Report Overview

Algae Oil Market Report, Highlights

Algae Oil Market Report Size:

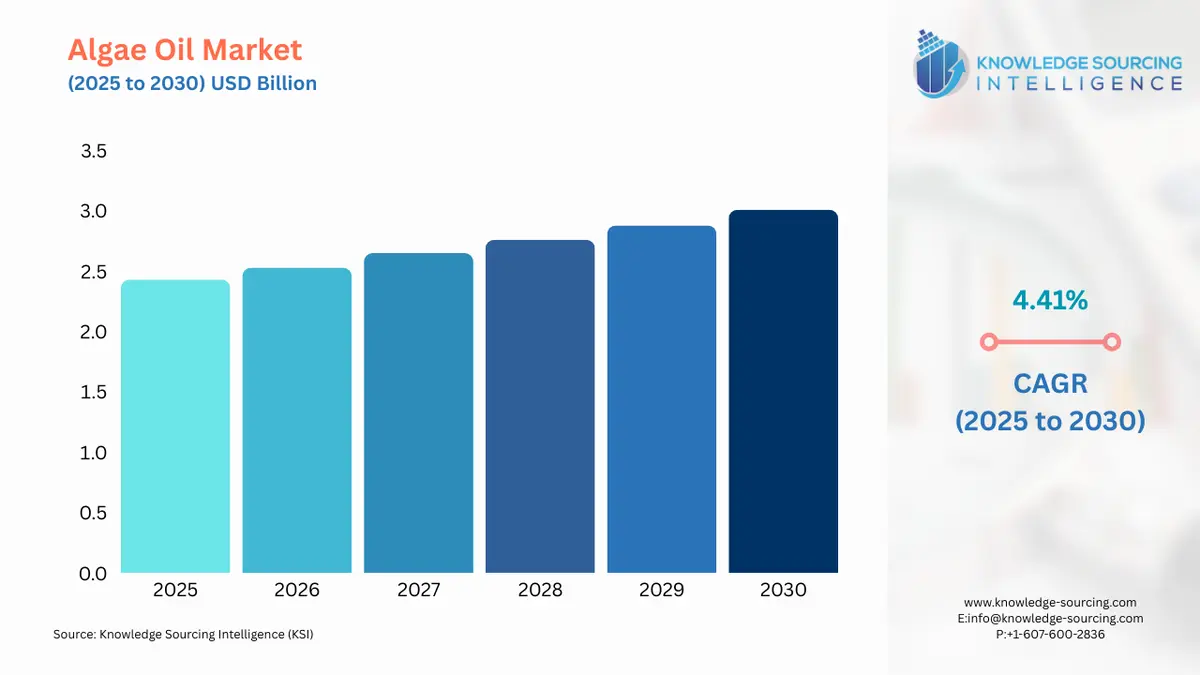

The global algae oil market is estimated to attain a market size of US$3.012 billion by 2030, growing at a 4.41% CAGR from a valuation of US$2.427 billion in 2025.

Algae oil is a protein-rich oil extracted from species of marine algae. It is a plant-based source of omega-3 fatty acids, namely EPA and DHA, which are believed to confer numerous health benefits. It aids in controlling cholesterol, inflammation, and the risk of strokes. It is rich in minerals and vitamins and is used to supplement baby formulas. It is also used as a stabilizer in the manufacture of ice creams, pet foods, and other dietary supplements. A rising consumer preference for sustainable, plant-based, and environmentally friendly alternatives leads to the need for algae oil products, which are promoted among consumers with their high nutritional value.

Moreover, the rise in urban consumers having access to health information, sustainable products, and plant-based diets alike, the demand for algae oil in food, supplements, and cosmetics, and support for retail infrastructure, is also boosting the market demand.

Algae Oil Market Overview & Scope:

The global algae oil market is segmented by:

- Grade: By grade, the global algae oil market is segmented into food grade, feed grade, and fuel grade. Algae oil improves the nutritional value of animal feed, ensuring wholesome growth and peak performance in livestock, poultry, and aquaculture animals. Its healthy fat content is rich, and it enhances animal liveliness and general wellness, making it a vital constituent in animal food. Growing consciousness among animal feed producers regarding the quality of feed and its direct relationship with the health of animals and the output of products is also driving the use of algae oil. Better formulation of feed using algae oil has been associated with improved immune systems, growth rates, and reproductive performance in animals. The R&D efforts of the feed industry are steadily placing greater emphasis on integrating such functional ingredients that provide tangible benefits to animal well-being and the profitability of farms.

- Application: By application, the global algae oil market is segmented into animal feed, biofuel, health supplements, food and beverages, and medicines. The spur in the growth of the biofuel sector is driving the growth of algae oil production directly. With increasing demand for cleaner substitutes to fossil fuels, algae oil is taking root with its diversity, renewability, and compatibility with current fuel infrastructure. In line with this, in 2022, the United States produced around 18.7 billion gallons of biofuels, of which approximately 17.6 billion gallons were used. The United States was a net exporter of around 1.0 billion gallons of biofuels in 2022. Fuel ethanol accounted for the majority of biofuel exports, both gross and net.

Apart from this, innovations are also driving the feasibility of algae oil in the biofuel market. Improvements in cultivation systems like photobioreactors and open pond systems, and harvesting and extraction methodologies have improved efficiency and scalability. Genetic modification and integrated biorefinery models are also pushing the lipid yields higher and facilitating the use of co-products, enhancing the economics of algae-based biofuels. These advances are rendering algae oil cost-competitive and viable for application in biodiesel, aviation fuels, and other renewable energy uses.

- Sales Channel: By sales channel, the global algae oil market is segmented into supermarkets and hypermarkets, convenience stores, specialty stores, and others. The supermarkets and hypermarkets segment is expected to have a significant market share in this segment.

- Region: The global algae oil market, by geography, is segmented into regions including North America, South America, Europe, the Middle East and Africa, and Asia Pacific. Asia-Pacific is the fastest-growing region for the global algae oil market due to the high population of livestock in countries like India, China, Pakistan, Bangladesh, and others.

Top Trends Shaping the Algae Oil Market

1. High Health Benefits and Increasing Consumer Awareness

- The algae oil market globally has been growing due to algae oil's high nutritional value and health benefits, alongside an increasing consumer awareness for inclusive of this in their health diet. Algae oil contains nutrients that are essential for a healthy body, with omega-3 fatty acids being more abundant, especially docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA), which are key components of health. Additionally, algae oil can also be beneficial in lowering the risk of heart disease as algal Omega-3s reduce triglycerides, improve cholesterol profiles, and lower blood pressure. Hence, algae oil is used in dietary supplements and functional foods for the health-conscious. According to World Health Organization data, about 17.9 million people die due to cardiovascular disease each year globally.

- Moreover, as per the U.S. Centers for Disease Control and Prevention (CDC) data report published in October 2024, heart disease-related deaths in the country account for 702,880 individuals, which is 1 in every 5 deaths. Meanwhile, coronary heart disease caused death was 371,50 people. Additionally, 1 in every 20 adults aged 20 and above has coronary artery disease as of 2022. Another well-known property of DHA present in algae oil involves a major incorporation into brain tissue that strengthens cognition, memory, and mental clarity, which will also promote market growth in the coming years.

2. Market Players Focus on Innovation and Advancement

- The market players are focusing on increasing the innovation and advancement in olive oil application for it to become an increasingly valuable and health-beneficial alternative to traditional vegetable oils. For instance, in December 2023, DIC Corporation announced the development of Dailube KS-519, which is globally first global innovation of algae oil-based high-performance sulfurized extreme pressure additive, providing superior performance compared to conventional vegetable oil-based products.

Algae Oil Market Growth Drivers:

Drivers:

- Growing Disposable Income: A higher disposable income level, especially in urban and developing areas, allows consumers to continue spending on premium health-oriented products such as algae-oil-based supplements, which are a healthy and plant-based alternative to fish oil to obtain omega-3 fatty acids. According to the data from the U.S. Energy Information Administration (EIA) of October 2023, a rise in disposable income by $14,368 per person is expected by 2040 globally, from an estimated value of $10,677 per person in 2025, while is projected at $11,862 and $13,116 per capita in 2030 and 2035, respectively.

- Growing Use of Algae Oil in Various Sectors: The global algae oil market is experiencing growth due to the versatility and wide-ranging use of algae oil in various sectors, including animal food, dietary products, biofuels, and beverages, which contribute significantly to its market value. Notably, In September 2021, AAK unveiled a strategic partnership with Progress Biotech to provide their top-tier, algae-based DHA for infant formula. DHA, a vital omega-3 fatty acid often sourced from fish oils, is known for its numerous clinically established advantages and is a mandatory component in infant formula throughout the European Union. Algae oil is recognized for providing essential nutrients, especially DHA, crucial for children's brain development, and this awareness drives its demand for health and dietary supplements. For example, GC Rieber VivoMega's VivoMega Algae Oils, sourced from microalgae, offer a vegan omega-3 oil solution, aligning with the growing health consciousness and dietary needs.

- Widespread Use of Algae Oil Extracted from Marine: Global algae oil industry demand is further bolstered by the widespread utilization of algae oil mainly extracted from certain marine. The production factors, such as the requirement for an increased workforce and substantial water resources for marine algae cultivation, also present limiting factors for the value of the global algae oil market. As an example, DSM, a company specializing in health, nutrition, and bioscience, introduced Veramaris® algal oil, offering an alternative to fish oil as a source of omega-3. In June 2023, Veramaris partnered with the World Ocean Council to demonstrate how its innovative algal oil contributes to the growth of aquaculture by reducing reliance on fragile fish oil supplies as the primary source of Omega-3 in aquafeed. Veramaris algal oil enables aquaculture to expand, increasing the availability of farm-raised seafood, and ensuring a reliable source of fish enriched with high levels of health-benefiting Omega-3 essential fatty acids for consumers.

Algae Oil Market Regional Analysis:

- North America: North America’s growth in the algae oil market is driven by evolving consumer preferences, followed by technological advancements. The algae oil market is experiencing growth due to the versatility and wide-ranging use of algae oil in various sectors, including animal food, dietary products, biofuels, and beverages, which contribute significantly to its market value.

Increasing demand for biofuels in the country, coupled with the presence of many local players in the country, is expected to drive the growth of the United States in the algae oil market. In this regard, according to the IEA Bioenergy Technology Collaboration Program, the U.S. biofuel production capacity rose to 23.8 billion gallons per year (BGPY) in 2023, which was a growth of over 1.7 billion gallons compared to 2022. The USA is expected to have a large demand for biofuel in the projected period, and the use of algae as an alternative for the production of biofuel is expected to increase in the coming years.

Algae Oil Market Key Developments:

- Product Launch: In February 2025, Microalgae protein pioneer Brevel, Ltd., inked a development and commercialization partnership with Israel's largest beverage company, The Central Bottling Company (CBC Group). The partnership will create functional drinks and dairy substitutes using Brevel's premium-value microalgae protein and oils.

List of Top Algae Oil Companies:

- Polaris

- Fermentalg

- Cellana Inc.

- Veramaris (DSM and Evonik joint venture)

- Archer-Daniels-Midland Company

Algae Oil Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Algae Oil Market Size in 2025 | US$2.427 billion |

| Algae Oil Market Size in 2030 | US$3.012 billion |

| Growth Rate | CAGR of 4.41% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Algae Oil Market |

|

| Customization Scope | Free report customization with purchase |

Global Algae Oil Market Segmentation:

By Grade

- Food Grade

- Feed Grade

- Fuel Grade

By Application

- Animal Feed

- Biofuel

- Health Supplements

- Food and Beverages

- Medicines

By Sales Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Taiwan

- Others

Our Best-Performing Industry Reports:

Navigation

- Algae Oil Market Report Size:

- Algae Oil Market Report Key Highlights:

- Algae Oil Market Overview & Scope:

- Top Trends Shaping the Algae Oil Market

- Algae Oil Market Growth Drivers:

- Algae Oil Market Regional Analysis:

- Algae Oil Market Key Developments:

- List of Top Algae Oil Companies:

- Algae Oil Market Scope:

- Our Best-Performing Industry Reports:

Page last updated on: September 18, 2025