Report Overview

Scandium Market - Strategic Highlights

Scandium Market Size:

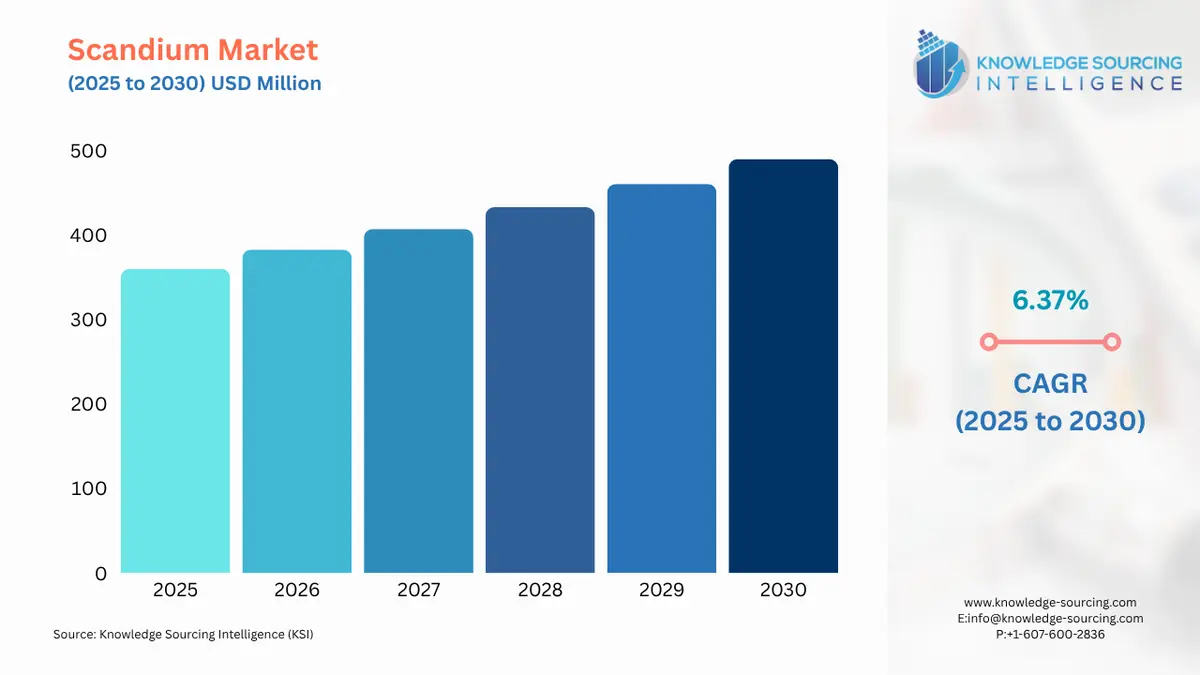

Scandium market is valued at US$359.749 million in 2025 is projected to grow at a CAGR of 6.37% to reach US$489.802 million in 2030.

Scandium Market Introduction:

The scandium market, centered around a rare earth element with unique properties, is emerging as a critical component in advanced manufacturing and clean energy technologies. Scandium, a silvery-white metallic element with the atomic number 21, is valued for its ability to enhance the strength, durability, and lightweight characteristics of alloys, particularly when combined with aluminum. Its applications span aerospace, solid oxide fuel cells (SOFCs), automotive, electronics, and emerging fields like 3D printing, making it a strategic material for industries prioritizing performance and sustainability. Despite its scarcity and high production costs, scandium’s potential to revolutionize lightweight materials and energy-efficient systems positions it as a key player in high-tech and green industries.

Scandium is primarily extracted as a byproduct from mining operations for other metals, such as rare earth elements, uranium, or titanium, due to its dispersed distribution in the Earth’s crust, with concentrations typically ranging from 20–50 ppm in viable deposits. Its most prominent application is in aluminum-scandium alloys, which offer superior strength-to-weight ratios, corrosion resistance, and weldability, making them ideal for aerospace components like airframes and fighter jet structures. For example, adding just 0.1–0.5% scandium to aluminum can reduce aircraft weight by up to 15%, enhancing fuel efficiency and performance, as noted by industry leaders like Scandium International Mining Corporation. Scandium is also critical in SOFCs, where scandium-stabilized zirconia (ScSZ) serves as an electrolyte, improving ionic conductivity and enabling operation at lower temperatures, thus reducing costs and extending cell life. This is particularly relevant in clean energy applications, such as distributed power generation for industrial and residential use.

Beyond aerospace and energy, scandium is used in high-intensity metal halide lamps, where scandium iodide produces sunlight-like illumination, and in high-performance sports equipment, such as bicycle frames and golf clubs, due to its lightweight and durable properties. Emerging applications in 3D printing and electric vehicle (EV) components are gaining traction, driven by the need for lightweight, high-strength materials. In August 2023, NioCorp Developments Ltd. announced advancements in eco-friendly scandium production for its aluminum-scandium master alloy program, targeting EV and aerospace applications. The market’s growth is further supported by strategic initiatives to secure scandium supply, as governments in Australia, Canada, and the United States recognize it as a critical mineral for national security and sustainable development.

Scandium Market Overview:

Scandium is a chemical element that is silvery-white, metallic, and has been categorized in the past as a rare earth resource. Scandium oxide, the main ore and the prime source of scandium metal, its other compounds, and alloys, is produced in small quantities in limited regions across the world. The best aspect of this oxide is that it is mined and extracted from the rarest rare earth and uranium compounds through the mining process and subsequent purification. Scandium has high electrical conductivity, acts as a heat stabilizer, offers creep-resistant properties, and is lightweight, making it an increasingly integral part of various profitable and industrial sectors.

The global market is experiencing significant growth driven by multiple key factors, including the expanding adoption of Solid Oxide Fuel Cells (SOFCs), rising aerospace applications, and increasing automotive industry utilization. Growing environmental concerns about traditional energy sources like coal and natural gas are accelerating demand for clean energy solutions, particularly SOFCs, which is expected to substantially boost scandium consumption in the coming years. Beyond energy applications, scandium plays a crucial role in alloy production, particularly for high-performance sports equipment and bicycles. Geographically, the market landscape has evolved significantly, with China and Russia currently dominating scandium production, while Australia is emerging as a promising new player through developing deposits in New South Wales. Industry dynamics are shifting as numerous companies explore scandium by-product recovery opportunities. The aerospace sector's evolving needs could trigger rapid spikes in global scandium demand, while the chemical refining industry presents additional promising avenues for producers to capitalize on during the forecast period. These converging factors create a dynamic market environment with substantial growth potential across multiple industrial sectors. By product, the metal and alloy segments are estimated to hold a dominant market share owing to their increasing usage across various industries, such as manufacturing, aerospace, and SOFCs. By industry application, the SOFCs segment is expected to hold a significant market share due to its usage in power generation.

Some of the major players covered in this report include Hunan Oriental Scandium Co. Ltd., Scandium International Mining Corp., NioCorp Developments Ltd., Platina Resources Ltd., Australian Mines Limited, Sumitomo Metal Mining Co. Ltd., Materion Corporation, GFS Chemicals Inc., Stanford Materials Corp., and Thermo Fisher Scientific Inc., among others.

Scandium Market Drivers:

Increasing Demand for Lightweight Aluminum-Scandium Alloys in Aerospace and Automotive

Scandium’s ability to significantly enhance the properties of aluminum alloys, such as strength, corrosion resistance, and weldability, drives its demand in aerospace and automotive industries. Aluminum-scandium alloys reduce weight by up to 15–20% compared to traditional alloys, improving fuel efficiency and performance in aircraft and vehicles. The aerospace sector, particularly, values these alloys for airframes, fuselage components, and fighter jet parts, while the automotive industry leverages them for lightweight electric vehicle (EV) components to extend battery range. In October 2024, Australian Mines Ltd. partnered with Deakin University to develop aluminum-scandium alloys for 3D printing, targeting aerospace and automotive applications to meet the demand for high-performance, lightweight materials. This collaboration highlights the growing emphasis on scandium’s role in advanced manufacturing, driven by the global push for fuel-efficient and sustainable transportation solutions.

Growing Adoption in Solid Oxide Fuel Cells (SOFCs) for Clean Energy

Scandium’s role in solid oxide fuel cells (SOFCs), particularly through scandium-stabilized zirconia (ScSZ), is a significant driver due to its ability to enhance ionic conductivity and enable lower operating temperatures, reducing costs and extending cell lifespan. SOFCs are increasingly adopted for clean energy generation in industrial, residential, and remote applications, aligning with global decarbonization goals. In September 2024, the U.S. Department of Energy announced $40 million in funding for SOFC development, emphasizing scandium’s critical role in improving energy efficiency and supporting sustainable power generation. This investment reflects the rising demand for scandium in energy-efficient technologies, positioning it as a vital material in the transition to renewable energy systems.

Government Support and Strategic Investments in Critical Minerals

Governments worldwide recognize scandium as a critical mineral, prompting investments in mining, extraction, and R&D to secure supply chains and reduce reliance on imports, particularly from China. These initiatives drive market growth by fostering domestic production and encouraging innovation in scandium applications. In July 2025, NioCorp Developments Ltd. supported a bipartisan U.S. bill (H.R. 4774) to provide tax incentives for scandium mining, aiming to boost domestic production for aerospace and energy applications. Similarly, in August 2023, Rio Tinto acquired the Owendale scandium project in Australia, with plans to produce up to 40 metric tons of scandium oxide annually, diversifying global supply. These developments underscore the strategic importance of scandium, driving market expansion through enhanced production capabilities.

Scandium Market Restraints:

Limited Supply and High Production Costs

Scandium’s scarcity and extraction challenges, primarily as a byproduct of other mining operations like uranium or titanium, result in limited global supply and high production costs. With only about 45 tons produced annually against a potential demand of 1,500 tons, supply constraints restrict scalability and adoption in cost-sensitive industries. A recent study highlighted that high energy costs and low extraction yields from low-grade ores (20–50 ppm) contribute to elevated prices, making scandium less competitive compared to alternative materials. These limitations hinder widespread use in applications like automotive manufacturing, where cost considerations are critical.

Price Volatility and Unstructured Market Dynamics

The scandium market suffers from price volatility and a lack of organized market infrastructure, driven by inconsistent supply and fluctuating demand. The absence of a stable pricing mechanism and limited primary production sources create uncertainty for manufacturers, deterring large-scale adoption. A 2025 analysis noted that the disorganized market structure, coupled with reliance on byproduct extraction, leads to unpredictable pricing, impacting industries like electronics and consumer goods that require cost stability. This volatility poses a significant barrier to market growth, particularly in emerging applications like 3D printing and high-intensity lighting.

Scandium Market Segmentation Analysis:

Scandium Alloys are growing in popularity

Scandium Alloys, particularly aluminum-scandium alloys, dominate the product type segment due to their exceptional strength-to-weight ratio, corrosion resistance, and weldability, making them critical for high-performance applications. These alloys are primarily used in aerospace and automotive industries, where even small additions of scandium (0.1–0.5%) significantly enhance aluminum’s properties, reducing weight and improving fuel efficiency. In aerospace, scandium alloys are employed in airframes, fuselage components, and fighter jet structures, while in automotive applications, they support lightweight electric vehicle (EV) components to extend battery range. The segment’s prominence is driven by increasing demand for lightweight materials in advanced manufacturing. In October 2024, Australian Mines Ltd. partnered with Deakin University to develop next-generation aluminum-scandium alloys for 3D printing, targeting aerospace and automotive applications to meet the growing need for high-performance materials. Additionally, NioCorp Developments Ltd.’s August 2023 announcement of eco-friendly scandium production for aluminum-scandium master alloys underscores the segment’s role in sustainable innovation. The versatility and performance of scandium alloys position them as the leading product type in the market.

The Aerospace and Defense sector is predicted to hold the largest market share

The Aerospace and Defense sector is the largest end-use segment for scandium, driven by the critical role of aluminum-scandium alloys in producing lightweight, durable, and high-strength components for aircraft and military equipment. Scandium alloys reduce aircraft weight, enhancing fuel efficiency and performance, which is vital for commercial airliners, private jets, and military applications like fighter jets and missile systems. The sector’s demand is fueled by global aerospace growth and defense modernization programs, particularly in the United States, Europe, and Asia-Pacific. In September 2024, Rio Tinto expanded its scandium oxide production in Canada to supply aerospace manufacturers with high-purity scandium for alloy production, supporting the industry’s focus on lightweight materials. Furthermore, a 2024 U.S. Department of Defense initiative highlighted scandium’s strategic importance for national security, emphasizing its use in advanced alloy applications for next-generation aircraft. The segment’s dominance is reinforced by the aerospace industry’s stringent performance requirements and ongoing investments in scandium-based solutions.

Asia-Pacific is expected to be the market leader

The Asia-Pacific region is the largest and fastest-growing market for scandium, driven by robust industrial growth, government support for critical minerals, and increasing demand in aerospace, automotive, and energy sectors. Countries like China, Japan, and Australia lead due to their advanced manufacturing capabilities and strategic investments in scandium production. China’s dominance in rare earth element processing, including scandium, supports its role in supplying electronics and solid oxide fuel cell (SOFC) markets, while Australia’s mining projects bolster global supply. In January 2025, Hunan Oriental Scandium Co. Ltd. launched a new extraction facility in China to enhance scandium supply for electronics and SOFCs, leveraging the country’s rare earth infrastructure. Additionally, in November 2023, Scandium International Mining Corp. advanced the Nyngan Scandium Project in Australia, marking the world’s first scandium-only mining operation to meet rising demand in aerospace and clean energy applications. The region’s strong R&D ecosystem, coupled with government policies promoting critical minerals, positions Asia-Pacific as the epicenter of the scandium market.

Scandium Market Key Developments:

July 2025: NioCorp Developments Ltd. backed a bipartisan U.S. bill (H.R. 4774) to provide tax incentives for scandium mining, aiming to boost domestic production. The initiative targets increased supply for aerospace and clean energy applications, addressing supply chain vulnerabilities and promoting scandium’s use in aluminum alloys and solid oxide fuel cells (SOFCs). This policy supports the U.S. scandium market by encouraging investment in critical mineral production.

January 2025: Hunan Oriental Scandium Co. Ltd. opened a new scandium extraction facility in China, enhancing supply for electronics and SOFC applications. The facility leverages China’s rare earth infrastructure to improve production efficiency, supporting the growing demand for scandium in high-tech and clean energy sectors, particularly in Asia-Pacific.

Scandium Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 359.749 million |

| Total Market Size in 2029 | USD 489.802 million |

| Forecast Unit | Million |

| Growth Rate | 6.37% |

| Study Period | 2020 to 2029 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2029 |

| Segmentation | Product Type, Application, End-Use Sector, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Scandium Market Segmentations:

Scandium Market Segmentation by Product Type

The market is analyzed by product type as follows:

Scandium Oxide

Scandium Metal

Scandium Alloys

Scandium Compounds

Others

Scandium Market Segmentation by Application

The market is segmented by application:

Aluminum-Scandium Alloys

Solid Oxide Fuel Cells (SOFCs)

High-Intensity Discharge (HID) Lamps

Lasers

Others

Scandium Market Segmentation by end-use sector

The report analyzes the market by end-use sector:

Aerospace and Defense

Automotive

Energy

Electronics

Additive Manufacturing

Others

Scandium Market Segmentation by regions:

The study also analysed the scandium market into the following regions, with country-level forecasts and analysis as below:

North America (US, Canada, and Mexico)

South America (Brazil, Argentina, and Others)

Europe (Germany, UK, France, Spain, Italy, and Others

Middle East and Africa (Saudi Arabia, UAE, and Others)

Asia Pacific (China, Japan, India, South Korea, Thailand, Indonesia, and Others)