Report Overview

UK AI-Driven Hypothesis Generation Highlights

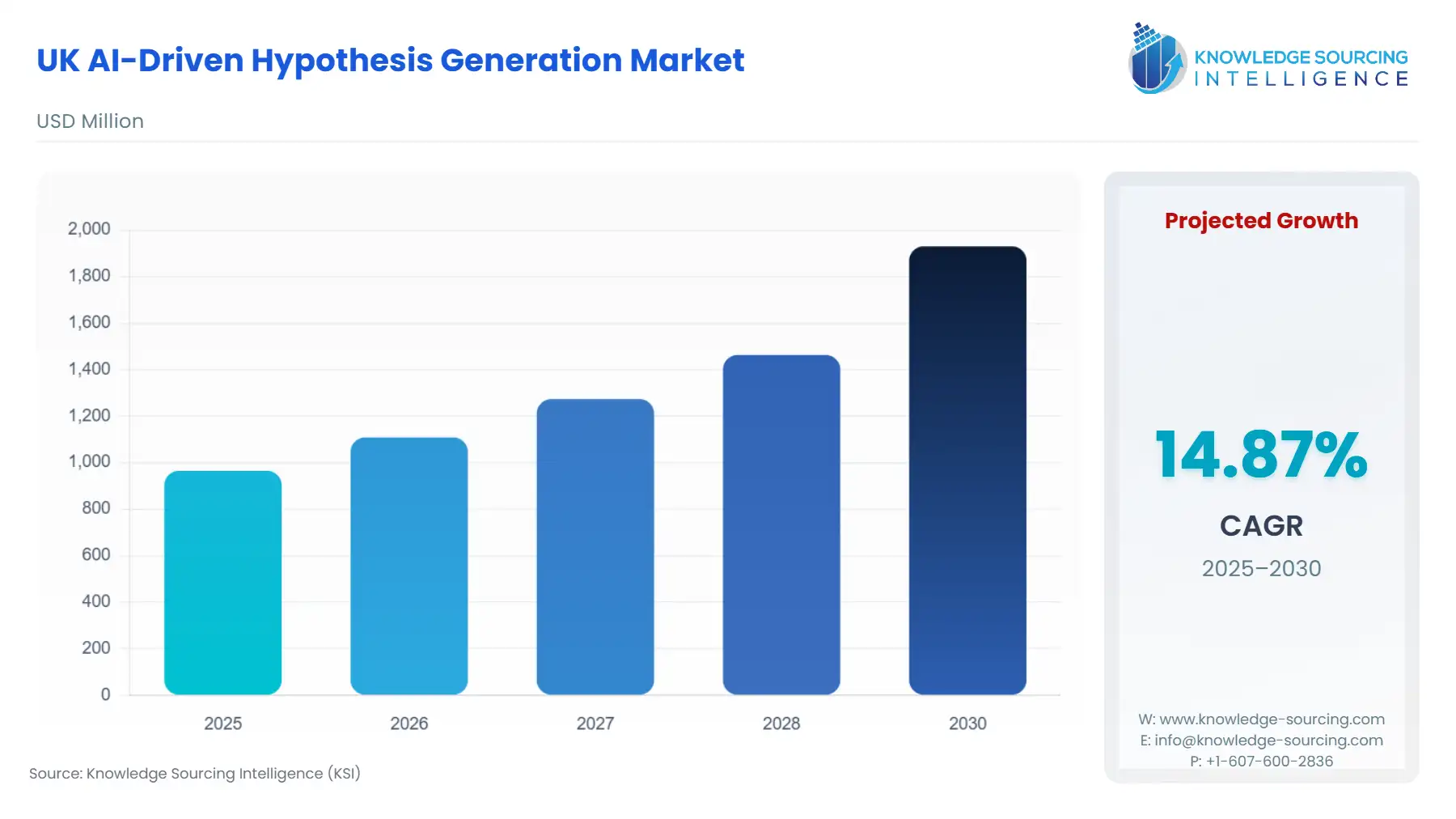

UK AI-Driven Hypothesis Generation Market is forecast to move from USD 965.203668 million in 2025 to USD 1930.407336 million by 2030, at a CAGR of 14.87%.

UK AI-Driven Hypothesis Generation Market Key Highlights

The UK AI-Driven Hypothesis Generation market represents a high-value niche within the nation's rapidly expanding artificial intelligence ecosystem. Focused primarily on accelerating the initial, non-linear stages of scientific and commercial research, this sector provides proprietary software platforms that leverage machine learning, natural language processing (NLP), and large language models (LLMs) to identify novel relationships, predict latent variables, and propose testable hypotheses from vast, unstructured datasets. This capability is critical for sectors facing acute discovery bottlenecks, most notably biopharma, which relies on these tools to de-risk and shorten the traditionally slow and capital-intensive processes of target identification and lead optimization. The market's operational model is highly data- and talent-dependent, clustering regionally around established hubs like London, Oxford, and Cambridge, which hold significant concentrations of both advanced AI research and life sciences expertise. The market's success hinges on its ability to translate data abundance and advanced algorithms into defensible intellectual property and actionable scientific insights for high-value enterprise clients.

UK AI-Driven Hypothesis Generation Market Analysis

Growth Drivers

- The imperative for scientific and commercial efficiency: The UK government's direct investment, including an $82 million pledge toward UK-based AI-driven therapeutics projects, explicitly generates immediate demand for sophisticated hypothesis generation platforms by funding the very users (academic and commercial research consortia) who require them to fulfill project mandates. Furthermore, the exponential increase in publicly available and proprietary omics and real-world data creates a structural information overload that traditional research methods cannot process. This data saturation makes AI-Powered Literature Mining Tools an operational necessity, directly increasing their procurement to manage, connect, and analyze disparate datasets to forge novel, verifiable scientific hypotheses at scale. The ability of these platforms to significantly reduce the discovery cycle time—a critical metric in drug development—translates directly into a measurable return on investment, cementing them as core infrastructure rather than discretionary research tools, thereby driving robust enterprise demand.

Challenges and Opportunities

- Talent Scarcity: A significant constraint on market expansion is the persistent scarcity of personnel possessing dual expertise in both advanced AI/machine learning and core domain science, such as medicinal chemistry or biological systems. This acute talent constraint restricts the capacity of AI companies to rapidly iterate and deploy new, validated solutions, effectively dampening potential supply and slowing adoption velocity among clients who lack internal expertise to integrate the tools.

- Public Sector Adoption: The primary opportunity resides in the expanding public sector adoption of AI. As the National Health Service (NHS) and affiliated research institutions increasingly seek to utilize AI-driven solutions for diagnostics and treatment pathway optimization, this creates a major, long-term opportunity. Successfully deployed systems in a high-profile public setting will establish a crucial efficacy benchmark and act as a powerful procurement signal for private healthcare and adjacent Life Sciences end-users, exponentially increasing commercial demand by reducing client adoption risk.

Supply Chain Analysis

The market's supply chain is entirely intangible, centering on three critical non-physical components: specialized talent, proprietary data assets, and high-performance computing (HPC) infrastructure. The UK's globally competitive academic environment (Cambridge, Oxford, London) serves as the primary production hub for the necessary AI and data science talent. Logistical complexity is not geographic but regulatory and algorithmic, revolving around ensuring data governance, privacy compliance (as per the Information Commissioner's Office, ICO), and the explainability of the models to gain client trust. The key dependency is on the global providers of scalable cloud computing (e.g., AWS, which powers one major UK platform) to enable the massive parallel processing required for complex multimodal AI platforms. Disruptions manifest as talent drain to US firms or regulatory ambiguity regarding data sharing, both of which immediately constrain the development pipeline and software iteration speed.

Government Regulations

The UK's regulatory framework for AI is a key market differentiator, adopting a non-prescriptive, pro-innovation stance relative to the EU, which directly influences market growth by lowering the regulatory friction for product deployment.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UK | Medicines and Healthcare products Regulatory Agency (MHRA) | The MHRA's focus on regulating AI as a Medical Device (AIaMD) creates a clear, though evolving, pathway for companies whose hypothesis generation tools lead to diagnostic or therapeutic claims. The risk-based classification system facilitates faster market entry for lower-risk software, stimulating early demand and adoption. |

| UK | Information Commissioner's Office (ICO) | The ICO's guidance on data protection in November 2024 for practices like federated learning provides necessary clarity on the legal basis for processing decentralized, sensitive patient data. This regulatory certainty is crucial for platforms dealing with healthcare data, de-risking their operations and increasing the commercial viability of data-intensive projects, thereby enabling demand. |

| UK | UK Intellectual Property Office (IPO) | Updated guidelines on examining patent applications related to AI inventions address complex questions of authorship and patentability for AI-generated discoveries. This clarification strengthens the IP position of AI platform developers, securing their business model and driving corporate investment into hypothesis generation tools. |

In-Depth Segment Analysis

By End-User: Drug Discovery & Life Sciences

The Drug Discovery & Life Sciences segment represents the largest and most critical demand vector for AI-driven hypothesis generation platforms. The fundamental growth driver is the industry's catastrophic failure rate in preclinical and clinical stages—a reality where traditional R&D models require over a decade and billions of pounds for a single successful drug. AI platforms fundamentally disrupt this equation by shifting the bottleneck from experimental trial-and-error to predictive, data-driven selection. Specifically, platforms utilizing Graph-Based Hypothesis Generation can rapidly query vast biological knowledge graphs (integrating genomics, proteomics, and phenotypic data) to predict novel drug targets or repurposing opportunities, which traditional human-centric methods overlook. This capability directly reduces the time and cost associated with validating a molecular target, generating immense demand from both large pharmaceutical enterprises (e.g., in collaboration with a platform developer) and early-stage biotech ventures seeking to de-risk their pipelines. Government funding, such as the $82 million pledged to support AI therapeutics, further confirms this segment's demand by validating the technology's strategic importance and underwriting early-stage adoption.

By Software Type: AI-Powered Literature Mining Tools

The AI-Powered Literature Mining Tools segment is driven by the sheer volume and fragmentation of scientific and patent literature, rendering manual analysis prohibitively slow and incomplete. These tools, which employ Natural Language Processing (NLP) and machine learning, serve as the foundational layer for high-level hypothesis generation by automating the extraction and linkage of entities (e.g., genes, compounds, diseases, mechanisms) across millions of unstructured documents. The necessity is not merely for search but for automated knowledge graph construction, where the tool infers novel, non-obvious relationships that a human researcher could not deduce. This capability directly increases the demand for all subsequent downstream AI models, as a well-curated, machine-generated knowledge base is the necessary input for more complex predictive modeling tools. In the academic and early R&D sectors, these tools are a critical prerequisite for identifying white space in drug discovery or predicting new applications for existing materials, effectively acting as an indispensable research catalyst.

Competitive Environment and Analysis

The UK AI-Driven Hypothesis Generation market is characterized by a strong presence of science-first, vertically integrated AI biotechs that leverage proprietary platforms to discover novel therapies. Competition centers on the validation of the AI platform's efficacy—measured by the speed and success rate of moving AI-generated targets into clinical trials—and the ability to secure high-value partnerships with major global pharmaceutical companies.

Exscientia

Exscientia is a UK-based, AI-driven pharmaceutical company that pioneered the use of AI to generate novel molecular designs, a process it terms "AI-driven precision drug design." Its strategic positioning is centered on the integration of its proprietary AI platform with full-stack, automated laboratory capabilities, creating end-to-end autonomous discovery loops. A pivotal strategic move occurred in November 2024 when Exscientia completed its combination with Recursion, an event that instantly created a larger, globally scaled entity with end-to-end drug discovery and development capabilities. This maneuver strengthens Exscientia's strategic positioning by pooling two distinct AI and data-generation technology stacks, securing a more formidable competitive edge against rival platforms by enhancing its scale and data moat.

BenevolentAI

BenevolentAI is a UK leader in applying AI to extract actionable insights from biomedical knowledge to accelerate the discovery of novel medicines. Its core product, the Benevolent Platform, leverages machine learning and computational methods to interpret vast quantities of complex scientific data, enabling the identification and validation of new drug targets. The company's key strategic activity was the Proposed Delisting via a Merger into Osaka Holdings S.à r.l., a significant corporate restructuring event intended to streamline operations and pursue its original mission with a focused, leaner approach. This strategic pivot signals a move toward optimizing operational capital and maximizing the efficiency of its core hypothesis-generation technology within a more focused financial structure, underscoring the market's pressure to prove clinical and commercial utility.

Recent Market Developments

- September 2025: Cambridge, UK-based Healx announced a strategic transaction with Vuja De Sciences, advancing its oncology pipeline. This move is a capacity addition in a new therapeutic area, utilizing Healx's proprietary AI platform, known for rare disease focus, to advance a clinical-stage program for cancer recurrence, explicitly leveraging the AI-powered platform to uncover and prioritize therapeutic opportunities beyond its original domain.

- November 2024: Exscientia, a UK-based leader in AI-driven precision drug design, completed its merger with Recursion, as announced in official company releases. This is a major acquisition and capacity-building event, uniting two of the sector's most prominent AI platforms to create a global entity with enhanced scale and end-to-end drug discovery capabilities, validating the industrialization of the market.

- July 2024: Exscientia announced the launch of an AI-powered platform built on AWS technologies, integrating generative AI drug design with robotic lab automation. This product launch and capacity addition create a fully automated, generative Design-Make-Test-Learn (DMTL) loop, designed to dramatically reduce the time and cost of discovery cycles by tightly integrating the AI hypothesis generation phase with the subsequent physical experimentation.

UK AI-Driven Hypothesis Generation Market Segmentation

- BY SOFTWARE TYPE

- AI-Powered Literature Mining Tools

- Graph-Based Hypothesis Generation Platforms

- Domain-Specific Predictive Modeling Tools

- Multimodal AI Platforms

- Others

- BY APPLICATION AREA

- Drug Discovery & Life Sciences

- Healthcare & Diagnostics

- Materials & Chemical Research

- Financial & Business Analytics

- Academic

- BY DEPLOYMENT MODE

- Cloud-Based

- On-Premise