Report Overview

AI in Crop Monitoring Highlights

AI in Crop Monitoring Market Size:

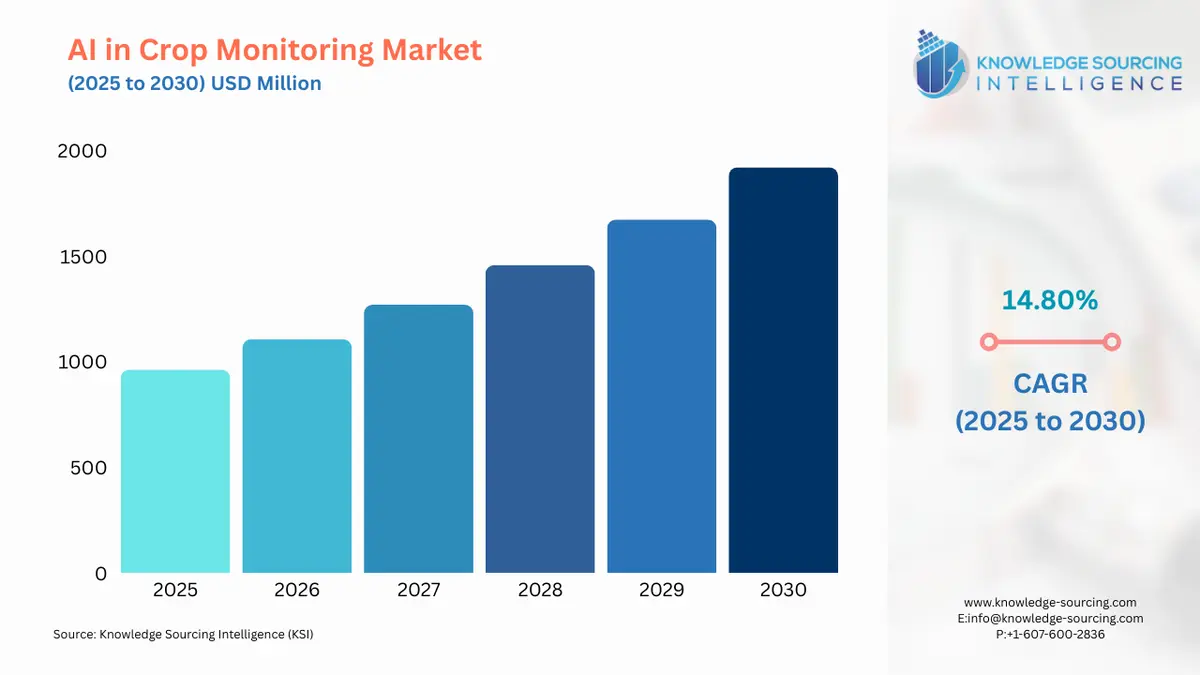

The AI in Crop Monitoring Market is projected to grow at a CAGR of 14.80% over the forecast period, increasing from USD 963.456 million in 2025 to USD 1,921.228 million by 2030.

The growing global demand for food, coupled with the limitation of available arable land, is a major factor driving the AI in Crop Monitoring market. Additionally, the rising adoption of precision agriculture practices and the increasing emphasis on environmentally sustainable farming are further fueling market growth. More importantly, advancements in AI and related technologies such as machine learning algorithms, computer vision, and cloud computing are playing a pivotal role in accelerating the growth of AI in the Crop Monitoring market.

Some of the key players in the AI in Crop Monitoring market include A.A.A Taranisnico Ltd., PEAT GmbH (Plantix), Sentera, Inc., Farmonaut Technologies Pvt. Ltd., EOS Data Analytics, Inc., CropX Inc., Cropin Technology Solutions Pvt. Ltd., Deere & Company, IBM Corporation, Bayer AG, Planet Labs PBC, and Granular Inc.

AI in Crop Monitoring Market Trends

The quick integration of precision farming practices through the implementation of IoT is one of the most prominent trends in the AI-based crop monitoring market. The use of sensors and other related systems is helping farmers produce real-time soil moisture, temperature, nutrient concentration, and crop health-related data, which are then used by AI models to make optimal decisions. This integration can enable the focused application of water, fertilizers, and pesticides so that resources are used only where and when they are needed. It has been demonstrated that these systems can cause a reduction in water consumption by 35 percent and yield forecasts by almost 30 percent. In addition, precision spraying using drones has become more of an established practice, and the adoption rates are rapidly increasing, contributing to the elimination of unnecessary use of chemicals and related expenses. This movement is also indicative of a larger-scale move towards data-driven and sustainable agriculture, with AI and IoT acting as the core of smarter and more efficient farming.

AI in Crop Monitoring Market Dynamics

Market Drivers

- Increasing Demand for AI for Crop Monitoring: In the crop monitoring market, AI applications such as machine learning, computer vision, data analytics, and other AI techniques are used to improve the accuracy, efficiency, and decision-making in monitoring crop health, growth, and productivity. It enables real-time monitoring and predictive insights, helping farmers optimise their yields by reducing costs and minimizing the environmental impact. Satellite imagery, drone footage, soil sensors, and many others are used with AI to find key data and help in crop health monitoring, yield prediction, pest and disease detection, irrigation optimization, weed detection, and precision agriculture support.

- Rising Global Food Demand: The world's population is projected to continue its upward trajectory. As the global population continues to grow, the demand for food is rising sharply to meet the nutritional needs of billions. However, since arable land is limited and largely fixed, this surge in demand is putting increasing pressure on food production systems, necessitating smarter, more efficient agricultural practices. This is one of the key factors that is driving the market for AI in crop monitoring by addressing these agricultural challenges by enabling smarter and data-driven farming practices through the use of machine learning, computer vision, and predictive analytics, helping in monitoring crop health, predicting yield, detecting diseases, and optimizing irrigation. Thus, it enhances productivity as well as makes agriculture more sustainable and environmentally friendly.

According to the World Bank, the global population is expected to reach 8.6 billion by 2030, 9.8 billion by 2050, and 11.2 billion by 2100, with roughly 83 million people being added each year. To feed this growing population, there is increasing pressure on fixed land, driving demand for AI-powered tools that can effectively optimise agricultural processes, enhancing productivity, reducing waste, and improving overall operational efficiency across the farming value chain.

- Government Initiatives: The increasing initiatives by the government are a key factor that is driving the market. For instance, the Indian government has been proactive in incorporating AI in agriculture. Union Education Minister Dharmendra Pradhan recently announced the setting up of three Artificial Intelligence Centres of Excellence (CoEs) in the areas of healthcare, agriculture, and sustainable cities. This program, under the "Make AI in India and Make AI Work for India" vision, is aided by an expenditure of Rs. 990 crore from FY 2023-24 to FY 2027-28. One of its major goals includes empowering farmers through AI-based solutions, such as Kisan e-Mitra Chatbot, AI-Based Crop Health Monitoring, and National Pest Surveillance System. Also, India's National Pest Surveillance System (NPSS) is a technology-enabled AI-based platform, introduced in August 2024, that aims to improve pest management for farmers. Farmers will be able to connect with agricultural specialists using their mobile phones. Farmers can upload pictures of pests or infested crops and get personalized pest-control recommendations from real-time inputs. The system makes farmers less reliant on pesticide shop owners, supports scientific pest-management practices, and discourages pesticide misuse, enabling sustainable farming.

Market Restraints

- Slower Adoption in Developed and Underdeveloped: One of the key challenges faced by the market is the slower rate of adoption of artificial technologies in monitoring crops in a major chunk of the agricultural world such as more particularly in those underdeveloped areas and developing regions. Lack of infrastructure, technological complexity, and lack of adequate incentives from the government there to a low adoption rate in these areas, affecting the market growth.

AI in Crop Monitoring Market Segmentation Analysis

By Application

Disease and Pest Management is dominating due to increasing crop losses.

Based on application, the market is classified into disease and pest management, precision irrigation, yield prediction, soil health monitoring, and weed control.

One of the biggest causes of yield loss in India has been crop disease, but now that is changing with AI. Computers and Electronics in Agriculture has found that in one study, neural networks were applied to identify diseases like apple scabs with 95 percent success. Similarly, machine learning has also been used to detect yellow rust in wheat fields to enable early intervention. Artificial intelligence-based pest surveillance systems like the National Pest Surveillance System are also helping farmers in India to deal with climate change-related losses, resulting in healthier crops.

Among the major factors that are driving the AI implementation in this industry is the fact that the issue of climate variability and its impact on plant health is on the rise. Unpredictable weather patterns, new pest infestations, and altered disease patterns make the traditional methods of farming ineffective. Just 17% of the GDP of India is provided by agriculture. India is the largest producer of such critical crops as tomatoes, potatoes, and pepper. Various factors, including environmental factors and cross-contamination, impact on the development and transmission of infections in agricultural regions. The number of crops that are being reduced in productivity due to the pest infestations is 30-33 per year.

The AI assists in predictive analysis based on previous and current data to predict future infestations and to prescribe preventive measures. This not only reduces economic losses to infestations but also increases resistance to disruptions caused by climatic changes. The government of India has been keen on integrating AI in the agricultural sector. Recently, the Union Education Minister Dharmendra Pradhan declared that three Artificial Intelligence Centres of Excellence (CoEs) will be established in the domains of healthcare, agriculture, and sustainable cities.

Moreover, the use of AI technology in farms is being accelerated by technological innovation in precision farming. AI-powered intelligent farming devices can scan plant health at the leaf level, recognize the various types of pests or diseases, and deliver specific treatment. Such a degree of control would allow it to treat specific territories only, therefore, reducing the input cost and environmental impacts. It can also provide practical information to farmers that will enhance decision-making and productivity. As one example, in 2024, Bayer declared a pilot that applies generative AI (GenAI) to retrain agronomists and other employees who deal with farmers to allow them to answer questions about agronomy, farm management, and Bayer farm products more quickly and correctly. This new domain-specific GenAI model, named E.L.Y. (Expert Learning for You), makes Bayer an agri-food leader in composing contextually relevant and compliant answers to user prompts.

AI in Crop Monitoring Market Regional Analysis

By region, the market is segmented into North America, South America, the Middle East and Africa, and Asia-Pacific.

- North America

The AI in Crop Monitoring market is dominated by North America, with a significant portion of the market due to the high rate of technological adoption in the country and the existence of large agritech firms. The US and Canada lead the pack, and it is common practice to use AI-enabled sensors, drones, and satellite images in precision farming practices. Regional farmers are using AI to optimize their irrigation systems, monitor crop diseases at an early stage, and even improve the overall productivity of their yields. The region is also experiencing growth due to strong government backing, investments in smart farming programs, and the growing need for sustainable farming practices. - Europe

Europe is a major AI Crop Monitoring market with stringent environmental policies, sustainable farming programs, and the prevalence of precision farming methods. Germany, France, and the Netherlands are at the forefront of adopting AI tools in combination with robotics, IoT devices, and remote sensing technologies. The need to enhance efficiency, eliminate the use of chemicals, and achieve the EU sustainability targets are some of the factors that see farmers demanding AI-powered crop monitoring solutions. There are also good research partnerships between research institutions, governments, and agritech companies in the region. - Asia-Pacific

The fastest-growing region in the AI in Crop Monitoring market is the Asia Pacific, which is rapidly digitizing its agricultural sector, growing in population, and where the necessity to boost crop yields is provoking its development. Countries like China, India, Japan, and Indonesia are massively investing in AI-based solutions, such as drones, smart sensors, and predictive analytics, to mitigate food security issues. In China and India specifically, AI technologies are being implemented to streamline irrigation, soil conditions, and pest control. The adoption is being accelerated by government programs in support of smart farming and the increasing number of agritech startups. The very high agricultural base in the region and the pressing demand to increase productivity make it the most ever-changing market in AI in crop monitoring. - South America

The South American region is also becoming an attractive AI market in Crop Monitoring, with Brazil and Argentina as the most adopting countries. The high emphasis of the region on large-scale farming, especially the production of soybeans, sugarcane, and corn, is promoting the application of AI-enabled monitoring tools to streamline production. Drones, sensors, and AI-based analytics are being embraced by farmers to monitor their soils and irrigate, as well as identify pests. The increase in export demand of agricultural commodities and the necessity to enhance efficiency in operations are also contributing to regional growth. - The Middle East and Africa

Crop monitoring is gradually being adopted by the Middle East and Africa as AI is being developed to solve water shortages and support food security and agricultural productivity. Some of the countries most advanced in AI innovation include Israel, the UAE, and South Africa, where large amounts of money have been invested in AI-driven irrigation systems, drones, and precision farming technologies. In areas that experience dry climatic conditions, AI is being employed to make the most of scarce water supplies and enhance the resistance of crops. The increasing number of international agritech firms and government-supported programs should also help to drive up adoption throughout the region.

AI in Crop Monitoring Market Competitive Landscape

Key Industry Players

The AI crop monitoring market is also extremely competitive with both international technology giants, agritech startups, and local solution providers. Rapid innovation fuels competition because businesses are in a race to combine AI with other compatible technologies like IoT, drones, satellite imaging, and robotics. There is also a concentration on providing scalable and affordable, easy-to-use platforms by the players to support not only large commercial farms, but also smallholder farmers in emerging markets. The partnerships between AI companies, agricultural equipment companies, and government agencies are also contributing to increasing competition. As food security and sustainability become worldwide issues of concern, the market is experiencing an unprecedented outpouring of investment and research and development, with technological distinction and service integration becoming key factors in market share acquisition.

List of Key Company Profiled

- A.A.A Taranisnico Ltd.

- PEAT GmbH (Plantix)

- Sentera, Inc.

- Farmonaut Technologies Pvt. Ltd.

- EOS Data Analytics, Inc.

- Other

AI in Crop Monitoring Market Key Developments

- Product Launch: In March 2025, Agmatix, a leading provider of AI-powered agronomic solutions, announced a strategic collaboration with BASF, one of the world’s largest chemical and agricultural solutions companies, to develop a cutting-edge digital solution for detecting and predicting the presence of soybean cyst nematode (SCN). This collaboration started through AgroStart, an open innovation and partnership platform by BASF, that aims to empower soybean growers with real-time, scalable insights to mitigate yield losses caused by SCN, one of the most damaging and often invisible soybean pests.

- Product Innovation: In September 2024, Syngenta launched Cropwise AI. It is a GenAI system designed to increase the efficiency of agronomic advisors and growers in determining the best crop management practices. It uses advanced machine learning algorithms and data analytics to offer deep insights and enhanced decision-making capabilities to optimize crop yields, improve sustainability, and drive profitability.

- Innovation: Bayer, for instance, in 2024, announced a pilot that utilizes generative AI (GenAI) to upskill agronomists and other farmer-facing employees, enabling them to quickly and accurately address questions related to agronomy, farm management, and Bayer agricultural products. This new domain-specific GenAI model, called E.L.Y. (Expert Learning for You), positions Bayer as an agri-food frontrunner in developing contextually relevant and compliant responses to user prompts.

AI in Crop Monitoring Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Crop Monitoring Market Size in 2025 | USD 963.456 million |

| AI in Crop Monitoring Market Size in 2030 | USD 1,921.228 million |

| Growth Rate | CAGR of 14.80% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the AI in Crop Monitoring Market |

|

| Customization Scope | Free report customization with purchase |

AI in Crop Monitoring Market Segmentation:

- By Technology

- Machine Learning

- Computer Vision

- Predictive Analytics

- Others

- By Offering

- Hardware

- Software

- Services

- By Application

- Disease and Pest Management

- Precision Irrigation

- Yield Prediction

- Soil Health Monitoring

- Weed Control

- By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Others

- North America