Report Overview

Global Deodorants and Fragrances Highlights

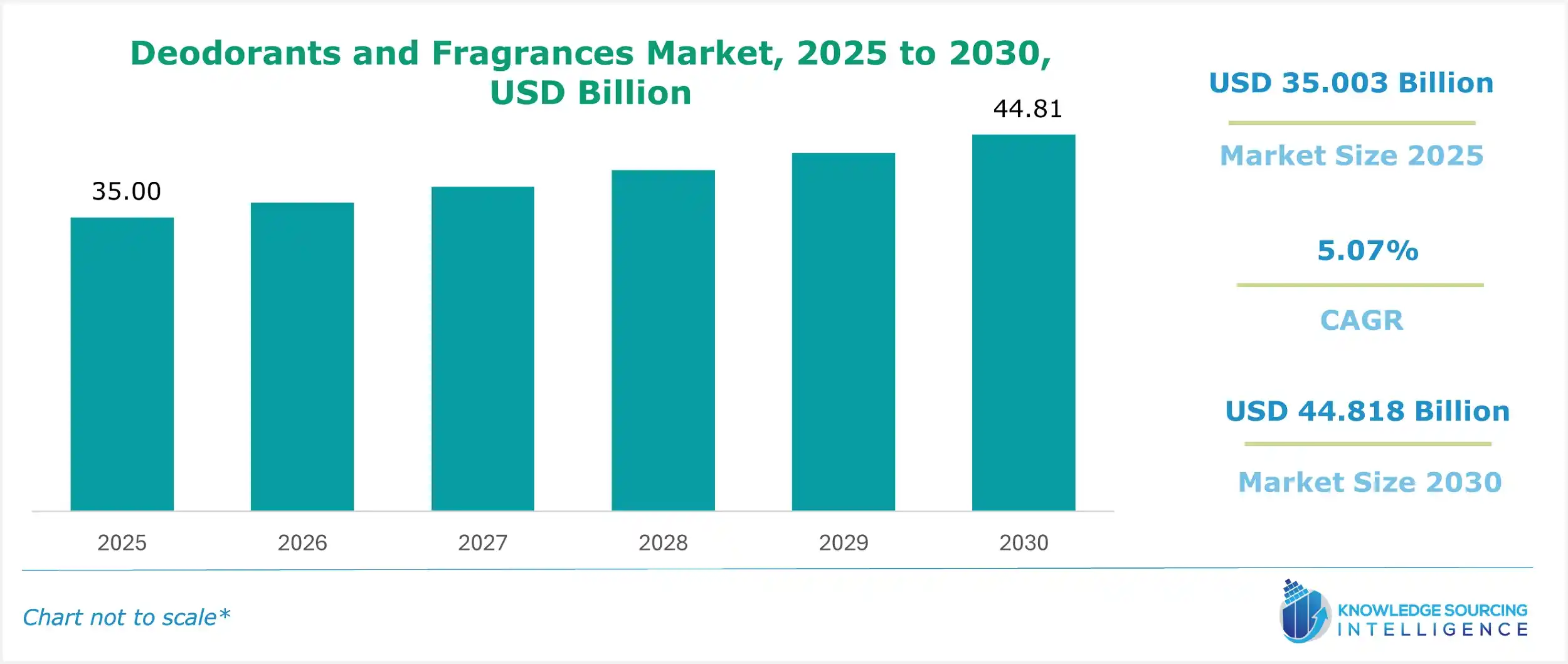

Deodorants and Fragrances Market Size:

The global deodorants and fragrances market, valued at US$44.818 billion in 2030 from US$35.003 billion in 2025, is projected to grow at a CAGR of 5.07% during the forecast period.

Deodorants and fragrances are used to reduce body odor caused by sweating. The global deodorant and fragrance market is expanding as men and women become more concerned with grooming and personal hygiene. The market is poised to grow due to rising disposable income, changing lifestyles, and increasing concern over one’s health and fitness. Increasing health and hygiene consciousness among people has led to a rise in people getting engaged in physical activities and going to gyms and fitness clubs to improve their physical health. This, in turn, is leading to an increase in the demand for deodorants for controlling body odor due to sweating.

Global Deodorants and Fragrances Market Overview & Scope

The global deodorants and fragrances market is segmented by:

- Composition: By composite, the global deodorants and fragrance market is categorized into parfum, eau de parfum (EDP), eau de toilette (EDT), and eau de cologne (EDC). The perfume category is expected to grow significantly.

- Gender: By gender, the global deodorant and fragrance market is segmented into men’s and women’s.

- Region: North America is expected to have a high market share due to the presence of major personal care companies and a large amount of consumption. People are increasingly purchasing new products launched by international companies, and the rising need for personal care products for daily grooming is boosting the demand for deodorants and fragrances. The growing demand for premium perfumes in the region will further expand the deodorants and fragrances market.

Top Trends Shaping the Deodorants and Fragrances Market:

1. Organic perfumes and deodorants

- The growing demand for organic and chemical-free perfumes and deodorants has witnessed a major increase, as organic perfumes feature all organic and natural ingredients.

2. Fragrance sticks and roll-ons

- The development of fragrance sticks and roll-ons offers consumers convenience and efficient forms of perfumes that can be easily applied and are easy to carry.

Deodorants and Fragrances Market Growth Drivers vs. Challenges:

Opportunities:

- Growing influence of social media: The growing influence of digital and social media is also contributing significantly to the mushrooming demand for deodorants and fragrances worldwide. Companies are increasingly investing in digital media platforms for marketing and advertising their products. This has led to an increase in the sales of fragrances and deodorants by advertising on social media platforms like Instagram, Facebook, YouTube, and Pinterest, thus bolstering the overall market growth.

- Increasing women's consumer base: The market for premium fragrances is being highly driven due to increasing demand from female consumers. The growing disposable income and increased number of working women have given them the liberty to buy their desired products. The increasing demand for organic products, mostly by women, is also propelling the market expansion. This is majorly due to increasing awareness among consumers about the health effects of perfume.

Challenges:

- Increasing health concerns: Deodorants and fragrances contain various types of chemical ingredients, increasing the risk of skin irritation and allergic reactions.

Deodorants and Fragrances Market Regional Analysis:

- Asia-Pacific: The Asia-Pacific region is expected to be the fastest-growing regional market for deodorants and fragrances. Due to rapid urbanization, the market is expanding in developing countries like India and China. This has increased people’s disposable income, the changing lifestyle, and the growing demand for quality and premium products by young consumers, further increasing the demand for deodorants and fragrances.

Global Deodorants and Fragrances Market Competitive Landscape:

The market is fragmented, with many notable players, including L'Oréal S.A., Estée Lauder Companies Inc., Avon Products, Inc., Coty Inc., Revlon Consumer Products Corporation, Shiseido Company Limited, Unilever N.V., Giorgio Armani S.p.A., LVMH Group, CHANEL International B.V., Royal Aroma, and VINI International, among others:

- Brand Launch: In January 2024, Unilever, a global leader in consumer goods, launched the Lynx Fine Fragrance Collection, a range of premium fragrances. The company stated that the collection consists of five different scent flavors available in 150ml aerosol cans.

- Product Launch: In September 2024, SKINN, a fragrance brand of the Titan Company, launched a 24seven Range of Fragrances in the Indian market. The collection features a wide variety of distinct scents, like aqua, woody, floral, and caramel, among others.

Deodorants and Fragrances Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Deodorants and Fragrances Market Size in 2025 | US$35.003 billion |

| Deodorants and Fragrances Market Size in 2030 | US$44.818 billion |

| Growth Rate | CAGR of 5.07% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Deodorants and Fragrances Market | |

| Customization Scope | Free report customization with purchase |

Deodorants and Fragrances Market is analyzed into the following segments:

By Composition

- Parfum

- Eau de Parfum (EDP)

- Eau de Toilette (EDT)

- Eau de Cologne (EDC)

By Gender

- Men

- Women

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa