Report Overview

Africa Anti-Rheumatic Drugs Market Highlights

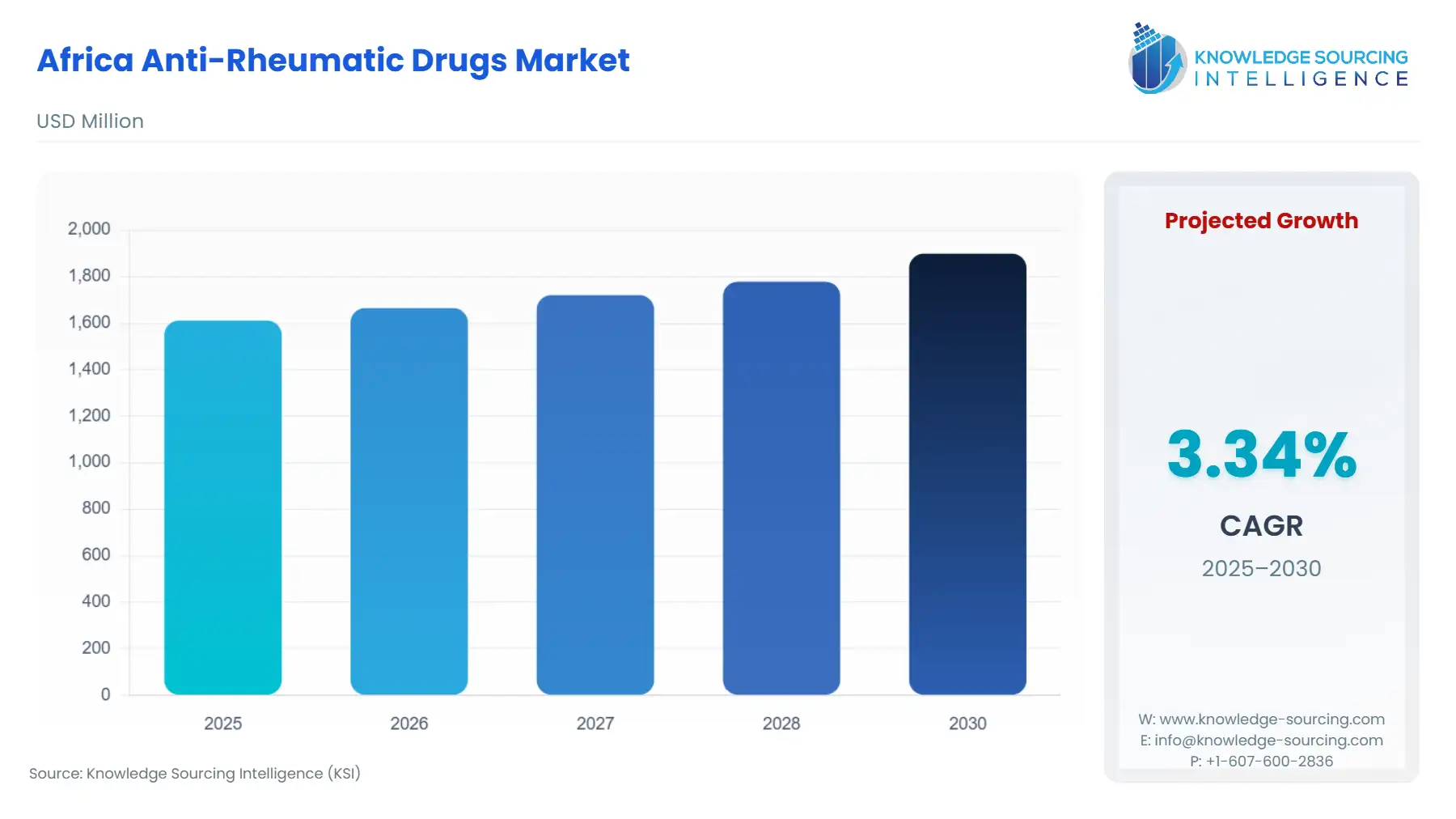

Africa Anti-Rheumatic Drugs Market Size:

The africa anti-rheumatic drugs market is expected to grow from USD 1,611.093 million in 2025 to USD 1,898.729 million in 2030, at a CAGR of 3.34%.

The Africa Anti-Rheumatic Drugs Market operates within a uniquely challenging and opportunity-rich continental landscape, characterized by profound health disparities, rapidly evolving regulatory environments, and a significant, yet under-diagnosed, disease burden. The prevailing market structure heavily favors affordable conventional therapies, driven by national essential medicines lists and constrained healthcare budgets, despite the clinical imperative for advanced biologic treatments in a high percentage of patients.

Africa Anti-Rheumatic Drugs Market Analysis

- Growth Drivers

The substantial prevalence of both Osteoarthritis (OA) and the rising incidence of Rheumatoid Arthritis (RA) serve as the fundamental demand catalysts for the anti-rheumatic drugs market. The documented high prevalence of OA in certain urban and geriatric cohorts, such as in South Africa, propels sustained demand for Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) and Corticosteroids for pain and inflammation management. Simultaneously, enhanced diagnostic capabilities in major urban centers—a direct result of increasing foreign direct investment in private healthcare and specialized training—are converting an estimated disease burden of RA into an identifiable patient pool. This conversion immediately generates demand across the entire therapeutic spectrum, initiated with Methotrexate and escalating to advanced biologics, driven by the clinical need to prevent irreversible joint damage under the 'Treat-to-Target' clinical protocol.

- Challenges and Opportunities

The market faces structural headwinds, primarily fragmented, high-cost supply chains and the pervasive threat of substandard and falsified medicines, which directly suppress legitimate demand by eroding patient trust and limiting realized access through stock-outs. Furthermore, the high regional prevalence of infectious co-morbidities, especially Tuberculosis (TB), poses a severe clinical challenge that constrains the safe use of immunosuppressive Biologic DMARDs, thus artificially limiting the high-value segment of the market. Conversely, the AfCFTA presents a major commercial opportunity. By aiming to eliminate most intra-African tariffs and non-tariff barriers, the agreement structurally lowers the cost and complexity of distributing drugs manufactured in regional hubs like Egypt or South Africa into other African markets, thereby substantially increasing product affordability and boosting effective patient demand.

- Supply Chain Analysis

The African anti-rheumatic drug supply chain remains heavily reliant on active pharmaceutical ingredient (API) and finished dose imports, primarily from India and China, creating dependencies susceptible to geopolitical and logistical disruptions. Key logistical complexities include inadequate cold-chain infrastructure necessary for biologic transport, pervasive customs inefficiencies, and fragmented last-mile distribution networks which result in high product attrition and stock-outs. The impact of tariffs and trade barriers further exacerbates cost: non-harmonized national import duties and protracted customs clearance times inflate the final patient cost of an imported drug. The aspiration of AfCFTA is to streamline cross-border trade, which is expected to gradually lead to the establishment of intra-African manufacturing and distribution corridors, fundamentally increasing supply chain resilience and expanding market penetration by reducing these prohibitive transaction costs.

Africa Anti-Rheumatic Drugs Market Government Regulations

Key regulatory bodies and frameworks across Africa actively shape the market's demand profile by controlling access, pricing, and quality standards.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

South Africa |

SAHPRA (South African Health Products Regulatory Authority) |

SAHPRA's adoption of stringent quality standards and its alignment with international benchmarks (ICH) facilitates the market entry of high-quality biosimilars and generics, fostering price competition which directly expands the accessible patient pool (demand). |

|

Nigeria |

NAFDAC (National Agency for Food and Drug Administration and Control) |

NAFDAC's slow drug registration and testing protocols act as a non-tariff barrier, delaying product availability and suppressing realized demand, particularly for novel imported biologic therapies. Rigorous testing is necessary to combat counterfeit drugs. |

Africa Anti-Rheumatic Drugs Market In-Depth Segment Analysis

- By Disease Type: Rheumatoid Arthritis

Demand in the Rheumatoid Arthritis (RA) segment is overwhelmingly governed by the therapeutic guidelines mandating a structured, aggressive 'Treat-to-Target' strategy to maximize the chance of remission. This protocol systematically drives demand, starting with the immediate requirement for conventional synthetic DMARDs (csDMARDs) like Methotrexate and Sulfasalazine upon diagnosis. For the high percentage of patients failing to achieve low disease activity on csDMARDs—a group often characterized by poor prognostic factors in African cohorts—the clinical imperative shifts demand to the high-value Biologic and Targeted Synthetic DMARDs (b/tsDMARDs). While significant cost barriers and payer restrictions constrain the widespread uptake of biologics, the clinical need is an immutable demand driver, creating strong pressure on governments and private insurers to adopt biosimilar alternatives to improve patient access.

- By Type: Disease Modifying Anti-Rheumatic Drug (DMARDs)

The DMARDs segment is the market’s center of gravity, with demand rooted in the documented efficacy of these agents in altering the progressive course of immune-mediated inflammatory diseases. The initial wave of demand is propelled by the affordability and established safety profile of csDMARDs, which are widely listed on national Essential Medicines Lists (EMLs) and are cost-effective from a health-provider perspective, as demonstrated by studies in regions like Zanzibar. A second, higher-value wave of latent demand exists for b/tsDMARDs. This demand is critically linked to improving socioeconomic factors, which enable patient self-pay or expanded insurance coverage, and the successful introduction of cost-saving biosimilars. The World Health Organization (WHO) actively promotes biosimilars for auto-immune diseases, directly endorsing their role as a mechanism to expand DMARD demand in low- and middle-income countries (LMICs).

Africa Anti-Rheumatic Drugs Market Competitive Environment and Analysis

The competitive landscape is bifurcated between global originator pharmaceutical companies dominating the b/tsDMARD segment and a host of local and international generic manufacturers saturating the csDMARD and NSAID segments. Market entry barriers for biologics are high, driven by patent protection, complex manufacturing, and stringent regulatory requirements, leading to a monopoly in the initial years. The primary mechanism of competition in the high-value segment is now the market penetration of biosimilars.

- AbbVie Inc.- AbbVie maintains a commanding position in the anti-rheumatic immunology space globally. Its strategic positioning in Africa is largely built upon the legacy of Humira (adalimumab), a blockbuster TNF inhibitor, and its newer specialty immunology assets like Rinvoq (upadacitinib, a JAK inhibitor).

- Pfizer Inc.- Pfizer possesses a diversified portfolio that includes both conventional (e.g., NSAIDs) and targeted synthetic anti-rheumatic drugs, such as Xeljanz (tofacitinib, a JAK inhibitor). Pfizer’s strategic approach in the emerging markets, including Africa, is characterized by leveraging its global supply chain to provide a broad-spectrum rheumatology offering.

Africa Anti-Rheumatic Drugs Market Recent Developments

- In September 2024, Eli Lilly and Company (“Lilly”) and EVA Pharma announced a collaboration to expand access to the JAK-inhibitor drug Baricitinib in low- and middle-income countries (LMICs) for treatment of rheumatoid arthritis, among others. Under the agreement, Lilly will license manufacturing know-how to EVA Pharma, enabling EVA to locally manufacture and supply Baricitinib across 49 African and other LMICs, with the goal of reaching an estimated 20,000 patients by 2030.

Market Segmentation:

- By Type

- Non-Steroid Anti-Inflammatory Agents (NSAIDs)

- Corticosteroids

- Disease Modifying Anti-Rheumatic Drug (DMARDs)

- Methotrexate

- Sulfasalazine

- Hydroxychloroquine

- Leflunomide

- Biologic DMARD

- Others

- By Disease Type

- Rheumatoid Arthritis

- Osteoarthritis

- Gout

- Lupus

- Others

- By Distribution Channel

- Online

- Offline

- By Country

- South Africa

- Nigeria

- Algeria

- Kenya

- Tunisia

- Others