Report Overview

UK AI in Finance Highlights

UK AI in Finance Market Size:

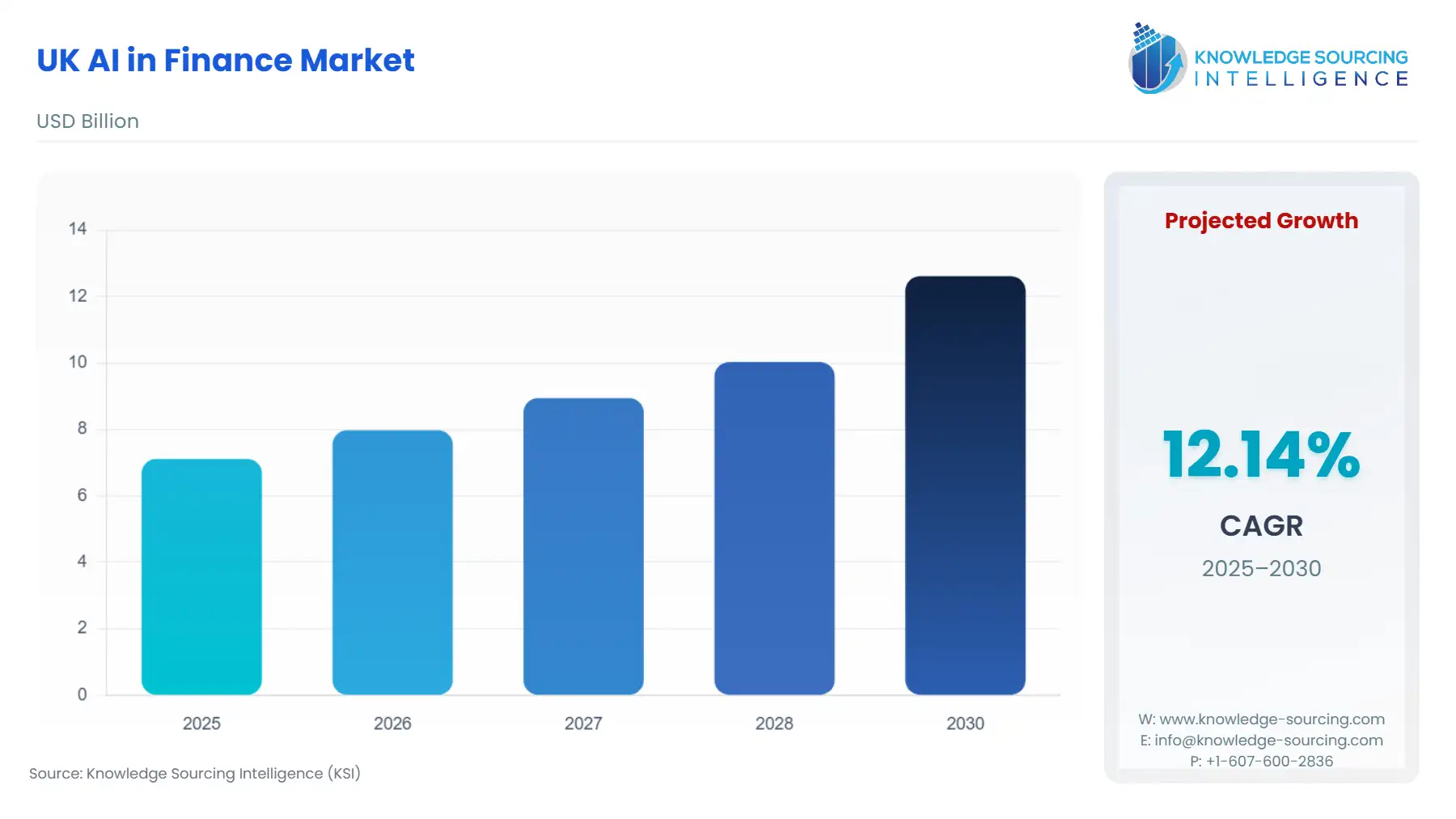

The UK AI in Finance Market is expected to grow at a CAGR of 12.14%, reaching USD 12.614 billion in 2030 from USD 7.112 billion in 2025.

The integration of Artificial Intelligence into the UK financial services sector represents a fundamental operational and strategic transformation, moving beyond mere technological enhancement to a core driver of competitive advantage. The nation's well-established fintech ecosystem and its position as a global financial hub provide a fertile environment for AI adoption. The current market is defined by financial institutions seeking to leverage AI's capabilities—speed, automation, and advanced analytics—to improve operational efficiencies, enhance customer experience, and, critically, manage a rapidly evolving landscape of systemic risk, including sophisticated fraud and stringent compliance demands.

UK AI in Finance Market Analysis:

Growth Drivers

- The imperative for enhanced fraud detection and cybersecurity directly propels demand for AI solutions. As digital transactions proliferate, the sheer volume and complexity of cyber threats compel institutions to invest in anomaly detection and predictive AI systems, increasing the need for highly specialized and real-time AI solutions. Simultaneously, the operational efficiency mandate drives strong demand for automated processes; specifically, AI-powered automation of high-volume tasks in areas like document processing, loan origination, and regulatory reporting directly reduces operational costs and turnaround times, thereby creating immediate demand for these efficiency-focused tools. Furthermore, the rising need for hyper-personalisation, especially in retail banking, stimulates demand for AI models that can process vast amounts of customer data to generate tailored financial product recommendations and bespoke financial advice.

Challenges and Opportunities

- The most significant non-regulatory constraint is the concern over the safety, security, and robustness of AI models, which curtails the need for high-materiality applications due to the associated systemic risk. An insufficient pool of domestic AI talent and access to necessary skills also constrain the rapid in-house development of complex AI, thereby increasing the demand for third-party, managed AI services and cloud-based platforms. Conversely, the opportunity to deploy AI to address Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements represents a substantial growth vector. The increasing global standardisation of financial crime prevention creates direct, non-negotiable demand for AI systems capable of automated transaction monitoring, risk scoring, and pattern recognition, effectively transforming a compliance cost into an AI-powered process.

Supply Chain Analysis

The supply chain for the UK AI in Finance market is inherently intangible and dominated by intellectual property and data infrastructure. Key production hubs are global cloud service providers, whose platforms host the majority of AI models and data processing capabilities, as the Cloud segment accounted for the largest revenue in 2024 due to its scalability and reduced initial costs. A critical logistical complexity is data sovereignty and cross-border data transfer, necessitating robust compliance with UK data protection regimes. The market exhibits a high dependency on specialised third-party model and data providers—firms often outsource the development and hosting of high-complexity machine learning and foundation models. This dependency shifts the core risk from internal operational failure to third-party vendor risk, requiring stringent due diligence and governance oversight from financial institutions.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United Kingdom | Financial Conduct Authority (FCA) Consumer Duty (Implemented 2023) | Directly increases demand for AI models that can monitor customer outcomes, ensure fair value, and verify that communications meet the information needs of target customers, shifting AI focus from purely operational to consumer-centric compliance. |

| United Kingdom | Senior Managers and Certification Regime (SM&CR) | Heightens accountability for senior leadership regarding AI model failures or misuse, creating strong demand for AI governance tools, robust explainability frameworks, and audit trails to demonstrate compliance and responsible deployment. |

| United Kingdom | Bank of England (BoE) and FCA Joint Initiatives (e.g., Surveys, Discussion Papers) | Signals the regulatory focus areas, particularly around third-party risk, security, and model robustness, driving the development and adoption of AI systems with inherent safety, security, and governance-by-design features. |

UK AI in Finance Market Segment Analysis:

By Technology: Natural Language Processing (NLP)

The need for Natural Language Processing (NLP) in UK finance is primarily driven by the exponential growth of unstructured data, including legal documents, internal reports, social media commentary, and customer interactions. Financial institutions face the imperative of deriving actionable intelligence from this data to maintain a competitive edge and meet regulatory obligations. The adoption of NLP is accelerating across compliance and risk operations, where more than 71% of UK financial service firms have integrated NLP into fraud detection efforts. This integration creates direct demand for NLP models capable of text classification, sentiment analysis, and Named Entity Recognition to automate compliance monitoring and anti-money laundering processes, thereby replacing manual data review with high-speed, high-accuracy AI processing. Furthermore, in the realm of customer experience, the shift toward virtual assistants and automated customer communication creates sustained demand for NLP systems that can interpret complex financial queries, leading to a reported 46% reduction in query resolution time for institutions adopting these solutions. The capability to process market commentary for sentiment evaluation also fuels demand for NLP within algorithmic trading and investment analysis platforms.

By User: Personal Finance

The personal finance segment is experiencing strong demand for AI-driven solutions, catalysed by the consumer desire for seamless, real-time financial control and hyper-personalised advice. The proliferation of digital banking platforms, such as those offered by challenger banks, has positioned AI as the core mechanism for delivering a tailored user experience. Its necessity is explicitly driven by features like automated savings tools that use machine learning to analyse spending patterns and automatically allocate funds, thereby removing the burden of manual money management for the user. Similarly, AI's predictive capabilities, which can forecast potential cash flow issues or offer tailored debt-reduction strategies, generate significant demand by addressing a core consumer pain point: financial anxiety and uncertainty. The rise of robo-advisors in the UK, which leverage AI to automate portfolio rebalancing and provide low-cost, personalised investment strategies, reflects the democratisation of financial services and directly increases the overall demand for AI in this segment by making sophisticated financial management accessible to a broader retail audience.

UK AI in Finance Market Competitive Environment and Analysis:

The UK AI in Finance market features a dynamic competitive landscape dominated by nimble fintechs that leverage AI as a foundational technology, challenging incumbent banks, which are now rapidly accelerating their own AI adoption. Competition centres not merely on product functionality but on the depth of AI integration in customer-facing and back-end processes, model accuracy, and user experience. Major companies, including Monzo, Revolut, Wise, and Starling Bank, use AI to underpin their core value proposition.

Monzo

Monzo's strategic positioning is rooted in its mobile-first current account, with a core focus on Personal Finance management. Their AI strategy is integral to their data-driven approach, particularly in fraud detection and personalised financial management. Key products like Salary Sorter and Bills Pots use algorithms to automate budgeting, enabling customers to divide their paycheck into separate 'pots' for spending and savings as soon as it is deposited. This focus on intuitive, AI-powered automation of everyday financial chores is a key differentiator, helping them reposition their offering from a spending card to a primary current account.

Revolut

Revolut positions itself as a global financial super-app, targeting customers who require multi-currency accounts, international transfers, and diversified financial services, including crypto and stock trading. Their strategic positioning leverages AI for enhanced security, fraud prevention, and real-time transaction analysis across their vast global customer base. Key products are their tiered subscription plans (Plus, Premium, Metal, Ultra) which bundle AI-enhanced features such as better savings rates and comprehensive insurance, all managed through a highly sophisticated, AI-backed digital platform. Their international expansion strategy, often involving localizing technology and securing specific licenses, is heavily dependent on AI to manage varying regulatory and compliance demands across multiple jurisdictions.

UK AI in Finance Market Recent Developments:

- October 2025: The Investment Association (IA) opened applications for the ninth cohort of its Engine Innovator Programme, a FinTech accelerator for the investment management industry. While not a direct product launch or M&A, this is a capacity-building event that signals a continuous, structured investment in developing AI-driven solutions and start-ups across the UK investment ecosystem, particularly in areas like asset allocation, ESG reporting, and quantitative analysis.

- June 2025: Starling Bank introduced a new "Spending Intelligence" feature, developed with Google Gemini, which allows users to query their spending data using natural language. This product launch is a significant application of Large Language Models (LLMs) in the Personal Finance segment, providing sophisticated, conversational analysis of a user's financial history and directly increasing the utility and demand for Starling's core banking app.

UK AI in Finance Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 7.112 billion |

| Total Market Size in 2031 | USD 12.614 billion |

| Growth Rate | 12.14% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Deployment Model, User, Application |

| Companies |

|

UK AI in Finance Market Segmentation:

- BY TYPE

- Natural Language Processing

- Large Language Models

- Sentiment analysis

- Image recognition

- Others

- BY DEPLOYMENT MODEL

- On-Premise

- Cloud

- BY USER

- Personal Finance

- Consumer Finance

- Corporate Finance

- BY APPLICATION

- Back Office

- Middle office

- Front Office