Report Overview

US 5G Network Infrastructure Highlights

US 5G Network Infrastructure Market Size:

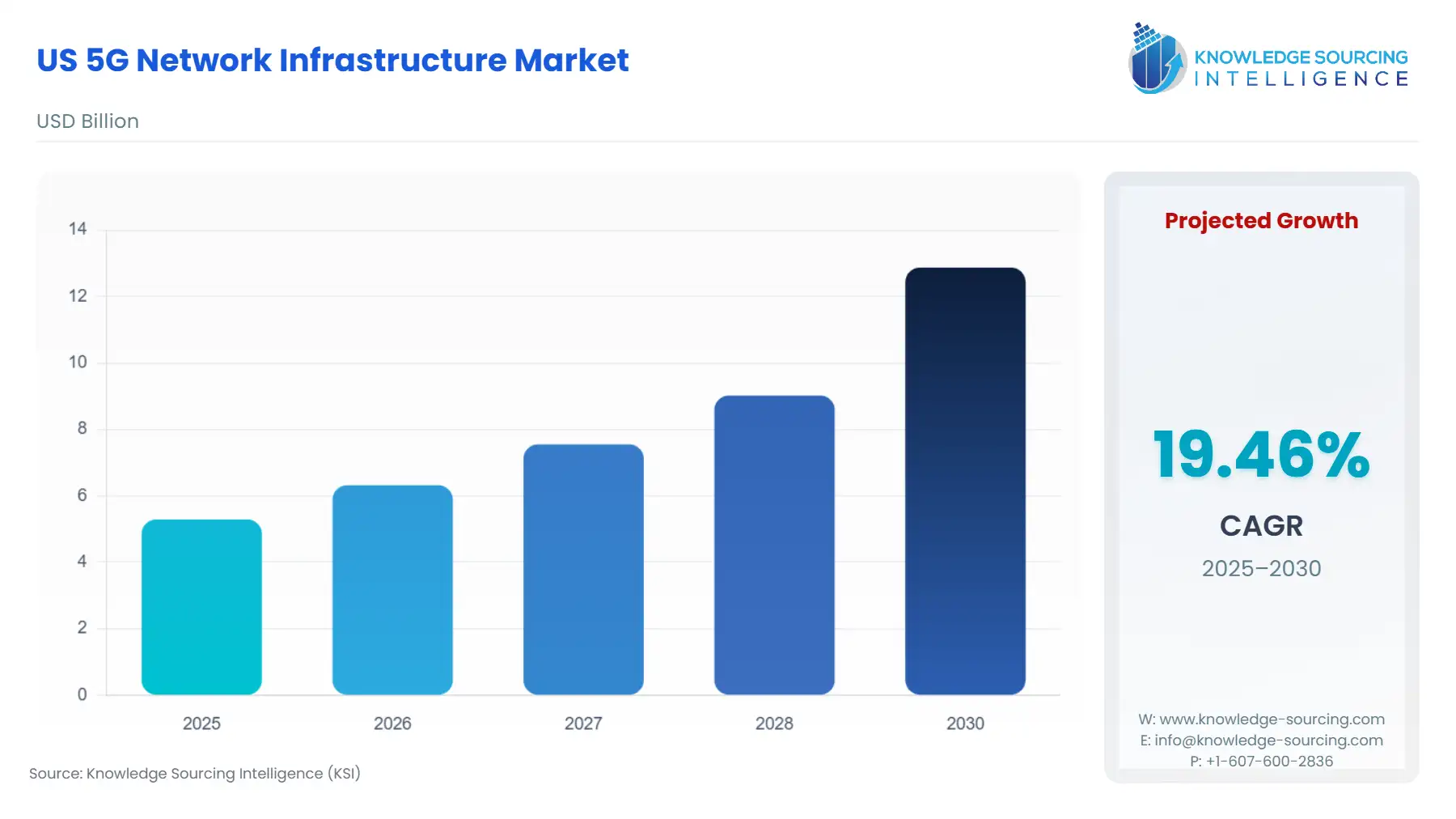

The US 5G Network Infrastructure Market is projected to expand at a CAGR of 19.46%, reaching USD 12.876 billion in 2030 from USD 5.292 billion in 2025.

The US 5G Network Infrastructure Market is fundamentally defined by the complex interaction of aggressive spectrum deployment, regulatory mandates, and the imperative for network virtualization. The initial phase of Non-Standalone (NSA) deployment, which leveraged existing 4G core networks, has largely concluded, shifting the market focus to the extensive buildout of Standalone (SA) architecture. This transition necessitates significant capital investment in 5G Core, transport, and edge compute layers to unlock the low-latency and massive connectivity capabilities required for advanced use cases such as industrial automation and telemedicine. The strategic decisions made by major telecom operators regarding spectrum allocation, specifically the blend of low-band for coverage, mid-band for capacity, and high-band (mmWave) for high-density applications, directly dictate the volume and type of infrastructure hardware and software demanded from vendors.

US 5G Network Infrastructure Market Analysis

- Growth Drivers

The continuous need for increased network capacity and performance catalyzes demand across all infrastructure segments. The proliferation of data-intensive consumer applications and the exponential growth in connected devices require a higher density of cell sites and a more sophisticated backhaul network to handle aggregated data traffic, directly increasing demand for fiber-optic transport and small cell equipment. Furthermore, the commitment by major US carriers to launch and expand Standalone 5G networks necessitates immediate investment in cloud-native 5G Core components, including the user plane function (UPF) and access and mobility management function (AMF), creating a new software and virtualization demand cycle distinct from the radio access rollout. This shift is critical as it enables true network slicing, an essential capability for commercializing new high-value services to enterprise customers.

- Challenges and Opportunities

A significant challenge is the capital-intensive nature and deployment complexity associated with dense network buildouts, particularly securing site permits and rights-of-way for small cells, which slows the rate of hardware demand. Additionally, the fragmented availability of mid-band spectrum presents a constraint, as it is crucial for balancing coverage and capacity. Conversely, a major opportunity exists in the accelerating adoption of Open RAN architectures. This technology shift, driven by a desire for vendor diversity and cost reduction, creates a distinct demand for open, standards-based radio units and cloud-native software platforms, providing a market entry opportunity for new or specialized software vendors and intensifying competition against traditional, integrated equipment manufacturers.

- Raw Material and Pricing Analysis

The US 5G Network Infrastructure Market relies heavily on physical components, primarily sophisticated electronics and materials. Key elements such as the Gallium Nitride (GaN) and Gallium Arsenide (GaAs) semiconductors used in high-power 5G radio frequency (RF) amplifiers, specialized printed circuit boards, and optical fiber cables dictate production costs. Geopolitical risks and supply chain concentration, particularly in Asia-Pacific manufacturing hubs, introduce material price volatility and lead-time variability. Equipment pricing dynamics are changing, moving from monolithic hardware-centric models to subscription-based software and service models for the 5G Core and orchestration layers. This shift necessitates vendors demonstrating measurable total cost of ownership (TCO) reductions to telecom operators who are under pressure to rapidly amortize multi-billion dollar spectrum license investments.

- Supply Chain Analysis

The global supply chain for 5G infrastructure exhibits strong consolidation and dependency on East Asian and Scandinavian production hubs for advanced Radio Access Network (RAN) and core network equipment. Key logistical complexities include the transportation of high-value, sensitive electronic components, which requires stringent inventory management and security protocols. The dependency on a limited number of specialized semiconductor fabrication facilities (fabs) for RF components and processing chips represents a significant vulnerability. The US government's emphasis on "trusted vendors" and secure supply chains has led to an explicit decoupling from certain foreign suppliers, artificially changing procurement flows and boosting demand for domestically certified or allied-nation-sourced infrastructure products, impacting both vendor selection and total cost.

US 5G Network Infrastructure Market Government Regulations:

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Federal Government | Secure and Trusted Communications Networks Act (2019) / FCC | Mandated the removal and replacement of equipment from designated foreign-sourced "untrusted" vendors, creating a direct, government-funded demand for equipment from certified manufacturers (e.g., Ericsson, Nokia) in existing carrier networks. |

| FCC | Spectrum Auctions (e.g., C-Band, CBRS) | Allocation of mid-band spectrum (C-Band) directly drives mass-scale deployment of mid-band RAN equipment, representing the largest single factor for hardware demand in urban and suburban markets. CBRS allocation fosters a new demand stream for Private 5G network equipment. |

| State/Local Governments | Small Cell Siting Regulations | Streamlining local permitting processes for small cell deployments accelerates the physical rollout of ultra-high-capacity mmWave infrastructure in dense urban areas, thereby hastening deployment and equipment demand timelines. |

US 5G Network Infrastructure Market Segment Analysis

- By Deployment Type: Private 5G Networks

The Private 5G Networks segment is fundamentally driven by the industrial and enterprise need for high-reliability, ultra-low-latency, and localized control that public networks often cannot guarantee. Manufacturing and Industrial Automation enterprises, in particular, require deterministic networking capabilities to support mission-critical applications like automated guided vehicles (AGVs), remote-controlled robotics, and real-time machine telemetry. Private 5G, leveraging spectrum options like CBRS, directly creates demand for specialized, smaller-scale 5G Core network solutions and ruggedized, enterprise-grade radio units designed for indoor and campus environments. This segment's demand curve is largely independent of carrier CapEx cycles, instead being propelled by specific enterprise digitalization roadmaps and the desire to migrate from less reliable technologies like Wi-Fi for critical operations. This market segment also fuels demand for specialized systems integrators and managed service providers, as enterprises rarely possess the in-house expertise to manage complex 5G network deployments.

- By End-User: Manufacturing and Industrial Automation

The Manufacturing and Industrial Automation sector represents a primary demand vector for high-performance 5G infrastructure due to the critical nature of its applications. Key growth drivers include the implementation of Industry 4.0 paradigms, which require ubiquitous connectivity across expansive factory floors to support real-time monitoring and control. The move to closed-loop automation—where sensors and actuators communicate with cloud-based AI systems to adjust processes instantly—require the sub-10ms latency capabilities inherent in 5G Standalone (SA) and Edge Infrastructure. This directly stimulates demand for multi-access edge computing (MEC) hardware co-located with the 5G network core to minimize signal travel time. Furthermore, the imperative for improved worker safety and predictive maintenance, where high-resolution video and massive data streams from thousands of IoT sensors must be processed instantly, propels the demand for higher capacity RAN and dedicated, secure 5G slices.

US 5G Network Infrastructure Market Geographical Analysis

- US Market Analysis

The US market for 5G network infrastructure is characterized by distinct deployment strategies across spectrum bands, which directly influences regional demand. Urban centers, particularly the densest metropolitan areas, exhibit high demand for high-band (mmWave) small cell infrastructure to provide multi-gigabit speeds in concentrated zones. Conversely, suburban and rural regions drive the demand for mid-band and low-band RAN equipment, focusing on broad area coverage and capacity upgrades to existing tower sites. Regulatory frameworks, such as the FCC's push for mid-band spectrum (C-Band) deployment, are national growth catalysts, driving nationwide infrastructure contracts. However, the varying complexity of local permitting for small cells means that infrastructure rollout rates and hardware procurement schedules differ substantially between states and municipalities. The consistent, national demand for Open RAN-capable and cloud-native equipment is a technological harmonizing factor across diverse geographies.

US 5G Network Infrastructure Market Competitive Environment and Analysis

The competitive landscape is dominated by a few global, integrated Original Equipment Manufacturers (OEMs), alongside an emerging segment of specialized software, cloud, and semiconductor firms. The market structure is shifting from a hardware-centric oligopoly to a more disaggregated, software-defined ecosystem, particularly with the rise of Open RAN.

- Ericsson Inc.

Ericsson's strategic positioning leverages its legacy as a trusted, large-scale vendor with deep relationships with major US telecom operators. Their core strategic positioning centers on providing a full spectrum of 5G solutions, from the Radio Access Network (RAN) to the cloud-native Dual-Mode 5G Core. A key product strategy involves pushing their 5G Standalone (SA) Core solutions, which are essential for carriers to monetize network slicing and ultra-low-latency services. For example, Ericsson actively promotes its Cloud Core portfolio, which utilizes cloud-native microservices architecture to provide operators with the necessary elasticity and automation to manage sophisticated 5G services, maintaining a leading position in the mission-critical core network segment.

- Cisco Systems

Cisco Systems positions itself as a critical enabler of the IP transport, routing, and automation layers of the 5G network, focusing on the backhaul and core interconnections. Their strategy emphasizes the virtualization and automation of the network, which is vital for service providers managing the complexity introduced by densified RAN and distributed edge compute. Cisco's 5G product portfolio includes its Ultra Gateway Platform and sophisticated automation/orchestration software, designed to unify the management of 4G and 5G services and accelerate the transition to cloud-native infrastructures. This focus on the IP core and automation suite directly addresses the operators' demand for operational efficiency gains as they scale their networks.

Qualcomm Technologies, Inc.

Qualcomm’s influence is highly concentrated at the baseband and RF front-end level, making them an indispensable supplier for both the user equipment (UE) and the infrastructure itself. Their strategic positioning focuses on enabling the Open RAN ecosystem through specialized silicon and platforms. Qualcomm's X100 5G RAN Accelerator Card and the Massive MIMO Qualcomm QRU100 5G RAN Platform are key products that facilitate the disaggregation of the RAN, enabling smaller vendors and specialized hardware manufacturers to enter the market with standards-compliant solutions. Their strategy is to supply the foundational technology that powers the next wave of virtualized, high-performance, and power-efficient RAN deployments.

US 5G Network Infrastructure Market Developments

- March 2025: Ericsson, T-Mobile, and Qualcomm Begin XR Trials on 5G Standalone Network

Ericsson, in collaboration with T-Mobile and Qualcomm Technologies, commenced Extended Reality (XR) trials on T-Mobile’s commercial 5G Standalone (SA) network. The trials specifically tested 5G Advanced features, including network slicing and Low Latency, Low Loss, and Scalable Throughput (L4S), utilizing AI-powered immersive smart glasses tethered to 5G Snapdragon mobile platforms. This development is a key product validation, demonstrating the ability of Ericsson’s 5G Advanced software portfolio to support high-performance, low-latency applications, thereby accelerating the commercial readiness of 5G infrastructure for the consumer and enterprise AR/VR market.

- February 2024: Cisco and TELUS Launch North America's First 5G Standalone Network for Connected Car CX

Cisco and TELUS launched North America's first 5G standalone network aimed at serving Internet of Things (IoT) use-cases for industry verticals, with a specific focus on connected cars. This initiative involved the deployment of Cisco's 5G core network technology to deliver advanced connectivity for original equipment manufacturers (OEMs). This development constitutes a major product launch and deployment that directly validates the commercial viability of 5G SA for enterprise services beyond enhanced mobile broadband, creating an immediate demand signal for Cisco's cloud-native core gateway technology for other carriers targeting the automotive sector.

US 5G Network Infrastructure Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.292 billion |

| Total Market Size in 2031 | USD 12.876 billion |

| Growth Rate | 19.46% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Component, Spectrum Band, Deployment Type, End User |

| Companies |

|

US 5G Network Infrastructure Market Segmentation:

- BY COMPONENT

- RAN

- 5G Core Network

- Transport or Backhaul Network

- Edge Infrastructure

- Network Management and Orchestration

- Others

- BY SPECTRUM BAND

- Low-band (<1 GHz)

- Mid-band (1-6 GHz)

- High-band/ mmWave (>24 GHz)

- BY DEPLOYMENT TYPE

- Public Carrier Networks

- Private 5G Networks

- Shared Infrastructure

- Hybrid

- BY DEPLOYMENT MODE

- Standalone

- Non-Standalone

- BY END-USER

- Telecom Operators

- Manufacturing and Industrial Automation

- Transportation & Logistics

- Energy and Utilities

- Healthcare

- Education

- Retail and Hospitality

- Public Sector

- Other Enterprises