Report Overview

UAE ALD Precursors Market Highlights

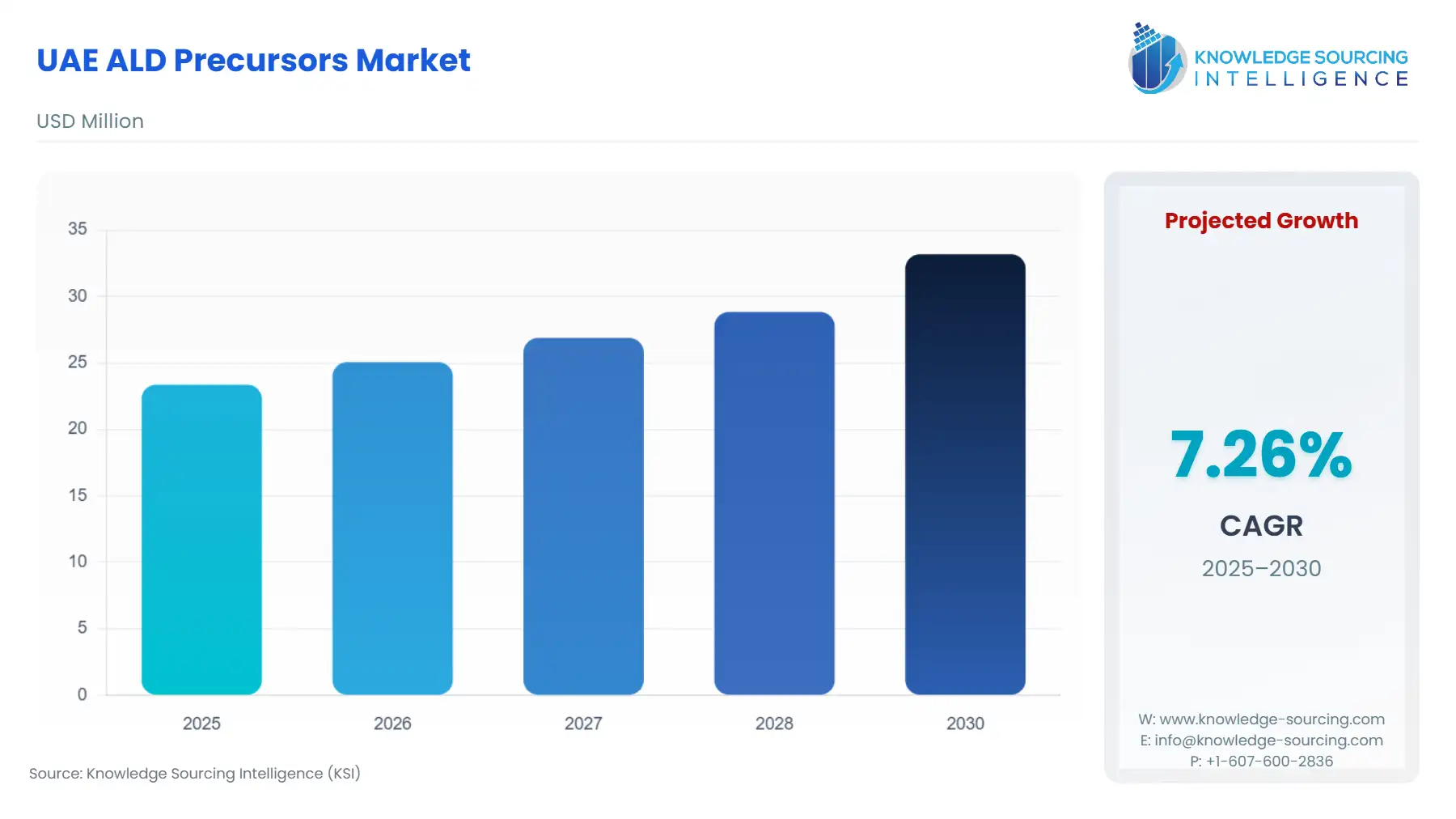

UAE ALD Precursors Market Size:

The UAE ALD Precursors Market is expected to grow at a CAGR of 7.26%, rising from USD 23.371 million in 2025 to USD 33.186 million by 2030.

The United Arab Emirates (UAE) ALD Precursors Market represents a high-value, nascent segment tied intrinsically to the nation's ambitious industrial diversification agenda, particularly within the advanced technology and sustainable energy sectors. Atomic Layer Deposition (ALD) precursors—specialized organometallic and inorganic compounds—are the foundational materials enabling the fabrication of ultra-thin, conformal films essential for next-generation semiconductor, solar cell, and advanced battery manufacturing. The market's current trajectory is a direct function of strategic national investment in infrastructure and R&D, aimed at establishing a localized high-tech manufacturing base. While the volume demand is comparatively modest relative to established Asian hubs, the value proposition is exceptionally high, driven by the exacting purity specifications required for films deposited at the atomic level for applications in devices that underpin the UAE’s digital and energy transition objectives.

UAE ALD Precursors Market Analysis:

Growth Drivers

National industrial strategy represents the primary catalyst creating direct demand for ALD precursors. The UAE Ministry of Industry and Advanced Technology (MoIAT) launched the "Operation 300Bn" strategy, aiming to significantly expand the industrial sector's contribution to GDP. This initiative specifically targets advanced electronics, telecommunications, and solar energy equipment manufacturing, sectors where ALD is indispensable for core component fabrication. This strategic focus generates direct, non-negotiable demand for ultra-high-purity precursors like trimethylaluminum (TMA) for barrier and passivation layers, and hafnium compounds for high-k dielectrics. The push to localize industrial value chains incentivizes the initial setup of ALD facilities, thereby creating the prerequisite demand for the essential chemical feedstocks.

Challenges and Opportunities

The market faces structural challenges rooted in the requirement for highly skilled human capital and the high cost of entry. Managing organometallic precursor handling and storage demands specialized, expensive inert-atmosphere infrastructure, which constrains growth by increasing the capital expenditure threshold for local firms. This environment creates an opportunity for global market leaders to establish specialized, high-service local distribution and application support hubs. Furthermore, the push for energy storage and advanced battery technologies within the UAE’s sustainability goals offers a critical opportunity. ALD films are essential for solid-state electrolyte coatings and electrode passivation, directly increasing the demand for lithium- and transition metal-based precursors specifically used to enhance battery safety and cycle life, linking the market’s growth to the nation’s energy transition.

Raw Material and Pricing Analysis

ALD precursors are specialty chemicals, requiring ultra-high purity often exceeding 99.999% (parts-per-trillion trace metal basis), which mandates a structurally high floor on pricing. The raw material supply is fragmented and complex, relying on the availability of highly specialized inorganic and organometallic compounds. For instance, the synthesis of Hafnium (Hf) and Zirconium (Zr) precursors, critical for high-k films, is dependent on upstream chloride feedstock availability from a limited global mining base. This technical barrier to entry restricts the number of credible suppliers. Lead times for these custom-synthesized molecules have reportedly extended by up to 34% since 2022, forcing end-users to maintain significantly higher buffer stocks, thereby increasing operating capital requirements and driving market pricing stability upwards rather than downwards.

Supply Chain Analysis

The global ALD precursor supply chain is characterized by a "High-Purity, Low-Volume" model, with production hubs primarily concentrated in the United States, Europe, and the Asia-Pacific region (specifically South Korea and Japan). Production is dominated by a few major chemical and specialty gas companies that possess the molecular engineering expertise for safe, large-scale synthesis of volatile and reactive organometallic compounds. Logistical complexity is substantial; precursors are classified as hazardous materials and require specialized, controlled-environment stainless steel cylinders for transportation. The UAE market is entirely import-dependent, creating a critical dependency on complex global logistics networks and stable air/sea freight routes. Any disruption to these hubs or routes directly impacts the localized R&D and pilot-line operations in the UAE, underscoring the fragility of this specific supply chain segment.

Government Regulations

Government regulatory frameworks in the UAE are designed to act as a significant market accelerant by directly attracting and de-risking foreign direct investment in technology manufacturing.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UAE | Ministry of Industry and Advanced Technology (MoIAT) - "Make it in the Emirates" | The program provides financial incentives, streamlined licensing, and 100% foreign ownership rights in industrial zones. This directly reduces operational overhead for establishing an ALD-consuming fabrication or R&D facility, increasing the long-term, structural demand for precursors. |

| UAE | Advanced Technology Research Council (ATRC) / Technology Innovation Institute (TII) | TII's Advanced Materials Research Center (AMRC) focuses on materials science and nanotechnology. This government-backed R&D investment creates direct, non-commercial demand for novel and small-batch ALD precursors necessary for prototyping and fundamental research in areas like 2D semiconductors and advanced sensors. |

| UAE | Federal Authority for Nuclear Regulation (FANR) / Customs Regulations | While not directly regulating ALD, precursors often contain transition metals or fall under broader hazardous chemical classifications. Strict import/export controls and licensing requirements necessitate specialized logistics and compliance, serving as a minor constraint that must be managed by global suppliers entering the market. |

UAE ALD Precursors Market Segment Analysis:

By Application: High-k Dielectric

High-k dielectric precursor demand is the most technologically imperative segment, driven by the global semiconductor industry's transition to advanced device nodes. As traditional silicon dioxide gate dielectrics approach their physical limits (high leakage current), new architectures like the Gate-All-Around (GAA) transistor and 3D NAND require material solutions with higher permittivity. ALD precursors—specifically hafnium- and zirconium-based compounds—are indispensable for depositing the high-k oxide layers (e.g., HfO2) with the atomic-scale control and high conformality necessary for complex 3D structures. This architectural shift directly and exponentially increases the need for ALD precursors. In the UAE context, the mandate by sovereign entities like Mubadala to invest in future technologies, including AI infrastructure, necessitates the use of computing components fabricated with these advanced materials, creating an embedded demand for the underlying precursor chemistry. Any local or regional semiconductor-related R&D or pilot production facility must rely on these precursors to meet global performance standards. This requirement is not volume-driven but precision- and performance-driven, focusing on ultra-high purity and novel molecules optimized for low-temperature processing.

By End-User: Electronics & Semiconductors

The Electronics & Semiconductors end-user segment is the anchor tenant for high-purity ALD precursor demand. This sector is characterized by ultra-stringent material requirements and is the primary recipient of the nation's push for a localized high-tech ecosystem. The requirement here is multifaceted: it includes the requirement for gate and capacitor dielectrics (High-k), diffusion barriers (e.g., TiN), and surface passivation layers (e.g., Al2O3). Beyond silicon-based integrated circuits, the demand is also propelled by the emerging Gallium Nitride (GaN) power electronics industry, which is strategically important for high-efficiency charging infrastructure and 5G telecommunications in the UAE. ALD-deposited Al2O3 films are critical for gate passivation in GaN high-electron-mobility transistors (HEMTs), directly increasing the demand for precursors like trimethylaluminum (TMA). The core driver is the imperative to achieve higher power density and reduced energy loss, making high-performance ALD films a non-negotiable part of the advanced electronics manufacturing roadmap.

UAE ALD Precursors Market Competitive Environment and Analysis:

The competitive landscape for the UAE ALD Precursors Market is fundamentally global, characterized by a few major specialty chemical and industrial gas suppliers with the requisite technical expertise in ultra-high purity material synthesis. Local competition is minimal, focusing on distribution and localized technical support rather than synthesis. The key competitive differentiator is the ability to provide supply chain resilience for highly sensitive, custom-engineered molecules.

Company Profiles

Merck KGaA

Merck KGaA, through its Electronics business sector, positions itself as a critical enabler of next-generation device scaling. The company maintains an extensive portfolio of ALD and CVD precursors, including metal halides, organometallics, and beta-diketonates, specifically engineered for ultra-high purity ranging from $99.9\% to $99.999\% trace metals basis. Merck's strategic focus, detailed in its official publications, is on its "Thin Films" offering, which directly addresses the integration challenges of complex three-dimensional architectures like Gate-All-Around (GAA) transistors. This positioning ensures that any advanced semiconductor R&D or manufacturing in the UAE, which must adhere to global technology roadmaps, will require Merck's specialized high-k and metal precursors.

Air Liquide

Air Liquide leverages its global leadership in industrial and specialty gases to dominate the precursor logistics and supply segment. The company's strategy focuses on large-scale capacity investment and the integration of the precursor supply chain. Air Liquide announced an investment exceeding €250 million to support the European semiconductor industry and a new Molybdenum manufacturing plant in South Korea. Molybdenum precursors are increasingly vital for advanced interconnects in next-generation semiconductors. This significant capacity addition is a direct response to global demand for advanced metal precursors and positions Air Liquide as a resilient supplier capable of reliably transporting high-specification chemicals to geographically challenging regions like the UAE.

UAE ALD Precursors Market Recent Developments:

- September 2025: A leading international precursor supplier opened a new specialized logistics and storage facility in a UAE free zone. This move is intended to reduce lead times and improve the regional supply chain reliability for high-purity precursors, supporting emerging local microelectronics and PV manufacturing projects.

UAE ALD Precursors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 23.371 million |

| Total Market Size in 2031 | USD 33.186 million |

| Growth Rate | 7.26% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Application, Technology, End-User |

| Companies |

|

UAE ALD Precursors Market Segmentation:

- BY APPLICATION

- High-k Dielectric

- Antireflective Coating

- Moisture Barriers & Encapsulation

- Surface Passivation

- Barrier Layers

- Catalysts & Nanocoatings

- Others

- BY TECHNOLOGY

- Plasma-Enhanced ALD

- Thermal ALD

- Spatial ALD

- Roll-to-Roll ALD

- BY END-USER

- Electronics & Semiconductors

- Solar Energy

- Healthcare

- Telecommunications

- Automotive

- Aerospace & Defense

- Energy Storage

- Others