Onshore Drilling Fluids Market expected to reach USD 7.981 billion by 2030

Onshore Drilling Fluids Market Trends & Forecast

According to a research study published by Knowledge Sourcing Intelligence (KSI), the onshore drilling fluids market will expand from USD 6.006 billion in 2025 to USD 7.981 billion in 2030 at a CAGR of 5.87% during the forecast period.The major driver behind the onshore drilling fluids market is the growing drilling activities worldwide. Petrobras launched a bidding process to contract four large rigs to drill oil and gas production wells onshore in the fields in August 2024. Further, in February 2025, Arabian Drilling and Shelf Drilling, Ltd. announced the signing of an MOU to form a strategic alliance. This was aimed at deploying some of Arabian Drilling’s premium jack-up rigs internationally and expanding the reach and capabilities. By combining resources, technical expertise, and operational excellence, the alliance would deliver significant results. Moreover, Saipem completed the transfer to KCA Deutag of the assets corresponding to 44 onshore rigs in Latin America, for a consideration of approximately 40 million USD. The transfer was part of the agreement signed with KCA Deutag in June 2022 for the sale of the entire onshore drilling business. The developments, along with the government incentives for domestic oil & gas production, is driving the market at a significant pace. According to OPEC, the number of wells completed has increased year-on-year from 46,305 in 2020, 51,924 in 2021, and 60,029 in 2022. Drilling fluids help to reduce wellbore instability issues and lowering costs. Increased focus on extended-reach drilling and horizontal wells, driving demand for advanced fluids. The companies are significantly investing in the onshore drilling technologies. Halliburton is at the forefront of the drilling and completion fluids industry. They develop and deploy innovative fluid technologies. They make advanced separation solutions for maximum performance. BaraHib high-performance water-based fluids a water-based systems that carry the conveniences of water and the performance of oil. Further, BaraFLC Nano-1 reduced dilution rates, lowered fluid viscosity, and tightened filtration rates during a 22-day interval with maximum downhole temperature >300ºF. It was used in a major operation in Oman. Halliburton Baroid customized BaraHib Nano drilling fluid using a wellbore sealant as the main fluid loss agent. BaraFLC Nano-1 wellbore sealant replaced the high-temperature synthetic fluid loss polymer from the formulation. Further, Baker Hughes Company delivers deepwater, onshore, shale, reservoir drill-in, high-pressure/high-temperature, and geothermal services for the intelligent fluid formulations in different environments. Their portfolio spans drilling fluids, completion fluids, and fluid waste management technologies. ? View a sample of the report or purchase the complete study at: Onshore Drilling Fluids Market Report

Onshore Drilling Fluids Market Report Highlights

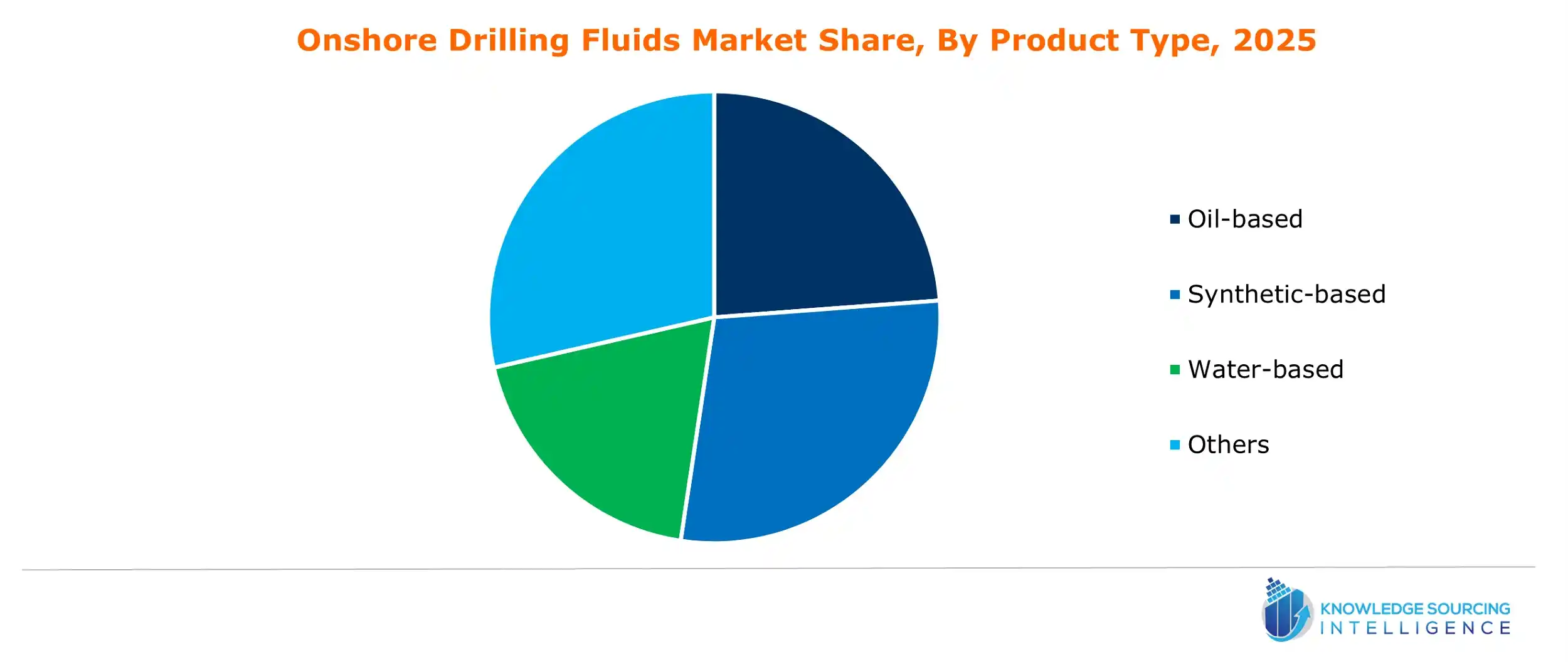

- By product type, the onshore drilling fluids market is divided into oil-based, synthetic-based, water-based, and others. The water-based ones are cost-effective and environmentally friendly. Synthetic-based drilling fluids are popular in most offshore drilling areas, despite high initial costs, because of their environmental acceptance and approval to dispose of cuttings into the water.

- By well type, the onshore drilling fluids market is divided into HPHT and conventional. Halliburton’s BaraXtreme water-based drilling fluid system was designed using new synthetic polymer technology in high-temperature/high-pressure (HTHP) drill projects. It functions as a clay-free HPWBM, which avoids high-temperature gelation. This fluid composition also serves to minimize wellbore damage.

- Asia Pacific will be the fastest-growing market during the forecast period, driven by industrialization and urbanization and investment in countries like China and India. These countries are investing on the onshore drilling technologies.

- North America is anticipated to see considerable growth, fueled by a continuous rise in consumer demands, increasing demand for oil and gas, and technology and operational breakthroughs that have also contributed to onshore drilling fluids in the region.

Report Coverage:

| Report Metric | Details |

| Onshore Drilling Fluids Market Size in 2025 | USD 6.006 billion |

| Onshore Drilling Fluids Market Size in 2030 | USD 7.981 billion |

| Growth Rate | CAGR of 5.87% |

| Drivers |

|

| Restraints |

|

| Segmentation |

|

| List of Major Companies in Onshore Drilling Fluids Market |

|

Onshore Drilling Fluids Market Growth Drivers and Restraints

Drivers:- S. Federal Onshore Lease Expansion Lowers Permitting Hurdles: The new policy requires quarterly onshore lease sales in certain states and lowers royalty rates, creating more certainty for drilling operators and promoting further fluid demand.

- Namibia’s First Local Mud Plant Reduces Supply Delays: Baker Hughes is constructing the country's first liquid mud plant, which will improve supply chains, reduce costs, and enhance the availability of local drilling fluid.

- Secret Use of Toxic Fracking Chemicals Risks Regulation Backlash: Oil companies in Colorado have been injecting undisclosed chemicals, sometimes toxic chemicals, leading to community health and regulatory concerns and possibly eliminating or constraining the usage of their drilling fluids altogether.

- Fluid Waste Disposal Remains Complex and Costly: There are strict regulations around management and disposal of drilling fluid waste and the environmental impact these cause- lead to high costs for operators around compliance and waste management.

Onshore Drilling Fluids Market Key Developments:

- ADNOC Drilling agrees to acquire 70% of SLB’s onshore rig operations in Oman and Kuwait, boosting regional drilling support capabilities.

- S. Federal Onshore Lease Expansion Reduces Permitting Hurdles: The new policy mandates quarterly onshore lease sales in certain states and lowers royalty rates, providing greater certainty for drilling operators and fostering increased demand for drilling.

Onshore Drilling Fluids Market Segmentation

Knowledge Sourcing Intelligence has segmented the global onshore drilling fluids market based on product type, well type, and region: Onshore Drilling Fluids Market, By Product Type- Oil-based

- Synthetic-based

- Water-based

- Others

- HPHT

- Conventional

- North America

- U.S.

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa (MEA)

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

- Baker Hughes

- Castle Harlan Inc.

- AMC Drilling Fluids & Products (Imdex Ltd.)

- Secure Energy Services

- Global Drilling and Chemicals

- Sagemines

- Halliburton Company

- Schlumberger

- National Oilwell Varco

- Total Energies

- Petra Industries Global L.L.C

About Knowledge Sourcing Intelligence (KSI)

Knowledge Sourcing Intelligence (KSI) is a market research and consulting firm headquartered in India. Backed by seasoned industry experts, we offer syndicated reports, customized research, and strategic consulting services. Our proprietary data analytics framework, combined with rigorous primary and secondary research, enables us to deliver high-quality insights that support informed decision-making. Our solutions empower businesses to gain a competitive edge in their markets. With deep expertise across ten key sectors, including ICT, Chemicals, Semiconductors, and Healthcare, we effectively address the diverse needs of our global clientele.Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Press Releases

Pain Management Drugs Market expected to reach USD 116.412 billion by 2030

Recently

Organic Acids Market expected to reach USD 21.582 billion by 2030

Recently

Enterprise Artificial Intelligence (AI) Market expected to reach USD 83.850 billion by 2030

Recently

Non-Woven Adhesive Tape Market expected to reach USD 3,124.230 million by 2030

Recently