Eco-Friendly Solutions: The Future of Sustainable Stain-Resistant Coatings

The stain-resistant coatings market around the world has been growing due to several factors. The major drivers are the development and growth of new housing projects, rising infrastructural projects around the world, growth in the automotive industry, rising demand for consumer goods, and growing awareness around the use of sustainable materials. The stain-resistant coatings have multiple applications in diverse industries, such as textiles, food packaging, electronics, and architectural surfaces, among others.

The growth of industrial coatings was mainly fueled by the rising demand for corrosion-resistant coatings across multiple industries. Additionally, the demand for high-performance coatings for industrial applications also contributed to the growth of the stain-resistant coatings market.

Driven by environmental concerns and increasing regulatory requirements, the adoption of eco-friendly stain-resistant coatings is on the rise. This trend is further supported by consumer sentiment, as evidenced by the Nielsen poll, 66% of global consumers are willing to pay more for environmentally responsible products.

The upcoming innovations, such as GreenShield and GreenShield ZERO, that are nanoparticle-based, reduce the health and environmental impact of stain-resistant fabric finishes. GreenShield reduces the amount of fluorochemicals required to repel oil-based stains, while GreenShield ZERO is a fluorine-free solution designed for water-based stain resistance. Both GreenShield and GreenShield ZERO utilize amorphous silica nanoparticles, a material also commonly found in products like toothpaste and cosmetic creams.

Further, in November 2024, Biesterfeld entered into a partnership with Anomer Inc., a Canadian manufacturer of sustainable cellulose advanced materials. As part of this new cooperation, Biesterfeld is aimed at expanding its product portfolio in the field of Coatings, Adhesives, Sealants, and Elastomers to include the nanocellulose products DextraCel HS and DextraCel HP.

Nanocellulose offers a sustainable alternative for a wide range of industrial uses. Products like DextraCel HS and DextraCel HP are based on nanocellulose particles and consist of 100% cellulose without any additives. DextraCel enhanced mechanical benefits like scratch, stain, and abrasion resistance. Their versatility makes it suitable for numerous coating applications, including those for wood and concrete floors, automotive interiors, paints, inks, varnishes, as well as leather and textile coatings.

Anomera Inc.'s partnership with Biesterfeld gives them access to European markets. This also allows for the distribution of advanced cellulose technologies.

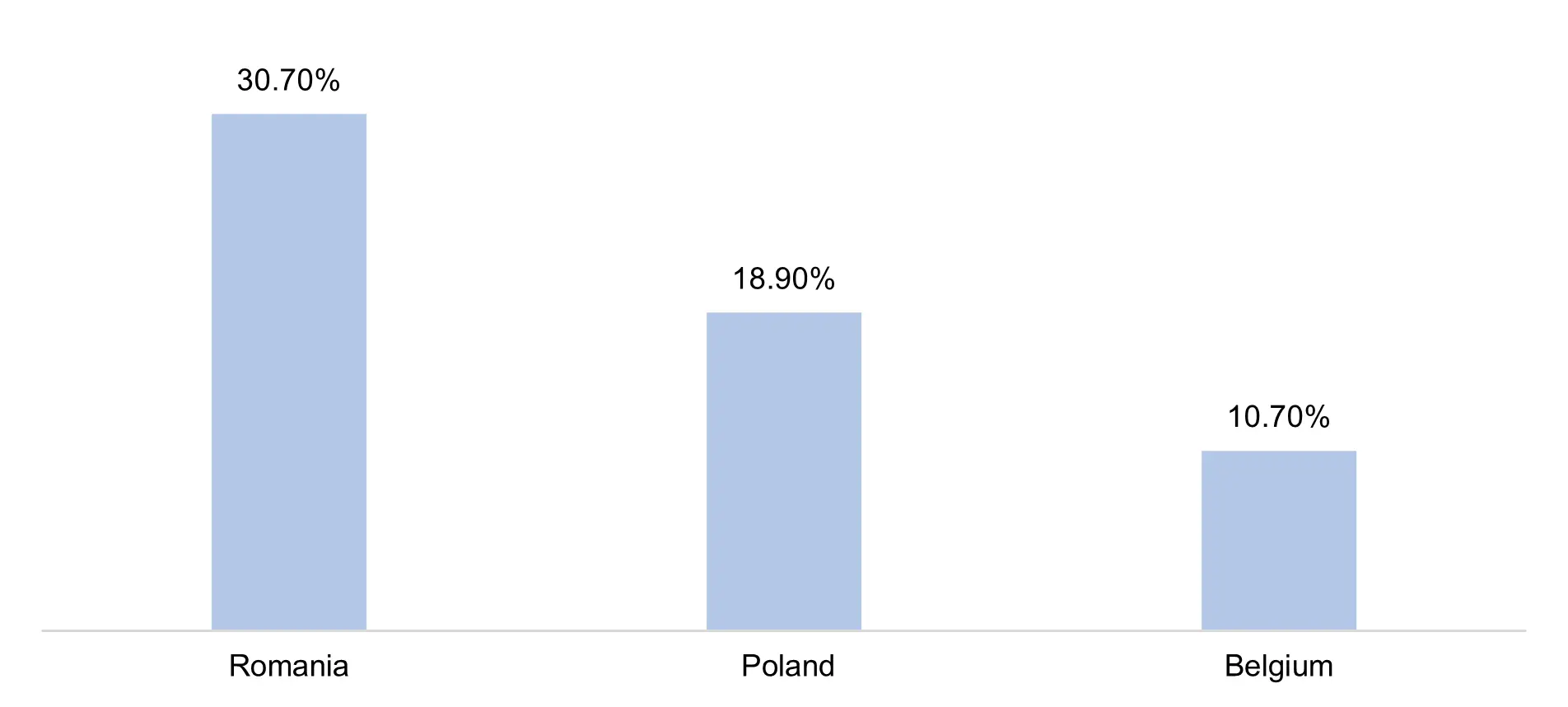

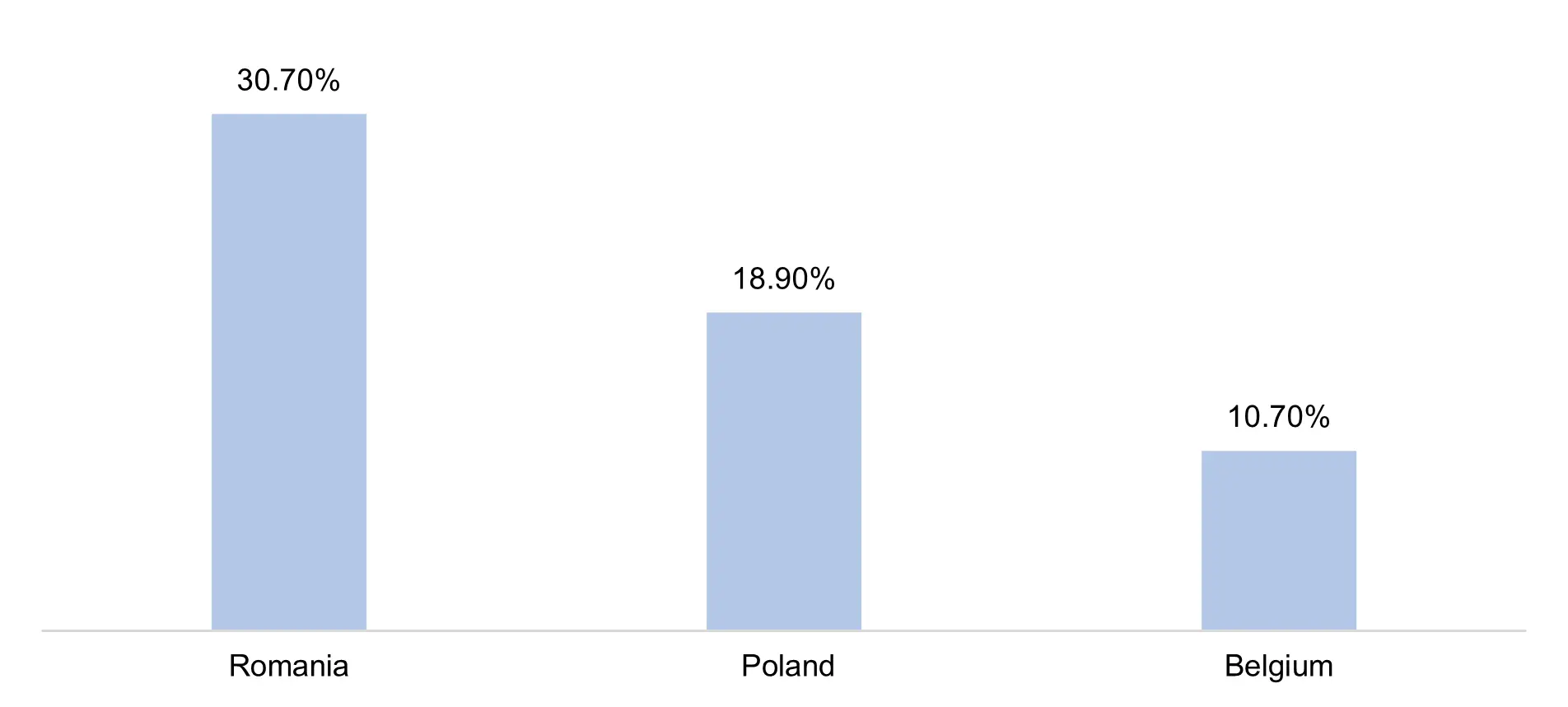

Source: Eurostat

Source: Eurostat

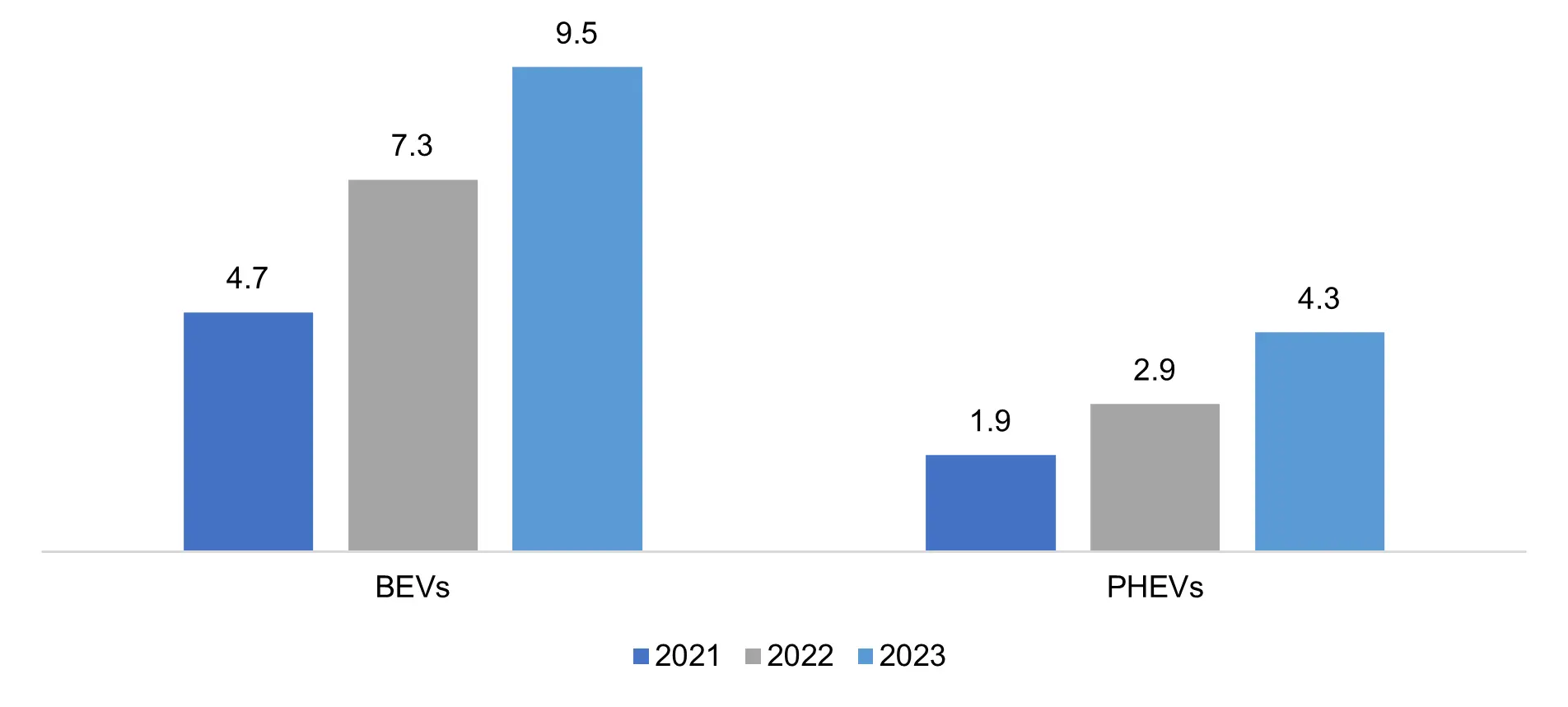

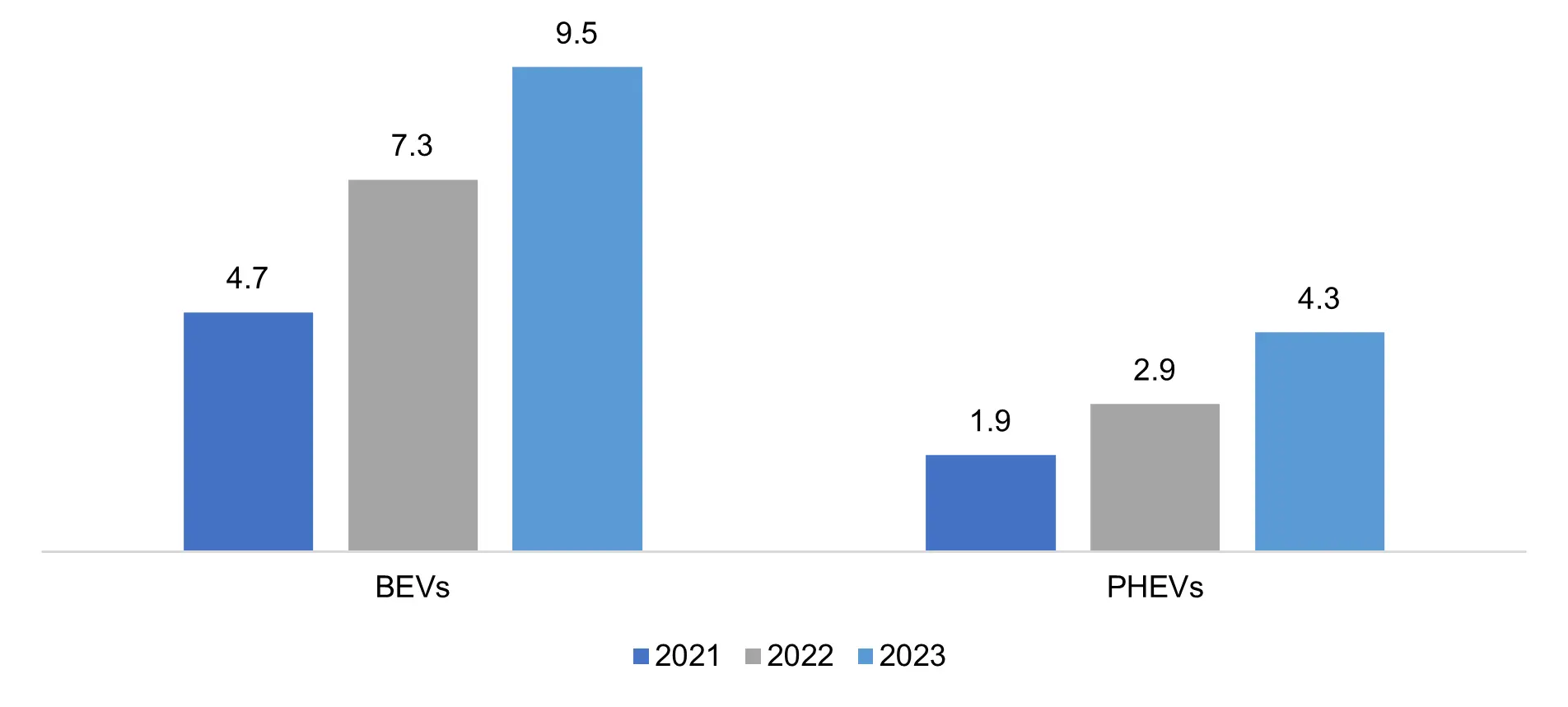

Source: International Energy Agency

Find some of our related studies:

Source: International Energy Agency

Find some of our related studies:

- Innovative solutions as alternative products

- The replacement for PFAS

- Demand growth from the construction industry

Source: Eurostat

Source: Eurostat

- Demand growth from the automobile industry

Source: International Energy Agency

Find some of our related studies:

Source: International Energy Agency

Find some of our related studies:

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently