Report Overview

Synthetic Lubricants Market - Highlights

Synthetic Lubricants Market Size:

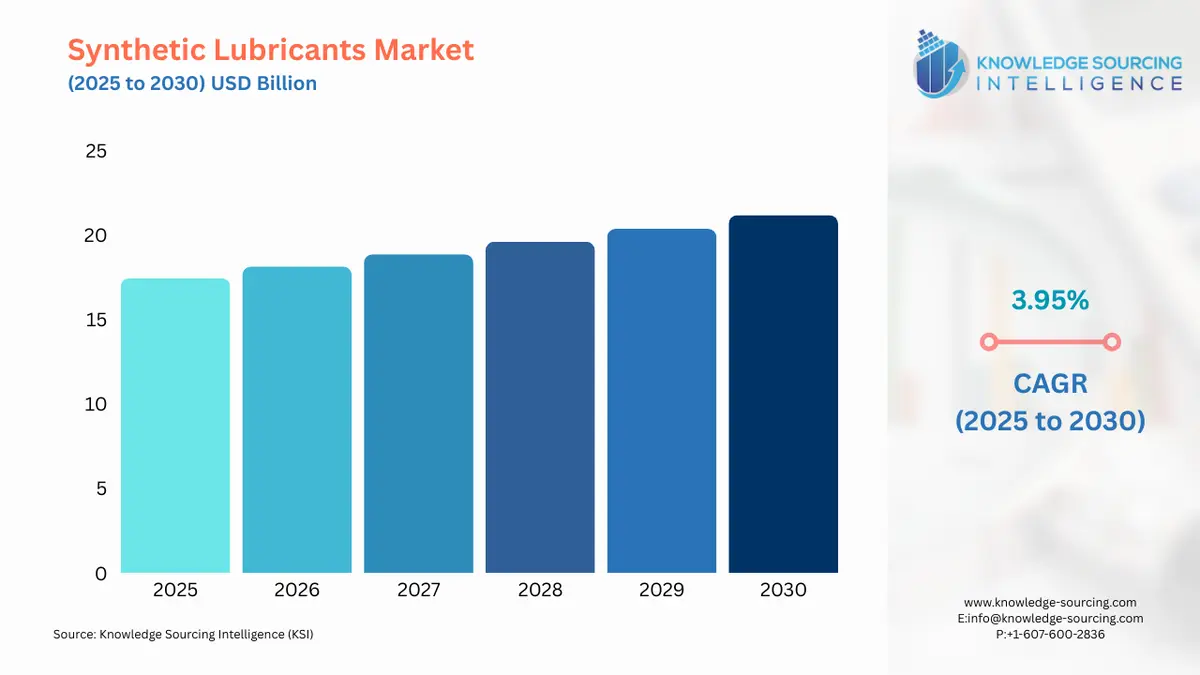

The Synthetic Lubricants Market is expected to grow at a CAGR of 3.95%, reaching USD 21.177 billion in 2030 from USD 17.450 billion in 2025.

The synthetic lubricants market operates at the nexus of technological innovation and evolving industrial requirements. Unlike conventional mineral oils, which are refined from crude oil, synthetic lubricants are engineered compounds that possess a controlled molecular structure, enabling them to perform reliably under extreme temperatures, high pressures, and prolonged operating conditions. This structural advantage translates directly into benefits for end-users, including enhanced fuel efficiency, extended equipment life, and reduced maintenance intervals. The market's trajectory is intrinsically linked to the performance demands of modern machinery and the imperative for sustainability across sectors, from automotive to heavy industrial applications.

Synthetic Lubricants Market Analysis

- Growth Drivers:

Technological advancements in engine and machinery design represent a fundamental driver propelling the demand for synthetic lubricants. Modern engines, particularly those in the automotive and aerospace sectors, operate at higher temperatures and with tighter tolerances than their predecessors. These conditions create an environment where conventional mineral oils degrade more rapidly, leading to increased friction and wear. Synthetic lubricants, with their inherent thermal stability and oxidation resistance, directly address this performance gap. For example, the development of smaller, turbocharged engines in passenger vehicles to improve fuel economy necessitates lubricants that can withstand the intense heat and stress of forced induction systems, thereby generating specific demand for synthetic engine oils. Similarly, in the industrial sector, the operation of high-speed bearings and sophisticated hydraulic systems requires a lubricant that maintains its viscosity and protective properties under continuous load, a characteristic that synthetics consistently deliver. This technological evolution effectively makes synthetic lubricants a performance imperative rather than a mere alternative.

The increasing emphasis on fuel efficiency and emissions reduction acts as another powerful catalyst for market growth. Governments and regulatory bodies worldwide are implementing stricter mandates for lower carbon emissions and higher fuel economy standards for vehicles and industrial equipment. This regulatory pressure compels manufacturers to seek every possible efficiency gain. Synthetic lubricants contribute to this objective by reducing internal friction within mechanical systems. This lower friction translates to less energy loss, directly improving fuel economy in vehicles and reducing power consumption in industrial machinery. The demand for synthetic products is therefore not only a function of performance but also a compliance-driven requirement, as they provide a verifiable means for companies to meet mandated efficiency targets and contribute to broader sustainability goals.

- Challenges and Opportunities:

The primary challenge facing the synthetic lubricants market is its higher production cost and associated premium pricing relative to mineral oil-based alternatives. This cost disparity can act as a significant barrier to adoption, particularly in price-sensitive emerging markets. Many consumers and businesses, especially those in less technologically advanced sectors, may opt for cheaper mineral oils, which fulfill basic lubrication requirements even if they offer inferior performance. This dynamic creates a market friction where the superior long-term value proposition of synthetic lubricants (e.g., longer drain intervals, reduced wear) is sometimes overlooked in favor of lower upfront costs.

Conversely, this pricing structure creates a distinct opportunity for market players. As industrialization and living standards rise in developing economies, the demand for higher-performance vehicles and more efficient machinery is growing. This trend provides an opening for synthetic lubricant manufacturers to educate end-users on the total cost of ownership, shifting the focus from initial purchase price to long-term savings in maintenance, fuel consumption, and equipment longevity. Furthermore, the increasing global focus on sustainability presents a significant opportunity. As industries seek to lower their environmental footprint, the longer service life of synthetic lubricants, which results in less waste oil, becomes an attractive value proposition. This aligns with the broader push towards circular economy principles and can drive demand from environmentally conscious corporations and consumers.

- Raw Material and Pricing Analysis:

The synthetic lubricants market's supply chain is highly dependent on petrochemical feedstocks, with key raw materials including polyalphaolefins (PAOs), esters, and polyalkylene glycols (PAGs). The pricing of these base oils is directly tied to the volatility of the global petroleum and chemical markets. PAOs, for example, are derived from crude oil-based feedstocks, making their cost subject to fluctuations in crude oil prices. Esters, which are synthesized from organic acids and alcohols, are also sensitive to changes in the cost of these chemical precursors.

This raw material price volatility has a direct and significant impact on the demand for finished synthetic lubricants. When feedstock costs rise, manufacturers often pass a portion of these increases on to their customers. Since synthetic lubricants already command a price premium over mineral oils, any additional cost increase can exacerbate the price sensitivity of end-users, potentially causing some to revert to less expensive alternatives or delay lubricant change intervals. This dynamic creates a demand-side headwind, as higher prices can temper the overall market's growth rate. Conversely, periods of stable or declining raw material costs allow manufacturers to stabilize or even reduce prices, which can stimulate demand and encourage a broader adoption of synthetic products.

- Supply Chain Analysis:

The global supply chain for synthetic lubricants is characterized by its complexity and vertical integration, with key production hubs concentrated in North America, Europe, and Asia. The supply chain begins with the production of base oils and additives. Major chemical and oil companies operate sophisticated synthesis plants for PAOs, esters, and other high-performance fluids. These base oils are then transported to blending facilities, where they are combined with proprietary additive packages to create the final, performance-specific lubricants. This blending process is a critical and geographically distributed step, with companies operating facilities close to major markets to reduce logistical costs and improve responsiveness.

Key logistical complexities include the transportation of hazardous chemical components, which is subject to strict international regulations, and the need for just-in-time inventory management to meet fluctuating regional demand. The market is also dependent on a limited number of specialized additive manufacturers, creating potential single-source dependencies. For instance, disruptions to the supply of specific friction modifiers or detergents can impact the production of a wide range of finished lubricants. Companies mitigate these risks through dual-sourcing strategies and by building regional buffer inventories, though this adds to operational costs.

Synthetic Lubricants Market Government Regulations

The regulatory environment plays a crucial role in shaping the demand for synthetic lubricants. Agencies and regulations in major economies are increasingly focused on environmental and performance standards, which directly influence lubricant formulation and market adoption.

- United States: Environmental Protection Agency (EPA) / Corporate Average Fuel Economy (CAFE) Standards - CAFE standards mandate higher fuel efficiency for vehicles, driving demand for low-viscosity synthetic lubricants that reduce parasitic engine drag and improve fuel economy, thereby helping automakers meet regulatory targets.

- Europe: European Union (EU) Emission Standards (e.g., Euro 6) - EU regulations impose strict limits on vehicle emissions. Synthetic lubricants, with their superior thermal stability and reduced volatility, contribute to lower exhaust emissions and particulate matter, creating a strong market pull.

- China: China V / VI Emission Standards - The implementation of stringent national emission standards for vehicles and industrial machinery necessitates the use of higher-grade lubricants that improve engine efficiency and reduce emissions, directly increasing the demand for synthetic alternatives.

Synthetic Lubricants Market Segment Analysis:

- By Application: Engine Oil

The engine oil segment is a cornerstone of the synthetic lubricants market, driven by the escalating performance demands of modern internal combustion engines (ICEs). As automakers pursue downsized, turbocharged, and direct-injected engine designs to meet fuel efficiency and emissions standards, the operating conditions within these powerplants become increasingly severe. These advanced engines generate higher temperatures and pressures, and their components have tighter tolerances. These conditions subject lubricants to greater thermal and oxidative stress. Conventional mineral oils often fail to provide adequate protection under these circumstances, leading to deposit formation, viscosity breakdown, and increased engine wear. Synthetic engine oils, formulated with thermally stable base stocks like PAOs and esters, maintain their viscosity and lubricating properties across a wider temperature range. This superiority directly drives their adoption as an essential component for ensuring engine longevity and performance. The demand for synthetic engine oils is further reinforced by the trend of extended drain intervals. Automakers increasingly recommend longer periods between oil changes, a practice only feasible with the durable and long-lasting performance of synthetic formulations, which reduces the total volume of lubricant consumed over the vehicle's lifespan while increasing the value proposition per unit.

- By End-User: Automotive

The automotive end-user segment is the single largest consumer of synthetic lubricants, a dominance driven by multiple converging trends. The global vehicle fleet is growing, and there is a widespread move towards high-performance and luxury vehicles, which often specify synthetic lubricants as a factory fill and service requirement. Furthermore, the ongoing push for fuel efficiency in both passenger cars and commercial vehicles—spurred by consumer demand and government regulations—propels the use of low-viscosity synthetic formulations. These products minimize internal friction, directly contributing to improved mileage. The expansion of the automotive aftermarket also fuels demand, as vehicle owners, particularly those with newer, more technologically advanced cars, recognize the benefits of using premium synthetic products for long-term engine health. The rise of electric vehicles, while presenting a long-term challenge to the ICE lubricant market, is concurrently creating a new demand vector for specialized synthetic fluids. These e-fluids are critical for the thermal management of battery packs and the lubrication of high-speed electric motors and gearboxes, functions where conventional lubricants are unsuitable. This dual-pronged demand profile—supporting both the legacy ICE market and the nascent EV sector—underscores the automotive segment's enduring importance.

Synthetic Lubricants Market Regional Analysis

- United States: The US market for synthetic lubricants is mature but continues to exhibit growth, driven by a combination of regulatory requirements and a consumer preference for high-performance products. The country's strict CAFE standards compel automakers to use factory-fill synthetic lubricants that improve fuel efficiency. In the industrial sector, the US market is characterized by a significant manufacturing base and a robust aerospace industry, both of which have high-performance lubrication needs. Demand for synthetic products is robust in applications ranging from heavy-duty diesel engines in trucking and logistics to turbine oils for power generation. Furthermore, the US aftermarket is highly developed, with consumers increasingly adopting synthetic motor oils for their personal vehicles, recognizing the benefits of extended drain intervals and superior engine protection. The market also sees growth in the emerging e-fluid segment, driven by the increasing production and adoption of electric vehicles.

- Brazil: Brazil's synthetic lubricants market is expanding, buoyed by the country's growing automotive manufacturing base and industrial sector. While a significant portion of the market remains dominated by conventional mineral oils due to price sensitivity, the demand for synthetic products is rising in tandem with the modernization of the vehicle fleet and industrial equipment. The automotive industry, including both domestic production and imports, is a key driver, with newer vehicle models requiring advanced lubricants. In the industrial segment, demand is particularly strong from the mining, agriculture, and manufacturing sectors, where robust equipment performance is critical. Economic development and rising disposable income among the middle class are gradually shifting consumer preferences towards higher-quality automotive products, creating a long-term demand catalyst for synthetic lubricants.

- Germany: Germany is a European powerhouse in the synthetic lubricants market, underpinned by its world-leading automotive and machinery manufacturing sectors. The country's market growth is driven by a deep-seated culture of engineering excellence and a focus on performance and longevity. German automakers and industrial equipment manufacturers often specify synthetic lubricants as a prerequisite for their products to meet stringent performance benchmarks. The country's progressive environmental regulations also serve as a key demand driver, compelling the use of lubricants that contribute to lower emissions and greater energy efficiency. The German market is a hub for innovation, with a strong emphasis on research and development for new synthetic formulations, particularly those for electric vehicles and industrial applications, further cementing its position as a leader in the sector.

- Saudi Arabia: The synthetic lubricants market in Saudi Arabia is undergoing a significant transformation, with demand being reshaped by the Kingdom's Vision 2030 and a shift towards economic diversification. While the market has traditionally been dominated by conventional lubricants for its large fleet of older vehicles, there is a clear trend towards modernization. The government's focus on developing new industrial sectors, including manufacturing and logistics, is creating a new source of demand for high-performance synthetic fluids. Furthermore, the lifting of the ban on women driving has unlocked a new consumer base and is contributing to the growth of the overall vehicle fleet. The gradual but increasing adoption of electric vehicles, supported by government initiatives and infrastructure development, also presents a nascent opportunity for specialized e-fluids.

- China: China represents the largest and one of the fastest-growing markets for synthetic lubricants globally. The country's rapid industrialization and status as the world's largest automotive manufacturer are the primary engines of demand. The massive and growing vehicle fleet, coupled with increasingly strict national emission standards (e.g., China VI), creates a powerful and sustained demand for high-performance synthetic engine oils. In the industrial sector, market growth is driven by heavy equipment for construction and mining, as well as machinery used in manufacturing and power generation. The Chinese government's strong support for domestic manufacturing and technological advancement, including the electrification of its vehicle fleet, ensures a robust future for synthetic lubricants, particularly for emerging applications like e-fluids and high-performance industrial oils.

Synthetic Lubricants Market Competitive Landscape

The competitive landscape of the synthetic lubricants market is dominated by a few integrated global players that leverage their extensive R&D capabilities, vast distribution networks, and strong brand recognition. These companies compete on product performance, technological innovation, and the ability to provide tailored solutions to industrial and automotive clients. The market also includes several regional and specialty producers that focus on niche applications or specific geographies.

- ExxonMobil Corporation: ExxonMobil is a major force in the synthetic lubricants market, primarily through its flagship Mobil 1 brand. The company's strategic positioning is built on a legacy of technological innovation and a premium brand image. Mobil 1 is widely recognized for its high performance and is a factory-fill choice for numerous high-performance and luxury automakers, a designation that validates its technical superiority and drives consumer demand. ExxonMobil’s competitive advantage stems from its vertical integration, which includes the production of high-quality synthetic base stocks. The company’s focus on R&D allows it to consistently develop new formulations that meet and exceed evolving industry standards for fuel economy and engine protection. Its global reach and extensive distribution network allow it to serve a diverse customer base, from individual consumers to large industrial clients.

- Shell plc: Shell holds a prominent position in the global lubricants market, with a diversified portfolio of synthetic products for consumer and industrial applications. The company’s strategic approach centers on innovation and sustainability. Shell has made significant investments in technologies like its proprietary PurePlus Technology, which converts natural gas into a crystal-clear synthetic base oil. This technology allows Shell to create lubricants with enhanced purity and performance attributes. The company’s brand, particularly its Shell Helix Ultra and Shell Rimula product lines, is strong in both the automotive and heavy-duty commercial vehicle segments. Shell is actively positioning itself as a leader in the transition to a lower-carbon economy by developing and marketing "carbon neutral" lubricants and specialized fluids for the growing electric vehicle market, a strategy that directly addresses evolving market trends.

- Chevron Corporation: Chevron is a key player in the synthetic lubricants market, with its presence rooted in a robust portfolio of brands, including Havoline and Delo. The company’s strategic positioning emphasizes technical excellence and reliability, with a strong focus on serving the automotive, commercial, and industrial sectors. Chevron has demonstrated a commitment to innovation, as evidenced by its joint venture, Novvi LLC, which focuses on producing renewable synthetic base oils from plant-based feedstocks. This initiative aligns with the increasing demand for sustainable and bio-based products. Chevron's integrated business model, which spans from base oil production to finished lubricant distribution, allows it to maintain control over quality and supply chain efficiency, providing a consistent and reliable offering to its global customer base.

Synthetic Lubricants Market Recent Developments

- September 2025: ExxonMobil announced an agreement to acquire the technology and U.S.-based assets of Superior Graphite, a company specializing in synthetic graphite. This strategic acquisition is intended to position ExxonMobil to enter the advanced synthetic graphite business, a key component in the anodes of batteries used in electric vehicles and stationary energy storage. The company’s press release states that this move will leverage its carbon-rich feedstocks from existing refining streams to produce higher-performance graphite, supporting American industry and energy security. This development marks a direct investment in the supply chain for electric vehicle components, a significant new area of demand for synthetic materials.

- August 2025: Shell unveiled an upgraded line of its Shell Helix lubricants with improved performance functionalities and new packaging. The revised Shell Helix Ultra, now featuring Shell's PurePlus Technology, is designed to offer enhanced engine performance and durability. The company's official newsroom highlights that the new formulation boosts engine power and responsiveness, leading to better fuel efficiency. The new packaging is intended to improve shelf visibility and simplify the product selection process for consumers.

Synthetic Lubricants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Synthetic Lubricants Market Size in 2025 | USD 17.450 billion |

| Synthetic Lubricants Market Size in 2030 | USD 21.177 billion |

| Growth Rate | CAGR of 3.95% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Synthetic Lubricants Market |

|

| Customization Scope | Free report customization with purchase |

Synthetic Lubricants Market Segmentation:

- By Product Type

- Polyalphaolefin (PAO)

- Esters

- Polyalkylene Glycol (PAG)

- Group III (Hydrocracked)

- Others

- By Application

- Engine Oil

- Hydraulic Fluids

- Compressor Oil

- Turbine Oil

- Gear Oil

- Transmission Fluid

- Refrigeration Oil

- Heat Transfer Fluids

- Others

- By End-User

- Automotive

- Passenger Cars

- Commercial Vehicles

- Industrial

- Manufacturing

- Power Generation

- Construction

- Mining

- Others

- Automotive

- By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Our Best-Performing Industry Reports:

Navigation:

- Synthetic Lubricants Market Size:

- Synthetic Lubricants Market Key Highlights:

- Synthetic Lubricants Market Analysis

- Synthetic Lubricants Market Government Regulations

- Synthetic Lubricants Market Segment Analysis:

- Synthetic Lubricants Market Regional Analysis

- Synthetic Lubricants Market Competitive Landscape

- Synthetic Lubricants Market Recent Developments

- Synthetic Lubricants Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 18, 2025