Report Overview

Assisted Reproductive Technology Market Highlights

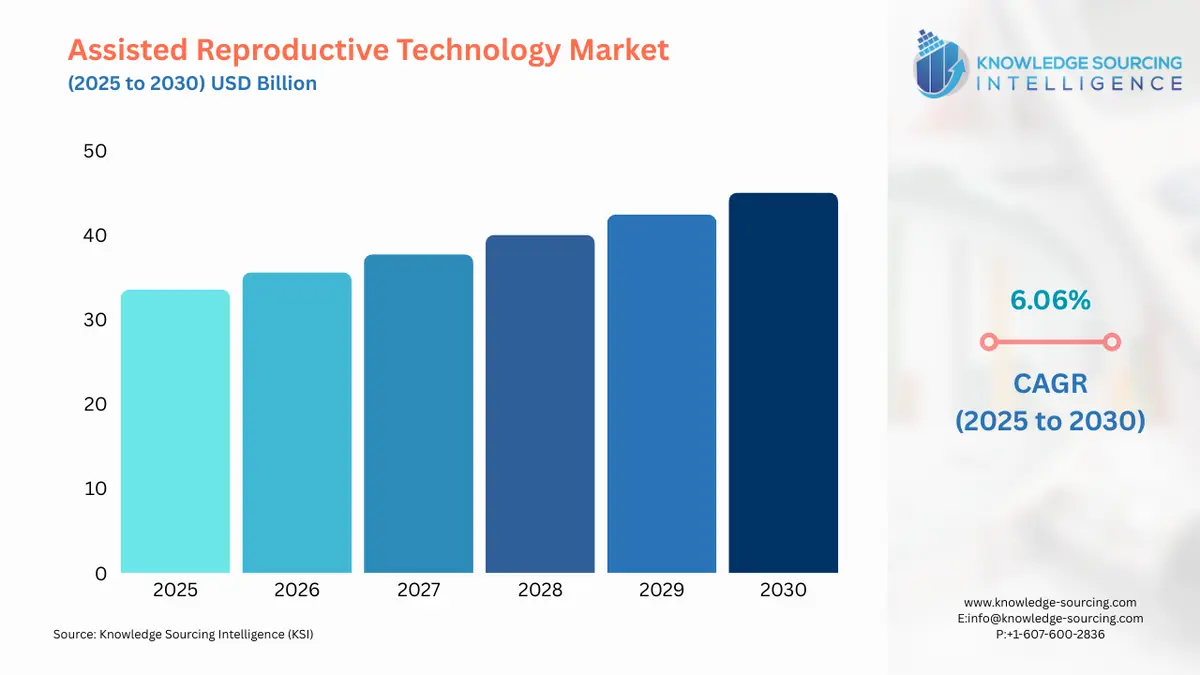

Assisted Reproductive Technology Market Size:

Assisted Reproductive Technology Market, with a 5.88% CAGR, is forecasted to expand from USD 33.539 billion in 2025 to USD 47.249 billion in 2031.

The word medical procedure used to cure infertility is assisted reproductive technology (ART). Fertility therapy is the term used when treatments are utilized to treat infertility. All forms of assisted reproductive technology (ART) include the handling of either eggs or embryos. ART methods often entail surgically extracting eggs from a woman's ovaries, fertilizing them in a lab, and either putting them back into her body or giving them to another woman.

Assisted Reproductive Technology Market Growth Drivers:

Opportunities for the cryptococcosis market to increase

Throughout the anticipated period, assisted reproductive technology market growth is anticipated to be driven by increased disposable income, higher ART success rates, and higher infertility rates in emerging nations. According to World Health Organisation Statistics 2020, 186 million people worldwide experience infertility-related problems. The increased incidence of infertility can be attributed to a variety of factors, including STIs, an increase in smoking, obesity, endometriosis, polycystic ovary syndrome (PCOS), primary ovarian insufficiency (POC), and others.

Increasing prevalence of infertility among individuals

An increase in the use of assisted reproductive technology among women who are experiencing increased infertility as a result of factors like rising inactivity, which in turn causes obesity among women and several chronic diseases. It led to an increase in infertility and improved the assisted reproductive technology market, which saw an improved market growth rate over the anticipated period thanks to improved assisted reproductive technology-produced technologies.

Increasing ovulation disorders in women, increased menstrual problems, and hormonal imbalance in women may affect menstruation and ovulation, which helps to drive the assisted reproductive technology industry with rising consumer demands and rising integration of cutting-edge technologies in healthcare facilities.

Organizational initiatives to drive the market

Several groups, like the American Society for Reproductive Medicine and the Society for Assisted Reproductive Technology (SART), are working together to spread knowledge of the various infertility treatment options. CooperSurgicals, for instance, found that culture media containing Granulocyte-macrophage Colony-Stimulating Factor (GM-CSF) contains essential nutrients needed for embryo development and further enhances the transmission between the embryo and the endometrium, creating the necessary environment for the pregnancy. Further, India formally passed legislation governing surrogacy services in the nation in January 2022. In India, the two statutes seek to control IVF clinics and outlaw commercial surrogacy.

An increasing number of single-parenting

It is projected that the assisted reproductive technology market will grow considerably throughout the forecast period due to factors including the growing number of single parents, growing acceptance of same-sex relationships, and other developments. For instance, according to the Human Rights Campaign (HRC) Foundation's 2022 report, there are already 32 countries where same-sex marriage is legal, and more are projected to follow since parliamentary or legal processes are ongoing in several other nations.

Increasing public awareness about In-vitro Fertilization technology

Significant variables that are anticipated to have a significant impact on the development of the assisted reproductive technology industry are improvements in IVF technology, more public awareness of surrogacy and governmental restrictions on it, and increased insurance coverage for IVF. The most successful type of assisted reproductive technology is In-Vitro Fertilization (IVF). The process is possible with the use of the couple's sperm and eggs. A known or unknown donor's eggs, sperm, or embryos may also be used during IVF.

Enhancement in technology

Depending on the needs of the patient, several techniques are used, such as in vitro fertilization (IVF), artificial insemination, zygote intra-fallopian transfer (ZIFT), and gamete intra-fallopian transfer (GIFT). To prepare the body for ART, medications such as orals and injectable hormones are utilized both before and throughout the therapy. The pharmaceutical market is anticipated to expand rapidly with a complex pipeline. Additionally, INVOcell and Anecova have created in vivo ART products that are anticipated to support assisted reproductive technology market growth throughout the projection period.

Assisted Reproductive Technology Market Geographical Outlook:

The market for assisted reproductive technologies in Europe is expected to grow rapidly.

As per the European Society of Human Reproduction and Embryology, 25 million people in Europe have a high prevalence of infertility which is anticipated to fuel the regional market. The forecast era is likely to see tremendous growth in North America due to factors like rising infertility in the region and initiatives by public organizations that are likely to increase assisted reproductive technology market growth over the forecast period, North America is expected to hold a significant market share in the global assisted reproductive technology market. Furthermore, the assisted reproductive technology market is anticipated to develop as a result of ART technology advances and the introduction of new products.

Assisted Reproductive Technology Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Assisted Reproductive Technology Market Size in 2025 | USD 33.539 billion |

Assisted Reproductive Technology Market Size in 2030 | USD 45.016 billion |

Growth Rate | CAGR of 6.06% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Assisted Reproductive Technology Market |

|

Customization Scope | Free report customization with purchase |

Assisted Reproductive Technology Market Segmentation

By Technique

In Vitro Fertilization (IVF)

Artificial Insemination (AI)

Frozen Embryo Transfer (FET)

Surrogacy

Others

By Procedure

Fresh Donor

Fresh Non-Donor

Frozen Donor

Frozen Non-Donor

By End-User

Hospitals

Fertility Clinics

Cryobanks

Research Institutes

By Geography

North America

USA

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

China

Japan

India

South Korea

Taiwan

Others

Our Best-Performing Industry Reports:

Navigation:

Page last updated on: September 19, 2025