Report Overview

UK AI for Predicting Highlights

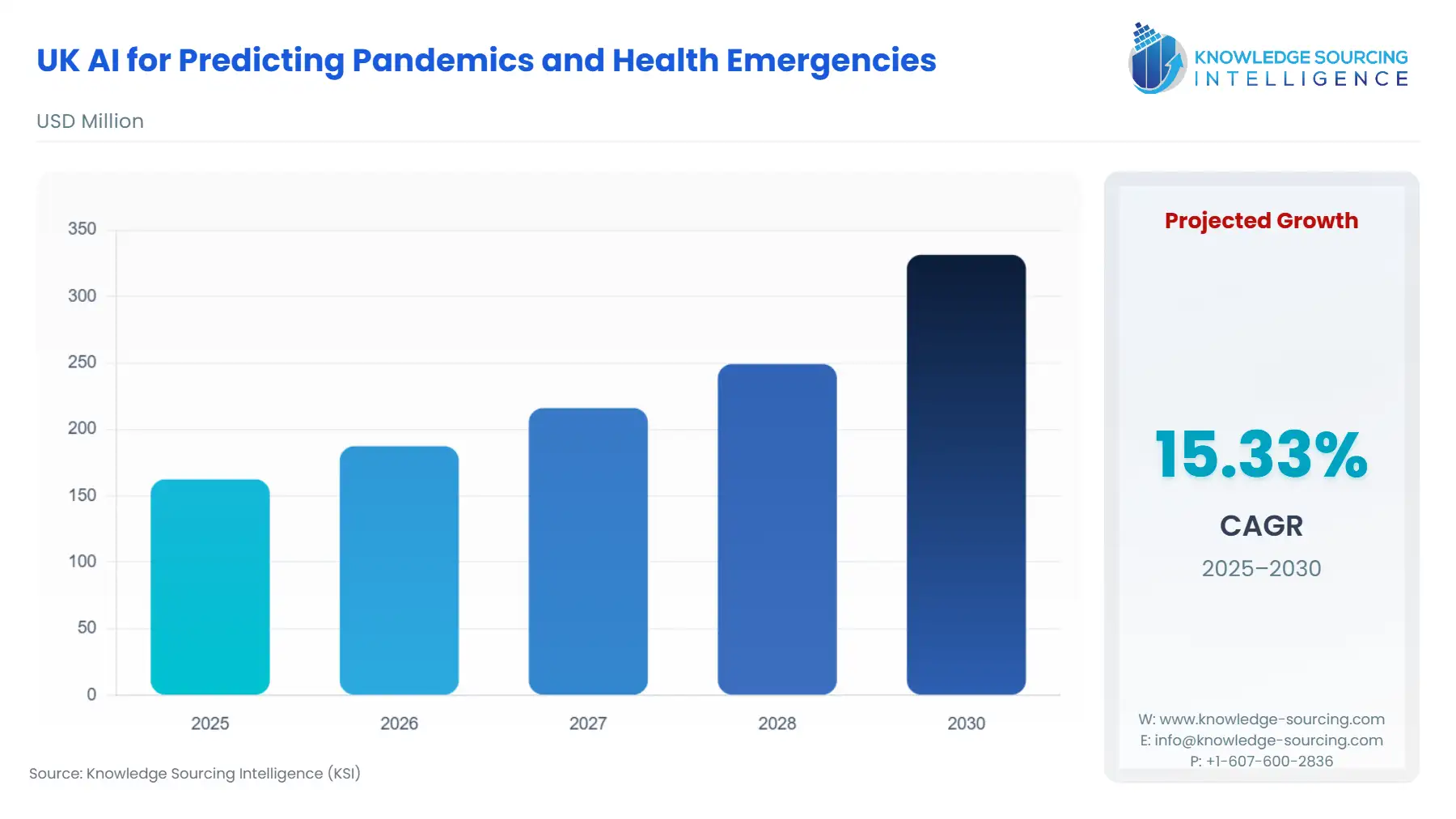

UK AI for Predicting Pandemics and Global Health Emergencies Market is set to expand from USD 162.4922 million in 2025 to USD 331.484088 million by 2030, growing at a CAGR of 15.33%.

UK AI for Predicting Pandemics and Global Health Emergencies Market Key Highlights

The UK AI for Predicting Pandemics and Global Health Emergencies market represents a high-stakes intersection of computational science and national security. The post-pandemic strategic reappraisal of public health resilience has positioned advanced analytics as an imperative, moving AI from an auxiliary research tool to a core component of the country’s biosecurity infrastructure. This market is fundamentally an intangible asset, dominated by software and services, where value is derived from algorithmic precision, proprietary data access, and model interpretability. The current landscape is one of rapid governmental procurement and strategic private investment, which prioritizes predictive accuracy and operational scale within the public health and pharmaceutical sectors.

UK AI for Predicting Pandemics and Global Health Emergencies Market Analysis

Growth Drivers

- Public Health Strategy and Digital Infrastructure: The strategic pivot by UK public health agencies towards preemptive health security constitutes a powerful market catalyst. The UKHSA is actively deploying AI projects to detect food-borne illness outbreaks by screening online reviews and using LLMs to analyze patient experience data, demonstrating an immediate, tangible need for sophisticated Outbreak Prediction & Detection and Disease Surveillance software. Furthermore, the explicit government mandate within the '10 Year Health Plan' to use AI for a predictive, patient-controlled system accelerates the demand for AI-driven Risk Assessment tools that can inform resource allocation and clinical intervention strategies before a crisis point. This centralized, top-down strategy of digital infrastructure development creates a stable, high-value demand environment for software and services that can process and integrate disparate national datasets.

Challenges and Opportunities

- Data Interoperability and Governance: The primary constraint facing the market is the challenge of data interoperability and governance. The transition to a "single, secure and authoritative account of patient data," as outlined by government plans, is essential for training and validating highly accurate predictive AI models, yet this transformation is a massive logistical undertaking. This friction creates a short-term hurdle for widespread adoption, particularly in integrating AI across varied NHS trusts. However, this very challenge simultaneously generates a massive opportunity for the Services segment, as demand surges for consulting, integration, and bespoke data-pipeline creation. Furthermore, the opportunity for UK-based companies to lead in Predictive Vaccine Design, leveraging AI to anticipate future viral evolution, creates a distinct competitive advantage and attracts pharmaceutical and biotech R&D expenditure to the UK market.

Supply Chain Analysis

As a software and service-centric market, the supply chain for UK AI for Predicting Pandemics focuses on intangible assets: data, talent, and high-performance computing (HPC) infrastructure. The key production hubs are concentrated around academic and commercial clusters in Oxford, Cambridge, and London, which serve as the primary source for elite machine learning and epidemiological talent. Logistical complexity centers on securing access to sensitive, de-identified health data (which often requires secure environments like NHS trusts' data silos) and maintaining high-availability cloud-based deployment modes. The critical dependency is on the supply of advanced computing power, with the government explicitly planning to expand the capacity of the AI Research Resource (AIRR) by at least 20x by 2030, a clear recognition that compute is the 'raw material' constraining the development of frontier AI models for pandemic prediction.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UK | Medicines and Healthcare products Regulatory Agency (MHRA) | By leading the safe use of AI in healthcare, including the establishment of the AI Airlock regulatory sandbox for AI medical devices, the MHRA accelerates the pathway for product commercialization, thereby increasing the supply-side capability to meet public sector demand. |

| UK | Department for Science, Innovation and Technology (DSIT) | The "AI Opportunities Action Plan" and National AI Strategy, which include significant investment commitments in AI infrastructure like the AIRR, directly drives the demand for AI software and services by providing the necessary foundational compute and research environments. |

| UK | National Commission into the Regulation of AI in Healthcare | This body's work to advise the MHRA on a new regulatory framework builds critical trust among public health agencies and end-users, reducing perceived risk and increasing the willingness of public bodies to procure and deploy novel AI solutions at scale. |

In-Depth Segment Analysis

By Application: Outbreak Prediction & Detection

The Outbreak Prediction & Detection segment is a non-negotiable area of demand, driven by the public health imperative to provide 'early warning' signals for both known and novel pathogens. This segment is propelled by the limitations exposed in traditional, retrospective surveillance methods, which rely on confirmed clinical diagnoses. AI solutions, conversely, process real-time, unstructured, and noisy data streams—including genomic sequencing data, wastewater surveillance, and natural language processing of online reports—to identify anomalies and transmission dynamics with greater speed. The UKHSA's demonstrable work in using LLMs to detect food-borne illness outbreaks exemplifies this direct demand. This capability allows public health agencies to transition from reactive containment to proactive intervention, creating sustained, high-value procurement for software platforms with validated, highly-specific predictive algorithms that can integrate with existing national health security systems.

By End-User: Government & Public Health Agencies

The Government & Public Health Agencies segment (including the NHS, UKHSA, and relevant government departments) remains the primary driver of market expansion. Unlike other segments, their procurement is not purely driven by profit but by national health security mandates, guaranteeing a structurally stable and non-cyclical demand for AI solutions. The shift toward a preventative model, as legislated by the '10 Year Health Plan', necessitates the purchase of end-to-end AI systems for Disease Surveillance and Public Health Resource Allocation. This segment is the sole purchaser of macro-level epidemic forecasting models and is motivated by political and social imperatives to demonstrate biosecurity resilience. Its necessity is characterized by a high barrier to entry for vendors, requiring robust data governance, regulatory compliance, and proven transparency, favoring established UK AI firms with existing governmental relationships and secure, auditable software architectures.

Competitive Environment and Analysis

The competitive landscape for UK AI in predicting pandemics is a concentrated ecosystem of specialist UK-based deep-tech companies, often spun out from world-leading universities like Oxford and Cambridge, positioning them for rapid adoption of cutting-edge research.

Mind Foundry

Mind Foundry, originating from the University of Oxford’s Machine Learning research group, is strategically positioned as a provider of responsible AI for high-stakes applications. Their core product, Mind Foundry Core, is a platform designed for the principled and transparent building, testing, and deployment of machine learning models. This focus on "First Principles Transparency" and "Human-AI Collaboration" directly addresses the critical governmental requirement for auditable and trustworthy AI systems within public health. The company's expertise in Bayesian inference makes it particularly relevant for complex, high-uncertainty scenarios inherent in outbreak prediction, leveraging limited, noisy real-world data to generate robust models, which is a key differentiator when addressing novel pathogens.

Baseimmune

Baseimmune occupies a critical, high-growth niche within the market, focusing on using AI to solve the challenge of viral evolution in vaccine design. The company leverages its proprietary AI platform to analyze vast amounts of genomic, proteomic, and epidemiological data to design synthetic antigens that target what a pathogen might evolve into, not just its current state. Their early-stage research in 2020 successfully predicted 80% of the mutations present in subsequent key coronavirus variants, validating the demand for their future-proofing technology among the Pharmaceuticals and Biotech Companies end-user segment. This strategic positioning in the upstream R&D pipeline for next-generation vaccines secures its relevance as a critical component of the UK's long-term pandemic preparedness strategy.

Recent Market Developments

- June 2025: The Medicines and Healthcare products Regulatory Agency (MHRA) announced its participation as the first founding 'pioneer' country in the new HealthAI Global Regulatory Network. This move is a strategic capacity addition focused on shaping international standards for AI in healthcare and accelerating the safe deployment of trusted AI tools into the NHS. This development directly improves the operational environment for AI companies by streamlining regulatory processes and promoting the development of high-quality AI products suitable for international scale-up.

- March 2025: The UK Health Security Agency (UKHSA) published an update on how it is pioneering artificial intelligence applications, including the use of Large Language Models (LLMs) to accelerate the analysis of qualitative survey data for patient experiences and to detect potential conflicts in public health guidance recommendations. This official report confirms the internal adoption of advanced AI techniques by the government's primary health security agency, validating the public sector demand for advanced Software solutions that leverage generative AI capabilities for rapid analysis and decision support.

UK AI for Predicting Pandemics and Global Health Emergencies Market Segmentation

- BY COMPONENT

- Software

- Services

- Hardware

- BY DEPLOYMENT MODE

- Cloud-based

- On-Premises

- BY APPLICATION

- Outbreak Prediction & Detection

- Disease Surveillance

- Contract Tracing

- Risk Assessment

- Health Trend Forecasting

- Public Health Resource Allocation

- Others

- BY END-USER

- Government & Public Health Agencies

- Hospitals & Clinics

- Research Institutions

- Pharmaceuticals and Biotech Companies

- Academic Institutions

- Others