Report Overview

United Kingdom Digital Wallet Highlights

United Kingdom Digital Wallet Market Size:

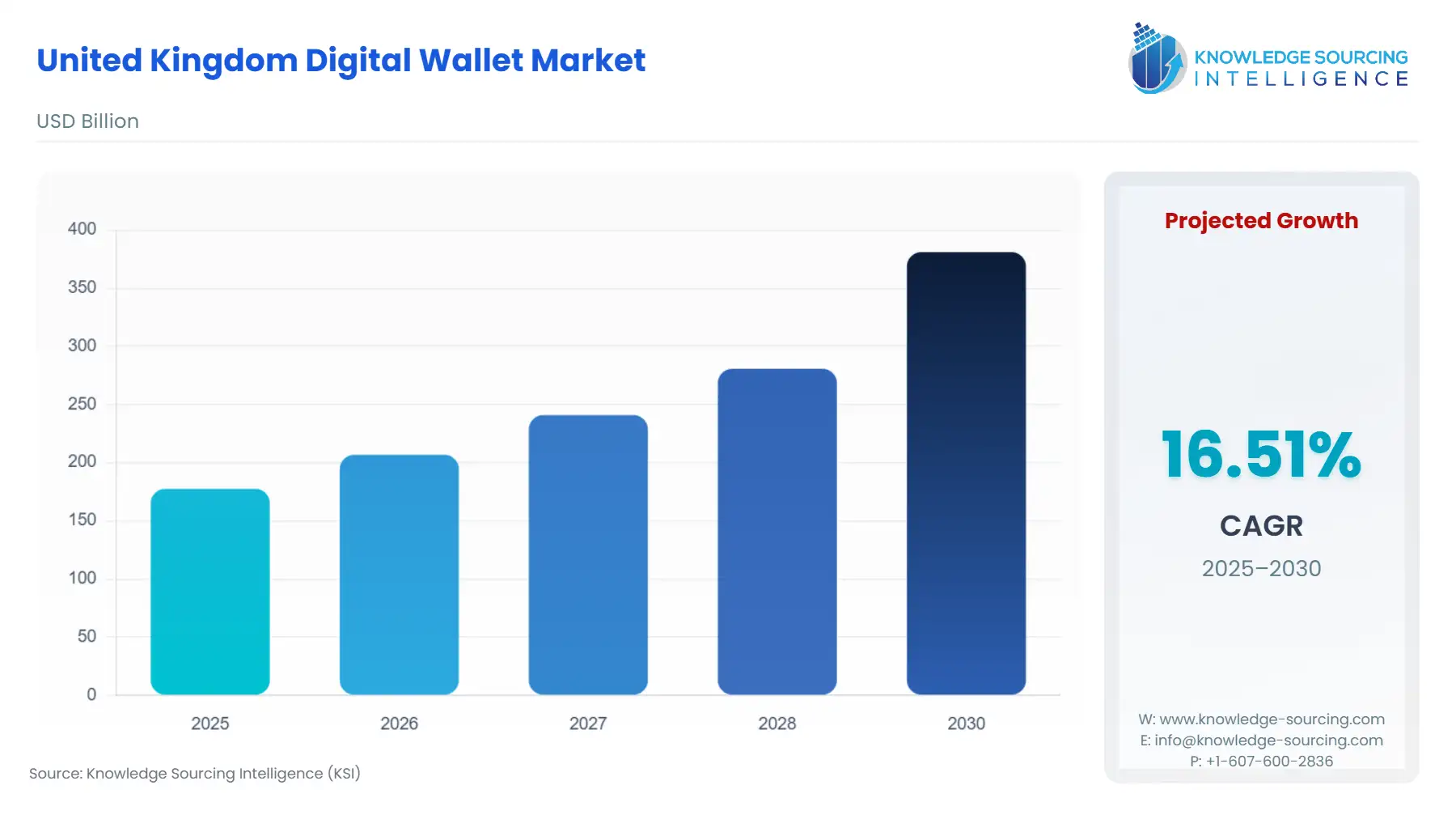

The United Kingdom Digital Wallet Market is estimated to attain a market size of US$381.114 billion by 2030, growing at a 16.51% CAGR from a valuation of US$177.517 billion in 2025, during the forecast period of 2025 to 2030.

United Kingdom Digital Wallet Market Trends:

The United Kingdom’s digital wallet market is witnessing an increased demand due to the payment systems' adaptation of consumers to pay for products and services after the COVID-19 outbreak. There was a dramatic change in how purchases were made physically, online, and through other means.

Moreover, the UK e-commerce industry is still expanding at an exponential rate. Consequently, customers are increasingly demanding the best of both worlds, and internet shopping is merging into a conventional store-based business. Owing to rising internet penetration and expanding smartphone usage, more individuals are embracing digital wallets to complete purchases.

The increased penetration of the internet is playing an important role in the increased digital payment usage, as per the World Bank. In 2023, nearly 96% of individuals in the United Kingdom were internet users. The E-wallet payment system offers services outside of processing payments to businesses, like integrating loyalty cards and serving marketing functions.

United Kingdom Digital Wallet Market Overview & Scope:

The United Kingdom Digital Wallet Market is segmented by:

- Device Type Analysis: The United Kingdom digital wallet market is segmented by device into PC/laptops and mobile. The increased daily usage of smartphones has created an upsurge in mobile applications on both major platforms, Android and iOS.

- Technology Landscape: The United Kingdom Digital Wallet by technology is segmented into NFC and QR-Code based. NFC-based digital wallets, such as Apple Pay, Google Pay, and Samsung Pay, dominate the UK market due to their seamless contactless payment experience.

- Application: By application, the United Kingdom digital wallet market is segmented into money transfer, recharge, movie booking, food ordering, and others. Key drivers for the United Kingdom digital wallet market differ by application: the money transfer segment is increasing due to a rise in mobile and cashless banking in the country, along with an increase in new digital wallet platforms.

- End-User Analysis: The United Kingdom Digital Wallet by end-user is segmented into personal and commercial. Personal digital wallets are widely used for everyday transactions, online shopping, and P2P transfers. Businesses increasingly adopt digital wallets for faster checkouts, payroll solutions, and expense management.

- Region: The United Kingdom digital wallet market is segmented by geography into regions, including England, Wales, Scotland, and Northern Ireland.

Top Trends Shaping the United Kingdom Digital Wallet Market:

1. Growth in e-commerce shopping

- The United Kingdom digital wallet market is estimated to grow at a steady rate during the forecast period. This growth is attributable to the booming demand for online shopping, improvement in payment platforms, and efforts to adopt a digital lifestyle.

United Kingdom Digital Wallet Market: Growth Drivers vs. Challenges

Drivers:

- Rising demand due to the e-commerce upsurge: The digital wallet market is witnessing an upsurge due to increased demand for e-commerce across different segments. According to the International Trade Administration, e-commerce revenues in the UK are expected to have an annual average growth rate of 12.6% by 2025. The UK has the third-largest e-commerce market in the world after China and the U.S.

- High usage of mobile: The UK has seen a strong expansion in the digital wallet market, driven by widespread and affordable smartphone ownership. The UK financial source data of the UK Payment Market 2023 showed that in 2022, about 54% of people aged between 16-24 were registered to use mobile payments, which is the highest. This is followed by the age group of 25-34, accounting for 48%, while the 35-44 age group was 38%, the 45-54 was 24%, the 55-64 was 15%, and more than 65 individuals were 12%.

Challenges:

- Data Privacy: The concern for data privacy is a serious concern for the growth of the United Kingdom Digital Wallet Market.

United Kingdom Digital Wallet Market Competitive Landscape:

The market is fragmented, with many notable players including Samsung, Apple Inc., PayPal, Google LLC, HSBC, ALTPAY LTD, Netcetera, Remitly, Inc., Wise Payments Limited, Mastercard, Velmie, Atomic Wallet, ALTPAY LTD, HSBC, FreedomPay, Amazon Pay, Curve, HyperJar, and Skrill, among others.

A few strategic developments related to the market:

- New Technology: ScotPayments is a revolutionary initiative involving state organizations and bodies for the optimal remodeling of the payment process. It is being improved by implementing the Confirmation of Payee service, which will make fraud prevention even more robust.

United Kingdom Digital Wallet Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| United Kingdom Digital Wallet Market Size in 2025 | US$177.517 billion |

| United Kingdom Digital Wallet Market Size in 2030 | US$381.114 billion |

| Growth Rate | CAGR of 16.51% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | England, Wales, Scotland, Northern Ireland. |

| List of Major Companies in the United Kingdom Digital Wallet Market |

|

| Customization Scope | Free report customization with purchase |

United Kingdom Digital Wallet Market Segmentation:

By Device

- PC/Laptops

- Mobile

By Technology

- NFC

- QR-Code based

By Application

- Money Transfer

- Recharge

- Movie Booking

- Food Ordering

- Others

By End-User

- Personal

- Commerical

By Region

- England

- Wales

- Scotland

- Northern Ireland