Report Overview

Swine Feed Additives Market Highlights

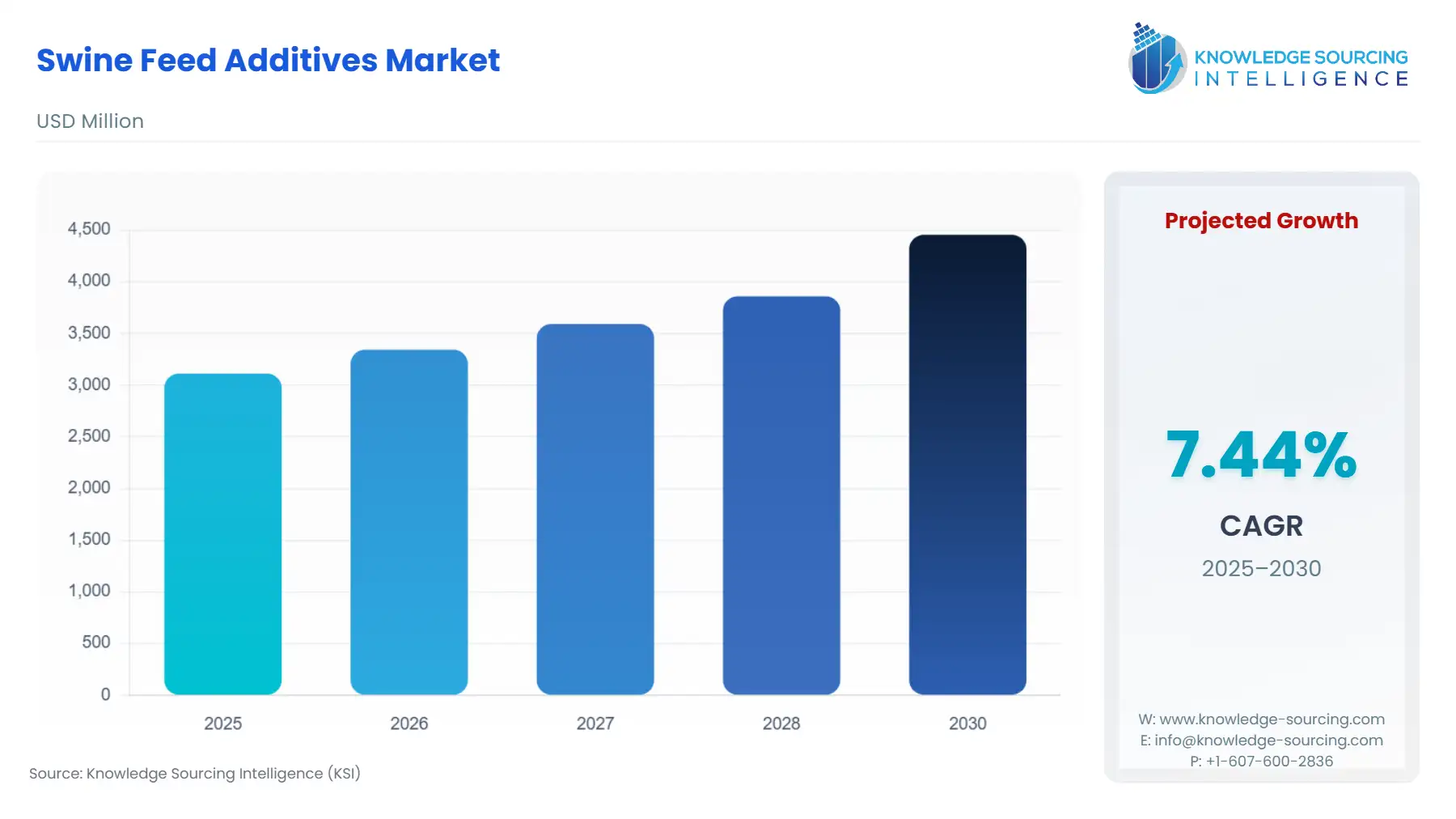

Swine Feed Additives Market Size:

The Swine Feed Additives Market is expected to grow from US$3,111.877 million in 2025 to US$4,455.048 million in 2030, at a CAGR of 7.44%.

The swine feed additives market is undergoing a structural transformation driven by the intersection of rigorous regulatory frameworks, geopolitical supply chain shifts, and a heightening focus on precision animal health. As global pork production adapts to fluctuating inventory levels, particularly in China, where sow numbers stabilized by late 2024, the demand for additives has shifted from basic nutritional supplementation to functional performance enhancement. This evolution is necessitated by a global move to reduce antibiotic inputs, replacing them with a complex array of acidifiers, enzymes, and phytogenic compounds that support gut integrity and immune resilience without leaving chemical residues.

The market environment is characterized by "Ecosystem-based Competition," where additive manufacturers no longer provide standalone products but integrated digital and nutritional solutions. Precision manufacturing techniques, such as microencapsulation, are now standard for high-end vitamins and acidifiers to ensure targeted delivery in the swine gastrointestinal tract. Furthermore, the 2025 market is defined by a "zero-emission" imperative, as producers like Perstorp and Evonik achieve Scope 1 and 2 emission reductions at their production sites, aligning additive supply chains with the sustainability mandates of large-scale European and North American retail chains.

Swine Feed Additives Market Overview:

The market is expected to grow steadily. In the U.S., the removal of routine antibiotic growth promoters and the initiation of the Veterinary Feed Directive have drastically affected user applicability of feed additives by necessitating the adoption of alternatives, such as probiotics, enzymes, acidifiers, and mycotoxin mitigation options that are under veterinary supervision. The changing pricing of corn and soybean meal will continue to be the primary controller of feed formulation economics, and monthly USDA World Agricultural Supply and Demand Estimates will continue to be consulted by producers before selecting inclusion rates of feed additives.

Many co-products, such as distillers’ dried grains (DDGS), also exert influence on ration consideration. The variability of co-products will affect inclusion rates based on availability and pricing for alternative energy and protein sources. Logistics and transportation complexity can impact supply availability, as indicated in USDA AMS reports regarding grain transportation. Constraints by rail, barge, or truck can modify flows of feed ingredient options and their subsequent demand. The disease is also a factor, with the USDA APHIS providing surveillance and emergency preparedness and response resources to protect the national herd from African Swine Fever and related transboundary diseases, increasing the observance of additives mentioned to support immune function and biosecurity.

The market is consolidating as well, with large integrators and feed manufacturers increasingly dominating supply chains, traceability, and quality. They raise barriers to entry but establish a stable landscape for additive suppliers with compliant, documented performance. USDA ERS feed outlooks explain trends in feed demand across the swine sector, providing additive manufacturers with insights to align production, along with expected consumption. Technological advances, as seen with precision nutrition tools, targeted enzymes, and datalogging feed programs, currently offer greater efficiencies of use and return on investment, justifying the higher inclusion costs for producers. Compliance with FDA ingredient approval pathways, as well as residue monitoring requirements, directly correlates with access to domestic and export markets, especially as buyers increasingly demand verified quality, safety, and sustainability.

Supply chain reliability for swine feed additives will depend on a steady supply of raw inputs, such as corn and soybean meal, and specialty ingredients such as vitamins or enzymes. Corn and soybean meal costs have been lower than their long-run averages in early–mid 2025, alleviating perhaps the largest cost pressure for feed formulators. Logistics disruptions - rail, port congestion, and distance from processing centres - continue to be a risk, particularly for the use of imported additive compounds or vitamins. The U.S. animal feed industry is also reliant on vitamin imports from China; about 78% of the inputs for vitamins in feeds come from China, exposing it to possible problems in trade or supply.

The quantity of hog inventory directly correlates with total feed consumption in the U.S.; this is the primary driver of the feed additives market. On levels stable or slightly increasing in 2023–2024, this suggests consistent demand for particular feed formulations and the associated additives - probiotics, enzymes, and acidifiers- and this is positive, supporting market growth because producers prioritize herd health and productivity, especially under a tighter veterinary oversight environment and disease-prevention measures. When inventories increase, it encourages integrators and feed manufacturers to be consistent with purchasing additive products to optimize feed conversion ratios and minimize production losses, respectively, positively impacting product sales and encouraging the industry to innovate within the swine feed additives space.

Swine Feed Additives Market Trends:

Soybean, organic corn, and wheat are used to make swine feed additives. To address the nutritional needs of pigs, they are also enriched with amino acids, vital fatty acids, enzymes, and vitamins. There are now a number of pellet and mash swine feeds on the market that are developed to improve performance targets and overall health. In addition, a wide range of swine feed additives includes proteins manufactured from organic plant sources and naturally occurring fungal-based enzymes that facilitate the digestion of the feed's various components. Additionally, producers continuously explore novel feed components and feed formulae to provide cutting-edge swine feed additives. Further, sales of swine feed are significantly impacted by the rising pig meat demand worldwide.

One of the key factors propelling the expansion of the market for swine feed additives is the emergence of illnesses in pigs. Additionally, businesses in the livestock industry and meat producers are being urged to employ probiotics due to the increased awareness and increasing need for animal nutrition, which is predicted to boost the market worldwide. Additionally, the demand and consumption of pig meat by consumers are predicted to increase with the expansion in the world's population, which is further increasing the population of animals. In addition, food quality control has emerged as a crucial issue for many countries worldwide, particularly in North America and Europe. For instance, the European Food Safety Authority (EFSA) and the US Food and Drug Administration (FDA) both place tight regulations on the quality of meat, paving the way for improvements that would fuel the market for these feed additives. Every country's and animal group's livestock output has increased to meet the demands of the population's shifting dietary habits, particularly in developing markets. While many farmers in developing nations like India and China continue to operate on a small, marginal scale, the livestock industry is becoming more industrialized on the global market, notably in the Asia-Pacific region.

Swine Feed Additives Market Analysis

Growth Drivers

The primary driver of the swine feed additives market is the global imperative for antibiotic reduction, reinforced by the 2025 EU AI Act's tangential influence on data-driven livestock monitoring and health tracking. As regulatory bodies enforce stricter maximum residue limits (MRLs), demand for natural growth promoters, such as probiotics and essential oils, has surged. Furthermore, surging raw material costs for corn and soy have created a direct demand for feed enzymes and amino acids. These additives serve as catalysts for precision nutrition, allowing swine producers to optimize Feed Conversion Ratios (FCR) and reduce the quantity of high-cost bulk feed required. The ability to use lower-grade grains without compromising animal growth has made these additives indispensable for maintaining farm profitability.

Challenges and Opportunities

Raw material price volatility remains a significant headwind, with amino acid and vitamin prices experiencing hikes in 2025 due to supply constraints in Europe and Asia. These cost pressures are exacerbated by lengthy and complex regulatory approval processes in the European Union, which increase time-to-market for innovative enzymes and probiotics. However, these challenges present a major opportunity in the biosecurity segment. The antiviral efficacy of organic acid blends against African Swine Fever (ASF) in feed has opened a new market for pathogen-control additives. Producers who can demonstrate "Safe Feed" certifications gain a competitive edge in export-heavy regions like Brazil and Spain, where safeguarding the swine population from transboundary diseases is a national economic priority.

Raw Material and Pricing Analysis

The pricing of swine feed additives is heavily influenced by the cost of essential chemical precursors and energy. Synthetic amino acids like MetAMINO® have faced price upward pressure due to fluctuating natural gas prices in European production hubs. Similarly, the vitamin segment saw a period of force majeure in 2025 for Vitamin E-Acetate, though production restarted in 2025, stabilizing supply but at a higher price floor. In the Asia-Pacific region, corn prices reached approximately USD 293 per metric ton in early 2025, while soybean meal hovered at USD 630 per metric ton. These spikes in base feed ingredients have made high-purity, microencapsulated additives more attractive, as they provide a higher return on investment through improved nutrient bioavailability compared to bulk, unprotected supplements.

Supply Chain Analysis

The swine feed additive supply chain is increasingly concentrated in specialized regional hubs, with Singapore, Antwerp, and China serving as critical production centers for amino acids and vitamins. In 2025, logistical complexities have been compounded by tariff-induced cost uncertainties and shifts in global trade agreements. For instance, DSM-Firmenich’s 2025 inauguration of a specialized mycotoxin solutions plant in India was a strategic move to cut delivery lead times to the regional market by five days. Dependencies on just-in-time delivery for liquid methionine and other temperature-sensitive additives require robust cold-chain infrastructure, which remains a constraint in emerging markets. To mitigate these risks, industry leaders are investing in in-country capacity expansions and vertical integration to secure the "last mile" of additive delivery to large-scale integrators.

Government Regulations

Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

European Union | EFSA FEEDAP Panel (2024-2025) | Updated Risk Assessment: Implementation of new guidance for nano-related additives and environmental safety, increasing the data requirements for product re-authorizations. |

United States | FDA / Kemin (June 2024) | Calcium Formate Approval: Formal approval of calcium formate as a feed acidifier in the U.S. has opened a new market for non-antibiotic pathogen control in swine diets. |

Brazil | Complementary Law 214/2025 | Tax Exemptions: Zeroing of taxes on pork and animal-origin products (except foie gras) stimulates domestic production, thereby increasing the total addressable market for feed additives. |

Swine Feed Additives Market Segment Analysis:

By Type: Amino Acids

Amino acids represent the most critical segment of the swine feed additives market due to their role as the "building blocks" of muscle development and their ability to reduce nitrogen excretion. The industry’s shift toward Low Protein Diets (LPD) drives the demand for L-Lysine, DL-Methionine, and L-Threonine. By supplementing precisely with amino acids, Swedish and German swine producers can reduce the total crude protein in the diet (often sourced from expensive soybean meal), which directly lowers ammonia emissions in farrowing and finishing houses. This segment is dominated by synthetic sources due to their high purity and consistent quality, which is essential for the automated, computer-controlled feeding systems used in modern swine operations. In 2025, manufacturers like Evonik have optimized their production setups in Singapore and Antwerp to meet the growing demand for MetAMINO®, utilizing new paper packaging to reduce carbon footprints, aligning with the "Sustainability as a Service" trend demanded by large-scale pork integrators.

By Application: Grower Feed

The grower feed segment accounts for the largest share of the application market, as this stage represents the longest phase of the swine production cycle and the period of highest weight gain. This segment’s demand is focused on optimizing the Feed Conversion Ratio (FCR). Growing pigs require high-density diets fortified with enzymes (like Xylanases and Phytases) to unlock nutrients from fibrous feed materials and phosphorus from plant phytate. The necessity is specifically driven by the need for skeletal integrity and muscle deposition during the rapid growth phase. Furthermore, the integration of mycotoxin binders is critical in grower feed, as toxins like deoxynivalenol (DON) can significantly impair growth performance and immune function in adolescent pigs. As global pork production shifts toward larger, more professionalized operations, the procurement of specialized "grower-finisher" additive blends, such as Cargill’s Aromex™, has increased to ensure consistent market weight and meat quality across entire herds.

Swine Feed Additives Market Geographical Analysis:

US Market Analysis

The United States market is characterized by a highly consolidated swine industry that prioritizes operational efficiency and large-scale throughput. The US market is currently driven by the transition toward "Responsible Antibiotic Use" frameworks, which have led to a surge in the adoption of phytogenic feed additives and yeast-based derivatives. The USDA’s focus on the U.S. Swine Health Improvement Plan (SHIP) reinforces the need for additives that support robust biosecurity and animal resilience. Furthermore, the integration of precision livestock farming (PLF) allows US producers to use real-time data to adjust additive concentrations, favoring suppliers who offer digital formulation support alongside physical products.

Brazil Market Analysis

As one of the world's leading pork exporters, Brazil's demand for feed additives is heavily influenced by international trade requirements and the cost of local raw materials. The Brazilian market is a major consumer of amino acids and vitamins to support its vast "Grower" and "Finisher" populations. Recent trends show an increased demand for additives that address environmental sustainability, specifically nitrogen and phosphorus management, to comply with the ESG (Environmental, Social, and Governance) requirements of European importers. In October 2024, the opening of new production facilities in regions like Minas Gerais highlights a shift toward localizing the supply of cattle and swine supplements to reduce reliance on imports.

Germany Market Analysis

Germany sits at the center of the European regulatory landscape, where animal welfare and environmental protection are the primary drivers of market demand. The German market has seen a sharp decline in the use of traditional minerals in favor of highly bioavailable organic trace minerals to meet strict soil protection laws. Following the 2024 Zinc Oxide ban, German producers have pioneered the use of "synergistic" additive blends, combining medium-chain fatty acids with specific probiotics, to maintain piglet health. This necessity is also rising for additives that improve air quality within barns by reducing ammonia emissions, directly responding to national "Clean Air" initiatives.

China Market Analysis

China remains the world's largest consumer of swine feed additives, with demand patterns currently shaped by the recovery and restructuring of the industry following ASF outbreaks. The Ministry of Agriculture's 2024-2025 policies emphasize the approval of "New Feed Additives" that utilize biotechnology to replace traditional chemicals. This has spurred demand for fermented products and enzyme-treated soy proteins. The Chinese market is also seeing a rapid professionalization of "backyard" farms into large-scale industrial units, which creates a massive demand for standardized, high-quality premixes and vitamins that can ensure uniform growth across millions of heads.

South Africa Market Analysis

The South African swine sector is focused on mitigating the impact of high feed ingredient costs through the use of specialized enzymes. As the regional hub for sub-Saharan Africa, South Africa’s demand is driven by a need for additives that can handle "non-conventional" feed ingredients like sorghum and sunflower meal. The market is also increasingly sensitive to biosecurity-enhancing additives as the industry seeks to protect its export status. The need for mold inhibitors and mycotoxin binders is particularly high due to the climatic conditions that can affect grain storage quality, making these additives essential for maintaining herd health and productivity.

Swine Feed Additives Market Competitive Environment and Analysis

The competitive landscape is defined by a shift toward specialization and strategic divestment, as companies seek to insulate themselves from commodity-like price fluctuations in the base vitamin and mineral markets.

Cargill, Incorporated

Cargill has positioned itself as a leader in micronutrition and microbiome science. Its strategic focus in 2025 revolves around its "Microverse" approach, which utilizes digital tools like Galleon™ and Panorama™ to navigate animal health challenges through a deep understanding of the gut microbiome. Cargill’s acquisition of Mig-Plus in Brazil signifies a major expansion into South America's burgeoning swine sector, allowing it to deliver more robust, localized solutions. The company’s portfolio, including the Dia-V™ and Enzae™ lines, emphasizes phytogenic-based additives and high-performance enzymes. By combining postbiotics with essential oil compounds, Cargill targets the demand for immune-supportive, non-antibiotic solutions that optimize health during critical transition periods, such as weaning and farrowing.

BASF SE

BASF SE has pursued a strategy of selective excellence and portfolio optimization. The company’s decision in 2025 to sell its global glycinate business to Biochem and its ongoing evaluation of its feed enzyme division reflect a move away from lower-margin segments toward highly specialized formulations. BASF’s 2025 return to the Vitamin A and D3 market with the Lutavit® A/D3 1000/200 NXT, a next-generation microencapsulated formulation, highlights its commitment to high-performance, sustainable product design. This product combines convenience with improved stability, directly addressing the demand for additives that maintain potency through the pelleting process. BASF's strategy leverages its "Nuvio Planet" platform to provide environmental footprinting, helping swine producers calculate the CO2 reduction achieved by using their high-efficiency enzymes and vitamins.

dsm-firmenich

dsm-firmenich has established itself as the pioneer of "Precision Biotics" and sustainability services. Following its recent unveiling of major plant investments in India and the U.S., the company has focused on mycotoxin management and microbiome metabolism modulators. The launch of its Sustell™ service for aquaculture and its expansion into swine indicate a move toward data-centric consulting. In the swine market, dsm-firmenich’s strategy focuses on replacing traditional antibiotic inputs with solutions like Symphiome™, designed to orchestrate microbiome metabolism for better growth and welfare. The company’s 2025 focus also includes the update of its OVN Optimum Vitamin Nutrition® guidelines, which assist farmers in complying with new sustainable farming practices while ensuring optimal animal welfare through high-quality, low-footprint vitamin supplementation.

Swine Feed Additives Market Developments:

September 2025: China’s Ministry of Agriculture and Rural Affairs approved new imported feed additive registrations, including additives suitable for swine and livestock nutrition.

September 2025: ADM and Alltech signed a definitive agreement to create a North American animal feed joint venture combining their feed mill operations.

July 2025: Feed & Additive industry media reported that Layn’s water-soluble polyphenol swine feed additives will be showcased and promoted to expand adoption in global animal nutrition.

March 2025: Kemin Industries introduced PROSIDIUM™, a novel antimicrobial feed additive designed to improve biosecurity for swine and poultry by reducing pathogen risks.

January 2025: Layn Natural Ingredients launched a new line of water-soluble polyphenol feed additives for swine, enhancing health through drinking-water delivery.

Swine Feed Additives Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 3,111.877 million |

| Total Market Size in 2030 | USD 4,455.048 million |

| Forecast Unit | Million |

| Growth Rate | 7.44% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Type, Source, Application, Form |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Swine Feed Additives Market Segmentation:

By Type

Vitamins

Enzymes

Binders

Acidifiers

Minerals

Amino Acids

Others

By Source

Synthetic

Natural

By Application

Starter Feed

Grower Feed

Finisher Feed

By Form

Crumbles

Mash

Pellets

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Australia

Indonesia

Thailand

Others