Report Overview

Australia AI in Weather Highlights

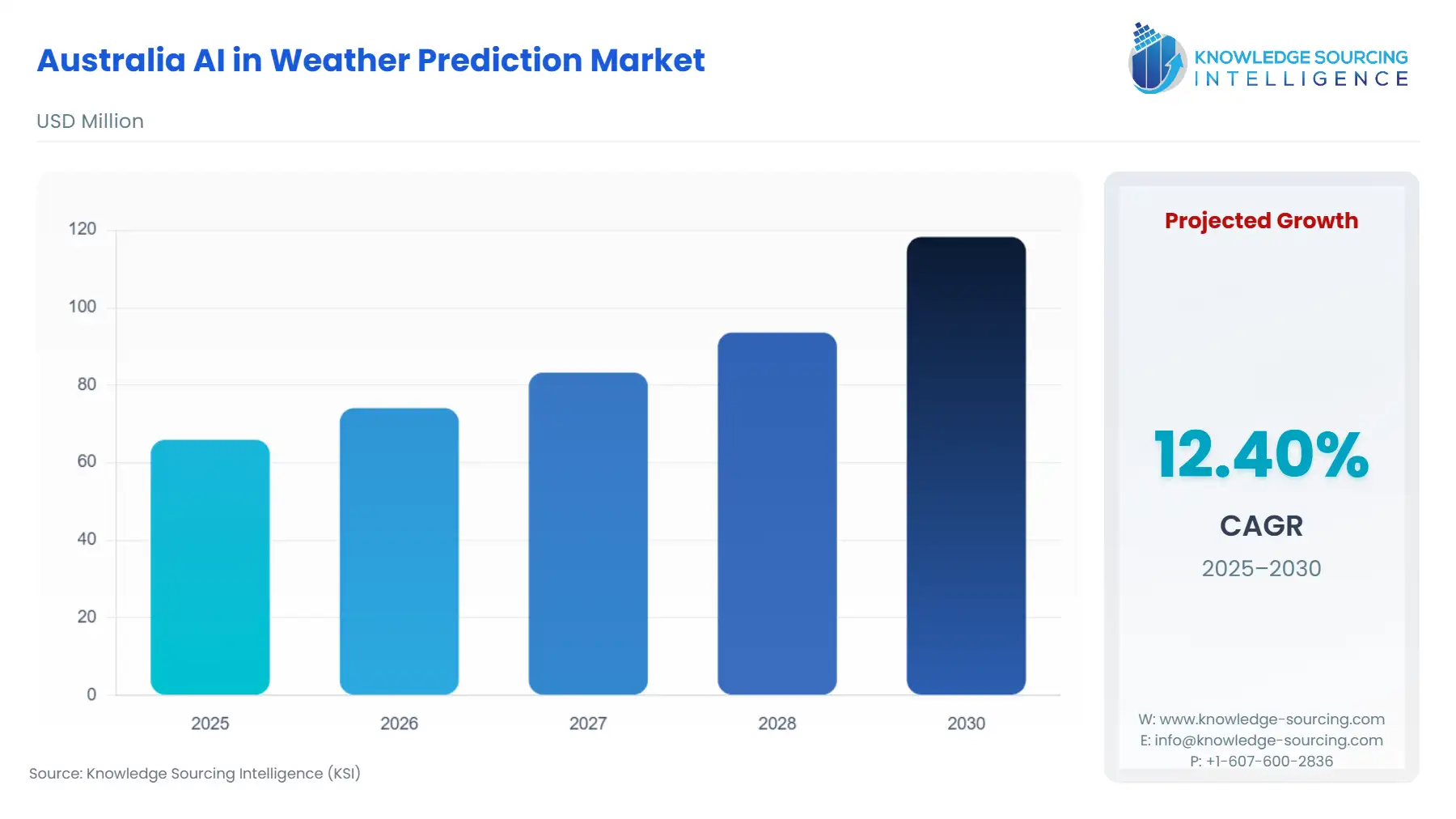

Australia AI in Weather Prediction Market Size:

The Australia AI in Weather Prediction Market is expected to grow at a CAGR of 12.40%, reaching USD 118.232 million in 2030 from USD 65.909 million in 2025.

The Australian market for Artificial Intelligence in Weather Prediction is rapidly transitioning from a research focus to operational deployment, underpinned by the nation's high vulnerability to climate variability and extreme weather phenomena. This shift is characterized by a strong commercial interest in leveraging advanced deep learning and machine learning algorithms to process high-volume, disparate data streams—including satellite imagery, radar, and IoT sensor inputs—for superior predictive accuracy. The core value proposition of AI in this context is the ability to generate hyper-local, high-resolution forecasts at a speed traditional Numerical Weather Prediction (NWP) models cannot match cost-effectively, directly addressing the critical operational needs of weather-sensitive industries across the continent.

Australia AI in Weather Prediction Market Analysis:

Growth Drivers

The escalating economic losses and safety risks attributed to extreme weather events create direct, urgent demand for AI-powered solutions. Governments and enterprises invest in AI for its superior capability to process massive meteorological datasets in real-time, thereby improving the timeliness and precision of early warning systems for floods, cyclones, and bushfires. In the energy sector, the national pivot towards renewable energy mandates advanced AI forecasting to predict the intermittent output of solar and wind farms, a necessity for grid stability and demand matching, directly increasing procurement for Machine Learning and Deep Learning-based services.

Challenges and Opportunities

A primary constraint on market expansion is the requirement for massive, high-quality, and labeled historical climate data to effectively train sophisticated AI models; inconsistencies or gaps in data provenance can directly undermine model reliability and decrease commercial uptake. Conversely, the opportunity lies in integrating AI-enhanced predictive outputs directly into industry-specific operational software, such as irrigation scheduling systems in agriculture or load-forecasting platforms for utilities. This seamless integration transforms a weather forecast from a generic data point into an actionable, automated decision-making tool, significantly increasing the value proposition and, consequently, the market expansion.

Supply Chain Analysis

The Australian AI in Weather Prediction supply chain is predominantly intangible, revolving around the global provision of high-performance cloud computing infrastructure and the specialized talent pool of data scientists and atmospheric scientists. Key production hubs are centered around major cloud service providers (CSPs) and global technology firms that host the foundational AI/ML frameworks. The critical logistical complexity is the secure and high-speed transfer and processing of exabytes of observational data, including proprietary Bureau of Meteorology (BOM) data, satellite feeds, and private sensor networks, across Australia's vast distances. The market exhibits a dependency on global research and open-source machine learning advancements, as local AI providers frequently leverage and fine-tune global models, such as those from the European Centre for Medium-Range Weather Forecasts (ECMWF) or US-based models, before integrating them with Australia-specific data.

Government Regulations

Australia lacks a consolidated, technology-specific legal framework for Artificial Intelligence; instead, existing legislation governs its deployment. The enforcement of these regulations dictates crucial development and deployment parameters, directly impacting the market's operational structure.

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| Commonwealth | Privacy Act 1988 / Office of the Australian Information Commissioner (OAIC) | Mandates strict compliance for entities with annual turnovers over AUD$3 million regarding the collection and use of personal information in AI model training, potentially constraining the use of certain publicly scraped datasets and increasing costs for governance and compliance assurance. |

| Commonwealth | Department of Industry, Science and Resources Voluntary AI Safety Standard | While non-binding, it establishes a community-wide expectation for establishing and publishing accountability and risk management processes, creating a demand-side preference for AI vendors demonstrating transparent and trustworthy data governance and model performance auditing. |

| Commonwealth | Bureau of Meteorology (BOM) Act and related regulations | Defines the BOM's public function as the primary provider of official weather information, which dictates the public-sector data sharing policies and creates a competitive landscape where private AI firms must demonstrate 'value-added' capabilities, such as hyper-local or specialized sectoral forecasts, to justify commercial demand. |

Australia AI in Weather Prediction Market Segment Analysis:

By Technology: Deep Learning

The Deep Learning segment experiences a significant growth driven by its proven ability to handle the non-linear, high-dimensional data characteristic of atmospheric physics. Deep learning models, particularly neural networks, surpass traditional Machine Learning in identifying intricate, non-obvious patterns within satellite imagery, radar data, and high-resolution atmospheric outputs. This technological superiority is critical for short-term nowcasting and highly localized severe weather events. The requirement specifically flows from government disaster management agencies and industries with immediate, high-stakes weather dependencies, such as the aviation and transportation sectors, which require rapid, highly accurate, minute-by-minute predictions to optimize take-offs, landings, and logistical routing, thereby significantly reducing weather-related operational delays and safety risks. Academic research focusing on deep learning's efficacy in predicting streamflow and large flooding events in Australian catchments further validates and drives public sector investment in this technology segment.

By End-User: Energy and Utilities

The Australian Energy and Utilities sector constitutes a significant, high-value demand segment, fundamentally altered by the rapid penetration of Distributed Energy Resources (DERs), predominantly solar and wind generation. This transition necessitates an urgent requirement for AI-in-Weather Prediction services to address resource intermittency. The necessity is not merely for weather data but for predictive grid management tools. Specifically, AI algorithms must perform real-time load forecasting and generation prediction by correlating highly localized, granular solar irradiance, cloud cover, and wind speed forecasts with asset-level performance data. This hyper-specific, AI-driven insight enables the Australian Energy Market Operator (AEMO) and utility companies to strategically manage battery storage, orchestrate vehicle-to-grid (V2G) systems, and make automated adjustments to grid-balancing mechanisms, directly improving efficiency by maximizing renewable energy uptake while averting network congestion and blackouts.

Australia AI in Weather Prediction Market Competitive Environment and Analysis:

The competitive landscape is characterized by a mix of specialized Australian-based meteorological firms and globally scaled technology companies. The primary competition focuses on the speed of model updates, the granularity of spatial resolution (e.g., down to a 1 km grid), and the depth of industry-specific API integration, moving competition away from generalized forecasting to specialized Weather Intelligence.

Jane's Weather

Jane's Weather strategically positions itself as a provider of "Weather Intelligence for your Business," focusing on delivering hyper-local, AI-enhanced API data with up to a 1 km grid resolution. The company's core product is an AI-enhanced API that integrates data from leading global weather models (including Australia's ACCESS, ECMWF, and GFS) with local weather station networks. This Machine Learning-powered approach allows them to offer custom forecast variables on demand and industry-specific insights, such as evapotranspiration (eTo) data for precision agriculture and heat stress forecasts, demonstrating a direct demand-side response to the needs of the Australian agricultural sector.

Weatherzone

As a major commercial weather company in Australia, Weatherzone, now owned by DTN, leverages its extensive history and infrastructure to service the high-value energy, utilities, and mining sectors. The company operates the proprietary Opticast forecast system, which aggregates data from numerous computer models, including its in-house Weather Research and Forecasting (WRF) model. This system runs hourly, a critical capability that addresses the demand for high-frequency, near real-time forecasts essential for the continuous, high-risk operations of these large-scale industries. Their strategic position is anchored in their ability to offer advanced forecasts and alerting products alongside a national Total Lightning Network (WZTLN).

Australia AI in Weather Prediction Market Recent Developments:

- September 2025: The World Meteorological Organization progressed on the AI for Nowcasting Pilot Project (AINPP), focusing on collaborative efforts to integrate AI-based nowcasting solutions into global processing and prediction systems. This development, while global in scope, directly impacts the Australian market by establishing standards, promoting open-source development, and offering a standardized framework to evaluate AI-based Sub-seasonal to Seasonal (S2S) forecasts. This creates a technical mandate for Australian providers to align their Deep Learning models with globally verifiable, rigorous frameworks to improve the trustworthiness and operational viability of their short-range prediction tools.

- January 2025: Weathernews Inc. launched a new feature called "Weather Agent", leveraging generative AI within their weather application. This chat-based function provides weather information through natural conversation and can respond to complex, non-standard inquiries. The development required modifying the AI model to access and utilize Weathernews' proprietary, highly accurate meteorological data, demonstrating a company-level investment in creating a weather-specialized generative AI model. This product launch reflects a broader trend of utilizing large language models to transform generic forecast data into user-friendly, actionable intelligence for end-users, potentially driving a new consumer-facing demand segment.

- July 2024: A research team from Google, MIT, Harvard, and the European Centre for Medium-Range Weather Forecasts (ECMWF) published a paper detailing the NeuralGCM model, an AI-powered general circulation model. The model aims to achieve forecast accuracy comparable to the best existing traditional models while incurring significantly lower computational costs after the initial training phase. This academic breakthrough is a foundational capacity addition that signals a clear future path for AI models. It directly validates the industry narrative that Machine Learning, and particularly physics-informed Deep Learning, can provide the computational efficiency necessary to make advanced, high-resolution forecasting accessible to a wider range of smaller institutions and private entities in Australia.

Australia AI in Weather Prediction Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 65.909 million |

| Total Market Size in 2031 | USD 118.232 million |

| Growth Rate | 12.40% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Services, End-User |

| Companies |

|

Australia AI in Weather Prediction Market Segmentation:

- BY TECHNOLOGY

- Machine Learning

- Deep Learning

- Others

- BY SERVICES

- Weather Forecasting

- Climate Modeling

- Severe Weather Prediction

- Others

- BY END-USER

- Aviation

- Marine

- Agriculture

- Energy and Utilities

- Transportation and Logistics

- Others