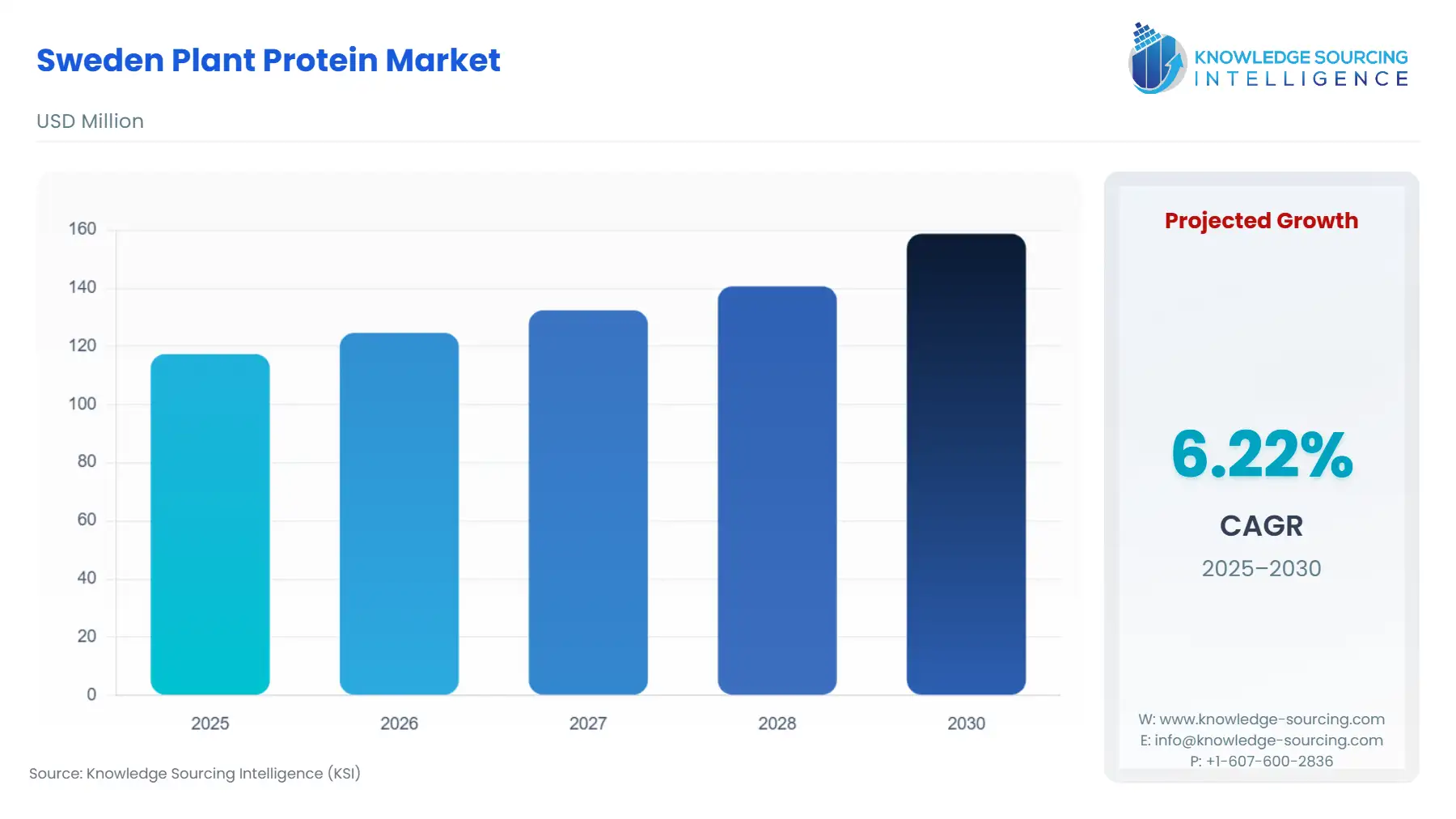

The Sweden Plant Protein Market is projected to grow at a CAGR of 6.22% over the forecast period, increasing from US$117.367 million in 2025 to US$158.724 million by 2030.

Sweden Plant Protein Market Introduction:

The growing number of lactose-intolerant consumers, combined with the diversification of dietary preferences facilitated by increased awareness of the health benefits of a vegan diet, is expected to boost the plant-based alternative segment, thereby fueling the Swedish plant protein market. Furthermore, due to the rising perception of the environmental implications associated with traditional milk production, particularly that of greenhouse-gas emissions and other ramifications like soil acidification, is projected to emerge as one of the key contributors towards bolstering the plant protein segment due to incremental demand for plant-based food and beverages. Furthermore, the increasing awareness of various international culinary preparations has also led consumers to be influenced by innovations like that of plant-based meat alternatives that comprise ingredients like a variety of proteins derived from plants.

The competitive strategies adopted by key players to improve their revenue generation opportunities are further expected to drive the market in Sweden. For example, to help speed the growth of the meat-free product sector, Birds Eye is utilizing its history with peas and its dominant position in the frozen food industry. With a growing trend away from the traditional sources of protein, plant proteins have become an incredibly popular source of protein. As a result, different businesses in the food and beverage industry are selling their goods while also attempting to connect with the values of today's value-driven consumers, who are becoming more prevalent.

Plant proteins have emerged as an extremely popular source of protein that is increasingly being marked by a shift from the traditional sources of protein. Thus, various players in the food and beverage segment are marketing their products and simultaneously endeavoring to resonate with the ethos of the current value-driven consumers who are increasingly taking up the market share and creating more opportunities for both legacy companies and startups to venture into the plant-based protein space. Further, due to a myriad of sources from which plant protein can be derived, allowing more space for players to make investments in the plethora of applications in which plant-based proteins could be utilized.

Sweden Plant Protein Market Overview

Report Metric

Details

Study Period

2021 to 2031

Historical Data

2021 to 2024

Base Year

2025

Forecast Period

2026 – 2031

:

This market trades in products derived from plants. It offers plant-based meat alternatives that closely resonate with the taste, texture, and nutritional profile of traditional meat products using soy, peas, wheat, or mycoprotein. As plant-based protein products become more widely used and categories rise, providing adequate product shelf-life and quality becomes increasingly important.

The Swedish plant protein market is booming due to the increased awareness of its health benefits, interest in gut health, and rising lactose intolerances. The rising disposable income among Swedish consumers gives them more discretionary spending power to go for plant-based proteins. According to Statistics Sweden, income increased in 2022 for the female population aged 20 to 64 years (28,53,580) and the male population of the same age (29,80,260). Premiumization of products is also a factor since consumers are willing to spend more on high-quality organic and sustainable plant-based protein products.

Sweden further announced an investment of SEK 1.2 billion into a Lidköping plant for manufacturing plant-based protein in September 2024, which became the country’s largest investment in this industry. The percentage of peas and faba beans processed will account for 35,000 tons of peas and 5,000 tons of faba beans, respectively. The objective is to upgrade and boost the Swedish pea growth figure by fifty percent from the current 80000 tons to about 120000 tons. Construction is scheduled to be completed in the first half of 2027. The plant is mainly found in vegetarian food and drinks, sports drinks, gluten-free noodles, and bakery items.

List of Top Sweden Plant Protein Companies:

Some of the major companies include ADM, Cargill, Corbion NV, and Cosucra Groupe Warcoing S.A.

- Established in 1902, Archer-Daniels-Midland Company (ADM) is an internationally known company in agricultural processing and food ingredient solutions. ADM provides different forms of plant-based protein that food manufacturers may use.

- Cargill is a leading player in the plant-based protein market, catering to the growing demand for healthier and more sustainable alternatives.

- Corbion NV is a global leader in sustainable solutions and a key player in food, home & personal care, and pharmaceuticals with innovative ingredients and solutions to improve the quality, safety, and shelf life of plant-based protein products.

Sweden Plant Protein Market Drivers:

- Increasing demand for plant-based diets

The growing interest in plant-protein-based eating and diets leads to the market expansion of plant proteins in Sweden. These are associated with reducing chronic disease risks such as heart disease, diabetes, and obesity. As per the Diabetes Atlas, there was an increase in cases of diabetes from 496.2 thousand people in 2021 to 498.9 thousand people in 2030. In addition, along with better digestive health due to fiber content, effective weight management because of low-calorie, low-saturated fats will propel market growth.

Moreover, manufacturers in Sweden are aligning with consumers' demand for plant protein-based products. They are coming up with innovations to improve the taste, texture, and other needs of the buyers in the country. This versatility drives innovation in Sweden, with brands launching new pea-based offerings constantly. For instance, in September 2022, Peas of Heaven teamed up with Mycorena to unveil four new frozen products in the Swedish market. The products include recipes and pea protein by both companies, known as Promyc. The two brands earlier worked together to produce The Converter, a vegan sausage product that made use of the pea protein/mycoprotein blend within the ingredients.

Sweden Plant Protein Market Segmentation Analysis:

- The food & beverage sector is predicted to hold a large market share

The Swedish plant protein market is segmented by application into dietary supplements, food and beverages, pharmaceuticals, and animal feed. Sweden is experiencing growth in food and beverage imports, which further impacts the growth of plant protein in the region. In this regard, the International Trade Association stated that the imports of sauces and condiments in 2022 in Sweden were US$1,93,257 thousand. Meanwhile, pet food and non-alcoholic beverages were US$2,72,817 thousand and US$1,61,564 thousand, respectively.

Moreover, as per Statistics Sweden, in 2022, total sales of food and beverages amounted to SEK 356 billion. This is a rise of approximately SEK 22 billion, or 6.6 percent compared with 2021. In fixed prices, the sales of sweets increased to SEK 107 per capita compared with 2021.

Alongside this, the companies are developing products that closely mimic traditional animal-based foods in terms of taste, texture, and nutritional profile. New products are coming into the market, and a vibrant plant-based food industry is growing in Sweden, where many startups and established companies are launching innovative plant-based food products. In this regard, in September 2024, Lantmännen invested SEK 1.2 billion in protein plants, a unique investment in Swedish food production. The new plant mainly produced plant-based proteins from peas. About 35,000 tonnes of peas and about 5,000 tonnes of faba beans will be processed each year in the plant, and a total of 7,000 tonnes of concentrated plant-based protein, or so-called protein isolate, will be produced annually.

Moreover, PAN Sweden Research Centre, a joint initiative involving the coordination role of Örebro University, is researching the health effects and sensory properties of plant-based proteins to support the transition to a more sustainable food system. Comprehensively, the future of plant-based protein in Sweden is anticipated to be influential as awareness and demand for sustainable and ethical food choices increasingly arise among consumers.

Sweden Plant Protein Market Recent Developments:

- In 2024, ADM invested SEK 1.2 billion in a new plant for plant-based protein in Lidkoping, which is regarded as the largest investment of its kind in Sweden for food production.

The Nordic region's greatest investment in alternative protein was made by the Swedish company Mycorena in its €24 million Series A funding round, which was successful, according to a March 2022 press release. A patentable plant protein invention shall benefit from the rise as it moves from the conception phase to the point of commercial distribution.

List of Top Sweden Plant Protein Companies:

- ADM

- Cargill

- Corbion NV

- Cosucra Groupe Warcoing S. A.

- DuPont de Nemours, Inc.

Sweden Plant Protein Market Scope:

| Report Metric | Details |

| Sweden Plant Protein Market Size in 2025 | US$117.367 million |

| Sweden Plant Protein Market Size in 2030 | US$158.724 million |

| Growth Rate | CAGR of 6.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| List of Major Companies in the Sweden Plant Protein Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation

- By Source

- Pea

- Rapeseed

- Soy

- Hempseed

- Others

- By Form

- Protein Concentrates

- Protein Isolates

- Protein Hydrolysate

- By Application

- Dietary Supplement

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- By Distribution Channel

- Online

- Offline