Driving Growth: Exploring Trends in the Oilseed Market

Oilseeds are a vital component of global agriculture and play a crucial role in the production of food, feed, and biofuels. These seeds contain high levels of oil and are cultivated primarily for their oil content. The oil extracted from oilseeds is used in various applications, including cooking oil, margarine, biodiesel, and animal feed. In this article, we will explore the oilseed market, analyzing its production and consumption trends, major crops, market dynamics, challenges, opportunities, and future outlook.

Global Production and Consumption Trends

The production and consumption of oilseeds have been steadily increasing over the years, driven by factors such as population growth, changing dietary habits, and the growing demand for biofuels. Leading oilseed-producing countries include the United States, Brazil, China, India, and Argentina. These countries account for a significant portion of global oilseed production, with soybeans, rapeseed, sunflower seeds, and palm kernels being the most commonly cultivated crops.

In recent years, there has been a notable increase in the production of oilseeds in emerging economies, particularly in South America and Southeast Asia. These regions have favorable agro-climatic conditions for oilseed cultivation and have seen significant investments in agricultural infrastructure and technology. However, challenges such as land degradation, water scarcity, and climate change pose risks to the sustainability of oilseed production in these areas.

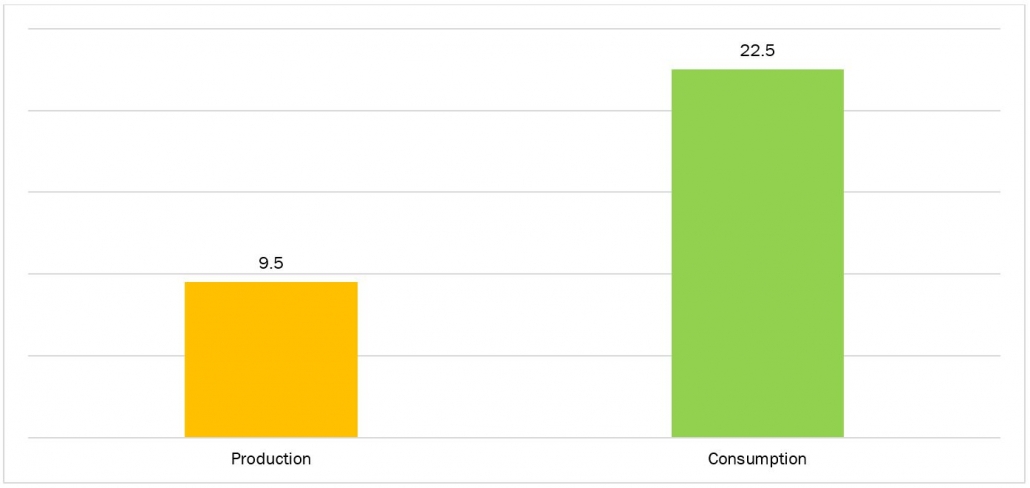

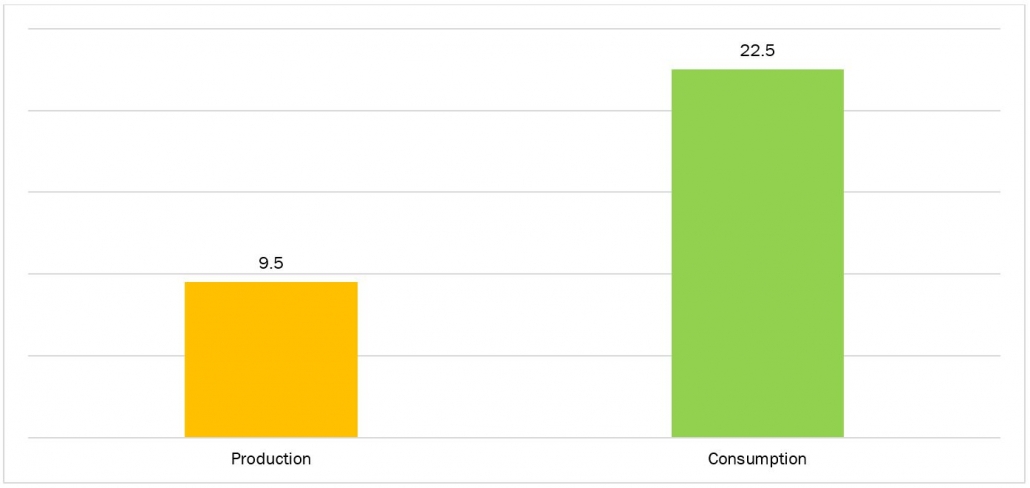

In the fiscal year 2021-22, global oilseed production totaled 632.86 million metric tons (MMT). Within the Indian agricultural sector, oilseeds hold the second most significant position in terms of both cultivated area and production, following food grains. In the fiscal year 2020-21, domestic production of edible oils amounted to 9.5 million metric tonnes, while domestic consumption stood at 22.5 million tonnes annually. Consequently, to bridge the gap of 13 million tonnes, the country resorts to imports, incurring a cost of US$ 13.5 billion (equivalent to approximately Rs. 1.17 lakh crore).

Figure 1: Edible Oil Domestic Production and Consumption in India for 2020-21 in Million Metric Tonnes

Source: NAARM Report

Major Oilseed Crops

Soybeans are the most widely cultivated oilseed crop globally, accounting for a significant portion of total oilseed production. Soybean oil is used in various food products, while soybean meal is a valuable protein source for animal feed. Rapeseed, primarily grown in Europe and Canada, is another important oilseed crop known for its high oil content and versatile applications. Sunflower seeds are cultivated mainly in Eastern Europe and Russia and are valued for their high-quality oil.

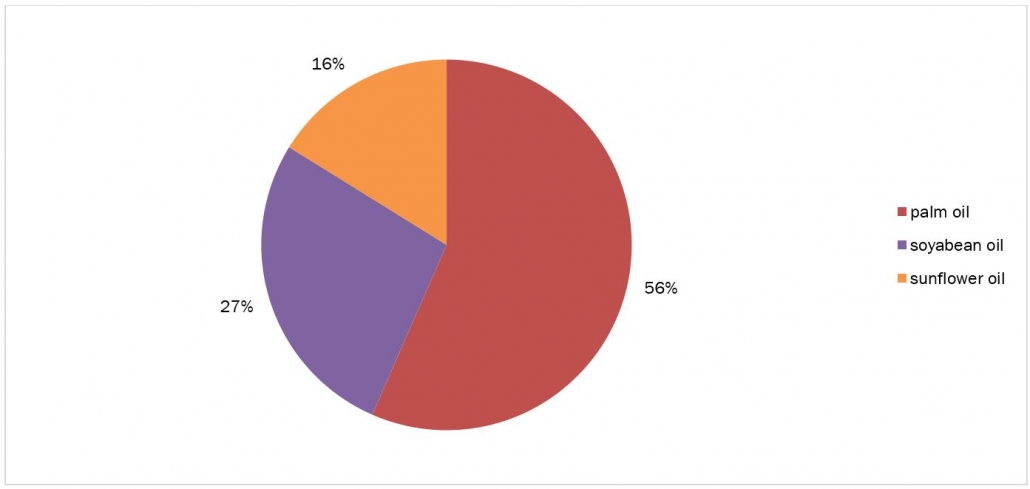

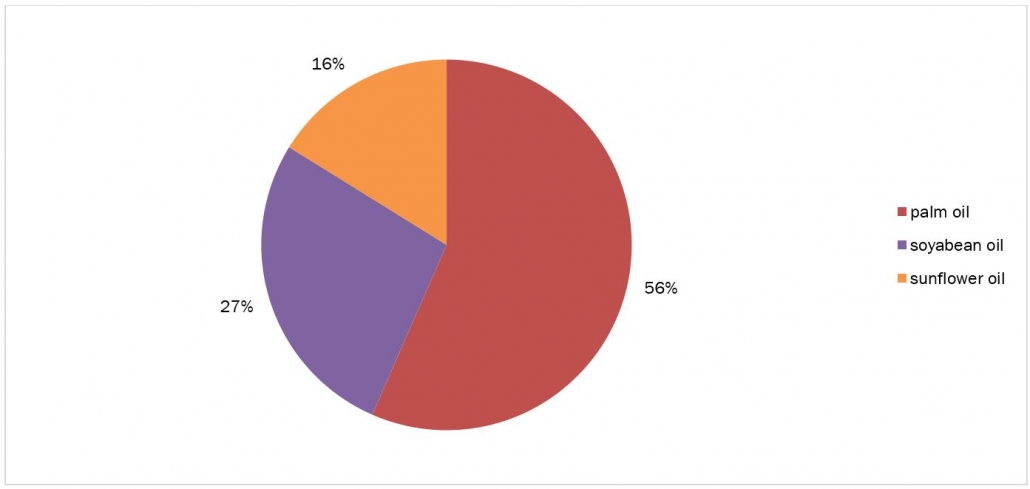

Palm oil, derived from the fruit of oil palm trees, is a crucial commodity in the oilseed market, with extensive use in the food, cosmetics, and biofuel industries. However, the production of palm oil has been associated with deforestation, habitat destruction, and environmental degradation, leading to concerns about its sustainability. In the fiscal year 2020-21, India imported approximately 13.352 million metric tonnes of edible oils, amounting to around Rs. 80,000 crores. Among all the imported edible oils, palm oil constitutes approximately 56% of the total, followed by soybean oil at 27%, and sunflower oil at 16%.

Figure 2: Segmentation of Edible Oil Import in India, in 2020-21

Source: NAARM Report

Major Oilseed Crops

Soybeans are the most widely cultivated oilseed crop globally, accounting for a significant portion of total oilseed production. Soybean oil is used in various food products, while soybean meal is a valuable protein source for animal feed. Rapeseed, primarily grown in Europe and Canada, is another important oilseed crop known for its high oil content and versatile applications. Sunflower seeds are cultivated mainly in Eastern Europe and Russia and are valued for their high-quality oil.

Palm oil, derived from the fruit of oil palm trees, is a crucial commodity in the oilseed market, with extensive use in the food, cosmetics, and biofuel industries. However, the production of palm oil has been associated with deforestation, habitat destruction, and environmental degradation, leading to concerns about its sustainability. In the fiscal year 2020-21, India imported approximately 13.352 million metric tonnes of edible oils, amounting to around Rs. 80,000 crores. Among all the imported edible oils, palm oil constitutes approximately 56% of the total, followed by soybean oil at 27%, and sunflower oil at 16%.

Figure 2: Segmentation of Edible Oil Import in India, in 2020-21

Source: NAARM Report

Market Dynamics and Drivers

Several factors drive the oilseed market, including population growth, urbanization, dietary shifts, and economic development. As populations grow and incomes rise, there is an increased demand for edible oils and protein-rich foods, driving the consumption of oilseeds. Moreover, the growing popularity of plant-based diets and the rising awareness of the health benefits of vegetable oils have contributed to the demand for oilseed products.

The expansion of the biofuel industry has also played a significant role in driving the oilseed market. Biofuels, such as biodiesel and bioethanol, are derived from renewable sources such as oilseeds and offer a cleaner alternative to fossil fuels. Government policies promoting the use of biofuels, along with concerns about energy security and climate change, have spurred investments in biofuel production, further boosting the demand for oilseeds. In August 2021, the Government of India launched the National Mission on Oilseeds and Oil Palm with the objective of achieving self-sufficiency in edible oil production and increasing domestic oilseed output. Under this initiative, the government plans to invest over 110 billion rupees ($1.48 billion) to provide farmers with comprehensive support, including improved technology and high-quality seeds.

Challenges and Constraints

Despite the promising prospects, the oilseed market faces several challenges and constraints that threaten its sustainability and growth. Climate change poses a significant risk to oilseed production, with extreme weather events, such as droughts, floods, and heatwaves, disrupting agricultural activities and reducing yields. Additionally, pest and disease pressures, soil degradation, and water scarcity present formidable challenges to oilseed producers.

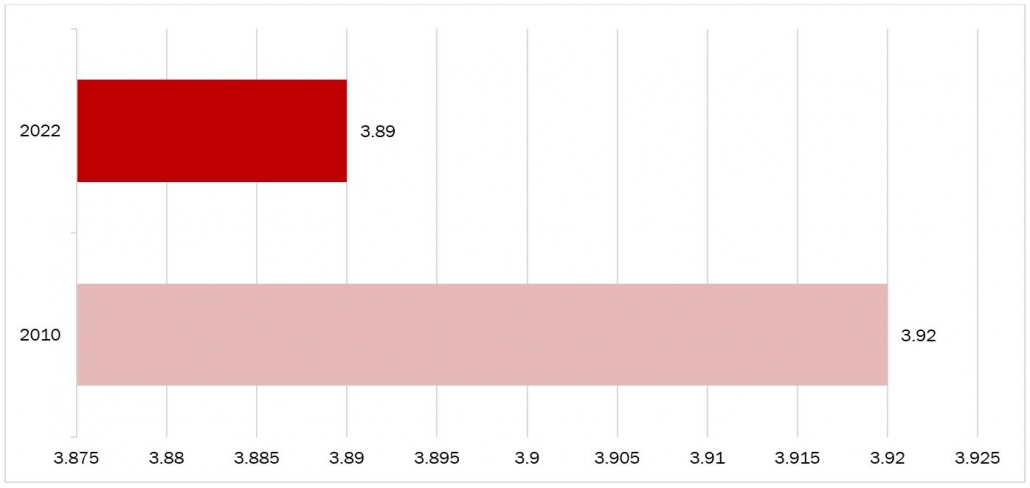

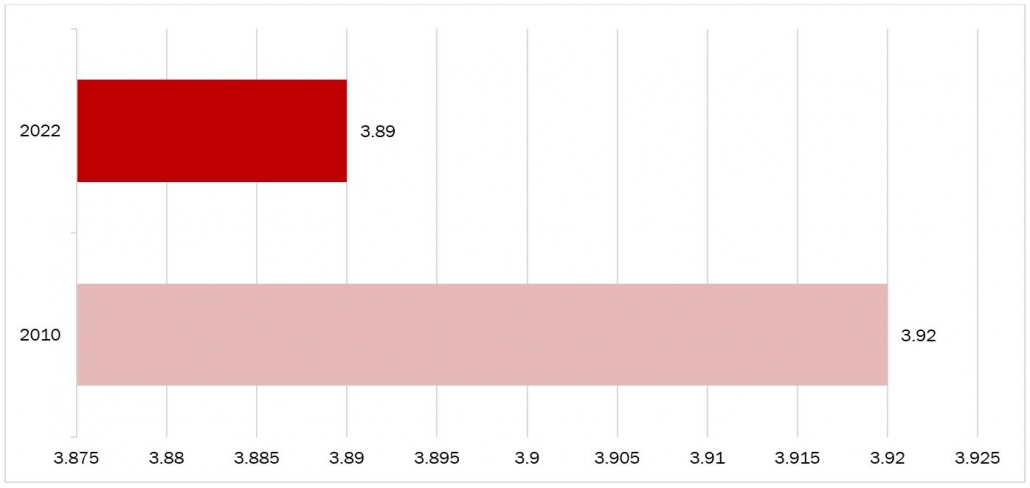

The expansion of oilseed cultivation has also raised concerns about its environmental impact, particularly in regions with fragile ecosystems. Deforestation, habitat loss, and biodiversity decline are associated with the conversion of forests and natural habitats into agricultural land for oilseed cultivation. In 2010, the world had 3.92 billion hectares (Gha) of tree cover, covering approximately 30% of its total land area. However, by 2022, it experienced a loss of 22.8 million hectares (Mha) of tree cover. In the same year, India possessed 31.3 million hectares (Mha) of natural forest, which accounted for about 11% of its land area. Unfortunately, by 2022, India witnessed a loss of 117 thousand hectares (kha) of natural forest, resulting in emissions equivalent to 62.9 million metric tons (Mt) of CO?. Sustainable agricultural practices and certification schemes, such as the Roundtable on Sustainable Palm Oil (RSPO), aim to address these concerns and promote responsible oilseed production.

Figure 3: Tree Cover in the World, From 2010 to 2022, in Billion Hectares

Source: NAARM Report

Market Dynamics and Drivers

Several factors drive the oilseed market, including population growth, urbanization, dietary shifts, and economic development. As populations grow and incomes rise, there is an increased demand for edible oils and protein-rich foods, driving the consumption of oilseeds. Moreover, the growing popularity of plant-based diets and the rising awareness of the health benefits of vegetable oils have contributed to the demand for oilseed products.

The expansion of the biofuel industry has also played a significant role in driving the oilseed market. Biofuels, such as biodiesel and bioethanol, are derived from renewable sources such as oilseeds and offer a cleaner alternative to fossil fuels. Government policies promoting the use of biofuels, along with concerns about energy security and climate change, have spurred investments in biofuel production, further boosting the demand for oilseeds. In August 2021, the Government of India launched the National Mission on Oilseeds and Oil Palm with the objective of achieving self-sufficiency in edible oil production and increasing domestic oilseed output. Under this initiative, the government plans to invest over 110 billion rupees ($1.48 billion) to provide farmers with comprehensive support, including improved technology and high-quality seeds.

Challenges and Constraints

Despite the promising prospects, the oilseed market faces several challenges and constraints that threaten its sustainability and growth. Climate change poses a significant risk to oilseed production, with extreme weather events, such as droughts, floods, and heatwaves, disrupting agricultural activities and reducing yields. Additionally, pest and disease pressures, soil degradation, and water scarcity present formidable challenges to oilseed producers.

The expansion of oilseed cultivation has also raised concerns about its environmental impact, particularly in regions with fragile ecosystems. Deforestation, habitat loss, and biodiversity decline are associated with the conversion of forests and natural habitats into agricultural land for oilseed cultivation. In 2010, the world had 3.92 billion hectares (Gha) of tree cover, covering approximately 30% of its total land area. However, by 2022, it experienced a loss of 22.8 million hectares (Mha) of tree cover. In the same year, India possessed 31.3 million hectares (Mha) of natural forest, which accounted for about 11% of its land area. Unfortunately, by 2022, India witnessed a loss of 117 thousand hectares (kha) of natural forest, resulting in emissions equivalent to 62.9 million metric tons (Mt) of CO?. Sustainable agricultural practices and certification schemes, such as the Roundtable on Sustainable Palm Oil (RSPO), aim to address these concerns and promote responsible oilseed production.

Figure 3: Tree Cover in the World, From 2010 to 2022, in Billion Hectares

Source: Global Forest Watch

Emerging Opportunities and Innovations

Despite the challenges, the oilseed market presents numerous opportunities for innovation and growth. Advances in agricultural technology, such as precision farming, genetic engineering, and digitalization, are revolutionizing oilseed cultivation and improving productivity and efficiency. Precision farming techniques, including satellite imaging, drones, and soil sensors, enable farmers to optimize resource use, minimize environmental impact, and enhance crop yields.

Genetic engineering and biotechnology have led to the development of improved oilseed varieties with enhanced traits, such as disease resistance, drought tolerance, and higher oil content. These genetically modified crops offer potential solutions to the challenges facing the oilseed industry and could help meet the growing demand for sustainable oilseed products.

Market Outlook and Future Trends

Looking ahead, the oilseed market is expected to continue growing, driven by rising global demand for food, feed, and renewable energy. Population growth, urbanization, and changing dietary habits will drive the consumption of oilseed products, while advancements in technology and sustainable practices will enhance productivity and efficiency in oilseed cultivation.

The adoption of innovative technologies, such as artificial intelligence, blockchain, and biotechnology, will play a crucial role in shaping the future of the oilseed industry. These technologies offer opportunities to improve crop yields, reduce environmental impact, and enhance supply chain transparency and traceability.

However, addressing sustainability challenges, such as deforestation, biodiversity loss, and climate change, will be paramount for the long-term viability of the oilseed market. Collaborative efforts between governments, businesses, and civil society organizations will be essential in promoting responsible oilseed production practices and achieving sustainable development goals.

Key Developments

Source: Global Forest Watch

Emerging Opportunities and Innovations

Despite the challenges, the oilseed market presents numerous opportunities for innovation and growth. Advances in agricultural technology, such as precision farming, genetic engineering, and digitalization, are revolutionizing oilseed cultivation and improving productivity and efficiency. Precision farming techniques, including satellite imaging, drones, and soil sensors, enable farmers to optimize resource use, minimize environmental impact, and enhance crop yields.

Genetic engineering and biotechnology have led to the development of improved oilseed varieties with enhanced traits, such as disease resistance, drought tolerance, and higher oil content. These genetically modified crops offer potential solutions to the challenges facing the oilseed industry and could help meet the growing demand for sustainable oilseed products.

Market Outlook and Future Trends

Looking ahead, the oilseed market is expected to continue growing, driven by rising global demand for food, feed, and renewable energy. Population growth, urbanization, and changing dietary habits will drive the consumption of oilseed products, while advancements in technology and sustainable practices will enhance productivity and efficiency in oilseed cultivation.

The adoption of innovative technologies, such as artificial intelligence, blockchain, and biotechnology, will play a crucial role in shaping the future of the oilseed industry. These technologies offer opportunities to improve crop yields, reduce environmental impact, and enhance supply chain transparency and traceability.

However, addressing sustainability challenges, such as deforestation, biodiversity loss, and climate change, will be paramount for the long-term viability of the oilseed market. Collaborative efforts between governments, businesses, and civil society organizations will be essential in promoting responsible oilseed production practices and achieving sustainable development goals.

Key Developments

Source: NAARM Report

Major Oilseed Crops

Soybeans are the most widely cultivated oilseed crop globally, accounting for a significant portion of total oilseed production. Soybean oil is used in various food products, while soybean meal is a valuable protein source for animal feed. Rapeseed, primarily grown in Europe and Canada, is another important oilseed crop known for its high oil content and versatile applications. Sunflower seeds are cultivated mainly in Eastern Europe and Russia and are valued for their high-quality oil.

Palm oil, derived from the fruit of oil palm trees, is a crucial commodity in the oilseed market, with extensive use in the food, cosmetics, and biofuel industries. However, the production of palm oil has been associated with deforestation, habitat destruction, and environmental degradation, leading to concerns about its sustainability. In the fiscal year 2020-21, India imported approximately 13.352 million metric tonnes of edible oils, amounting to around Rs. 80,000 crores. Among all the imported edible oils, palm oil constitutes approximately 56% of the total, followed by soybean oil at 27%, and sunflower oil at 16%.

Figure 2: Segmentation of Edible Oil Import in India, in 2020-21

Source: NAARM Report

Major Oilseed Crops

Soybeans are the most widely cultivated oilseed crop globally, accounting for a significant portion of total oilseed production. Soybean oil is used in various food products, while soybean meal is a valuable protein source for animal feed. Rapeseed, primarily grown in Europe and Canada, is another important oilseed crop known for its high oil content and versatile applications. Sunflower seeds are cultivated mainly in Eastern Europe and Russia and are valued for their high-quality oil.

Palm oil, derived from the fruit of oil palm trees, is a crucial commodity in the oilseed market, with extensive use in the food, cosmetics, and biofuel industries. However, the production of palm oil has been associated with deforestation, habitat destruction, and environmental degradation, leading to concerns about its sustainability. In the fiscal year 2020-21, India imported approximately 13.352 million metric tonnes of edible oils, amounting to around Rs. 80,000 crores. Among all the imported edible oils, palm oil constitutes approximately 56% of the total, followed by soybean oil at 27%, and sunflower oil at 16%.

Figure 2: Segmentation of Edible Oil Import in India, in 2020-21

Source: NAARM Report

Market Dynamics and Drivers

Several factors drive the oilseed market, including population growth, urbanization, dietary shifts, and economic development. As populations grow and incomes rise, there is an increased demand for edible oils and protein-rich foods, driving the consumption of oilseeds. Moreover, the growing popularity of plant-based diets and the rising awareness of the health benefits of vegetable oils have contributed to the demand for oilseed products.

The expansion of the biofuel industry has also played a significant role in driving the oilseed market. Biofuels, such as biodiesel and bioethanol, are derived from renewable sources such as oilseeds and offer a cleaner alternative to fossil fuels. Government policies promoting the use of biofuels, along with concerns about energy security and climate change, have spurred investments in biofuel production, further boosting the demand for oilseeds. In August 2021, the Government of India launched the National Mission on Oilseeds and Oil Palm with the objective of achieving self-sufficiency in edible oil production and increasing domestic oilseed output. Under this initiative, the government plans to invest over 110 billion rupees ($1.48 billion) to provide farmers with comprehensive support, including improved technology and high-quality seeds.

Challenges and Constraints

Despite the promising prospects, the oilseed market faces several challenges and constraints that threaten its sustainability and growth. Climate change poses a significant risk to oilseed production, with extreme weather events, such as droughts, floods, and heatwaves, disrupting agricultural activities and reducing yields. Additionally, pest and disease pressures, soil degradation, and water scarcity present formidable challenges to oilseed producers.

The expansion of oilseed cultivation has also raised concerns about its environmental impact, particularly in regions with fragile ecosystems. Deforestation, habitat loss, and biodiversity decline are associated with the conversion of forests and natural habitats into agricultural land for oilseed cultivation. In 2010, the world had 3.92 billion hectares (Gha) of tree cover, covering approximately 30% of its total land area. However, by 2022, it experienced a loss of 22.8 million hectares (Mha) of tree cover. In the same year, India possessed 31.3 million hectares (Mha) of natural forest, which accounted for about 11% of its land area. Unfortunately, by 2022, India witnessed a loss of 117 thousand hectares (kha) of natural forest, resulting in emissions equivalent to 62.9 million metric tons (Mt) of CO?. Sustainable agricultural practices and certification schemes, such as the Roundtable on Sustainable Palm Oil (RSPO), aim to address these concerns and promote responsible oilseed production.

Figure 3: Tree Cover in the World, From 2010 to 2022, in Billion Hectares

Source: NAARM Report

Market Dynamics and Drivers

Several factors drive the oilseed market, including population growth, urbanization, dietary shifts, and economic development. As populations grow and incomes rise, there is an increased demand for edible oils and protein-rich foods, driving the consumption of oilseeds. Moreover, the growing popularity of plant-based diets and the rising awareness of the health benefits of vegetable oils have contributed to the demand for oilseed products.

The expansion of the biofuel industry has also played a significant role in driving the oilseed market. Biofuels, such as biodiesel and bioethanol, are derived from renewable sources such as oilseeds and offer a cleaner alternative to fossil fuels. Government policies promoting the use of biofuels, along with concerns about energy security and climate change, have spurred investments in biofuel production, further boosting the demand for oilseeds. In August 2021, the Government of India launched the National Mission on Oilseeds and Oil Palm with the objective of achieving self-sufficiency in edible oil production and increasing domestic oilseed output. Under this initiative, the government plans to invest over 110 billion rupees ($1.48 billion) to provide farmers with comprehensive support, including improved technology and high-quality seeds.

Challenges and Constraints

Despite the promising prospects, the oilseed market faces several challenges and constraints that threaten its sustainability and growth. Climate change poses a significant risk to oilseed production, with extreme weather events, such as droughts, floods, and heatwaves, disrupting agricultural activities and reducing yields. Additionally, pest and disease pressures, soil degradation, and water scarcity present formidable challenges to oilseed producers.

The expansion of oilseed cultivation has also raised concerns about its environmental impact, particularly in regions with fragile ecosystems. Deforestation, habitat loss, and biodiversity decline are associated with the conversion of forests and natural habitats into agricultural land for oilseed cultivation. In 2010, the world had 3.92 billion hectares (Gha) of tree cover, covering approximately 30% of its total land area. However, by 2022, it experienced a loss of 22.8 million hectares (Mha) of tree cover. In the same year, India possessed 31.3 million hectares (Mha) of natural forest, which accounted for about 11% of its land area. Unfortunately, by 2022, India witnessed a loss of 117 thousand hectares (kha) of natural forest, resulting in emissions equivalent to 62.9 million metric tons (Mt) of CO?. Sustainable agricultural practices and certification schemes, such as the Roundtable on Sustainable Palm Oil (RSPO), aim to address these concerns and promote responsible oilseed production.

Figure 3: Tree Cover in the World, From 2010 to 2022, in Billion Hectares

Source: Global Forest Watch

Emerging Opportunities and Innovations

Despite the challenges, the oilseed market presents numerous opportunities for innovation and growth. Advances in agricultural technology, such as precision farming, genetic engineering, and digitalization, are revolutionizing oilseed cultivation and improving productivity and efficiency. Precision farming techniques, including satellite imaging, drones, and soil sensors, enable farmers to optimize resource use, minimize environmental impact, and enhance crop yields.

Genetic engineering and biotechnology have led to the development of improved oilseed varieties with enhanced traits, such as disease resistance, drought tolerance, and higher oil content. These genetically modified crops offer potential solutions to the challenges facing the oilseed industry and could help meet the growing demand for sustainable oilseed products.

Market Outlook and Future Trends

Looking ahead, the oilseed market is expected to continue growing, driven by rising global demand for food, feed, and renewable energy. Population growth, urbanization, and changing dietary habits will drive the consumption of oilseed products, while advancements in technology and sustainable practices will enhance productivity and efficiency in oilseed cultivation.

The adoption of innovative technologies, such as artificial intelligence, blockchain, and biotechnology, will play a crucial role in shaping the future of the oilseed industry. These technologies offer opportunities to improve crop yields, reduce environmental impact, and enhance supply chain transparency and traceability.

However, addressing sustainability challenges, such as deforestation, biodiversity loss, and climate change, will be paramount for the long-term viability of the oilseed market. Collaborative efforts between governments, businesses, and civil society organizations will be essential in promoting responsible oilseed production practices and achieving sustainable development goals.

Key Developments

Source: Global Forest Watch

Emerging Opportunities and Innovations

Despite the challenges, the oilseed market presents numerous opportunities for innovation and growth. Advances in agricultural technology, such as precision farming, genetic engineering, and digitalization, are revolutionizing oilseed cultivation and improving productivity and efficiency. Precision farming techniques, including satellite imaging, drones, and soil sensors, enable farmers to optimize resource use, minimize environmental impact, and enhance crop yields.

Genetic engineering and biotechnology have led to the development of improved oilseed varieties with enhanced traits, such as disease resistance, drought tolerance, and higher oil content. These genetically modified crops offer potential solutions to the challenges facing the oilseed industry and could help meet the growing demand for sustainable oilseed products.

Market Outlook and Future Trends

Looking ahead, the oilseed market is expected to continue growing, driven by rising global demand for food, feed, and renewable energy. Population growth, urbanization, and changing dietary habits will drive the consumption of oilseed products, while advancements in technology and sustainable practices will enhance productivity and efficiency in oilseed cultivation.

The adoption of innovative technologies, such as artificial intelligence, blockchain, and biotechnology, will play a crucial role in shaping the future of the oilseed industry. These technologies offer opportunities to improve crop yields, reduce environmental impact, and enhance supply chain transparency and traceability.

However, addressing sustainability challenges, such as deforestation, biodiversity loss, and climate change, will be paramount for the long-term viability of the oilseed market. Collaborative efforts between governments, businesses, and civil society organizations will be essential in promoting responsible oilseed production practices and achieving sustainable development goals.

Key Developments

- On March 8, 2023, the International Crops Research Institute for the Semi-Arid Tropics (ICRISAT) and the Indian Oilseeds & Produce Export Promotion Council (IOPEPC) entered into a Memorandum of Understanding (MoU) aimed at boosting the cultivation of high-quality oilseeds in India.

- In August 2022, Bayer increased its current investment to obtain a controlling stake in CoverCress Inc., a sustainable oilseed producer focused on reducing carbon emissions.

- In July 2022, Corteva Agriscience, BASF, and MS Technologies entered into an agreement to collaborate on the development of advanced Enlist E3 soybeans featuring the nematode resistant soybean (NRS) trait for farmers in the United States and Canada.

- In May 2022, Syngenta Canada introduced the innovative Pelta seed pelleting technology for canola, designed to enhance seed size and uniformity, thereby improving the performance of singulation planters.

- In May 2022, Corteva Agriscience expanded its sunflower seed operations in Europe by investing USD 14.1 million in upgrading the Afumati production facility in Romania. This investment aims to address the increasing demand from both domestic and international farmers for top-quality sunflower seeds.

Get in Touch

Interested in this topic? Contact our analysts for more details.

Latest Thought Articles

Top OSAT Companies Driving Semiconductor Assembly and Test Services Worldwide

Recently

EV Charging Stations Market Outlook: Smart Charging, Fast Charging, and Regional Expansion

Recently

Future of Corporate Wellness: Global Trends and Regional Outlook

Recently

Regional Breakdown of the Mechanical Keyboard Market: Who Leads and Why?

Recently