Report Overview

Agricultural Adjuvants Market Size, Highlights

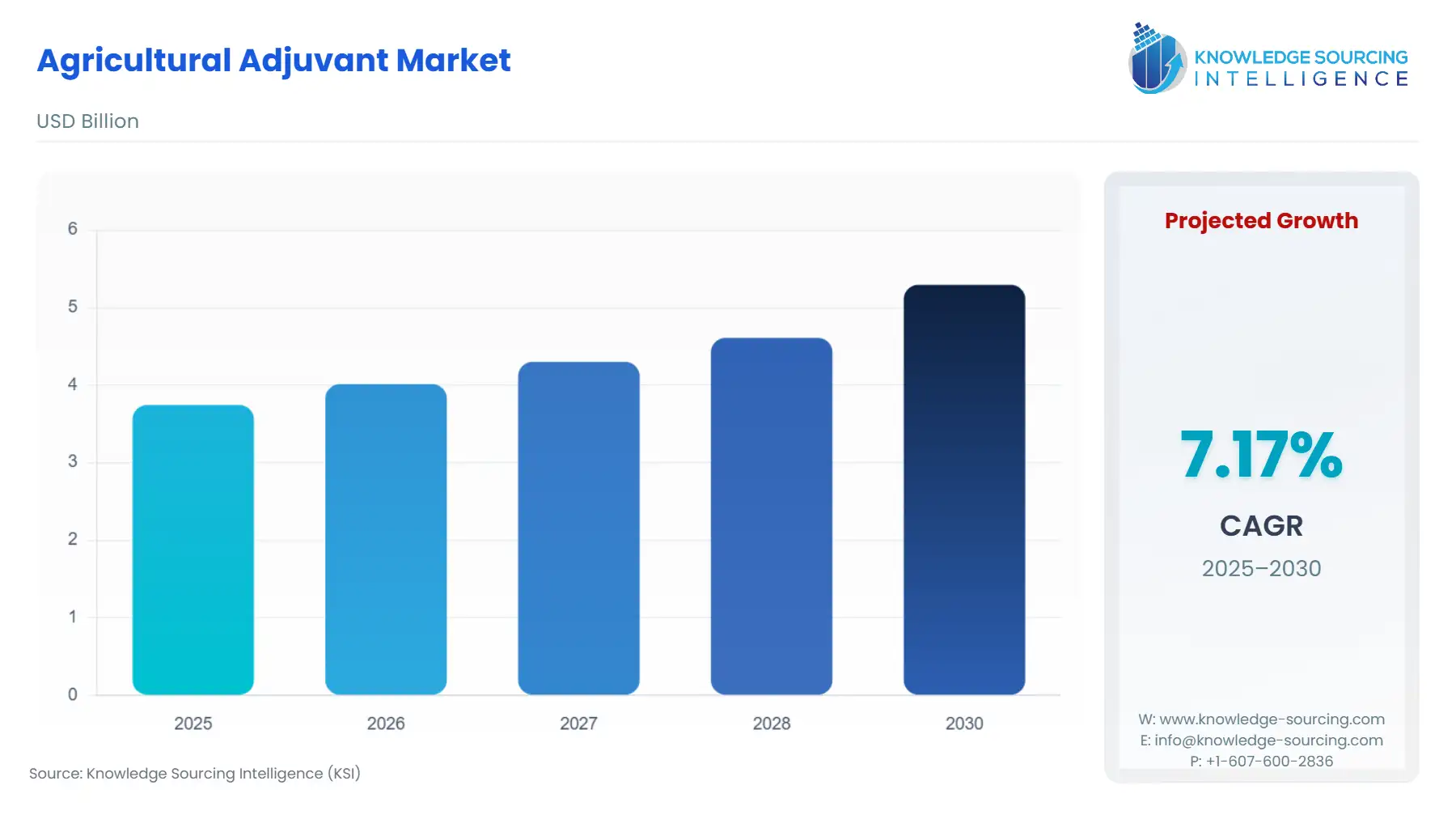

The global agricultural adjuvants market will grow from US$3.745 billion in 2025 to US$5.295 billion in 2030 at a CAGR of 7.17%.

Agricultural Adjuvants Market Highlights

Agricultural Adjuvants Market Trends:

Agriculture adjuvants help increase the penetration, adhesion, and dispersion of fertilizers and pesticides on plant surfaces, improving overall crop protection and nutrient delivery efficacy. They are supplements that enhance the effectiveness of the main inputs used in agriculture. Growing focus on sustainable agricultural practices, which call for the economical use of inputs like pesticides and fertilizers, the increasing demand for improved crop protection and increased agricultural productivity, and the adoption of precision farming techniques are the major factors driving the agricultural adjuvants market. In addition, the market is further growing because of developments in formulations and technologies that enhance adjuvant effectiveness while lowering environmental impact.

Businesses are using a variety of tactics in the ever-changing agricultural adjuvants industry to overcome obstacles and seize new possibilities. Product innovation is still crucial, and businesses are spending money on R&D to create adjuvants that complement contemporary agricultural methods while emphasizing enhanced performance and environmental sustainability. For instance, in September 2023, AtloxTM BS-50, a delivery system designed to particularly address the demands of the expanding biopesticide sector, was launched by Croda. The agricultural industry is moving towards more environmentally friendly goods, and biopesticides made of natural ingredients are being investigated extensively as a potential solution. Furthermore, in February 2020, AltaHance, a new bio-based adjuvant product line from Ingevity, was introduced. AltaHance is a multipurpose retention technology with adjustable rain fastness that is intended to be used in crop protection products to increase the agrochemical's efficacy.

Strategic alliances and partnerships with academic institutions, agricultural organizations, and business associates help promote a stronger market presence for key players. Access to complementary resources and market data is made possible by these alliances and collaborations. For instance, in November 2022, Corteva, Inc. and Stoller Group, Inc. jointly announced that Corteva had finalized a deal to purchase one of the biggest independent biological firms in the business, Stoller, located in Houston. With operations and sales in more than 60 countries and projected revenues of over $400 million in 2022, Stoller offers Corteva rapid scale and profitability with accretive EBITDA margins.

Agricultural Adjuvants Market Growth Drivers:

- Increasing adoption of indoor farming to propel the product demand.

The agricultural adjuvants market is significantly impacted by the use of precision agriculture techniques in indoor farming. Crop management accuracy is essential in indoor farming, which is defined by controlled conditions like greenhouses and vertical farms. In relation to this, agricultural adjuvants are essential since they increase the effectiveness of agrochemicals like pesticides and herbicides. Adjuvants help to get the best outcomes possible, and the regulated circumstances of indoor farms need the precise and efficient administration of these chemicals. According to the data published by iFarm, a leading vertical farm company in Saudi Arabia, the annual revenue of iFarm Vertical Farms increased from 72 thousand dollars in 2021 to 74 thousand dollars in 2022 owing to the growth in awareness of vertical farms and increasing arable land. Moreover, initiatives for the growth of indoor farming by various players is further fueling the agricultural adjuvants market worldwide. For instance, in June 2021, the state-of-the-art Research Center for AeroFarms, a pioneer in indoor vertical farming and a certified B Corporation, began construction in Abu Dhabi. AeroFarms AgX LTD, the company's wholly-owned subsidiary in the United Arab Emirates, planned to focus solely on the newest advancements in indoor vertical farming, innovation, and AgTech. Additionally, in May 2023, the world's most technologically sophisticated indoor vertical farm, the Plenty Compton Farm, debuted in Compton, California. It's one city block was used to grow up to 4.5 million pounds of leafy greens a year. Numerous patent assets held by Plenty enable it, such as its innovative 3D vertical design, which powers the farm's industry-leading production of up to 350 times that of a traditional farm per acre.

Furthermore, according to UN estimates, the world will need to feed an additional 2.3 billion people by 2050, the majority of whom will live in cities far from agricultural areas. To deal with this, NASA implemented vertical farming principles on a practical level, having constructed the nation's first vertical farm. Technologists piled hydroponic trays against the walls of a defunct hypobaric room that had been used to test the Mercury space spacecraft. Then, using readily available components, systems for lighting, ventilation, and water circulation were built. On the stacked trays, several crops were planted to see how well they would grow in water and without the aid of sunlight or fresh air.

Comprehensively, the focus on sustainability in indoor farming is consistent with adjuvants' potential to mitigate the environmental effects by utilizing lower chemical application rates. The need for agricultural adjuvants is expected to rise as the indoor farming industry expands due to reasons including year-round production and resource efficiency, highlighting the adjuvants' crucial role in contemporary controlled-environment agriculture.

Agricultural Adjuvants Market Geographical Outlook:

- It is projected that the global agricultural adjuvants cooker market in the North American region will grow steadily.

The agricultural adjuvants market is expected to propel in the United States. This is owing to the increasing use of precision agriculture in the market coupled with the presence of companies such as the Dow Chemical Company, are all adding to the market growth in coming years. Additionally, the United States agricultural adjuvants market growth is driven by the substantial utilization of agrochemicals, primarily in conjunction with adjuvants. Increasing focus on augmenting agricultural productivity is leading to heightened chemical application, consequently boosting the demand for adjuvants. The consistent upward trajectory in revenue within the pesticides and agricultural chemicals sector signifies a positive growth pattern for pesticides. This, in anticipation, is projected to drive the United States agriculture adjuvant market forward throughout the forecast period. According to the U.S. Department of Agriculture, in 2021, the combined contribution of agriculture, food, and related industries to the U.S. gross domestic product (GDP) was approximately $1.264 trillion, representing a 5.4% share. Specifically, the output generated by American farms accounted for $164.7 billion of this total, constituting approximately 0.7 percent of the overall U.S. GDP. Hence, the rising agriculture sector in the United States is expected to boost the market for agricultural adjuvants.

Key players in the dynamic US agricultural adjuvants use a variety of tactics to keep and grow their competitive landscape. To guarantee the launch of cutting-edge solutions, ongoing investment in research and development for technical improvements remains a cornerstone. Companies may increase their market reach and level of expertise through strategic alliances, acquisitions, and collaborations. For instance, in November 2023, Rovensa Next is strategically expanding its global operations into key regions such as Iberia, the United States, Mexico, South Africa, MENA, and Latin America. In today's context, where sustainable agriculture is of growing importance and there is an increasing demand for holistic global solutions to address pressing agricultural challenges, Rovensa Next's entry into the Iberian Peninsula, the US, Mexico, South Africa, MENA, and Latin America signifies a notable accomplishment. These launches build upon the company's earlier market entries in China, France, Italy, and Brazil this year, highlighting its dedication to being a leading proponent of a more environmentally sustainable future on a global scale.

- Russia-Ukraine War Impact Analysis

The global agriculture industry has been impacted by the Russia-Ukraine conflict, affecting the agricultural adjuvants market as well. Production and transportation of essential raw materials for adjuvants, such as minerals, starches, and vegetable oils, have been hampered by the conflict. Additionally, disruptions in the supply chain introduced more complexity. Delivery delays are caused by difficulties procuring necessary components and ingredients, endangering the availability of the product. Furthermore, farmers abroad may decide to make financial adjustments as a result of increased food costs and unpredictability, which would affect the sales of adjuvants.

Owing to the crisis itself, fresh or increased economic sanctions on Russia and Belarus, and delays in Black Sea trade routes, fertilizer shipments were hampered from these two nations. Belarus and Russia are significant producers of each of the three main nutrients used in fertilizers. In 2020, Russia contributed 11% and 14%, respectively, to world commerce in phosphate and urea, while, along with Belarus, it accounted for 41% of global trade in potash. The fertilizer industry is susceptible to trade shocks since a small number of nations generate a significant portion of the fertilizers that are exported worldwide.

Furthermore, global food security is also at risk due to growing energy and fertilizer prices, a decline in export capacity from Russia and Ukraine, and increased international food prices. The data provided by the OECD indicates that a 50% decrease in Russian wheat exports, combined with the complete loss of Ukraine's export potential, resulted in a 34% increase in global wheat prices in the marketing year 2022–2023.

However, when the security of agricultural areas permits, Ukrainian farmers continue to produce crops and livestock products, demonstrating a high level of resilience to the interruptions brought about by the conflict. Production for the winter crops of 2022–2023 was positive as of May 2022, but they remained unpredictable due to several factors, including farmers' capacity to apply fertilizers and complete other maintenance tasks before the June 2022 harvest. Further, the regions where the main crops are planted (sunflower seed, maize, and spring barley) were 20% less than in 2021.

Nonetheless, the conflict has also led to some advancements. It has brought attention to the necessity of diversifying the sources of raw materials, which may encourage investments in bio-based substitutes that might eventually help upsurge the industry.

Agricultural Adjuvants Market Key Developments:

- In September 2023, AtloxTM BS-50, a delivery system designed to particularly address the demands of the expanding biopesticide sector, was launched by Croda. The agricultural industry is moving towards more environmentally friendly goods, and biopesticides made of natural ingredients are being investigated extensively as a potential solution.

- In November 2022, Corteva, Inc. and Stoller Group, Inc. jointly announced that Corteva had finalized a deal to purchase one of the biggest independent biological firms in the business, Stoller, located in Houston. With operations and sales in more than 60 countries and projected revenues of over $400 million in 2022, Stoller offers Corteva rapid scale and profitability with accretive EBITDA margins.

- In February 2020, AltaHance, a new bio-based adjuvant product line from Ingevity, was introduced. AltaHance is a multipurpose retention technology with adjustable rain fastness that is intended to be used in crop protection products to increase the agrochemical's efficacy.

Agricultural Adjuvants Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Agricultural Adjuvants Market Size in 2025 | US$3.745 billion |

| Agricultural Adjuvants Market Size in 2030 | US$5.295 billion |

| Growth Rate | CAGR of 7.17% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Agricultural Adjuvants Market |

|

| Customization Scope | Free report customization with purchase |

Segmentation:

- By Type:

- Activator Adjuvants

- Oil Adjuvants

- Surfactants

- Utility Adjuvants

- Activator Adjuvants

- By Application:

- Herbicides

- Insecticides

- Fungicides

- Others

- By Geography

- North America

- US

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- UAE

- Saudi Arabia

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Australia

- Others

- North America