Report Overview

Antimony Mining Market - Highlights

Antimony Mining Market Size:

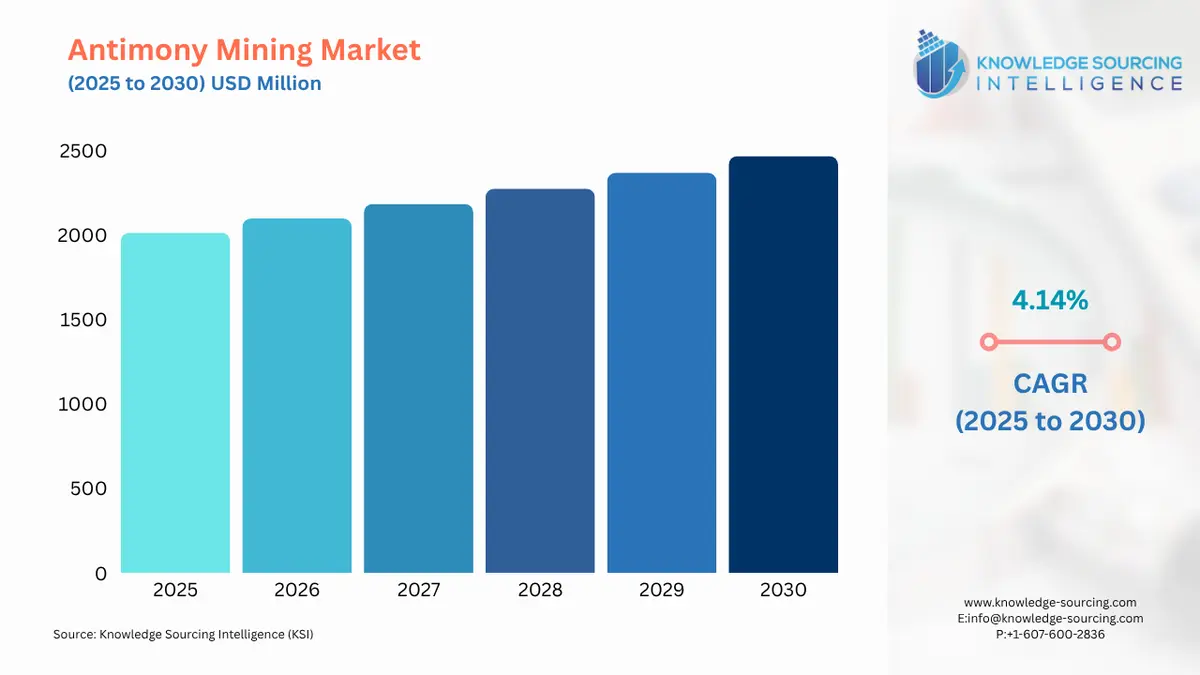

The Antimony Mining Market is forecasted to increase at a CAGR of 4.14%, rising from USD 2,014.172 million in 2025 to USD 2,467.087 million in 2030.

Antimony Mining Market Key Highlights:

- Antimony’s growing role in flame retardants and battery technologies is expanding its importance across multiple industries.

- Advancements in refining and processing technologies are improving efficiency and product quality in antimony mining operations.

Antimony is an important metal that is used primarily in flame retardants, batteries, semiconductors, and other industrial uses. Mining antimony produces raw materials from ore deposits, then refines the ore into trioxide and alloys for downstream applications. As industrialisation continues to grow, the need for energy storage solutions, and especially electronics, is creating an interest in antimony resources. Mining techniques (like any mineral extraction) must follow strict environmental guidelines, due to antimony's potential toxicity, along with regulations in place for mining. Advances in processes for operational efficiencies, extraction technologies, and sustainable mining processes are also affecting the industry and providing confidence that we will be able to supply a constant supply of antimony to meet the global demands for antimony while maintaining an environmental footprint that is low.

Antimony Mining Market Overview & Scope:

The antimony mining market is segmented by:

- Type: The market is segmented into Antimony Ore, Antimony Trioxide, Antimony Alloys, and Others. Antimony Trioxide is the most commonly used, mainly in elements like flame retardants in plastics and textiles. Trioxide is also critical in battery applications and electronics. Antimony ore is mined from where it is then processed into the form of trioxide to meet the requirements of a large-scale industry. Antimony trioxide is in demand by safety standards that are a requirement in industries, through specifications in areas of construction to avoid things being flammable, especially in electronics. The production of trioxide involves roasting of ore; the processing route is key for trioxide end users, with a significant focus on efficiencies and product purity.

- Application: The market segment consists of Flame Retardants, Lead-Acid Batteries, Semiconductors, Solar Panels, and others. The market segment includes Flame Retardants, Lead-Acid Batteries, Semiconductors, Solar Panels, and others. Flame retardants are the largest application of antimony. Antimony trioxide is mixed with halogenated compounds to increase the fire resistance of plastics, textiles, and coatings. This is important in electronic applications, building products, and automotive components when they are required to meet safety requirements. Antimony is valued as an efficient fire retardant because of the characteristics it offers, such as durability, thermal stability, and fire inhibition. An increase in regulatory focus on fire safety in consumer products globally is pushing flame retardants, resulting in the flame retardants sector being at a steady level of high demand in the antimony market.

- End-User Industry: The market is segmented by Electronics, Automotive, Construction, Energy, and Others. Electronics is an important end-user industry. Antimony is used in semiconductors, flame-retardant plastics, and solder alloys. The continuously increasing production of smartphones, computers, and consumer electronics continues to lead to a growing demand for antimony materials of the highest purity. The electronic manufacturers rely on antimony for thermal stability, long-term durability and the ability to provide homes and business buildings with adequate fire safety compliance. The electronic sector continues to be one of the largest end consumers of antimony and will continue to be a key driver of antimony mining and refining.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping the Antimony Mining Market

- Sustainable Mining Practices

- The Mining companies recognise, as does society, that there will be consequences for their activities, whether there is governmental regulation or not. As such, mining companies have begun implementing more eco-friendly means of mining to attempt to minimise their environmental footprint. These will be reflected in areas such as waste management, energy-efficient extraction, compliance with International Finance Corporation standards and ensure accepted sustainable methods are employed to comply with internationally acceptable sustainability targets.

- Technological Advancements in Refining

- Improvement in technology and processing will have a significant effect on the recovery rate of antimony, as well as the purity of the final product. Automation and technology will allow for improved efficiency while reducing risk related to human error related operational activities at refining plants, including ensuring quality consistency.

Antimony Mining Market Growth Drivers vs. Challenges

Drivers:

- Rising Demand in Flame Retardants and Electronics: The worldwide increase in electronics production, along with fire safety regulations driving demand for antimony, and in particular trioxide form, is a further demand driver. The construction sector, with high use of flame-retardants, consumer electronics with conventional antimony-based flame-retardants, and the development of flame-retardants for other end-use sectors, creates a more consistent demand from antimony manufacturers and a greater incentive to grow mining and refining operations.

- Growing Use in Energy Storage and Batteries: As large and small-scale batteries, in particular, lead-acid batteries, and innovative energy storage technology emerge, antimony is becoming more common for performance and durability. Combined with the expansion of the electric vehicle sector and renewable energy initiatives, antimony demand will increase and push mining companies to invest in exploration and development of antimony mines in their service area to meet their customer’ industrial needs.

Challenges:

- Environmental and Health Risks: Antimony mining and processing involve toxic materials. Exposure can harm workers and surrounding communities, creating regulatory and operational challenges.

Antimony Mining Market Regional Analysis

- Asia-Pacific: The Asia-Pacific region's dominance in the antimony mining industry is due to major reserves, particularly in China, which is the largest producer of antimony globally by a huge margin. Moreover, the strong mining infrastructure and existing mining and refining capabilities, plus lower production costs, assure large-scale extraction and processing. Rapid industrialisation and growth in electronics manufacturing capacity, increasing demand for flame retardants, and notable increases in antimony trioxide demand for batteries is all supporting market growth. Additionally, governments are ordering firms to pursue sustainable mining practices and invest in more modern technologies to improve efficiencies. The region is also well-positioned on the global supply chain, ensuring that antimony mined and produced from the Asia-Pacific region continues to be supplied to major international markets.

Antimony Mining Market Key Development:

- Australia’s government injected A$135 million to bail out Trafigura’s lead and zinc smelters at Port Pirie and Hobart on the condition that they begin producing critical minerals like antimony, bismuth, and germanium from byproducts, strengthening domestic supply chains and reducing Chinese reliance.

List of Top Antimony Mining Companies:

Antimony Mining Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 2,014.172 million |

| Total Market Size in 2031 | USD 2,467.087 million |

| Growth Rate | 4.14% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Type, Application, End-Use Industry, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Antimony Mining Market Segmentation:

- By Type

- Antimony Ore

- Antimony Trioxide

- Antimony Alloys

- Others

- By Application

- Flame Retardants

- Lead-Acid Batteries

- Semiconductors

- Solar Panels

- Others

- By End-User Industry

- Electronics

- Automotive

- Construction

- Energy

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America