Report Overview

Air Freshener Market - Highlights

Air Freshener Market Size:

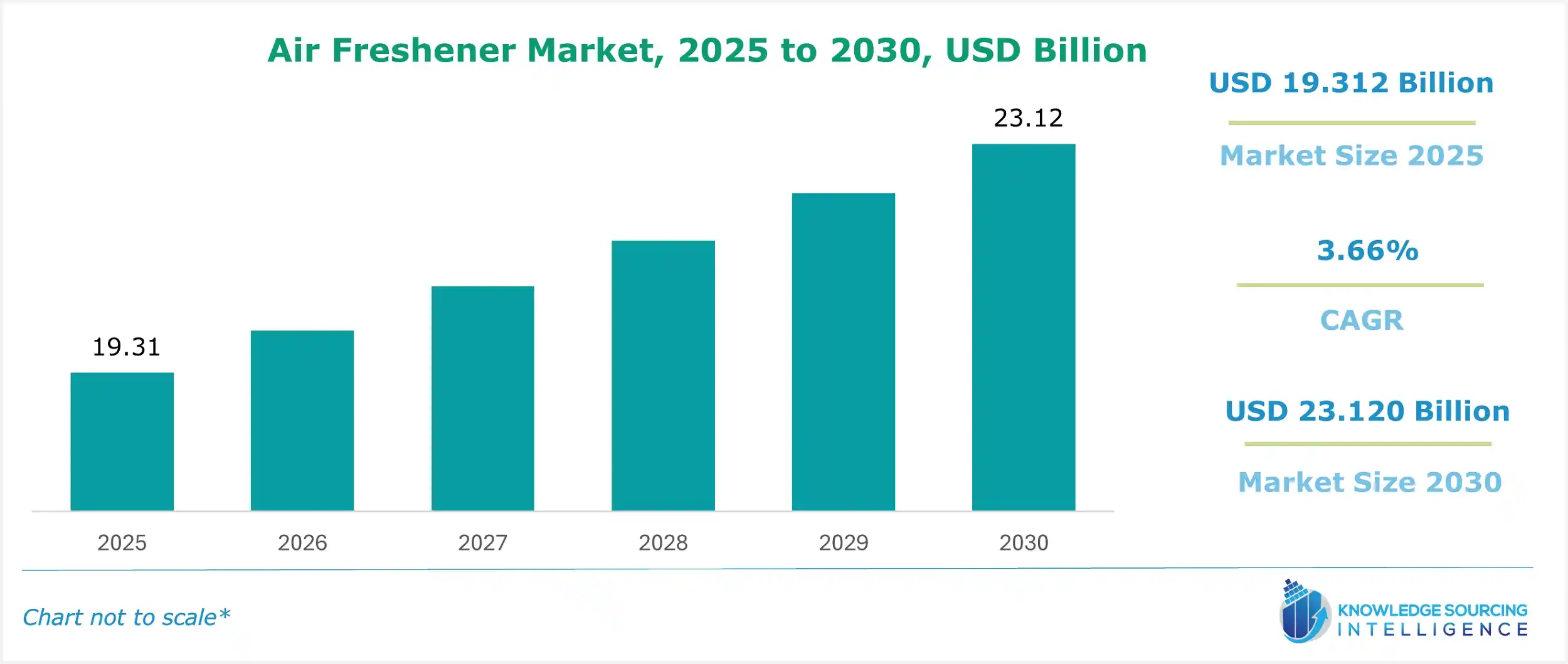

The Air Freshener Market is expected to grow from USD 19.312 billion in 2025 to USD 23.120 billion in 2030, at a CAGR of 3.66%.

Air Freshener Market Introduction:

The global air freshener market, encompassing the home fragrance market, is driven by demand for air care products and indoor air quality solutions. Odor eliminators, room sprays, car air fresheners, and commercial air fresheners cater to diverse consumer and business needs. Innovations in eco-friendly formulations and delivery systems enhance product appeal across residential, automotive, and commercial applications. As consumers prioritize pleasant and healthy indoor environments, the market utilizes advanced technologies to deliver effective, sustainable solutions. This growth potential addresses evolving preferences for fragrance, convenience, and air quality in modern spaces.

Air Freshener Market Overview:

An air freshener is a product that emits fragrances to remove bad odours from a room, space, bathrooms, cars, and other areas. These fresheners contain fragrances, essential oils, aerosol propellants, and glycol, among others, that can neutralize unpleasant odor. These fresheners, when sprayed or evaporated, further mask the unpleasant smell in the air. The wide applications of air fresheners in residential buildings, offices, hotels, restrooms, and gyms, among others, are one of the major factors driving the air freshener market growth during the next five years.

Additionally, the burgeoning adoption of air fresheners in public transportation, such as airplanes, cars, buses, and taxis, among others, is also providing an impetus for the market to grow shortly. The inclination of consumers toward the use of air fresheners due to the rising concerns regarding air quality has also amplified the adoption, especially across the developed economies around the globe, due to higher purchasing power and high standards of living.

Furthermore, rapid urbanization in developing economies such as India, China, and Indonesia has led to an upsurge in construction activities across the residential sector. It is also anticipated to positively impact the demand for air fresheners, thereby driving market growth throughout the forecast period. Also, the government initiatives regarding the uplifting of the commercial infrastructure have led to a booming construction of malls, offices, airports, and other commercial spaces are also projected to boost the demand for air fresheners in the coming years and thus propel the opportunities for the market to grow in the near shortly the rising participation by the key players of the market in the form of collaborations, partnerships, agreements, facility expansions, and R&D for the development and launch of new products further shows the potential for the market to grow in the next five years.

In addition, the initiatives by various companies for spreading awareness regarding social issues to attract more customers and capture a greater market share also drive market growth. For instance, in November 2019, Lynx, a brand under Unilever, unveiled its debut range of car air fresheners.

The air freshener market has been segmented based on type, end-use, distribution channel, and geography. Based on type, the market is segmented into electric, spray, gel, and others. Based on end-use, the market is classified into residential, commercial, and automotive. By distribution channel, the market has been classified as online and offline. Geographically, the air freshener market has been segmented into North America, South America, Europe, the Middle East and Africa, and the Asia Pacific, among others.

Air Freshener Market Trends:

The air freshener market is progressing constantly with wellness fragrances and aromatherapy scents, aligning with consumer demand for health-focused indoor environments. Personalized fragrances and luxury air fresheners drive the premium air care segment, offering bespoke scent experiences. Functional fragrances, including multi-functional air fresheners, combine odor elimination with benefits like stress relief or air purification, enhancing utility. Innovations in sustainable formulations and smart delivery systems cater to eco-conscious consumers. These trends reflect a shift toward high-value, tailored solutions, enabling industry experts to capitalize on growing preferences for sophisticated, health-oriented air care products in residential and commercial spaces.

Air Freshener Market Segment Analysis:

- An electric segment to show rapid growth

By type, the spray segment is anticipated to hold a substantial share in the market throughout the forecast period. The major factor supplementing the share of this segment includes the wide usage of spray-based products in houses and offices due to ease of use and the availability of a vast variety of products. The electric air freshener market is projected to witness considerable growth over the next five years due to the rapid adoption of these products in showrooms, malls, and theatres, among others. The gel segment is also projected to grow substantially over the next five years on account of its burgeoning usage in cars.

- The residential segment holds a considerable share

By application, the residential segment will hold a decent share throughout the forecast period, primarily because of the vast usage of air fresheners in houses. Also, the increasing standards of living, coupled with an increase in the middle-class population of the developing economies of the world, is further bolstering the growth of this segment throughout the forecast period. The automotive segment will witness decent growth during the next five years due to the launch of premium products, particularly cars.

- Online sales are expected to show healthy growth

By distribution channel, online sales are projected to show substantial growth during the next five years. The prime factors that are bolstering the growth of this segment are the rising penetration of smartphones and the availability of cheaper internet in major developing countries like India, China, and Vietnam, among others. Furthermore, the burgeoning e-commerce industry is also bolstering the growth of this segment during the next five years.

Air Freshener Market Geographical Outlook:

- North American region is expected to hold a decent share

The air freshener market is experiencing robust global growth, segmented into North America, South America, Europe, the Middle East and Africa, and Asia-Pacific. Air fresheners, including sprays, plug-ins, candles, and diffusers, are in high demand due to consumer preferences for indoor air quality, home fragrance, and health-conscious living. The market thrives on product innovation, sustainability, and regional economic trends.

- North America: The region holds a significant share, driven by a health-savvy population prioritizing clean indoor environments. The United States and Canada lead due to high disposable incomes and demand for natural air fresheners made with essential oils and eco-friendly ingredients. Retail channels, including e-commerce, and brand innovation by companies like Procter & Gamble and SC Johnson boost market growth (SC Johnson, 2024). Regulatory standards for low-VOC products further support sustainable air fresheners.

- Asia-Pacific: Projected to witness substantial growth, Asia-Pacific is driven by rapid urbanization, rising disposable incomes, and an expanding middle-class population in India, China, and Indonesia. Consumer awareness of hygiene and home aesthetics fuels demand for aromatic products. China’s urban markets and India’s growing e-commerce sector, supported by platforms like Flipkart, enhance accessibility (IBEF, 2024). Cultural preferences for natural fragrances drive product diversification.

- Europe: Countries like the UK, Germany, and France contribute through demand for premium air fresheners and sustainable products. EU regulations promote eco-friendly formulations, aligning with green living trends (European Commission, 2024).

- South America, and Middle East and Africa: Emerging markets, driven by urbanization and rising living standards, show steady growth, particularly in Brazil and UAE.

Challenges like environmental concerns over chemical-based products persist, but bio-based air fresheners and recyclable packaging address these issues. The air freshener market thrives on health trends, sustainability, and regional consumer preferences, with North America and Asia-Pacific leading due to economic growth and innovative products.

Air Freshener Market Key Developments:

- In July 2025, Godrej Consumer Products announced the launch of its Godrej AER Power Pocket product, which is a compact, non-electric air freshener in the Nigerian market. It offers portability, affordability, and long-lasting fragrances to consumers.

- In July 2025, ELiX Scent introduced MIST with Jelly Pearls, which is a 250 ml room spray air freshener featuring micro-pearls of concentrated perfume suspended in a water-based carrier.

- In May 2025, Aroma Amplifier announced the launch of an eco-friendly aromatherapy diffuser for a Natural, Toxin-Free Home without the presence of any synthetic fragrance and chemicals.

List of Top Air Freshener Companies:

Prominent key market players in the air freshener market include P&G, Henkel, Godrej Consumer Products Limited, and Reckitt Benckiser Group plc, among others. These companies hold a noteworthy share in the market because of their good brand image and product offerings.

Major players in the air freshener market have been covered along with their relative competitive position and strategies. The report also mentions recent deals and investments of different market players over the last two years.

Air Freshener Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Air Freshener Market Size in 2025 | USD 19.312 billion |

| Air Freshener Market Size in 2030 | USD 23.120 billion |

| Growth Rate | CAGR of 3.66% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Air Freshener Market |

|

| Customization Scope | Free report customization with purchase |

Air Freshener Market Segmentation:

- By Type

- Electric

- Spray

- Gel

- Candle

- Others

- By End-Use

- Residential

- Commercial

- Automotive

- By Distribution Channel

- Online

- Offline

- Supermarket

- Convenience Store

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Indonesia

- Taiwan

- Others

- North America

Our Best-Performing Industry Reports:

Navigation

- Air Freshener Market Size:

- Air Freshener Market Key Highlights:

- Air Freshener Market Introduction:

- Air Freshener Market Overview:

- Air Freshener Market Trends:

- Air Freshener Market Segment Analysis:

- Air Freshener Market Geographical Outlook:

- Air Freshener Market Key Developments:

- List of Top Air Freshener Companies:

- Air Freshener Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 26, 2025