Report Overview

UK Application-Specific Integrated Circuits Highlights

UK Application-Specific Integrated Circuits (ASIC) Market Size:

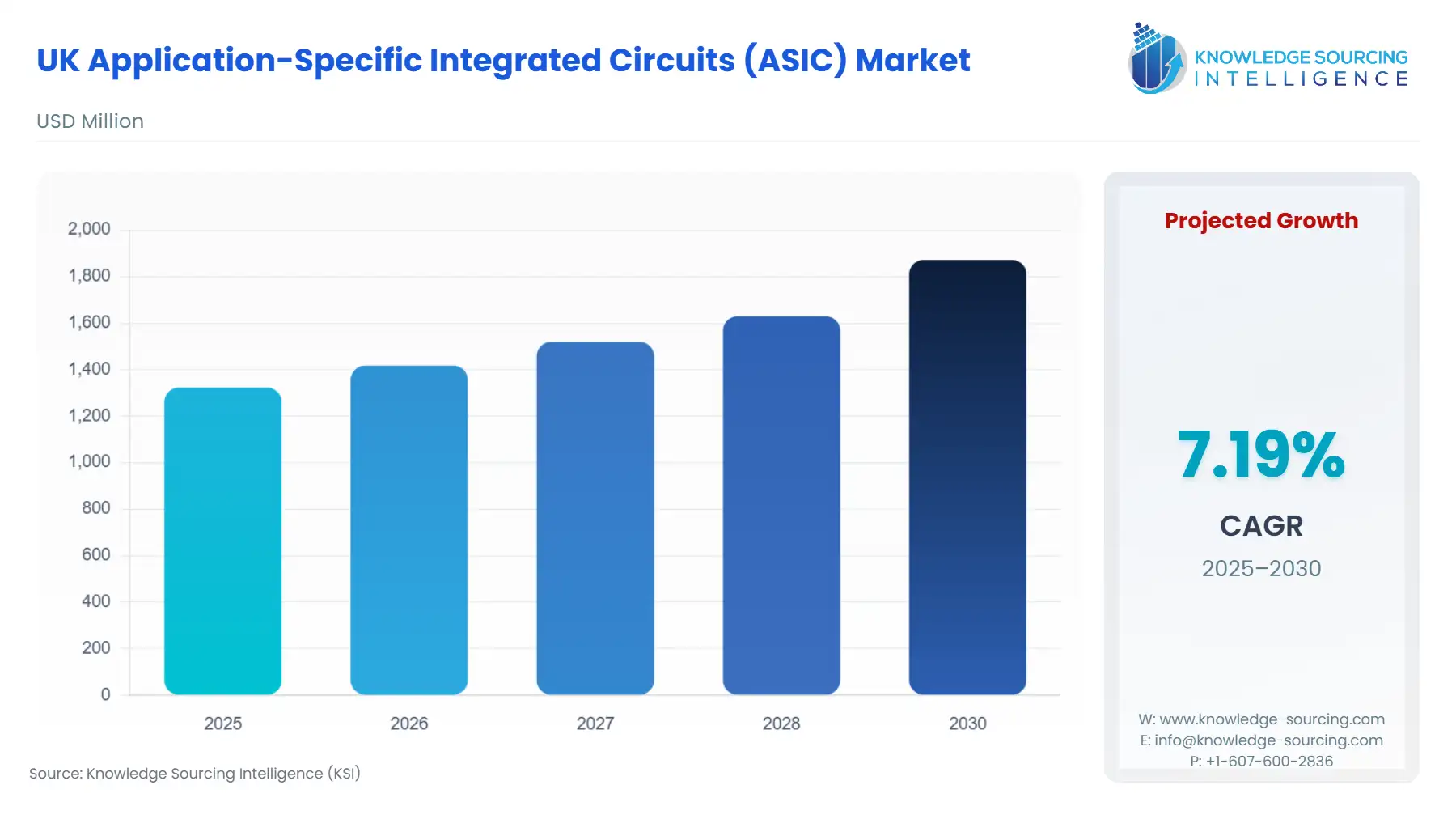

The UK Application-Specific Integrated Circuits (ASIC) Market is anticipated to rise at a CAGR of 7.19%, attaining USD 1.872 billion in 2030 from USD 1.323 billion in 2025.

The UK Application-Specific Integrated Circuits (ASIC) market is defined by its specialization in high-complexity design and intellectual property (IP), rather than large-scale, high-volume fabrication. The nation holds a strategic position in the global semiconductor value chain, serving as a critical hub for foundational chip architectures and differentiated design services. This structural advantage shifts the focus of the domestic market dynamics from purely manufacturing-driven growth to innovation-centric demand. The imperative for tailored, power-efficient, and performance-optimized silicon across key industrial sectors, notably defense, automotive, and data center computing, underpins the market's activity. The core value proposition of an ASIC—the ability to embed highly specific functionality and performance optimization directly onto the chip—aligns perfectly with the UK's high-technology, low-volume, high-value manufacturing base.

________________________________________________________________

UK Application-Specific Integrated Circuits (ASIC) Market Analysis

- Growth Drivers

UK-designed ASICs are fundamentally propelled by the necessity for performance-per-watt efficiency in hyperscale data centers and sophisticated edge computing. Hyperscalers, increasingly utilizing custom silicon to differentiate their cloud services, directly drive demand for full-custom ASICs tailored for specific machine learning and data processing unit (DPU) workloads. Concurrently, the UK's persistent investment in defense modernization, including electronic warfare and autonomous platforms, creates a non-negotiable demand for high-security, radiation-hardened ASICs. These chips, which require domestic design expertise and secure intellectual property, command a premium and stabilize the market by insulating it from volatile consumer electronics cycles. The growing complexity of on-device AI in automotive and industrial IoT further accelerates the need for specialized silicon that offers lower latency and reduced power consumption than off-the-shelf Field-Programmable Gate Arrays (FPGAs).

- Challenges and Opportunities

The primary constraint facing the UK market is the global supply chain's dependence on offshore leading-edge foundry capacity. Since the UK does not host high-volume fabrication facilities for advanced nodes (7 nm and below), domestic design houses face longer lead times and elevated non-recurring engineering (NRE) costs, which can increase the barrier to entry and slow time-to-market. This constraint specifically depresses demand for time-sensitive, advanced-node ASICs in high-volume consumer applications. Conversely, the opportunity lies in leveraging the UK's unparalleled IP ecosystem, particularly in CPU and GPU core design. The transition to more complex Systems-on-Chip (SoCs) directly increases the demand for licensed UK IP blocks, positioning domestic firms as critical enablers for global semiconductor producers. Furthermore, the push for digital transformation in the UK's healthcare and industrial sectors provides a growing, localized demand for semi-custom ASICs in medical imaging and industrial automation.

- Raw Material and Pricing Analysis

ASICs are physical electronic components, making this section mandatory. The pricing structure for ASICs is less influenced by commodity raw materials (like silicon) and far more by intellectual property, design complexity, and fabrication node. The raw material supply chain for advanced ASICs is dominated by the procurement of ultra-pure silicon wafers, specialty gases, and rare earth metals. Pricing is determined less by the cost of these raw materials and more by the scarcity of advanced manufacturing processes, specifically lithography capacity at 7 nm and 5 nm nodes, which is geographically concentrated in East Asia. UK ASIC designers pay substantial non-recurring engineering (NRE) fees to secure wafer slots, pushing the final ASIC price point up significantly, especially for low-to-mid volume custom designs, thereby constraining demand for full-custom designs to only the highest-value end-user segments like aerospace and high-performance computing (HPC).

- Supply Chain Analysis

The UK ASIC supply chain is fundamentally bifurcated. The upstream segment, which encompasses design, verification, and intellectual property (IP) core development, is highly concentrated and globally leading. UK design houses are heavily dependent on Electronic Design Automation (EDA) software from the US. The downstream segment, high-volume fabrication, is almost entirely outsourced to production hubs in Taiwan, South Korea, and increasingly, the US and Europe. This logistical complexity, coupled with geopolitical risk, creates a vulnerability in the supply chain for advanced-node ASICs. UK firms manage this dependency through long-term capacity agreements, but the reliance translates into long and fixed lead times, which limit the domestic market's agility in responding to demand spikes for programmable or semi-custom ASICs from sectors like networking and consumer electronics.

UK Application-Specific Integrated Circuits (ASIC) Market Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| UK (Federal) | UK Semiconductor Strategy | Supports domestic semiconductor production with funding and incentives, fostering innovation in ASICs for automotive, AI, and telecommunications industries. |

| UK (Environmental) | Waste Electrical and Electronic Equipment (WEEE) Regulations | Requires responsible recycling of electronics, driving demand for sustainable, eco-friendly ASICs and influencing production processes toward reduced environmental impact. |

| UK (Telecommunications) | Ofcom – Telecoms Regulatory Authority | Regulates telecom infrastructure, including 5G and IoT, creating a growing need for specialized ASICs that optimize network performance and connectivity. |

| UK (Energy Efficiency) | Energy Efficiency (Private Sector) Regulations | Mandates energy-efficient electronic solutions, prompting ASIC developers to focus on low-power, high-performance designs for energy-sensitive sectors like IoT and automotive. |

| UK (Customs & Trade) | UK Customs and Tariff Regulations | Imposes tariffs on imported ASICs, creating a competitive advantage for domestic manufacturers while raising costs for companies dependent on imports. |

________________________________________________________________

UK Application-Specific Integrated Circuits (ASIC) Market Segment Analysis

- By Application: Defense & Aerospace

The Defense & Aerospace segment is a consistent growth anchor, driven by the sector's non-negotiable requirements for performance stability, longevity, and radiation tolerance. The UK's commitment to modernizing its defense infrastructure, which includes investment in advanced radar systems, secure communications, and space-based platforms, directly mandates the use of specialized ASICs. These applications cannot rely on commercial-off-the-shelf (COTS) components due to stringent functional safety and mission-critical reliability standards. Consequently, this segment primarily drives demand for Full-Custom ASICs at mature and mid-range nodes (22 nm and above), where the priority is durability and verified performance over bleeding-edge density. The long lifecycle of defense platforms ensures sustained, predictable demand for re-spins and long-term supply agreements for specific ASIC types. This strategic governmental procurement acts as a powerful growth buffer against broader economic headwinds.

- By Application: Data Centers & Cloud Computing

The hyperscale Data Centers & Cloud Computing segment is characterized by a relentless pursuit of total cost of ownership (TCO) reduction and workload acceleration, driving significant demand for highly optimized ASICs. As the foundational architecture of cloud services shifts towards distributed, heterogeneous computing, the need for specialized silicon to offload general-purpose CPUs becomes an imperative. This trend, particularly the proliferation of custom AI accelerators, network interface cards (NICs), and DPUs, directly fuels demand for both Full-Custom and Standard Cell-Based Semi-Custom ASICs. UK-based IP developers benefit immensely as these large cloud providers often license core IP to build their proprietary chips. The necessity is concentrated on Leading-Edge Nodes (7 nm and 5 nm) due to the absolute necessity for maximum transistor density, energy efficiency, and high-speed input/output (I/O) to process colossal data flows with minimal latency, representing the market's most significant volume opportunity in the advanced-node space.

________________________________________________________________

UK Application-Specific Integrated Circuits (ASIC) Market Competitive Environment and Analysis

The UK ASIC market's competitive landscape is uniquely structured around design and IP licensing. While UK-headquartered companies dominate the foundational IP space, they operate within an ecosystem where global giants provide the necessary fabrication, EDA tools, and, in some cases, final silicon integration. Competition is centered on architectural superiority, power efficiency metrics, and the strength of the IP portfolio rather than foundry scale.

- Arm Holdings

Arm Holdings is strategically positioned as the foundational technology provider, holding a near-monopoly on IP for mobile and embedded processors worldwide, with its architectures used in over 99% of smartphones. The company's positioning is shifting to address the data center and automotive markets with its high-performance Neoverse and Automotive Enhanced (AE) cores, respectively. Arm's licensing model allows global ASIC design houses to leverage proven, energy-efficient cores to create their custom SoCs, directly catalyzing the semi-custom ASIC segment. The recent development of its Total Compute Solutions (TCS) and its focus on AI-specific instruction sets reinforce its control over the architectural blueprint of future high-end ASICs.

- Imagination Technologies

Imagination Technologies holds a strategic position in the GPU and AI processor IP domain, challenging the incumbent for automotive, mobile, and desktop graphics. The company's focus is on providing high-performance, power-efficient GPU and neural network accelerator (NNA) IP cores that are critical for on-device AI and advanced driver-assistance systems (ADAS). Its strategy centers on flexible licensing models that enable system designers to deeply integrate their IP into custom ASIC architectures, thus driving demand for optimized, differentiated solutions, particularly in the premium, power-constrained edge computing segment.

________________________________________________________________

UK Application-Specific Integrated Circuits (ASIC) Market Developments

- December 2024: Imagination Technologies announced the expansion of its team in the United States, citing considerable business growth driven by the emergence of compute-intensive and AI applications for edge devices such as autonomous driving and smart consumer products. This strategic expansion confirms the growing international demand for the company's flexible parallel processing GPU and AI IP, which is a key component in semi-custom ASIC design.

- October 2024: OpenAI partnered with Broadcom to co-develop a specialized ASIC chip optimized for AI model inference, enhancing efficiency in data centers and edge devices. This UK-relevant project leverages Broadcom's Cambridge design center for European talent integration. The chip promises 30% lower power consumption than GPUs, targeting scalable AI deployments. Announced amid rising AI demand, it strengthens the UK's role in global semiconductor ecosystems, with prototypes expected in early 2025 and full production scaling by mid-year.

________________________________________________________________

UK Application-Specific Integrated Circuits (ASIC) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 1.323 billion |

| Total Market Size in 2031 | USD 1.872 billion |

| Growth Rate | 7.19% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Process Technology, Product Type, Application |

| Companies |

|

UK Application-Specific Integrated Circuits (ASIC) Market Segmentation:

- BY PROCESS TECHNOLOGY

- Advanced Nodes

- 3 nm and below

- Leading-Edge Nodes

- 5 nm

- 7 nm

- Mid-Range Nodes

- 10 nm

- 12 nm

- 14 nm

- 16 nm

- Mature Nodes

- 22 nm and above

- Advanced Nodes

- BY PRODUCT TYPE

- Full-Custom ASIC

- Semi-Custom ASIC

- Standard Cell-Based ASIC

- Gate-Array Based ASIC

- Programmable ASIC

- Others

- BY APPLICATION

- Consumer Electronics

- Automotive

- Networking & Telecommunications

- Data Centers & Cloud Computing

- Healthcare

- Industrial & IoT

- Defense & Aerospace

- Others