Report Overview

Global Graphite Market Size, Highlights

Graphite Market Size

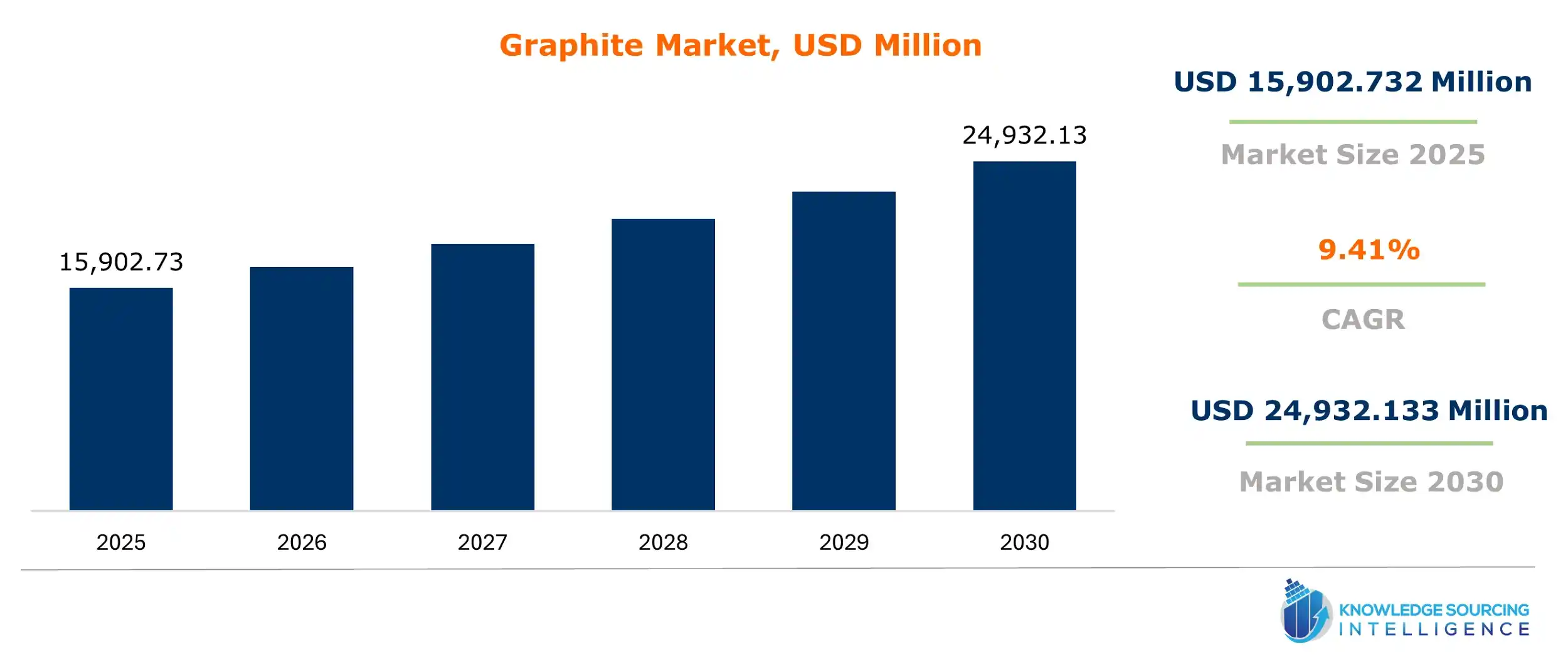

The global graphite market is projected to surge at a CAGR of 9.41% from a market size of USD 15,902.732 million in 2025 to USD 24,932.133 million by the end of 2030.

Graphite is found in the form of black crystal flakes and masses. Important properties include high electrical conductivity, thermal stability, and slipperiness, i.e., also known as lubricity. These properties make it highly suitable for several industrial applications, including lubricants, steelmaking, refractories, and electronics. The use of graphite in emerging applications such as fuel cells and lightweight high-strength composite applications is predicted to surge drive the demand for graphite in the forecast period. The growing adoption of Electric Vehicles further fuels market growth during the forecast period. China, India, and Brazil are the world's top three major graphite producers. During the forecast period, the steel industry is the major end-user of the global graphite market.

Graphite Market Segmentation Analysis:

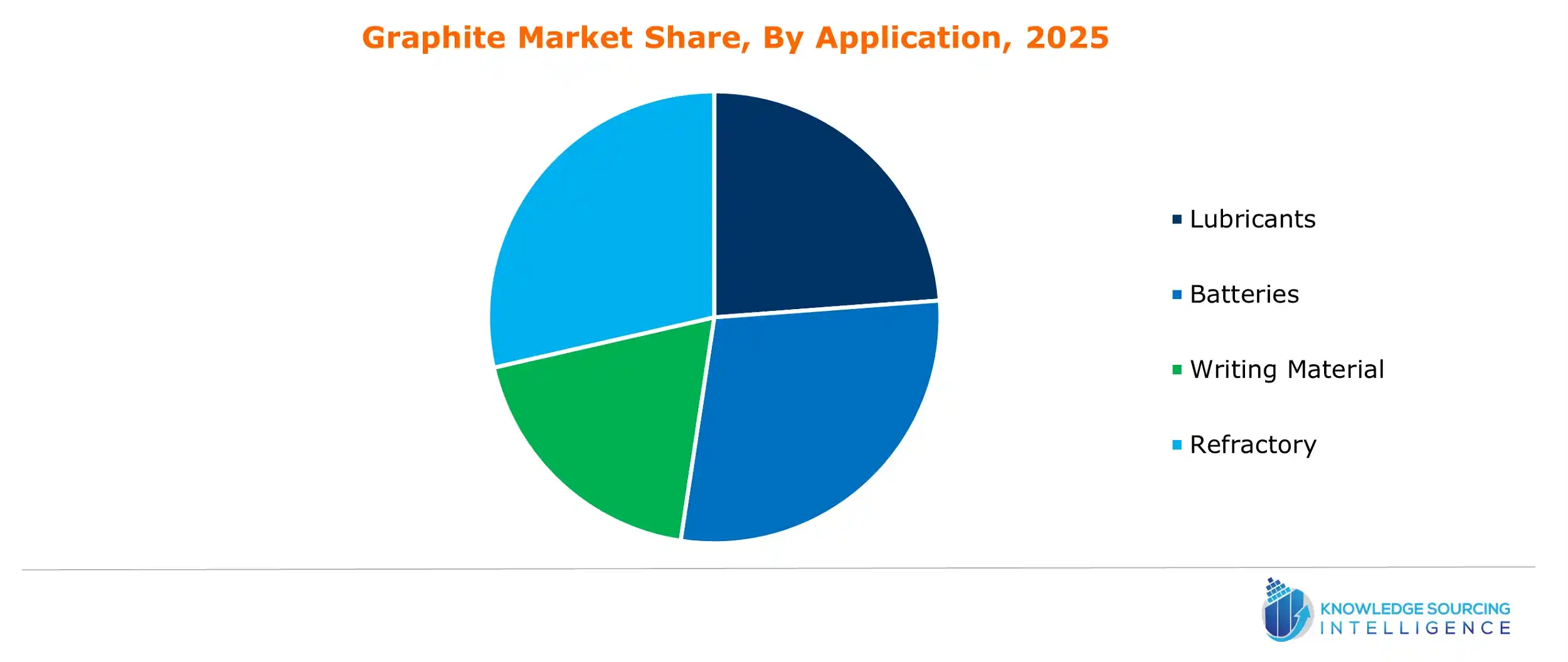

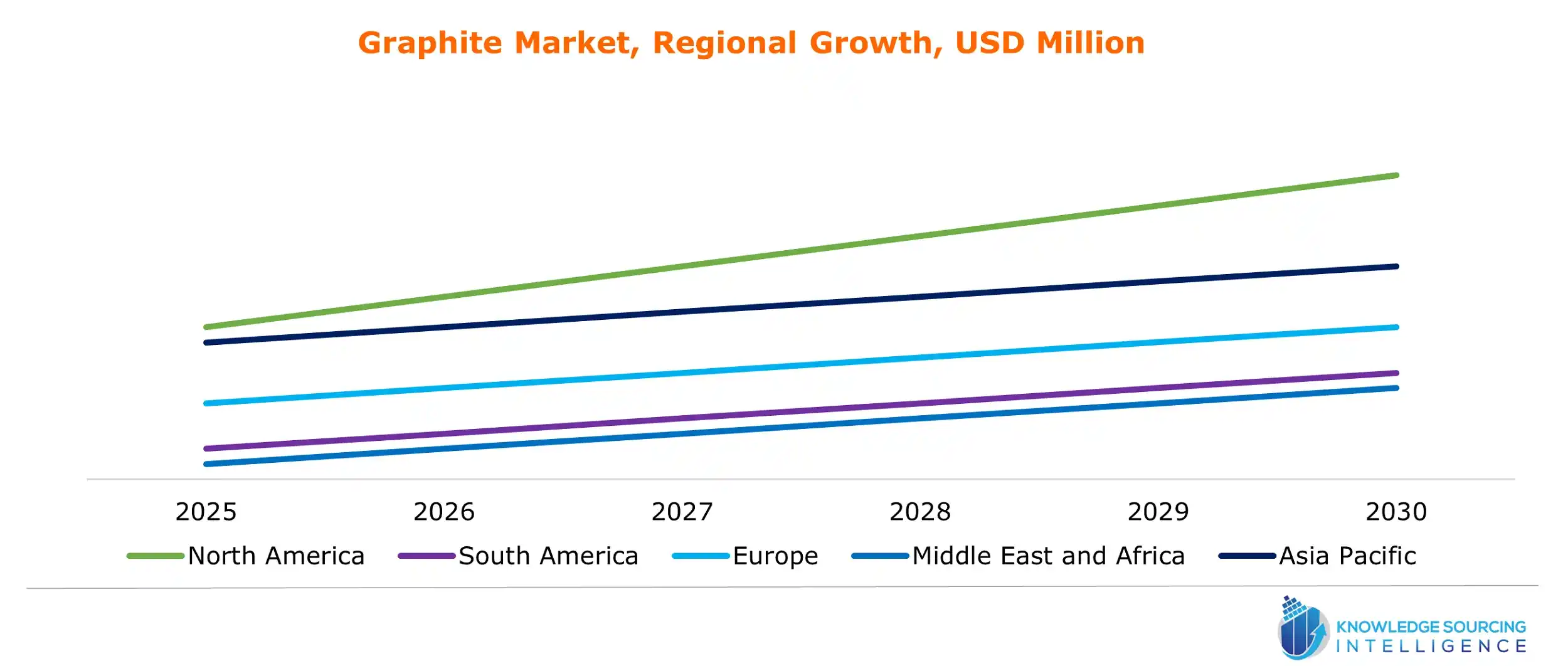

Based on type, the market is classified as natural and synthetic. Synthetic graphite is predicted to hold a significant market share in the forecast period. Based on application, the market is segregated into lubricants, batteries, writing materials, refractories, nuclear reactors, and graphene sheets. Refractory applications are estimated to hold a significant market share, while batteries are estimated to be the fastest-growing application in the forecast period. The use of graphite in lithium-ion batteries is also increasing the demand. The global graphite market is categorized into automotive, energy & power, steel, electronics, aerospace, and others based on the end-user industry. During the forecast period, the steel end-user industry is expected to hold a significant market share. The market is further categorized into North America, South America, Europe, the Middle East, Africa, and the Asia Pacific region based on geography. The APAC region is predicted to hold a significant market share in the global graphite market during the forecast period.

Graphite adoption in clean technology is the biggest trend in increasing market expansion, especially in electric vehicles (EVs). Lithium-ion batteries power most EVs, which is why graphite is considered an essential material. With the shift in focus worldwide toward reduced carbon emissions and sustainability, there is a significant increase in the demand for electric vehicles, thereby boosting the graphite market. Government policies, including subsidies, tax incentives, and stringent environmental rules that encourage the shift from gasoline-petrol engine automobiles to more eco-friendly and sustainable electric vehicles, have pushed the demand for the said commodity. Thus, higher-demanding batteries in good performances, which demand considerable graphite, are expected during the forecast period.

EV adoption significantly increases graphite demand while also fostering innovations in battery technologies, enhancing energy density, and improving the efficiency of lithium-ion batteries. In addition, the surge in the adoption of clean technologies such as solar and wind power is creating a positive feedback loop where demand for raw materials like graphite intensifies. Moreover, with the increasing demand for EV manufacturers to enhance the range and reduce charging times, graphite's importance in furthering battery performance is only increasing. As the world shifts toward decarbonization and the EV market expands, graphite is likely to be in high demand in the coming years, increasing its significance in the clean technology ecosystem.

Graphite is one of the essential materials used in manufacturing electric car batteries. It is a highly conductive material for making EV electrodes. It has been observed that synthetic graphite is preferred for EV batteries due to its higher purity. It is a byproduct of coal tar or petroleum coke baked at 28,000°C in an electrically fired furnace from coal-fired utility plants. The product is, however, more environmentally unpleasant. The lithium-ion battery contains more graphite (around 40 times) than lithium. Hence, with the increasing demand for EVs globally, the market will continue to grow in the forecast period. The ban on gas- and diesel-powered cars by the federal governments worldwide creates a need for the manufacturing of electric cars. In addition to France, other nations are also geared to work on reducing environmental impacts caused by automobiles, thus contributing to reducing carbon emissions. In the United Kingdom, the government is focused on the targets set by the Paris Convention to make all vehicles zero-emission by the end of 2050. Similarly, in Norway, the government has decided that all the new cars and vans sold after 2025 should be electric vehicles.

Graphite Market Geographical Outlook:

The world's developing regions are also poised to play a role in EV adoption. For example, China is working on a novel target where around 12% of all vehicles are expected to be electric by the end of 2020. In India, a policy stating all vehicles sold should be electric by the end of 2030 has been established. According to the IEA statistics, electric car sales in 2019 accounted for around 2.1 million globally. This is projected to exceed in the coming years, further boosting the stock of electric cars to around 7.2 million. Electric cars registered a 40% y-o-y growth from 2018 to 2019.

Graphite Market Growth:

With the rapid technological development, the electrification of two- and three-wheelers, buses, and trucks is likely to drive the electric vehicle market during the forecast period. Energy density, charging speed, and overall efficiency are driving improvements in battery technology, making electric vehicles more practical and cost-effective for a broader range of consumers and businesses. The key impact of these developments lies in the two-wheeler and three-wheeler segments, where electric options are being increasingly adopted for personal transportation and last-mile delivery services. The shift toward electric buses and trucks, motivated by the need for sustainable urban mobility solutions and the reduction of greenhouse gas emissions, is accelerating the adoption of EVs in the public transport and freight sectors.

Increased by government incentives, stricter emissions laws, and growing consumer preference for environment-friendly alternatives, these trends are further driving electrification in the transportation sector. The more extensive and available the EV infrastructure, especially through charging stations, the greater the feasibility and attractiveness of replacing transport modes with electric vehicles. Another way electric buses and trucks can be widely adopted is to significantly reduce the carbon footprint related to public transportation and logistics. This is most likely going to happen in cities. As these technologies continue to reduce costs and improve the performance of electric vehicles, the overall market for EVs, including two-wheelers, three-wheelers, buses, and trucks, is poised to expand rapidly in the coming years, marking a significant shift toward cleaner, more sustainable transportation.

Global Graphite Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Graphite Market Size in 2025 | USD 15,902.732 million |

| Graphite Market Size in 2030 | USD 24,932.133 million |

| Growth Rate | CAGR of 9.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Graphite Market |

|

| Customization Scope | Free report customization with purchase |

The Global Graphite Market is analyzed into the following segments:

- By Type

- Natural

- Synthetic

- By Application

- Lubricants

- Batteries

- Writing Material

- Refractory

- Nuclear Rectors

- Graphene Sheets

- By End-User

- Automotive

- Energy & Power

- Steel

- Electronics

- Aerospace

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Spain

- Others

- Middle East and Africa

- UAE

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Taiwan

- Others

- North America