Report Overview

Access Control Market Size, Highlights

Access Control Market Size:

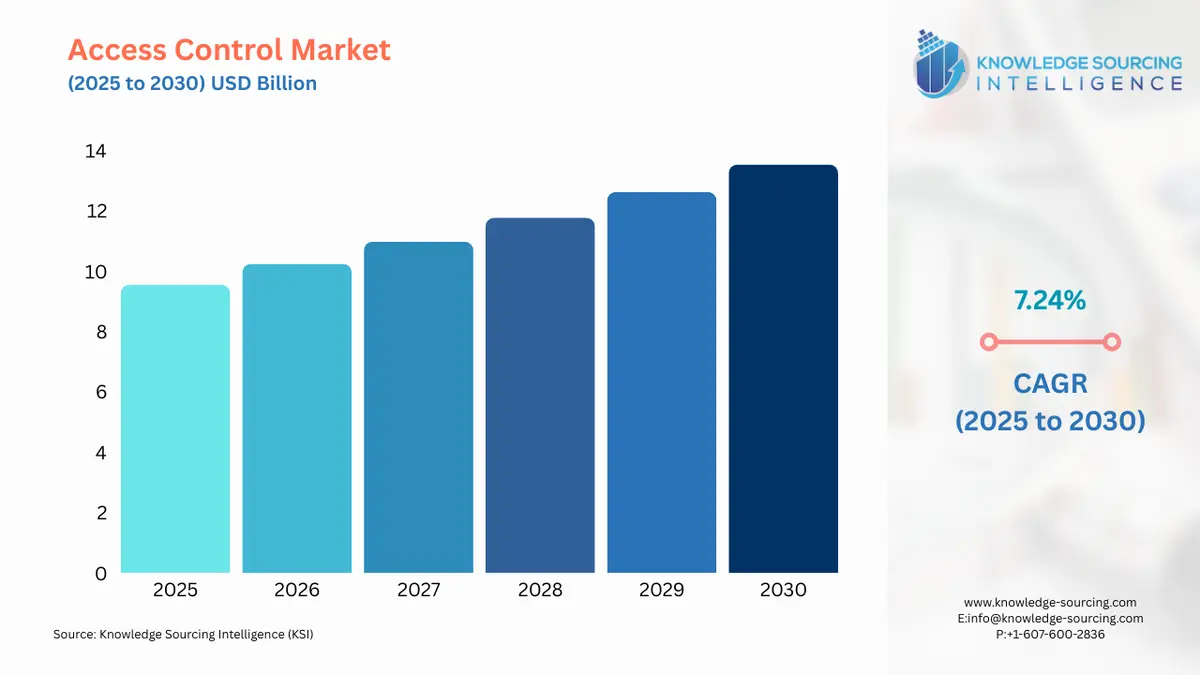

The access control market is evaluated at US$9.546 billion in 2025, growing at a CAGR of 7.24%, reaching a market size of US$13.542 billion in 2030.

Access Control Market Trends:

Access control is a security system that regulates who or what can enter a system, an environment, or a building. It restricts entry to the system or physical or virtual resources. In computing, access control is how users can be granted or refused access to systems, resources, data, and particular rights. These control systems perform identification, authentication, and authorization of users by evaluating login credentials that include passwords, personal identification numbers, biometric scans, security tokens, and others. The key purpose is to grant entrance to a system or building only to authorized personnel.

The public and private sectors' growing concerns about security have led to a high adoption rate of cutting-edge technology. Demand is being driven by the automated systems' round-the-clock protection and accessibility in both residential and commercial spaces. Additionally, software as a service (SaaS) and on-premises device benefits are combined with access control as a service (ACaaS). These solutions are becoming more and more popular because they offer remote, secure data storage as well as data backup capabilities. The increasing demand for the ACaaS solution is due to its ability to keep permanent records of previous accesses. The entry of cloud computing and wireless access points into the security industry, along with its rapid transformation, is expected to drive demand for access control systems. The need for physical security will also be fueled by the growing number of smart buildings, smart homes, and smart infrastructure initiatives. New opportunities for advanced technologies are being created by the increasing use of cloud computing platforms, the growing prevalence of wireless security systems, and rising crime rates.

Access Control Market Drivers:

- Security concerns and regulatory compliance

The interconnectedness of our world has demanded serious attention to security issues. Organizations are investing more in access control systems because cyber attacks, data breaches, and physical security risks have become rampant. Be it for safeguarding people’s safety and physical belongings or guarding sensitive information, access control is a major section of any all-encompassing security scheme. More so, there are rigorous stipulations for access management in various sectors, including government, finance, and healthcare, which are put forward by industry-specific regulations and regulatory bodies. For instance, GDPR, PCI DSS, and HIPAA command that good access management policies be in place to comply with their provisions. Consequently, there is an increase in the scope of the market for access control in response to this requirement.

- Technological advancements and IoT integration

Due to technological advancements that increase system flexibility, user-friendliness, and compatibility with emerging products, the access control market is changing. This sector is growing due to the application of biometrics, cloud-based solutions, and the integration of IoT. Their accuracy and ease of use have led to their rising acceptance. Biometric identification techniques, including fingerprint or face recognition, are gaining more popularity every day. Because these technologies ensure that only those with permission can access them, they offer increased security. Access control systems can interact with other systems and devices through IoT integration, facilitating smooth automation and improved security. A fully formed security ecosystem can be achieved by integrating smart locks, access cards, building management systems, video surveillance, and alarms.

- Increasing adoption of smart building solutions

The growing use of intelligent structures and IoT has led to increased market growth. Smart buildings combine different technologies to upgrade productivity, safety, and occupant comfort, thus making access control indispensable within such environments.

In addition to standard door entry, smart building access control systems also manage lighting, HVAC, and occupancy monitoring. Improved safety, energy conservation, and resource management are all made possible by this integration. Access control solutions are becoming increasingly popular among businesses and property owners who want to create safe and comfortable spaces. Personalized experiences for tenants, like touchless entry, individual climate control, and lighting customizations, are also made possible by smart access systems.

- Increasing adoption of smart building solutions

Across several fields, companies are becoming increasingly aware of the increasing importance of safeguarding their infrastructure, information, and possessions against risks such as cyberattacks or physical breaches. Therefore, they are increasingly implementing robust access-control measures as a precautionary approach to mitigate risks and ensure comprehensive security protocols. Thus, there is a continuous increase in demand for access control solutions because of the urgency to fortify security systems in this digitalized and globalized era.

- Rising Incidence of Cyber threats

Cyber threats are expected to become more pervasive and targeted towards access control systems, which will require a more holistic approach–including hardware, software and end-user due diligence in identifying threats–to establish the strongest line of defense. It has emerged as a big challenge for security players. Recent reports on hackers using cameras to launch DDoS attacks further underscore the importance of guarding against cyber threats. It has become a serious issue as video surveillance migrates from analogue to IP. The ever-growing proliferation of IP cameras makes the need to protect camera systems from cyber threats which has significantly created robust demand for a more secure and sophisticated access control system.

Access Control Market Restraints:

- High cost of ownership

Buying an integrated access control system costs much more than simply buying it. These costs include software purchase and license renewal fees, hardware purchase costs, maintenance, and other hidden costs. For example, even though it may seem insignificant during the early stages of an investment in an access control system (ACS), the software can significantly raise the total cost of ownership (TCO) over its lifespan. Hence, small enterprises face many challenges in acquiring these ACSs.

Access Control Market Geographical Outlook:

- Asia Pacific is witnessing exponential growth during the forecast period

There has been a rapid growth in demand for access control systems throughout the Asia Pacific region due to economic development, which has led to demand for enhanced security measures in both the public and private sectors. Smart city development, together with urbanization as well as infrastructure growth, are key factors driving the use of access control systems globally, while Asia Pacific’s manufacturing industry adopts them heavily to secure their factories.

North America will also have a significant market share throughout the forecast period owing to early adoption of the technology across different end-use sectors and the presence of major players of global access control market in the U.S. High rate of investment in R&D in the access control industry boosts the growth of access control market in the region. Recent rise in cyber-attacks across end use sectors, especially in BFSI and healthcare, is further encouraging market players to develop advanced and effective access control solutions, thereby positively impacting the growth of access control market in the North America region.

Access Control Market Segmentation Analysis:

- Hardware segment is growing significantly in the market

By product, the access control market has been segmented as hardware and software. Hardware segment holds the larger market share and is expected to grow further in the coming years. The hardware segment is further divided into sub segments as biometrics, cards and readers, mobile phones, and others.

Growing need for better security and access control management in various industrial sectors, government institutions, and others, to control, allow, and restrict access to different entities is a major driving force behind the rising adoption of access control systems. Safeguarding employee and organizational data and assets is another major factor leading to the continuous growth of the access control market.

Security has always been a major concern for any sector of the society. The need to restrict access to people to files, important documents, and assets is a key concern area. The government, businesses, banks, and almost every other sector have important data and assets that need to be kept confidential to maintain privacy and protect their organization from any possible threats. In any security system, there are two essential components namely, hardware and software.

The hardware is the physical security layer while the software is the component which enables the hardware to function. Hardware includes systems like biometric access control systems, biometric door locks, and cards and readers among others. With the advancements in technology the rise in physical threats is on the high. Cases of unauthorized entrance, security threats, terrorist activities, hackings are increasing more than ever. To counter such threats continuous investments in research and development are being made to develop more advanced and sophisticated access control systems. One of the major requirements for such systems is accuracy. These systems need to be flexible and very efficient to minimize security risks. Major companies are investing in new access control systems to be installed in their premises to control access of unauthorized persons in different levels of their organization. New companies are coming with more advanced products to help these organizations to counter any possible physical or virtual security threats.

Access Control Market Key Launches:

- In February 2023, Trace-ID entered into an exclusive deal with Identiv Inc., a world leader in digital identification and security for the Internet of Things (IoT). Identiv’s manufacturing footprint can grow, its product range can increase, and it can become stronger as a global leader in specialty RFID technology through its partnership with Trace-ID. This partnership will also enable industrial UHF RFID solutions for by Identiv across multiple industries.

- In January 2023, two members of the ASSA ABLOY Group, Assa Abloy AB and Abloy Oy, launched their ABLOY Key Deposit System, which allows access without keys. The system employs a Bluetooth Low Energy (BLE) connection to permit keyless entry into properties via smartphone. Thus, property managers can offer different user groups access to homes without unnecessary key logistics or access control through their phones through this deposit.

Access Control Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Access Control Market Size in 2025 | US$9.546 billion |

| Access Control Market Size in 2030 | US$13.542 billion |

| Growth Rate | CAGR of 7.24% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Access Control Market |

|

| Customization Scope | Free report customization with purchase |

The Access Control market is segmented and analyzed as follows:

- By Product

- Hardware

- Biometrics

- Cards and Readers

- Mobile Phones

- Others

- Software

- Hardware

- By Service

- Installation and Integration

- Support and Maintenance

- Professional Services

- By Deployment

- Cloud

- On-premise

- By End User Industry

- Telecommunication

- BFSI

- Government

- Healthcare

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- Spain

- United Kingdom

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation:

- Access Control Market Size:

- Access Control Market Key Highlights:

- Outsourcing Services Market Trends:

- Access Control Market Drivers:

- Access Control Market Restraints:

- Access Control Market Geographical Outlook:

- Access Control Market Segmentation Analysis:

- Access Control Market Key Launches:

- Access Control Market Scope:

- Our Best-Performing Industry Reports: