Report Overview

AI For Agriculture Market Highlights

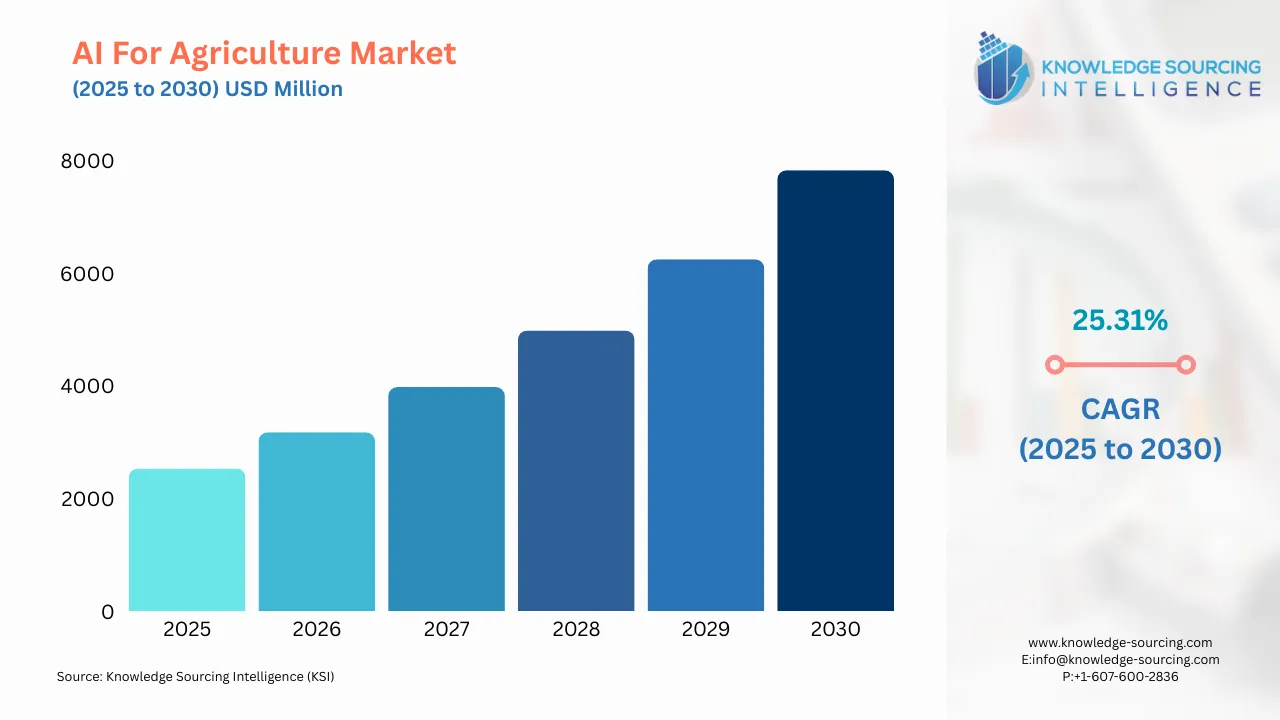

AI for Agriculture Market Size:

The AI For Agriculture Market is expected to grow at a CAGR of 25.31%, reaching a market size of US$7,826.880 million in 2030 from US$2,533.140 million in 2025.

Variables on temperature, soil, water use, weather, etc., are generated daily by farms. Artificial intelligence (AI) and machine learning models use this data in real-time to derive insightful conclusions, including determining the optimal time for planting seeds, selecting crops, choosing hybrid seeds for higher yields, and making other agricultural decisions. Precision farming, also called intelligent systems, helps improve the general value and precision of yields. AI helps to identify infestations, plant diseases, and malnutrition in farms. AI sensors can detect and target weeds before choosing which herbicide to apply in a region.

Many technical firms created robots that accurately monitor weeds with spray guns using image processing techniques and artificial intelligence. These robots can lower the price of herbicides by eliminating large amounts of the chemicals that are often sprayed on crops. By dramatically reducing the number of pesticides required in the fields, these sophisticated AI sprayers can raise the standard of agricultural output.

AI for Agriculture Market Growth Drivers:

- Increased globalization and the adoption of new technology are anticipated to propel the market growth

Rising customer demand for agricultural products is expected to drive market value growth. Contemporary agricultural technologies, government initiatives, and regulations are also promoting industrialization. The shifting costs of research and development, as well as the increasing use of drones and changes in form, have contributed to the product implications, thus expanding the market. To boost agricultural output, the government is encouraging research and development (R&D) in the field through the State Agricultural Universities (SAUs) and the Indian Council of Agricultural Research (ICAR). In 2023–24, the Department of Agricultural Research & Education (DARE) will have a budget of Rs. 9504 crores, up from Rs. 7846.17 crores in 2019–20. This budget is aimed at developing new techniques, demonstrating these in farmers’ fields, and equipping them with the knowledge to adopt modern methods.

- Growing need for livestock monitoring is anticipated to drive the market growth

The increasing need for livestock monitoring in agriculture is one of the most important trends in artificial intelligence. With cutting-edge AI technologies, dairy farms can now individually monitor every behavioral feature of a herd, including body condition score, feeding patterns, and animal facial recognition and picture classification. In terms of time and effort, it could lead to a revolutionary change in farmers' perspectives of farmlands. Additionally, farmers are increasingly using AI vision to track behavior, monitor food and water consumption, record body temperature, and identify patterns in hides and facial features.

- Increased use of predictive analysis & computer vision is increasing the demand

Predictive analytics employs statistical models and data mining methods to forecast future occurrences or results. By analyzing meteorological records, satellite images, and other parameters, the agricultural industry employs it to anticipate short-term weather patterns. Consequently, farmers can schedule their irrigation more effectively by predicting soil moisture levels and water demands for crops. In this case, the best planting strategies are determined by predicting production yield and demand, among other factors. Instead of relying on past averages or guesswork, producers can make proactive decisions based on data through predictive analytics.

Further, computer vision analyzes photos and videos taken from cameras or drones using AI algorithms, thus providing real-time information regarding livestock monitoring, crop health analysis, and pest detection. Using computer vision, farmers can instantly receive specific information regarding crop growth stages, soil quality indices, and pest infestations. Automation of processes such as disease detection, together with enhanced irrigation methods and spraying of pesticides, will improve efficiency in managing farms through this technology. For instance, Blue River Technology created “See & Spray" technology. It sparingly sprays herbicides only on weeds while using computer vision and machine learning.

AI for Agriculture Market Restraints:

- Lack of knowledge due to increasing technological advancements is anticipated to impede market growth

Understanding the distinctions between the agricultural sectors of developed and developing nations is crucial. In certain regions, AI in agriculture may be beneficial, but it may be difficult to market in places where such things are still rare. For the most part, farmers will need help putting it into practice. Farmers often think that AI is exclusive to the digital world. It's possible that they won't recognize how this technology can help them cultivate the land more effectively. It's not that they are resistant to change or archaic; rather, their resistance stems from their ignorance of the practical applications of artificial intelligence tools. To help farmers properly implement AI, technology vendors still have a lot of work to do.

AI for Agriculture Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period

The North American economy is characterized by rising disposable income, continuous investments in automation, large bets on the Internet of Things, and an increasing focus from governments on developing domestic AI equipment. Several agricultural technology vendors' research into artificial intelligence solutions benefits the market as well. In farming, there is a technological revolution coming, as predicted by AI. As drones, robots, and intelligent monitoring systems are used in research and field experiments, it is expected that this will increase significantly in the years to come. Regional markets also expect rapid growth with increased use of AI-powered technologies within the agricultural sector.

AI for Agriculture Market Key Launches:

- In February 2024, the Ministry of Agriculture and Farmers employed Artificial Intelligence methods to help farmers overcome various challenges they face in agriculture. A bot called “Kisan e-Mitra” is created using artificial intelligence, which provides information related to the PM Kisan Samman Nidhi Scheme for farmer queries. This solution is also intended to facilitate other governmental initiatives while it caters to multilingual requirements.

The AMDT system is designed as a national pest surveillance system to avoid losses of produce due to climate change. The practical use of AI and machine learning in this system allows it to identify diseases affecting crops and offer them timely solutions to enhance their growth. It deploys AI-based analytics through georeferenced photos targeting plant health assessment, enabling rice as well as wheat crop monitoring by making use of remote sensing data, including satellite imagery, weather patterns, and soil moisture content.

- In April 2023, insights into water usage were given by IBM and AgriLife for farmers so that agricultural production could be enhanced at low costs (environmental/fiscal). For instance, Texas A&M AgriLife, along with IBM, will put into action and scale up “Liquid Prep,” an innovative apparatus that aids farmers in deciding when to irrigate, especially in drought-prone parts of the USA.

List of Top AI For Agriculture Companies:

- Gamaya SA

- IBM Corporation

- Trimble Inc.

- Bayer AG

- Prospera Technologies Ltd.

AI For Agriculture Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| AI for Agriculture Market Size in 2025 | US$2,533.140 million |

| AI for Agriculture Market Size in 2030 | US$7,826.880 million |

| Growth Rate | CAGR of 25.31% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2025 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in AI for Agriculture Market |

|

| Customization Scope | Free report customization with purchase |

AI for Agriculture Market Segmentation:

- By Technology

- Machine Learning

- Computer Vision

- Predictive Analytics

- By Application

- Agricultural Robots

- Precision Farming

- Drone Analytics

- Livestock Monitoring

- Weather Tracking

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Other

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Vietnam

- Thailand

- Others

- North America