Report Overview

Access Control Hardware Market Highlights

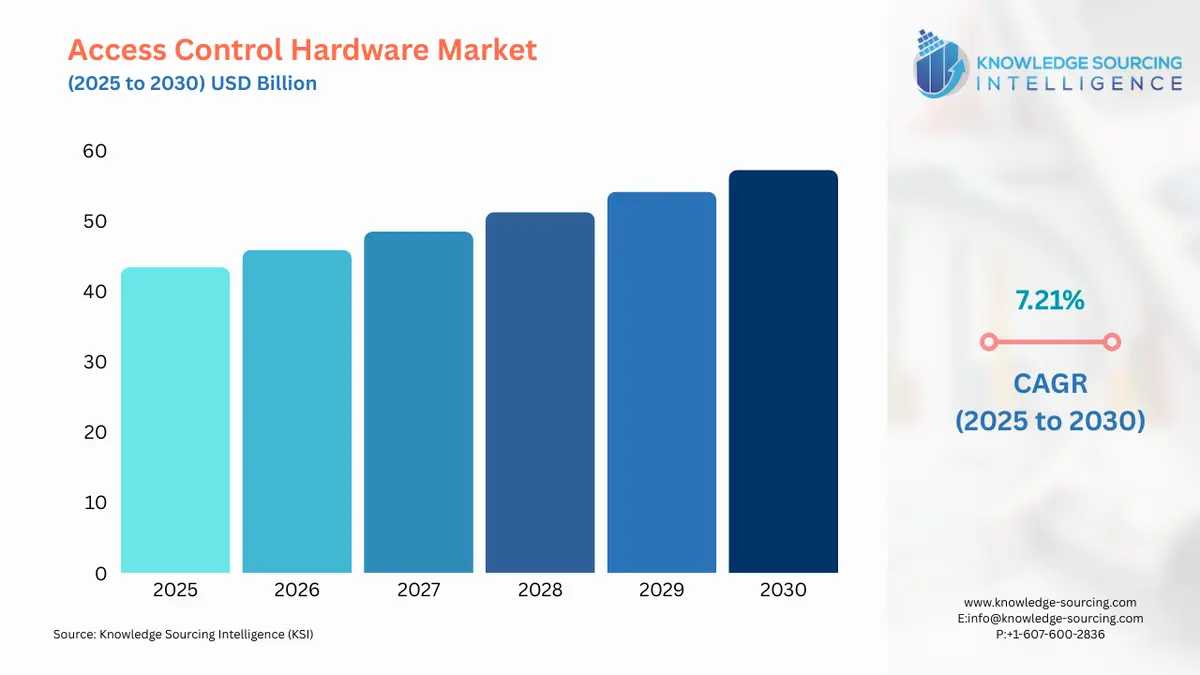

Access Control Hardware Market Size:

The Access Control Hardware Market is expected to grow at a 7.21% CAGR, achieving USD 10.321 billion by 2030 from USD 7.287 billion in 2025.

Building security may be easily managed with the use of keyless entry and card access systems, or other access control systems. Users of an access control system can demand a set of obligatory credentials from anybody trying to enter the area. This guarantees that a facility's safety and security standards are satisfied without the burden of conventional security systems. The need for cost-effective security solutions is driving growth in the access control hardware market. Moreover, it is anticipated that growing urbanization and consumer demand for wireless and IoT-based security solutions will propel the access control hardware market ahead in the coming years.

The commercial and defense sectors' quick adoption of access control hardware systems, together with investments from several private and public organizations, has propelled the growth of the Indian access control systems market. Additionally, growing technology parks and industrial businesses are highlighted as major investors in biometrics for security. The biometric readers are anticipated to have the biggest market share for the access control hardware. The considerations can be linked to the technology's expanding use in industrial plants, defense installations, power plants, businesses, and governmental buildings. In public security and safety operations, the usage of biometric authentication systems that employ fingerprint or face recognition is rising in popularity. Alarm systems and touchscreen keypads are in greater demand as smart infrastructure projects like smart agriculture, smart cities, and smart homes emerge. As a consequence, it is anticipated that the hardware industry would considerably fuel market growth.

Access Control Hardware Market Growth Drivers:

- The fastest growth rate is anticipated for biometric readers in the future.

One of the perimeter security solutions with the fastest-growing market share is biometrics. The identification of a person's physical characteristics via biometrics enables controlled physical access to infrastructure. Government agencies, industrial facilities, power plants, military installations, and commercial enterprises are all using this technology more and more. Moreover, the biometrics technology used in speech and facial recognition is non-contact, non-intrusive, and simple to use. The contactless method of identification and authentication encourages people to spend more on biometric readers. Businesses also need an authentication system that offers rapid and safe access to the information given the rising popularity of online transactions. Additionally, single-factor authentication techniques call for the user to confirm his identity by matching just one factor. The market for biometric readers is anticipated to expand as a result of rising smartphone users worldwide and the growing IoT device integration of biometric system (Access Control Hardware Market). One new product, a biometric prisoner management software, was unveiled in India.

- Modernizations in access control hardware technology.

To meet the demand for more sophisticated and secure access technology, which is an essential component of physical security systems, several companies are developing cutting-edge technologies. The technical improvements in the systems are made possible by the systems' combination of artificial intelligence (AI) and machine learning (ML). Also, because operating through a mobile device is convenient, businesses are quickly implementing mobile access control. Also, the cost of the systems has decreased thanks to cloud-based access control technology, making them more affordable for small-scale businesses to employ. Moreover, modern features like biometric access control, multi-factor authentication, multimodal authentication, blockchain authentication, and other features are drawing more and more users to access control hardware solutions.

Access Control Hardware Market Geographical Outlook:

North America is projected to be the prominent market shareholder in the global access control hardware market and is anticipated to continue throughout the forecast period.

Due to the rising amount of viruses and cyberattacks in the area, North America will have the greatest share of the market. Due to the increasing frequency of cyber and malware attacks in the area, several governments and security agencies are being pressured to upgrade security features in their operations through the implementation of RFID and biometric technology. In the United States, employees make up the bulk of users who are targeted because they have administrative access to corporate policies, which gives hackers complete control over the systems. As a result, a sizable portion of the world's demand for access control systems comes from the United States. This issue may be solved by employing strategic Identity Access Management (IAM) methods, such as moving from passwords to biometric authentication. Cloud-based IAM deployment solutions include several benefits, including economies of scale, cheaper costs, a lack of requirement for hardware deployment, and improved administration.

Access Control Hardware Market Key Developments:

- In March 2023, The C•CURE IQ Security Client is a security operations solution that includes a feature set designed for both access control and video surveillance to create a completely streamlined enterprise security system, according to Johnson Controls, the industry leader in smart, healthy, and sustainable buildings.

List of Top Access Control Hardware Companies:

- 360 Connect LP

- Johnson Controls

- Honeywell International Inc

- Mercury Security

- Kisi

Access Control Hardware Market Segmentation:

- ACCESS CONTROL HARDWARE MARKET BY TYPE

- Biometrics

- Cards and Readers

- Mobile Phones

- Others

- ACCESS CONTROL HARDWARE MARKET BY APPLICATION

- Residential

- Commercial

- Military and Defense

- Hospitals

- Others

- ACCESS CONTROL HARDWARE MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America