Report Overview

Artificial Intelligence (AI) In Highlights

Artificial Intelligence (AI) in Drone Market Size:

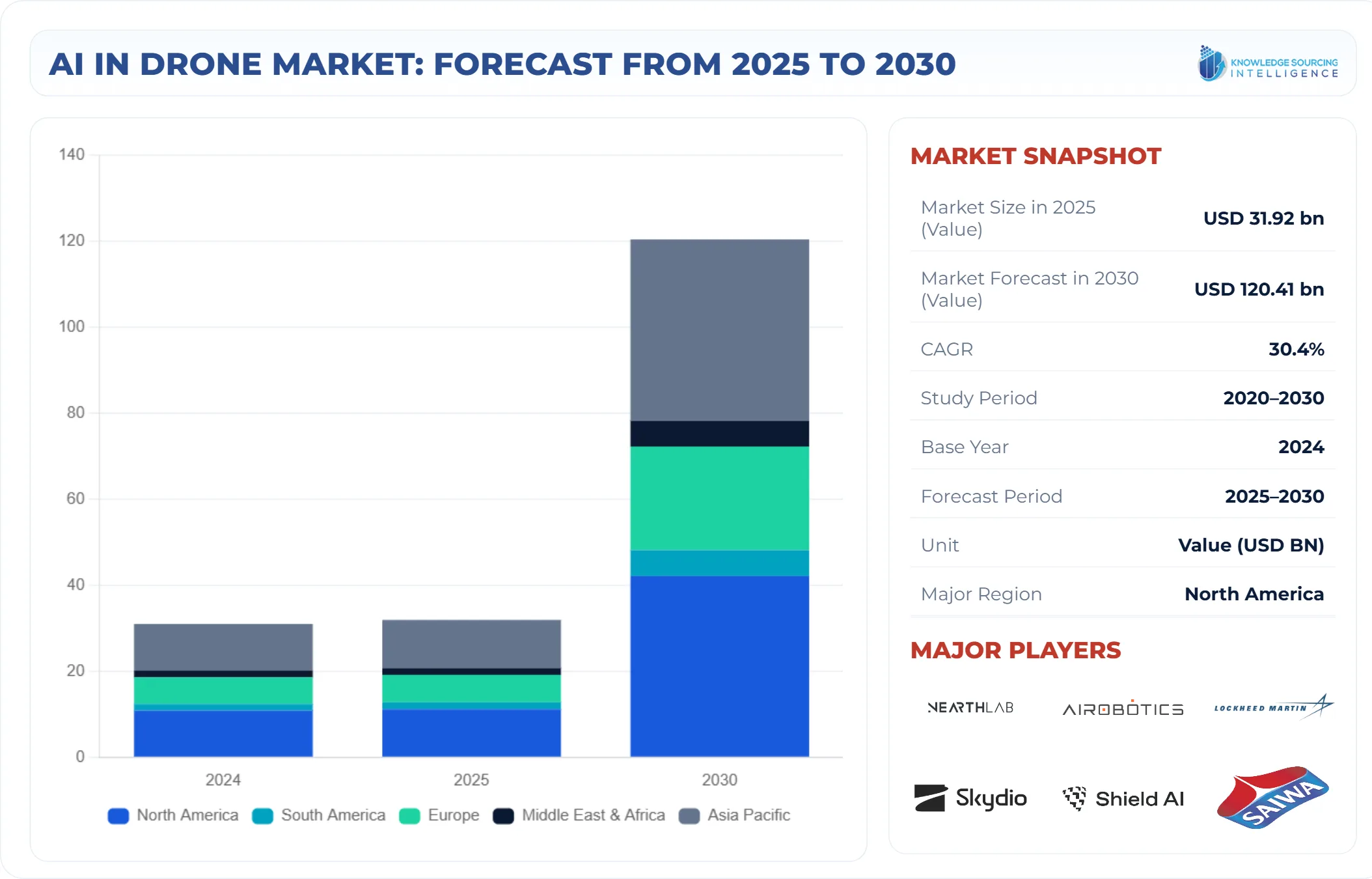

The AI in the drone market is projected to grow at a CAGR of 30.49% over the forecast period, increasing from USD 31.923 billion in 2025 to USD 120.410 billion by 2030.

AI in the drone market is revolutionizing unmanned aerial vehicle (UAV) applications across industries. Drone AI solutions power intelligent drones and autonomous UAVs, enabling advanced navigation, obstacle avoidance, and mission planning. Smart drones, integrated with drone robotics, enhance precision in sectors like agriculture, logistics, and surveillance. Drone data analytics, driven by drone software AI, processes real-time data for actionable insights, optimizing tasks such as mapping and monitoring. As demand for efficiency and automation grows, this market is pivotal in delivering scalable, intelligent solutions that redefine operational capabilities, safety, and data-driven decision-making in diverse industrial ecosystems. The AI in drones offers its application across multiple industries, like defense, agriculture, surveillance, surveys, and logistics, among others. In the agriculture sector, AI-based drones can map and monitor livestock and crop production.

Artificial Intelligence (AI) in Drone Market Trends:

The AI in drone market is experiencing exponential growth, driven by the surging adoption of AI-powered drones in the global logistics and e-commerce sectors. Artificial intelligence (AI) revolutionizes drone delivery by enabling real-time navigation, obstacle detection, and optimized routing, significantly enhancing last-mile delivery efficiency. Leading companies like Amazon have pioneered drone delivery solutions, launching services in countries such as the UK and Italy in October 2023, demonstrating the transformative potential of AI drones in e-commerce logistics (Amazon press release, 2023).

According to the U.S. Census Bureau, e-commerce retail sales in the U.S. grew from $287,855 million in Q1 2024, representing 15.8% of total retail sales, to $292,567 million in Q2, and reached $300,053 million in Q3 2024. This rapid expansion underscores the critical role of AI-driven drones in meeting delivery demands. AI technologies, including machine learning, computer vision, sensor fusion, and deep learning, empower drones to navigate complex urban environments, ensuring precision, safety, and speed in delivery operations.

Innovative trends are reshaping the AI drone market. Drone-in-a-box systems enable automated, on-demand deployments, ideal for logistics and emergency response. Beyond Visual Line of Sight (BVLOS) operations expand drone autonomy and operational range, unlocking applications in remote areas. Drone-as-a-Service (DaaS) and AI as a Service (AIaaS) provide scalable, cloud-based solutions for industries like agriculture, infrastructure monitoring, and security. Climate-smart drones, incorporating energy-efficient designs and eco-friendly materials, align with sustainable drone operations, addressing environmental concerns. Real-time drone insights, powered by AI analytics, enhance decision-making, while predictive maintenance minimizes downtime, boosting operational reliability.

North America leads the market, supported by advanced technology infrastructure, regulatory frameworks, and R&D investments. Asia-Pacific, particularly China, India, and Japan, is a fast-growing region due to e-commerce expansion, urbanization, and government support for drone technology. Challenges like regulatory compliance and data privacy persist, but AI innovations and standardized protocols are mitigating these issues. The AI in the drone market is poised for transformative growth, fueled by drone automation, sustainability, logistics efficiency, and industry-specific applications, cementing its role in the future of intelligent aerial solutions.

Artificial Intelligence (AI) in Drone Market Growth Drivers:

-

Growing global defense expenditure

AI drones offer a key application in the global market. In the defense sector, drones help enhance the efficiency of surveillance systems and improve military capabilities. With the rising global military and defense expenditure in the global market, the demand for AI in the drone market is expected to significantly increase.

The Stockholm International Peace Research Institute, in its global report, stated that in 2023, the global military expenditure witnessed a growth of about 6.8% compared to 2022. The agency stated that in 2023, the total military expenditure of the USA and China was recorded at US$916 and US$296 billion, respectively. Similarly, the military expenditure of Russia and India was recorded at US$109 and US$83.6 billion, respectively.

-

Increasing demand for the AI-powered software in drones

The growth of AI in the drone software segment is primarily driven by better data analysis and interpretation, automated processing of data, accuracy, productivity, and advanced analytics functionalities. Such software connected to AI is expected to be more significant due to efficiency in the processing of the enormous amounts of data collected by drones in the form of pictures, videos, and sensor readings, to reduce the consumption of time and effort to do this processing. It can also define possible patterns, unusual behaviors, and trends in drone data for improved and more informed decisions. The enhancement in this segment is mainly attributable to the high adoption of AI in the drone industry.

Further, SafePro AI delivered SpotlightAI ONSITE, a real-time AI-powered drone image processing introduced in December 2024. This is a real-time threat detection software for over 150 land mines and unexploded ordnance classes from drone imagery, in support of forward operations. It offers extensive practical field experience in Ukraine under real-world testing by Safe Pro AI, a subsidiary of Safe Pro AI. It is designed to work with virtually any drone. Thus, these latest innovations and advancements result in more demand for increased AI in drone software technologies, which in turn will increase the market in the years to come.

Additionally, AI-powered software in drones is opening a doorway for certain new applications, such as precision agriculture, infrastructure inspection, and delivery services. The AI-powered drone software providers are launching software for various sector applications such as environmental monitoring, search and rescue, and logistics-specific solutions. On an application basis, this segment is witnessing an expansion across industries, which is contributing to the market growth.

Artificial Intelligence (AI) in Drone Market Geographical Outlook:

By geography, the AI in the drone market is segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as the ASEAN countries.

North America AI in Drone Market

North America is expected to have a significant market share for AI in the drone market. USA AI in the drone market is witnessing growth due to emerging technology advances in machine learning, computer vision, and natural language processing, which are opening up an avenue for future-proofing solutions. Such advanced AI technologies allow drones to perform more sophisticated functions while managing tasks within autonomy. Increased demand for industrial automation in the region is improving efficiency in task performance and reducing costs and safety incidents, which supports the case for using AI-powered drones for outsourcing tasks like data collection, inspections, and deliveries.

Additionally, as per Federal Aviation Administration data of the U.S. of October 2024, there were 791,597 registered drones, while 396,746 drones were commercial registered and 415,635 were remote pilot certified. The increasing density of drones in the region indeed necessitates advanced technologies like AI to address the challenges of space complexity, safety, and enhanced drone capabilities. The huge amount of data produced by drones will provide a fertile ground for AI R&D towards training algorithms for object detection, navigation, and decision-making, among other tasks, as well as increase utilization in the security and surveillance purposes by the defense sector of the USA.

Besides that, the increasing number of drones brings new avenues for regional AI companies to work on the development and deployment of AI-based solutions for drone operations, such as traffic management systems, collision avoidance systems, and payload delivery systems. The innovations are making complex information accessible and can democratize the adoption of AI-powered drone solutions, leading to the promotion of their utilization in agriculture, delivery, and infrastructure inspection in the region.

Artificial Intelligence (AI) in Drone Market Segment Analysis:

- The AI in the drone market, by technology type, is divided into software, AI pilot, and others. The software category is forecasted to attain a greater market share.

- By offerings, the AI in the drone market is divided into hardware and software. The hardware category is forecasted to attain a greater market share.

- The AI in the drone market, by end-user, is divided into defense, logistics & delivery, agriculture & precision farming, disaster management and search & rescue, environmental monitoring, and others. The defense category is forecasted to attain a greater market share.

Artificial Intelligence (AI) in the Drone Market Key Developments:

The market leaders for AI in the drone market are Folio3 Software Inc., Saiwa, Shield AI, Skydio, Lockheed Martin Airobotic Nearthlab, Percepto, Ayaan Autonomous Systems Pvt. Ltd., AI Aerial Dynamics, Asteria Aerospace, Skylark Drones, and Blue Bear Systems Research Ltd. The key players in the market implement growth strategies such as product launches, mergers, acquisitions, etc., to gain a competitive advantage over their competitors. For Instance,

- October 2025: Lockheed Integrates Tomahawk Missiles on Sea Drones. Lockheed Martin announced a $50 million investment in Saildrone to equip large surveillance sea drones with AI-guided Tomahawk missiles, advancing maritime defense and autonomous naval operations.

- October 2025: China Deploys DeepSeek AI for Drone Swarms. China revealed plans to leverage DeepSeek AI for military applications, including autonomous drone swarms and robot dogs, aiming to deploy thousands by end-2025 for advanced warfare scenarios.

- October 2025: Shield AI Unveils Wingman Drone for Fighter Jets. Silicon Valley-based Shield AI launched its AI-powered wingman drone for fighter jet integration, with initial tests planned for 2026 and production readiness by 2028.

- October 2025: Palladyne AI Partners with Draganfly for UAV Autonomy. Palladyne AI and Draganfly Inc. announced a collaboration to integrate advanced AI for autonomous operations and swarming on Draganfly UAV platforms, targeting defense and commercial applications.

- January 2024, Nearthlab, a prominent developer of autonomous drone technologies, made a big stir through the launch of its “AIDrone”, representing the merging of AI with drone technology.

- In December 2023, Dronewatch launched ChatUAV, described as the world's first AI-powered drone knowledge base to answer all queries and questions that are drone-related, from hobbyist to professional regulatory issues.

- In October 2023, Maris-Tech launched “Jupiter Drones,” an Ultra-Compact AI-powered video analytics product for the autonomous aerial vehicle market. A wide range of professional civilian, homeland security, and defense applications is suitable for Jupiter Drones.

List of Top Artificial Intelligence (AI) In Drone Companies:

- Folio3 Software Inc.

- Saiwa

- Shield AI

- Skydio

- Lockheed Martin

Artificial Intelligence (AI) in Drone Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI in Drone Market Size in 2025 | US$31.923 billion |

| AI in Drone Market Size in 2030 | US$120.410 billion |

| Growth Rate | CAGR of 30.49% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI in Drone Market |

|

| Customization Scope | Free report customization with purchase |

Artificial Intelligence (AI) in Drone Market Segmentation:

- By Technology Type

- Software

- AI-pilot

- Others

- By Offerings

- Hardware

- Software

- By End-User

- Defence

- Logistics and Delivery

- Agriculture and Precision Farming

- Disaster Management and Search & Rescue

- Environmental Monitoring

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Thailand

- Taiwan

- Rest of Asia-Pacific

- North America