Report Overview

Krill Oil Market Size, Highlights

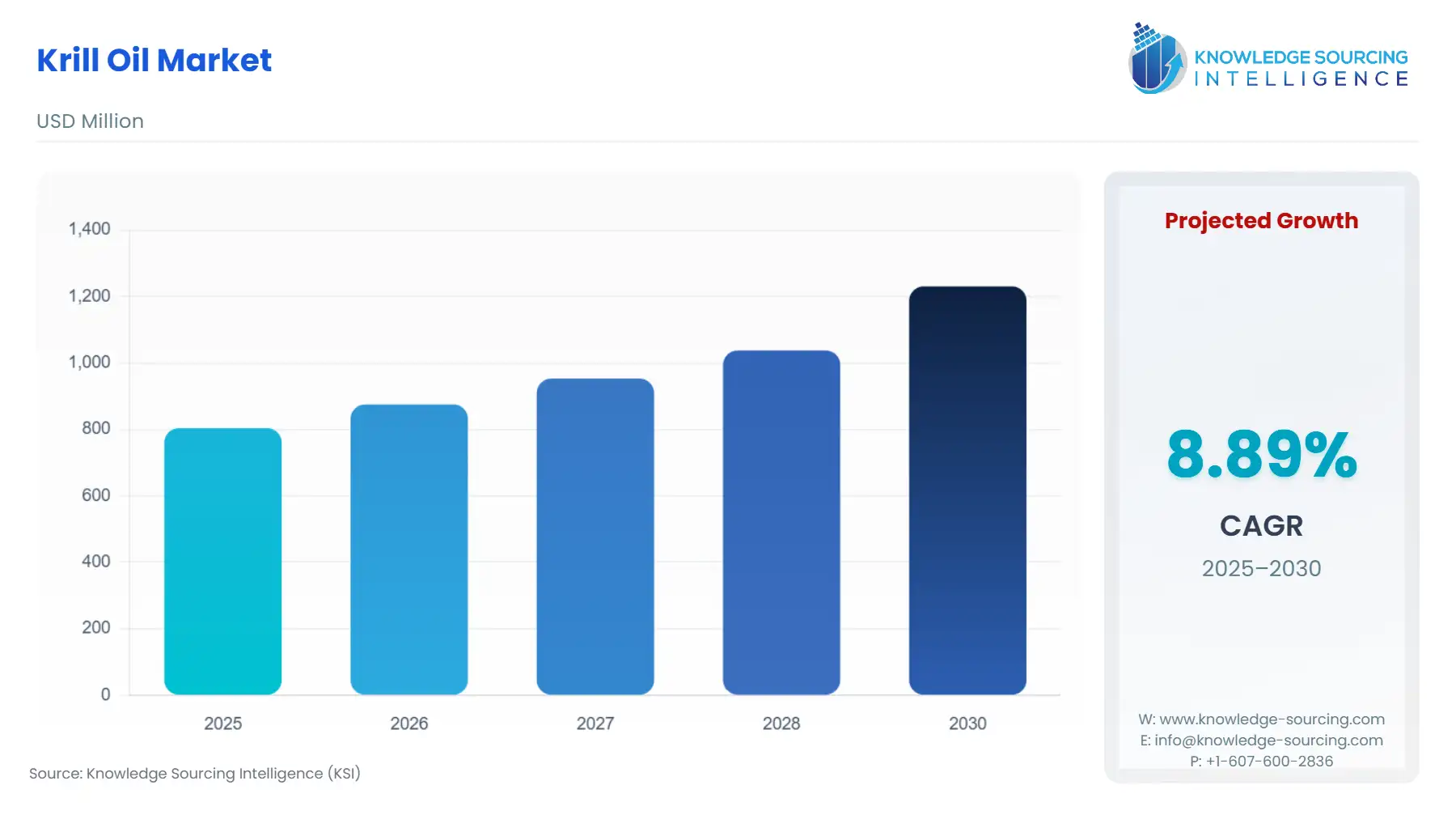

Krill Oil Market Size:

The Krill Oil Market is expected to soar from USD 803.938 million in 2025 to USD 1,230.729 million in 2030, driven by an 8.89% CAGR.

The Krill Oil market operates at the nexus of advanced marine ingredient processing, nutritional science, and highly constrained global resource management. Krill oil, derived from the Antarctic krill (Euphausia superba), is prized for its superior delivery of Omega-3 fatty acids, Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA), primarily in phospholipid form, which enhances bioavailability compared to traditional triglyceride-based fish oils. The intrinsic presence of the powerful antioxidant Astaxanthin further differentiates the product. Market dynamics are uniquely tethered to the geopolitical governance of the Southern Ocean resource, creating a supply-side dependency that necessitates a vertical integration strategy among core competitors and mandates strict compliance with international conservation protocols.

Krill Oil Market Analysis

- Growth Drivers

Superior bioavailability drives sustained consumer demand, as the phospholipid structure of krill oil allows for more efficient absorption of EPA and DHA than traditional fish oil, appealing to the premium health segment. Scientific evidence continues to demonstrate the efficacy of krill oil in supporting cardiovascular and cognitive health, directly translating into consumer trust and adoption in the Dietary Supplements segment. Furthermore, the oil's natural content of Astaxanthin provides antioxidant properties, positioning krill oil as a comprehensive, multi-benefit ingredient that commands a higher price point and expands its utility beyond pure omega-3 supplementation.

- Challenges and Opportunities

The most significant market challenge is the high retail cost of krill oil relative to conventional fish oil substitutes, which limits adoption in price-sensitive markets. This challenge is structurally amplified by the absolute ceiling on raw material supply, as mandated by the CCAMLR catch limit, which restricts production scalability and fuels price volatility. However, this scarcity creates major opportunities: a premium price structure facilitates higher investment in Product Form innovation, specifically driving demand for advanced, smaller-dosage softgels and novel Functional Food and Beverage applications. Focus on Animal and Pet Food applications also offers a high-growth, high-value diversification pathway for krill protein and meal derivatives.

- Raw Material and Pricing Analysis

The raw material, Antarctic krill, is subject to a strict precautionary catch limit of 620,000 metric tons in Area 48, set by the CCAMLR. Raw material pricing is acutely sensitive to this finite supply and highly volatile, particularly after the fishery closure in August 2025. The necessity for specialized, high-technology harvesting methods, such as Aker BioMarine's continuous pumping system (Eco-Harvesting), to ensure immediate onboard processing and prevent enzymatic degradation, introduces high operational costs. This complex, capital-intensive raw material supply chain necessitates a premium pricing model for the finished krill oil product, maintaining its position in the high-end nutritional supplement category.

- Supply Chain Analysis

The supply chain is vertically integrated and geographically concentrated, centered on the harvesting operations in the Southern Ocean, specifically the Antarctic Peninsula (CCAMLR Area 48). The core logistical complexity lies in operating specialized, large-capacity harvesting vessels in extreme environments and the immediate, energy-intensive onboard processing to stabilize the krill, a prerequisite for high-quality oil extraction. Key dependencies exist on a small group of highly capitalized fishing fleets (primarily Norwegian, Chilean, and South Korean flagged vessels) and downstream processing facilities located near major maritime hubs. This deep vertical integration, exemplified by companies like Aker BioMarine and RIMFROST, mitigates, but does not eliminate, the supply risk inherent in a resource governed by a single international conservation commission.

Krill Oil Market Government Regulations:

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

Global |

Commission for the Conservation of Antarctic Marine Living Resources (CCAMLR) |

Imposes Absolute Supply Constraint: CCAMLR sets the precautionary 620,000 tonne ‘Trigger Level’ catch limit in Area 48, an absolute cap on raw material. The limit being reached in August 2025 led to an immediate supply shock, increasing competitive pressure for existing stock and driving up raw material costs for all krill oil manufacturers globally. |

|

Global |

Marine Stewardship Council (MSC) Certification |

Mandates Sustainability/Traceability: While voluntary, MSC certification acts as a critical market signal. Its stringent requirements on sustainable harvesting practices and scientific observer coverage drive demand by assuring key brand owners and end-consumers of the product's ecological legitimacy, effectively favoring MSC-certified suppliers like Aker BioMarine. |

|

United States |

Food and Drug Administration (FDA) / GRAS (Generally Recognized as Safe) Status |

Ensures Market Access/Safety: FDA approval of krill oil and its derivatives (e.g., krill meal) under GRAS status is non-negotiable for commercialization in the largest consumer market. This validation fuels consumer confidence and enables broader incorporation into the Functional Food and Beverages and Animal and Pet Food segments. |

Krill Oil Market Segment Analysis

- By Application: Functional Food and Beverages

The Functional Food and Beverages segment represents a high-potential growth avenue for krill oil, driven by the consumer demand for seamless incorporation of essential nutrients into daily consumption patterns. Krill oil, especially in micro-encapsulated or powdered form, is sought after by manufacturers for its unique phospholipid-bound EPA/DHA and Astaxanthin content, which enhances the product's health positioning beyond simple omega-3 enrichment. Specifically, growth is catalyzed by the sports nutrition sector, where krill oil's anti-inflammatory properties aid muscle recovery, and by the cognitive health sector, which values the highly bioavailable phospholipid form. This demand necessitates innovation in processing Technology to deliver a taste-neutral ingredient suitable for fortification in liquids, powders, and bars, effectively diversifying krill oil away from its traditional Capsule form.

- By Product Form: Capsules

The Capsules segment, including soft gels and liquid-filled hard capsules, remains the dominant Product Form because it effectively addresses key technical challenges associated with krill oil. The primary growth driver for this segment is the need to protect the highly sensitive oil from oxidation and degradation, ensuring the stability and potency of the EPA, DHA, and Astaxanthin content over the product's shelf life. Consumers prefer softgel Capsules for the convenience of standardized dosage and the mitigation of the characteristic marine aftertaste or "burp-back" often associated with bulk liquids. Manufacturers innovate within this segment by introducing smaller, high-concentration softgels, such as those formulated with advanced phospholipid-enhancing technologies, catering directly to the health-conscious consumer willing to pay a premium for reduced pill size and enhanced efficacy.

Krill Oil Market Geographical Analysis

- US Market Analysis

The US market is the largest consumer hub for krill oil, driven by high consumer health awareness, disposable income, and the high prevalence of cardiovascular and inflammatory lifestyle-related diseases. The requirement is acutely sensitive to scientific endorsements (e.g., American Heart Association recommendations) and is characterized by a strong preference for premium, branded, and certified sustainable products. The extensive penetration of online and specialty retail channels facilitates the growth of the Dietary Supplements segment, where brands like Reckitt Benckiser's MegaRed leverage mass-market advertising to draw consumers from the traditional fish oil category toward krill oil's superior delivery mechanism.

- Brazil Market Analysis

The krill oil market in Brazil is primarily an emerging one, centered on the growing middle class, increasing exposure to global health trends via digital media, and a rising focus on preventative nutrition. Krill oil is positioned as a niche, premium, and sophisticated alternative to domestically available fish oil. The requirement is concentrated in major urban centers and is facilitated by specialized health food stores and Online distribution, but the high price point acts as a major constraint on mass-market adoption. Local market growth depends heavily on regulatory clarity and consumer education regarding the unique benefits of the phospholipid-bound omega-3s.

- Germany Market Analysis

The German market exhibits strong and stable demand, anchored by a consumer base that highly values pharmaceutical-grade quality, scientific research, and environmental sustainability. The need for krill oil is often driven by recommendations from healthcare practitioners and is channeled through pharmacies and certified drug stores (Offline distribution). The market's high ethical standards make MSC certification a non-negotiable consumer requirement. German demand is typically focused on concentrated, low-dosage Capsules and is less reactive to basic health trends, preferring products with robust clinical validation.

- Saudi Arabia Market Analysis

Krill oil demand in Saudi Arabia is nascent and driven by rapid economic diversification and increasing Western influence on dietary habits and health awareness. The high disposable income in the region allows the krill oil supplement to be priced as an imported, high-end luxury wellness product. The necessity is concentrated among the affluent urban population and is fueled by the growing awareness of chronic diseases like diabetes and hypertension. Market growth is structurally reliant on import logistics and effective marketing campaigns that emphasize the ingredient’s premium quality and health benefits in the context of preventive health.

- South Korea Market Analysis

South Korea is a critical and rapidly growing demand center, driven by a deeply entrenched culture of functional food and dietary supplementation, coupled with an aging population seeking cognitive and joint health solutions. The market is highly sophisticated and competitive, demanding frequent innovation in product delivery and potency. The requirement is robust across all Product Forms and is heavily influenced by domestic scientific research, media reporting, and effective celebrity endorsement. The focus here is on novel extraction technologies and the inclusion of other high-value ingredients to create multi-functional krill oil products.

Krill Oil Market Competitive Environment and Analysis

The competitive landscape is defined by vertical integration, control over the raw material harvest, and technological differentiation in oil processing. High capital requirements for specialized fishing fleets and onboard processing technology limit the number of major global participants.

- AKER BIOMARINE

Aker BioMarine maintains the industry's most dominant position through deep vertical integration, controlling the entire value chain from sustainable Antarctic harvesting (Eco-Harvesting technology) to final product formulation. The company’s strategic focus shifted entirely to the human health segment following the 2024 divestiture of its feed division. Its competitive advantage is rooted in proprietary innovation, such as the patented PL+ technology (an enhanced absorption formulation) and the launch of Lysoveta in 2025, which targets next-generation nutrient delivery, cementing its position as the premium technology leader in the Dietary Supplements space.

- RIMFROST (Olympic Group)

RIMFROST, as part of the Olympic Group, positions itself as a major vertically integrated player, emphasizing full control over its supply chain, vessel operations, and on-shore processing. The company focuses on minimizing environmental impact, which aligns with the market's strong demand for traceable and sustainable ingredients, especially in Europe. RIMFROST competes by focusing on high-quality, specialty krill oils and protein powders marketed primarily to other finished product manufacturers, serving as a key B2B raw material supplier and emphasizing purity and consistent ingredient specifications.

- Reckitt Benckiser Group plc.

Reckitt Benckiser Group plc. (RB) is a key competitive force not as a harvester, but as a brand owner and mass-market distributor, utilizing its global scale and consumer trust. RB commands significant market share through its MegaRed brand, which positions krill oil as a superior alternative to traditional fish oil for heart health. RB’s strategy is built on leveraging its extensive marketing budget, global Offline and Online distribution networks, and a simplified consumer message, effectively driving mainstream demand and making krill oil accessible to a much broader consumer base outside of specialist health stores.

Krill Oil Market Developments

- November 2025: Aker BioMarine's Lysoveta, a phospholipid ingredient derived from krill, was named an Innovation Winner, highlighting a key product launch focused on advanced nutrient delivery for brain and eye health, creating new demand in the premium Dietary Supplements segment.

- August 2025: The Commission for the Conservation of Antarctic Marine Living Resources (CCAMLR) enforced the immediate closure of the Antarctic krill fishery after the precautionary 620,000 tonne limit was reached. This market-defining capacity constraint introduced critical supply risk and upward price pressure on the raw material.

- September 2024: Aker BioMarine completed the transaction to divest its Feed Ingredients segment to American Industrial Partners. This corporate restructuring and capacity realignment allows the company to focus capital and resources exclusively on its core, high-margin Human Health Ingredients business.

Krill Oil Market Segmentation:

- By Product Form

- Liquid

- Capsules

- Soft Gels

- By Application

- Dietary Supplements

- Functional Food and Beverages

- Animal and Pet Food

- By Distribution Channel

- Online

- Offline

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others