Humanoid Robot Market Report, Size, Share, Opportunities, and Trends Segmented by Component, Mobility Type, Application, End-User, and Region – Forecasts from 2025 to 2030

Comprehensive analysis of demand drivers, supply-side constraints, competitive landscape, and growth opportunities across applications and regions.

Description

Humanoid Robot Market Size:

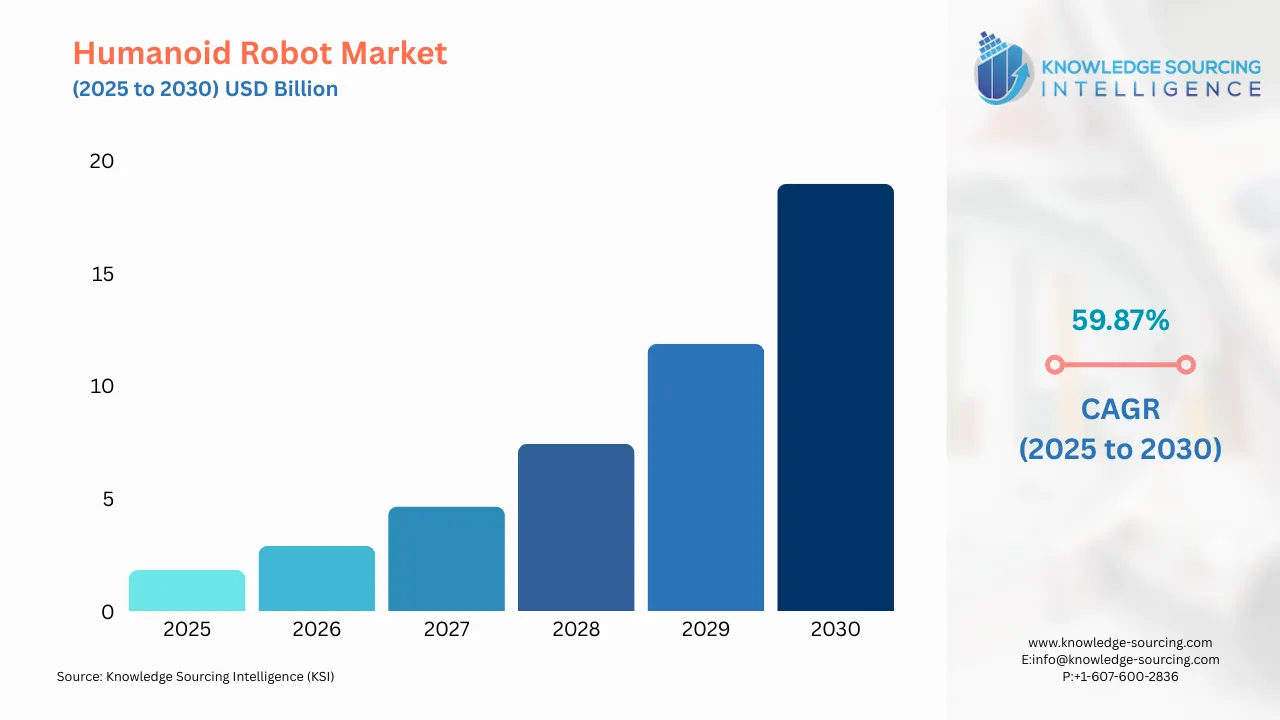

The Humanoid Robot Market is projected to grow at a CAGR of 59.87% to reach US$18.971 billion in 2030 from US$1.817 billion in 2025.

Humanoid Robot Market Highlights:

- Advancements in AI: Enhanced cognitive abilities drive human-like interaction and task adaptability.

- Automation Demand: Labor shortages spur humanoid robot adoption in manufacturing and logistics.

- Healthcare Applications: Robots address caregiving needs for aging populations with companionship and support.

- Investment Surge: Significant funding and industry collaborations accelerate humanoid robot development.

Humanoid Robot Market Introduction:

The humanoid robot market represents a transformative frontier in robotics and artificial intelligence (AI), characterized by machines designed to emulate human appearance, movement, and interaction. These robots, engineered to perform tasks in human-centric environments, are rapidly evolving from experimental prototypes to viable solutions across industries such as healthcare, logistics, education, and manufacturing. The humanoid robot sector is witnessing unprecedented interest, fueled by advancements in AI, sensor technology, and mechanical engineering, alongside growing societal needs for automation and human-robot collaboration.

To learn more about this report, request a free sample copy

Humanoid robots are distinguished by their anthropomorphic design, incorporating bipedal or wheeled mobility, articulated limbs, and advanced AI systems that enable human-like interaction and task execution. Unlike traditional industrial robots confined to structured environments, humanoid robots are built to operate in dynamic, unstructured settings, such as homes, hospitals, or warehouses. Their versatility makes them suitable for applications ranging from caregiving and customer service to hazardous tasks like search and rescue or industrial maintenance. The market is driven by a convergence of technological innovation and societal demands, with significant investments from both established technology giants and agile startups pushing the boundaries of what these robots can achieve.

Recent industry developments underscore the market’s momentum. For instance, in February 2024, Figure AI, a startup focused on general-purpose humanoid robots, secured $675 million in funding from investors including Nvidia, Microsoft, and Jeff Bezos to accelerate development for applications in warehousing and elder care. Similarly, Tesla’s Optimus robot, designed for repetitive and dangerous tasks in manufacturing and logistics, has progressed to pilot testing in automotive factories, with plans to scale production to thousands of units by 2026. These advancements highlight the growing commercial viability of humanoid robots and their potential to reshape industries.

The humanoid robot market spans diverse sectors, each leveraging the robots’ ability to mimic human behavior and adapt to complex environments. In healthcare, robots like SoftBank’s Pepper and Aeolus Robotics’ Aeo are deployed for patient monitoring, medication delivery, and companionship, addressing the needs of aging populations. In logistics, companies like Agility Robotics are testing humanoid robots such as Digit in warehouse settings to perform tasks like picking and packing, enhancing operational efficiency. Education and entertainment see robots engaging students and audiences through interactive learning and performances, while search and rescue operations benefit from robots’ ability to navigate hazardous terrains. These applications reflect the market’s broad potential, with each sector driving demand for specialized capabilities.

Humanoid Robot Market Overview:

The broadening use of humanoids is fueling growth in the humanoid robot market. For example, there is an increasing demand for humanoid robots as personal assistants in the retail sector. Likewise, their use in medical training is on the rise, further boosting this market’s expansion. Additionally, a rapidly aging population and the growing number of rehabilitation centers are heightening the need for humanoids, which can assist elderly individuals. Other factors driving this growth include rising consumer spending power, rapid innovation, and the growing popularity of autonomous rescue operations. However, steep initial costs are limiting adoption and slowing the humanoid robot market’s progress.

Regionally, North America holds a substantial market share and remains a key player throughout the forecast period. Concurrent adoption of humanoid robots across various sectors is propelling this growth, with the presence of numerous leading companies in the United States further strengthening this dominance. Meanwhile, the Asia Pacific (APAC) region is experiencing rapid growth over the forecast period. The demand spurred by aging populations in China and Japan is a major driver of regional market expansion, supported by ongoing research, development, and innovation.

Humanoid Robot Market Growth Drivers:

- Alleviating Labor Shortages and Enhancing Productivity: The global humanoid robot market is primarily driven by the increasing need to address widespread labor shortages across various industries. An aging global population, declining birth rates, and changing workforce demographics have created significant gaps in sectors that rely on manual labor, such as manufacturing, logistics, and healthcare. Humanoid robots are being developed to fill these voids by performing repetitive, physically strenuous, and dangerous tasks that are difficult to staff with human workers. Their ability to operate in human-centric environments without extensive re-engineering of existing infrastructure makes them a highly attractive solution. For instance, companies are deploying robots like Agility Robotics' Digit to handle material handling and movement tasks in warehouses, directly addressing the staffing challenges faced by the logistics industry. This not only maintains operational continuity but also frees up human employees to perform more complex and cognitively demanding work, thereby boosting overall organizational productivity and efficiency. This driver is particularly pronounced in developed economies where these demographic shifts are most acute.

- Advancements in AI and Machine Learning: The rapid progress in artificial intelligence and machine learning is a fundamental catalyst for the humanoid robot market's expansion. The development of sophisticated AI models, including large language models and reinforcement learning, is enabling robots to move beyond simple, pre-programmed tasks. These AI breakthroughs allow humanoids to perceive and understand their surroundings, make autonomous decisions, and adapt to new situations in real-time. This cognitive leap is crucial for their deployment in unstructured and dynamic environments where they must interact with humans and unpredictable objects. For example, modern humanoid robots are being equipped with advanced computer vision and tactile sensors, powered by machine learning, which enables them to perform delicate manipulation tasks with human-like dexterity. The ability to learn through imitation and receive natural language commands is simplifying robot programming and making them more accessible to non-experts. This continuous evolution of AI is transforming humanoids from rigid tools into intelligent, versatile agents capable of solving a wide array of problems.

- Declining Component Costs and Economies of Scale: The increasing commercial viability of humanoid robots is being accelerated by the steady decline in the cost of critical hardware components and the emergence of economies of scale. As the robotics industry matures, the price of essential parts like sensors (LiDAR, cameras), actuators, and powerful processors is decreasing. This makes the production of humanoid robots more cost-effective. Furthermore, as demand for these robots grows, companies are moving towards mass production, which further reduces the per-unit cost. The goal of many leading players is to produce humanoids at a price point that makes them a cost-competitive alternative to human labor, even for minimum-wage tasks. This economic factor is a key enabler for widespread adoption across a diverse range of industries. The strategic investments from major corporations and venture capital firms are also helping to scale production and drive down costs, making humanoid robotics a more attractive proposition for businesses looking to automate their operations.

Humanoid Robot Market Restraints:

- High Development and Deployment Costs: Despite the declining cost of individual components, the overall high cost of developing and deploying a fully functional humanoid robot remains a significant market restraint. The research and development phase for these complex machines requires substantial capital investment to solve intricate engineering challenges related to bipedal locomotion, dynamic balance, and advanced manipulation. The final product, even for a single unit, can be prohibitively expensive for many potential end-users, particularly small and medium-sized enterprises. The total cost of ownership extends beyond the initial purchase price, including expenses for customization, integration into existing workflows, and ongoing maintenance and repairs. The lack of a standardized, plug-and-play solution means each deployment often requires bespoke engineering, which adds to the expense and complexity. This financial barrier limits the market primarily to large corporations and well-funded research institutions, slowing down the pace of broader commercial adoption.

- Technological Complexity and Reliability Issues: While AI has made significant strides, humanoid robots still face profound technological complexities and reliability issues that act as a major restraint. Creating a robot that can reliably navigate an unstructured environment, handle a wide variety of objects with different shapes and textures, and safely interact with humans is an incredibly difficult engineering challenge. Bipedal locomotion, for example, is inherently unstable, and maintaining balance on uneven surfaces while carrying objects requires highly sophisticated control systems. The current state of AI for robotics, while advanced, is not yet a generalized solution; it often requires extensive training for each new task, which can be time-consuming and costly. Additionally, the physical hardware is subject to wear and tear, and a failure in a single component can lead to a complete system breakdown. These factors create concerns about the reliability and robustness of humanoid robots in real-world, dynamic settings, leading to a lack of confidence among potential customers.

Humanoid Robot Market Segmentation Analysis:

- The Personal Assistance and Caregiving segment is rising considerably: The personal assistance and caregiving segment is the most significant application area for humanoid robots. This is driven by the dual challenges of a rapidly aging global population and a shortage of human caregivers. Humanoid robots, with their human-like form and interactive capabilities, are uniquely suited to provide companionship, monitor health, assist with daily activities, and ensure the safety of the elderly and individuals with disabilities. Robots in this segment can perform tasks such as reminding users to take medication, helping with mobility, and providing emotional support through conversation and social interaction. Their ability to operate in a home environment and assist with routine chores helps to prolong the independence of the elderly, delaying the need for assisted living facilities. The development of robots with advanced social AI and empathetic responses is a key focus, as it enhances the user experience and builds trust. The market for these robots is not just about physical assistance but also about addressing the psychological and social needs of a vulnerable population.

- The Medical & Healthcare sector is anticipated to hold a large market share: The medical and healthcare sector is the largest end-user of humanoid robots, largely due to the alignment of their capabilities with the industry's critical needs. Humanoid robots are being integrated into hospitals, clinics, and care centers to assist medical professionals and improve patient outcomes. Their applications range from performing repetitive, logistical tasks like delivering medicine and supplies to more complex, patient-facing roles such as rehabilitation therapy and patient monitoring. The ability of humanoid robots to maintain a sterile environment, work for long hours without fatigue, and perform tasks with high precision makes them invaluable in a healthcare setting. They can monitor vital signs, assist with patient mobility, and provide interactive support, freeing up nurses and doctors to focus on more complex clinical decisions and direct patient care. The increasing demand for automation in hospitals, coupled with the potential for humanoid robots to enhance efficiency and quality of care, solidifies this sector's position as the leading end-user.

- North America, particularly the US, is expected to lead the market expansion: North America holds the largest share of the humanoid robot market, a position underpinned by a confluence of factors. The region boasts a highly developed and mature ecosystem for technology and innovation, with a strong presence of leading robotics companies, AI research institutions, and a robust venture capital landscape. This environment fosters rapid development and commercialization of advanced robotics technologies. Furthermore, the North American market, particularly the United States, is an early adopter of automation and has a high tolerance for technological disruption. The significant labor shortages in key industries and a strong emphasis on productivity and efficiency have created a compelling business case for the adoption of humanoid robots. The region's substantial investments in research and development, coupled with supportive government policies and a large pool of skilled talent, continue to drive market growth. These factors combine to position North America at the forefront of the humanoid robot market, with a continuous stream of new products and applications emerging from the region.

Humanoid Robot Market Key Developments:

- June 2025: Hexagon, a leader in measurement technology, unveiled a new humanoid robot named AEON, specifically designed for industrial use cases to address labor shortages and improve autonomy in sectors like manufacturing and logistics.

- April 2024: Boston Dynamics Unveils All-Electric Atlas - The company retired its hydraulic Atlas model and introduced a new, fully electric version. This marked a shift from a research platform to a commercial product, with the robot slated for pilot deployment in Hyundai's factories.

- March 2024: Figure AI closed a substantial $675 million Series B funding round with key investments from tech giants like Microsoft and OpenAI, highlighting strong industry confidence and accelerating their development of general-purpose humanoid robots.

- January 2024: The Norwegian robotics company, 1X Technologies, which focuses on creating androids for everyday tasks, raised a significant $100 million in a Series B funding round, with EQT Ventures leading the investment.

List of Top Humanoid Robot Companies:

- Figure AI

- Tesla, Inc.

- SoftBank Robotics Group Corp.

- Agility Robotics, Inc.

- Aeolus Robotics Corporation

Humanoid Robot Market Scope:

| Report Metric | Details |

| Humanoid Robot Market Size in 2025 | US$1.817 billion |

| Humanoid Robot Market Size in 2030 | US$18.971 billion |

| Growth Rate | CAGR of 59.87% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Humanoid Robot Market |

|

| Customization Scope | Free report customization with purchase |

The Humanoid Robot Market is analyzed into the following segments:

By Component

- Hardware

- Software

- Service

By Mobility Type

- Bipedal

- Wheeled

By Application

- Personal Assistance and Caregiving

- Education and Entertainment

- Industrial

- Search and Rescue

- Others

By End-User

- Medical & Healthcare

- Retail & Hospitality

- Manufacturing

- Logistics

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Our Best-Performing Industry Reports:

Navigation

- Humanoid Robot Market Size:

- Humanoid Robot Market Highlights:

- Humanoid Robot Market Introduction:

- Humanoid Robot Market Overview:

- Humanoid Robot Market Growth Drivers:

- Humanoid Robot Market Restraints:

- Humanoid Robot Market Segmentation Analysis:

- Humanoid Robot Market Key Developments:

- List of Top Humanoid Robot Companies:

- Humanoid Robot Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025

Frequently Asked Questions (FAQs)

The humanoid robot market is expected to reach a total market size of US$18.971 billion by 2030.

Humanoid Robot Market is valued at US$1.817 billion in 2025.

The humanoid robot market is expected to grow at a CAGR of 59.87% during the forecast period.

The expanding applications of humanoids are the major factor driving the humanoid robot market growth.

Geographically, North America is expected to hold a notable share of the humanoid robot market.

Table Of Contents

1. EXECUTIVE SUMMARY

2. MARKET SNAPSHOT

2.1. Market Overview

2.2. Market Definition

2.3. Scope of the Study

2.4. Market Segmentation

3. BUSINESS LANDSCAPE

3.1. Market Drivers

3.2. Market Restraints

3.3. Market Opportunities

3.4. Porter’s Five Forces Analysis

3.5. Industry Value Chain Analysis

3.6. Policies and Regulations

3.7. Strategic Recommendations

4. HUMANOID ROBOT MARKET BY MOBILITY TYPE

4.1. Introduction

4.2. Bipedal

4.3. Wheeled

5. HUMANOID ROBOT MARKET BY APPLICATION

5.1. Introduction

5.2. Personal Assistance and Caregiving

5.3. Education and Entertainment

5.4. Industrial

5.5. Search and Rescue

5.6. Others

6. HUMANOID ROBOT MARKET BY COMPONENT

6.1. Introduction

6.2. Hardware

6.3. Software

6.4. Service

7. HUMANOID ROBOT MARKET BY END-USER

7.1. Introduction

7.2. Medical & Healthcare

7.3. Retail & Hospitality

7.4. Manufacturing

7.5. Logistics

7.6. Others

8. HUMANOID ROBOT MARKET BY GEOGRAPHY

8.1. Introduction

8.2. North America

8.2.1. USA

8.2.2. Canada

8.2.3. Mexico

8.3. South America

8.3.1. Brazil

8.3.2. Argentina

8.3.3. Others

8.4. Europe

8.4.1. Germany

8.4.2. France

8.4.3. United Kingdom

8.4.4. Spain

8.4.5. Others

8.5. Middle East and Africa

8.5.1. Saudi Arabia

8.5.2. UAE

8.5.3. Others

8.6. Asia Pacific

8.6.1. China

8.6.2. Japan

8.6.3. India

8.6.4. South Korea

8.6.5. Taiwan

8.6.6. Thailand

8.6.7. Indonesia

8.6.8. Others

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Market Share Analysis

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Competitive Dashboard

10. COMPANY PROFILES

10.1. Figure AI

10.2. Tesla, Inc.

10.3. SoftBank Robotics Group Corp.

10.4. Agility Robotics, Inc.

10.5. Aeolus Robotics Corporation

10.6. Apptronik, Inc.

10.7. NVIDIA Corporation

10.8. Boston Dynamics, Inc.

11. APPENDIX

11.1. Currency

11.2. Assumptions

11.3. Base and Forecast Years Timeline

11.4. Key benefits for the stakeholders

11.5. Research Methodology

11.6. Abbreviations

Companies Profiled

Figure AI

Tesla, Inc.

SoftBank Robotics Group Corp.

Agility Robotics, Inc.

Aeolus Robotics Corporation

Apptronik, Inc.

NVIDIA Corporation

Boston Dynamics, Inc.

Related Reports

| Report Name | Published Month | Download Sample |

|---|---|---|

| Consumer and Business Robot Market Report: Size, Forecast 2030 | April 2025 | |

| Social Robots Market Insights: Growth, Trends, Forecast 2030 | September 2025 | |

| Service Robot Market Report: Size, Share, Trends, Forecast 2030 | August 2025 | |

| Medical Robots Market Insights: Size, Share, Trends, Forecast 2030 | May 2025 |