Report Overview

Turbochargers Market - Strategic Highlights

Turbochargers Market Size:

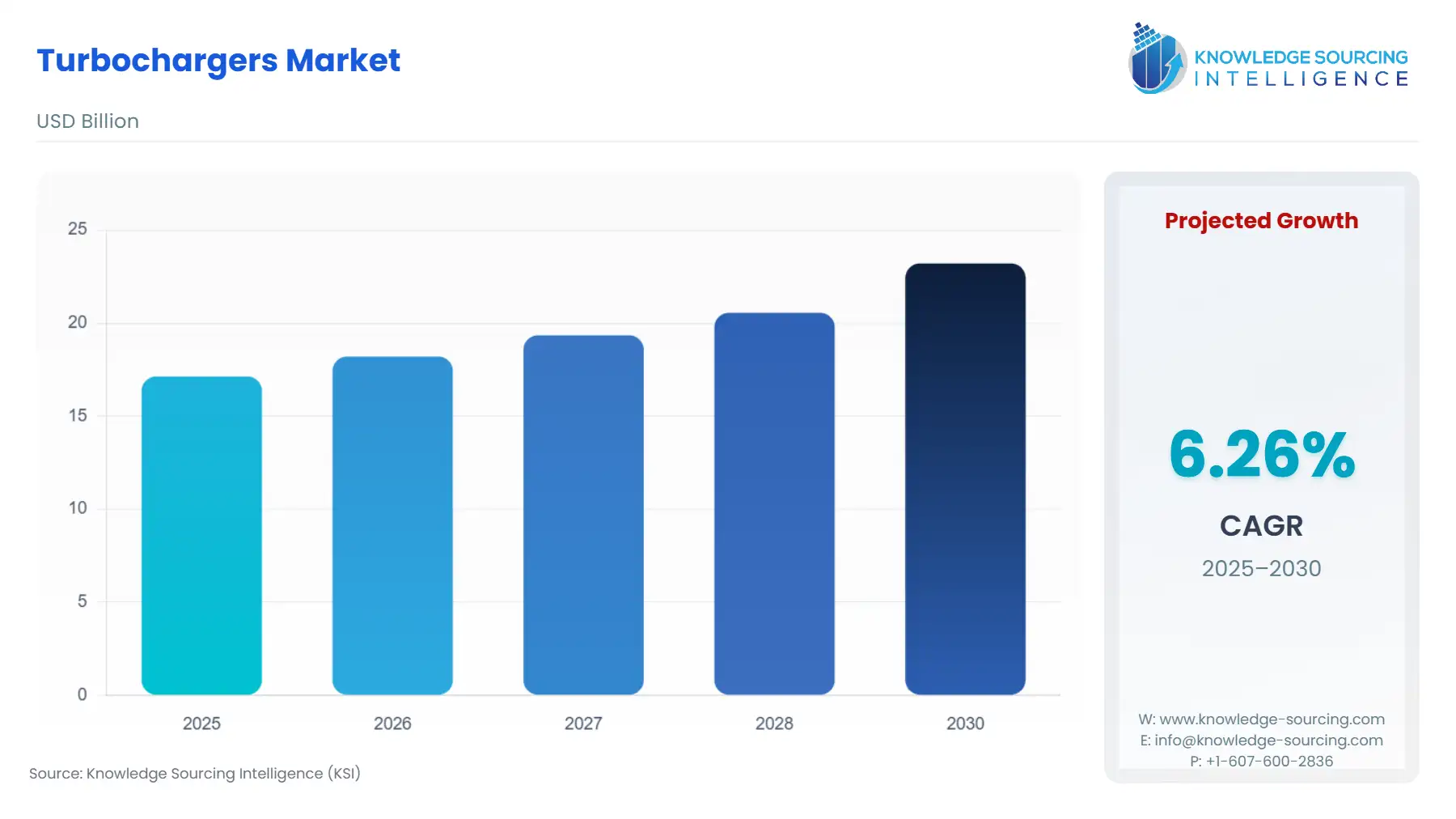

The turbochargers market, with a 6.07% CAGR, is projected to increase from USD 17.134 billion in 2025 to USD 24.404 billion in 2031.

Turbochargers Market Trends:

A turbocharger is an ingenious device that harnesses the energy of exhaust gases to amplify the airflow entering the engine. Turbochargers have broad applications in the automotive, aerospace, marine, and power & energy sectors. They are commonly classified into four types single turbo, twin turbo, twin-scroll turbo, and electric turbo. The bolstering growth in end-users coupled with product innovations and launches are majorly driving the turbochargers market growth.

Turbochargers Market Growth Drivers:

The growing marine industry bolsters the turbocharger market growth.

Turbochargers enable enhanced power output and improved fuel efficiency, and as ships and vessels strive for higher performance, turbochargers offer a solution by effectively boosting the combustion process, optimizing engine performance, and increasing power density. The marine industry is a key driver for the growth of the turbocharger market. According to the National Marine Manufacturers Association (NMMA), the sales of new powerboats experienced a notable increase of 12% in 2020, resulting in an estimated 310,000 new boats sold.

Automotive sector growth drives the turbocharger market expansion.

With the increasing demand for more powerful and fuel-efficient vehicles, turbochargers enable the downsizing of engines while maintaining the overall engine performance and improving the fuel economy. As stricter regulations on emissions and fuel efficiency continue to shape the automotive industry, turbochargers offer a viable solution to meet these requirements. The rising adoption of turbochargers in passenger cars, commercial vehicles, and sports cars has propelled the growth of the turbocharger market. According to the Society of Indian Automobile Manufacturers (SIAM) report the industry produced around 2,59,31,867 vehicles including Passenger Vehicles, Commercial Vehicles, Three Wheelers, Two Wheelers, and Quadricycles in April 2022 to March 2023, as against 2,30,40,066 units in April 2021 to March 2022.

Rising power & energy sector propels the turbocharger market growth.

Turbochargers are extensively utilized in power plants, gas turbines, and renewable energy systems to maximize power output, reduce emissions, and improve overall efficiency. As demands for energy efficiency, sustainability, and power generation increase, turbochargers have emerged as crucial components in optimizing performance and enhancing fuel efficiency.

Turbochargers Market Geographical Outlook:

The Asia-Pacific region is expected to account for a significant market share.

Asia Pacific’s strong presence in industries such as power generation, aerospace, and marine further contributes to the turbochargers market's growth in the region. Moreover, the rapidly growing automotive sector in countries like China, India, Japan, and South Korea is further driving the demand for turbochargers. According to the Ministry of Ports, Shipping, and Waterways. India's coastal and overseas fleet witnessed a growth trajectory from 1,491 in 2021 to 1,520 in 2022, reflecting an increase in the total fleet size during this period.

Turbochargers Market Restraints:

Booming EV demand restrains the turbochargers market growth

The increasing adoption of electric vehicles (EVs) poses a significant challenge to the turbocharger market. Unlike internal combustion engines, which heavily rely on turbocharging to enhance power and efficiency, EVs do not require turbochargers for these purposes. As the popularity of EVs grows, the automotive sector's demand for turbochargers is expected to decline. According to the International Energy Agency, the first quarter of 2023 witnessed remarkable growth in the electric car market, with over 2.3 million units sold, marking a substantial 25% increase compared to 2022 and indicating sales of approximately 14 million electric cars by the end of 2023.

Turbochargers Market Key Developments:

June 2023: Accelleron recently introduced the X300-L series, the next generation of turbochargers specifically designed for two-stroke engines. One of the key advancements of the X300-L series is its enhanced serviceability, which allows for turbocharger overhaul without being dependent on dry docking schedules.

August 2022: MAN Energy Solutions and Mitsui E&S Machiner formed a strategic partnership through a 10-year license agreement. This agreement enables Mitsui E&S Machinery to distribute MAN's state-of-the-art TCT axial-turbocharger series and allows Mitsui E&S Machinery to offer the latest and most advanced turbocharger technology to the market.

June 2022: BorgWarner expanded its product portfolio by introducing nine new turbochargers designed for passenger car applications. These latest additions include turbochargers specifically developed for renowned automotive brands such as BMW, Porsche, Volvo, and VW. The introduction of these new turbochargers broadens BorgWarner's offerings, enabling them to cater to a wider range of vehicles from these prestigious manufacturers.

Turbochargers Market Company Products:

EFR 9280: BorgWarner offers the EFR 9280 turbocharger, equipped with a D-Type turbine housing. This turbocharger model is designed to deliver a power output ranging from 600 to 1100 horsepower, making it suitable for high-performance applications. It incorporates a Gamma-T1 turbine wheel, known for its efficient performance characteristics, further enhancing the turbocharger's overall capabilities.

Electric Turbocharger: IHI's Electric Turbocharger is used particularly in fuel cell vehicles (FCVs), by supplying compressed air (oxygen) for the hydrogen reaction. This innovative turbocharger technology significantly contributes to the system's high efficiency, compact size, and lightweight design. By efficiently providing the required oxygen for the fuel cell, the Electric Turbocharger enhances the overall performance of FCVs while maintaining a compact and lightweight system configuration.

List of Top Turbocharger Companies:

Cummins Inc

MITSUBISHI HEAVY INDUSTRIES, LTD.

ABB

TOYOTA INDUSTRIES CORPORATION

Komatsu

Turbochargers Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Turbochargers Market Size in 2025 | USD 17.134 billion |

Turbochargers Market Size in 2030 | USD 23.214 billion |

Growth Rate | CAGR of 6.26% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in Turbochargers Market |

|

Customization Scope | Free report customization with purchase |

Key Segment:

By Type

Single Turbo

Twin Turbo

Twin-Scroll Turbo

Electric Turbo

Others

By Component

Compressor Cover

Bearing Housing

Turbine Housing

Compressor Wheel

Turbine Wheel

Shaft Assemble

By Fuel Type

Gasoline

Diesel

By End-User Industry

Oil & Gas

Automotive

Marine

Aerospace & Defense

Power & Energy

Others

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others