Dumper Trucks – Backbone of the Mining Industry

Dumper trucks also known as tipper trucks are widely used across the construction and mining industry for the handling of heavy materials. These trucks are equipped with an open-box hinged at the rear which can be put in use for handling and dumping of materials.

The market for dumper trucks is expected to show a nominal growth on account of the constantly growing construction and mining industry around the globe. Rapid urbanization and industrialization have led to a boom in the construction activities especially across the developing economies of the world such as India, China, and Brazil among others. Furthermore, the booming infrastructural development in various economies of the world due the impressive economic growth has led to the development and up-gradation of the commercial infrastructure as well, which in turn is projected to augment the demand for dumper trucks. The growing demand for minerals has also led to an upsurge in the activities across the mining sector globally, thus, a significant growth in the investments in the mining sector in the major developing economies is further widening up the opportunities for the manufacturers over the next five years. Additionally, the constant participation by the major manufacturers operating under the market are playing a significant role in shaping up the global dumper truck market growth throughout the forecast period. Major players are heavily investing in R&D and are further launching new vehicles with advanced features to meet the growing requirements of the end-users.

However, the recent outbreak of the novel coronavirus disease is projected to negatively impact the growth during the short run as the temporary halt in the construction activities has led to a decline in the demand by the end-users. Also, the temporary suspension of manufacturing activities across the automotive sector due to a decline in demand is also inhibiting the market growth during a short period of six to eight months. Also, the longer average lifespan of these trucks coupled with the growing acceptance of pre-owned fleet are also considered to be some of the major factors that are expected to hamper the demand for the new fleet by the fleet owners as well, thereby expiated to negatively impact the market growth in the coming years.

Booming Investments in Infrastructure Development Is Driving the Growth

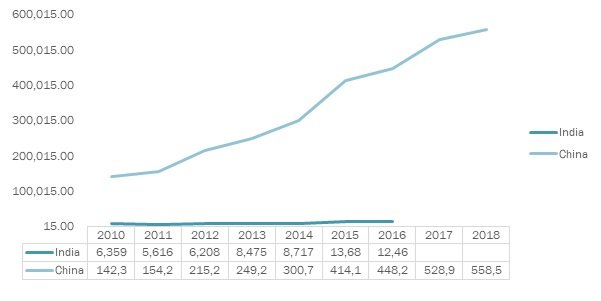

Infrastructure is considered as one of the most essential areas where dumper trucks are used widely either for waste handling or material handling. Impressive economic growth in several countries around the globe has led the government to take various initiatives to the development of commercial infrastructure. Thus, an increase in the number of construction projects globally will bolster the demand for dumper trucks during the next five years. In the major emerging economies such as India and China urbanization and industrialization have led to an upsurge in the construction activities. According to the statistics from the Organisation for Economic Co-operation and Development,the infrastructure investment in road, rail, and air have increased significantly over the past years in the world’s fastest-growing economies, India and China.

Infrastructure Investment, 2010-2018, India and China, in Million Euros

Source: Organisation for Economic Co-operation and Development

The above figure represents the infrastructure spending in India and China which covers the spending done on new transport construction and also the improvement of the existing transport infrastructure. Thus, a significant increase in the construction of transport infrastructure is also playing a major role in widening up the opportunities for the key market players during the next five years as investments in the infrastructure represents a significant growth of the transport industry as it requires the construction of new roads, highways, airports, and others.

Participation by Market Players

The global dumper truck market is poised to witness a decent growth on account of the constant participation by the major players of the market in partnerships, R&D, mergers, and acquisitions for the expansion of their market share during the next five years. Players are also launching new vehicles with advanced features to cater to the growing end-use requirements, which is also positively impacting the growth during the next five years. For instance, recently in June 2020, Ashok Leyland, an Indian automobile company announced the launch of a new range of trucks with BS-VI compliances that also included tipper trucks. Similarly, in September 2018, SML Isuzu Limited, leading commercial vehicle manufacturer announced the launch of its three new heavy-duty carriers Samrat GS tipper in the construction segment, and two trucks, Samrat GS HD19 and Sartaj GS turbo-CNG for commodity transportation. Furthermore, in March 2018, Ashok Leyland also announced a launch of three major trucks in the heavy-duty multi-axle range which included tipper trucks also. Similarly, in January 2018, Tata Motors announced its global expansion plans by announcing the launch of a range of trucks with an aim to tap the road construction and mining sector. Moreover, in January 2017, Man Trucks announced the launch of its new fuel-efficient CLA EVO 25.300, 6×4, BS 3, tipper truck.

Segment Overview:

The global dumper truck market has been segmented on the basis of type, end-user industry, and geography. On the basis of type, the classification has been done into articulated and rigid. By the end-user industry, the market has been segmented on the basis of mining and construction. Geographically, the market has been distributed into North America, South America, Europe, Middle East and Africa, and Asia Pacific.

Mining to Show a Healthy Growth

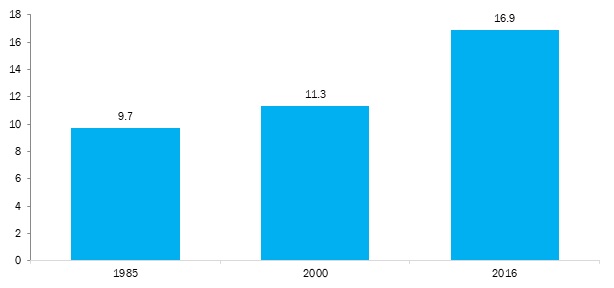

By the end-user industry, the mining sector is anticipated to witness a decent growth throughout the forecast period due to the growing investments in the mining sector globally. The growing demand for mineral fuels, iron, and other industrial minerals has been on the verge of increase for many years. According to the report from the International Organizing Committee for the World Mining Congresses, the world mining production reached 16.9 billion metric tons by 2016 from 11.3 billion metric tons in 2000.

World Mining Production, 1985, 2000, 2016, in Billion Metric Tons

Source: Knowledge Sourcing Intelligence Estimates