Report Overview

Renewable Energy Market Size, Highlights

Renewable Energy Market Size:

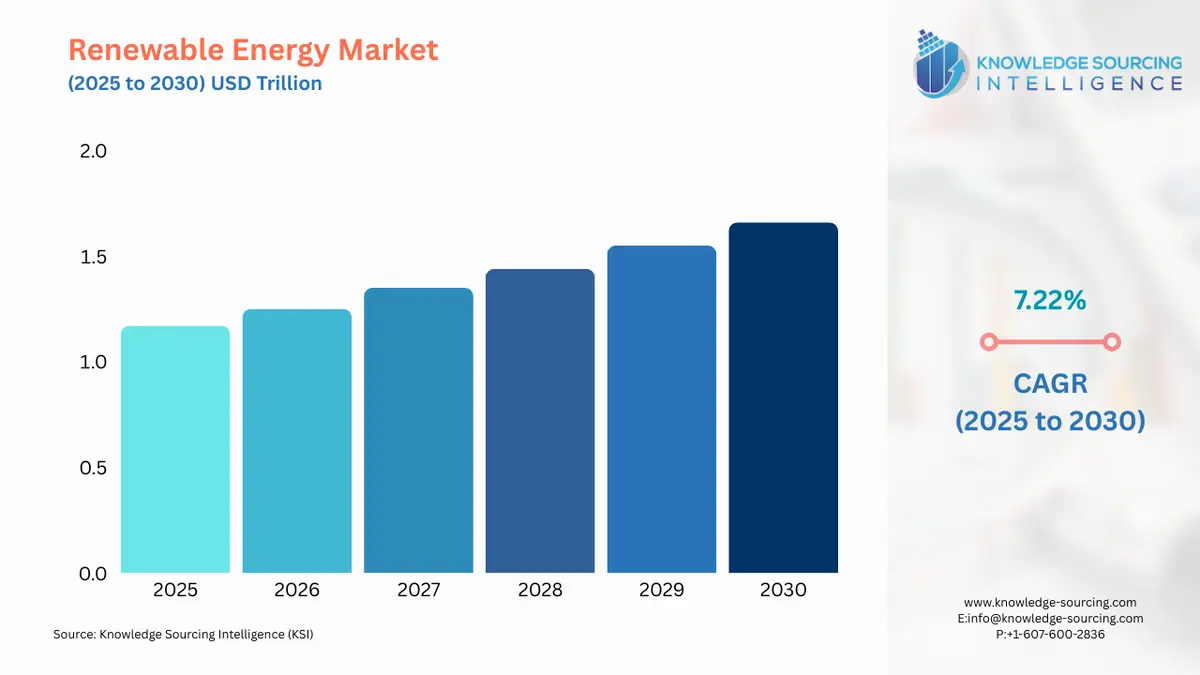

The Renewable Energy Market is expected to grow at a CAGR of 7.22%, reaching USD 1.658 trillion in 2030 from USD 1.170 trillion in 2025.

The global energy transition continues to accelerate, with renewable energy sources moving from a niche alternative to a central component of the global power mix. This shift is a direct response to a convergence of factors: the imperative to mitigate climate change, the pursuit of energy independence, and the increasing economic viability of renewable technologies. The market is characterized by a rapid pace of innovation and deployment, attracting significant investment across the value chain.

Renewable Energy Market Analysis:

Growth Drivers

- Decarbonization and Climate Goals: The growth of the renewable energy market is not a generic trend but a direct consequence of specific, demand-creating drivers. A primary catalyst is the global push for decarbonization and the establishment of stringent climate goals. The Paris Agreement and subsequent national commitments, such as the EU's Renewable Energy Directive, create a direct regulatory imperative for jurisdictions and corporations to transition to cleaner energy sources. This regulatory pressure directly increases the demand for renewable energy installations and associated infrastructure, as countries and companies must meet mandated targets for renewable energy generation as a percentage of their total energy consumption.

- Technological Advancements and Cost Competitiveness: Technological advancements have also created a powerful demand-side pull. Innovations in photovoltaic (PV) cell efficiency, improvements in wind turbine design, and the development of more effective energy storage solutions have drastically reduced the LCOE of renewable energy. For example, the declining cost of solar PV modules has made solar power a more economically attractive option for utility, commercial, and residential applications. This enhanced cost-competitiveness directly stimulates demand from a broader range of end-users who are motivated by financial savings, in addition to environmental benefits. The development of smart grid technologies and advanced inverters further increases demand by enabling the stable and reliable integration of variable renewable sources into the existing power infrastructure.

Challenges and Opportunities

- Intermittency and Grid Integration: A significant challenge confronting the market is the issue of intermittency and grid integration. Solar and wind power generation is inherently dependent on weather conditions, which can lead to fluctuations in supply. This variability creates a direct challenge to the stability of traditional power grids, which were designed for a consistent, on-demand supply from fossil fuel plants. This challenge, however, presents a substantial opportunity. It drives demand for technologies that can balance the grid, such as battery energy storage systems (BESS), advanced grid management software, and demand response solutions. These technologies are crucial for making high-penetration renewable energy grids viable, creating a new and expanding market segment.

- Capital Expenditure and Financing Models: Another challenge is the high initial capital expenditure required for large-scale renewable energy projects. While the LCOE has fallen, the upfront investment for utility-scale solar farms or offshore wind projects remains significant. This challenge is mitigated by an opportunity in financing models. The maturation of green bonds, power purchase agreements (PPAs), and other project financing mechanisms has lowered the cost of capital and made these large projects more attractive to investors. The growing corporate demand for renewable energy, driven by sustainability goals and the desire to lock in long-term, stable energy prices, also represents a significant opportunity. Companies are increasingly entering into PPAs to directly procure renewable energy, creating a stable, long-term demand stream for developers.

Raw Material and Pricing Analysis

The renewable energy market is fundamentally a physical product market, with the demand for power being fulfilled by the deployment of tangible assets. The supply chain for these assets, particularly solar PV panels and wind turbines, is highly dependent on key raw materials. For solar PV, polysilicon is a critical component. Pricing and supply for polysilicon are subject to geopolitical factors, manufacturing capacity, and energy costs. For wind turbines, the supply of rare earth elements, such as neodymium and dysprosium, is essential for the high-performance magnets used in direct-drive generators. The concentration of rare earth production and processing in a limited number of regions creates a supply chain risk. Fluctuations in the price and availability of these materials can impact manufacturing costs and, subsequently, the final price of renewable energy hardware, directly affecting the economic viability of new projects and thus influencing demand.

Supply Chain Analysis

The global renewable energy supply chain is complex and geographically concentrated. Asia-Pacific, particularly China, dominates the manufacturing of solar PV components, from polysilicon to cells and modules. This concentration creates a dependency for global projects and can introduce logistical complexities and risks related to trade policies and geopolitical tensions. For wind energy, the manufacturing landscape is more diverse, with major players in Europe, North America, and Asia. However, the sheer size and weight of wind turbine components, such as blades and nacelles, present significant logistical challenges. The transportation of these components from manufacturing hubs to project sites, which are often in remote areas, requires specialized infrastructure and complex planning. The supply chain for energy storage, particularly lithium-ion batteries, also faces its own set of challenges, including the availability of lithium, cobalt, and nickel, and the concentration of cell manufacturing in East Asia.

Government Regulations

- United States: Inflation Reduction Act (IRA): The IRA's extension of the Investment Tax Credit (ITC) and Production Tax Credit (PTC) for renewable energy projects directly reduces the cost of installation for developers. This fiscal support lowers the barrier to entry and increases the financial return on investment, thereby significantly increasing demand for utility-scale solar and wind projects.

- European Union: Renewable Energy Directive (RED II): The RED II mandates that the EU's share of renewable energy in final energy consumption reach at least 42.5% by 2030, with an aspirational target of 45%. This binding target creates a clear, long-term regulatory signal that compels member states to accelerate renewable energy deployment, thus generating sustained demand for a wide range of renewable technologies.

- India: Electricity (Promoting Renewable Energy Through Green Energy Open Access) Rules, 2022: These rules, issued by the Ministry of Power, simplify the process for large consumers to procure renewable energy directly from developers. The measure reduces regulatory hurdles and promotes green energy consumption, directly stimulating demand from commercial and industrial end-users seeking to meet their own energy needs and decarbonization goals.

- China: 14th Five-Year Plan for a Modern Energy System: The plan outlines ambitious targets for renewable energy capacity, aiming for non-fossil fuel energy to account for approximately 25% of total energy consumption by 2030. This top-down, state-driven policy provides a powerful mandate for investment and capacity expansion, driving immense demand for renewable energy hardware and project development across the country.

- Brazil: Leilões de Energia de Reserva (Reserve Energy Auctions): The Brazilian government holds auctions to contract new power generation capacity, which often favors renewable sources. This mechanism provides a stable, long-term revenue stream for renewable energy developers, reducing investment risk and directly stimulating demand for new projects by guaranteeing a buyer for the generated power.

Renewable Energy Market Segment Analysis:

- Utility-Scale Renewable Energy (By Application):

The utility-scale segment is the single largest application for renewable energy, with its demand dynamics directly tied to grid-level power generation. The primary demand driver is the falling LCOE of wind and solar. As the cost of building and operating large-scale solar farms and wind parks falls below that of new fossil fuel plants, utilities and independent power producers (IPPs) are increasingly selecting renewables for new capacity additions. This is a purely economic decision, where renewables have become the most cost-effective source of new bulk power generation. The market growth is further amplified by corporate and governmental renewable portfolio standards (RPS), which require a certain percentage of electricity to be sourced from renewables. These mandates create a long-term, non-discretionary demand for utility-scale projects. The need for grid stability, a challenge to this segment, simultaneously drives demand for complementary technologies like large-scale battery storage, which are often co-located with utility-scale renewable projects to manage intermittency. The demand for utility-scale projects is thus a direct function of economic viability and regulatory mandates, with ancillary demand for enabling technologies.

- Industrial (By End-User):

The industrial end-user segment, which includes heavy manufacturing, chemical production, and mining, is a massive consumer of energy. The need for renewable energy in this segment is driven by a dual imperative: economic efficiency and corporate social responsibility (CSR). Industrials are motivated to adopt renewables to reduce long-term operational costs and hedge against the volatility of fossil fuel prices. By entering into long-term PPAs, they secure a stable energy price for decades, which is a powerful financial incentive. Beyond cost, a significant demand driver is the need to meet corporate sustainability goals and reduce a company's carbon footprint. Large multinational corporations are setting ambitious net-zero targets and are demanding that their supply chain partners also decarbonize. This creates a powerful downstream demand signal, compelling industrial players to invest in on-site renewable generation or to procure green energy. The demand is not just for electricity but also for industrial process heating and cooling, which drives the adoption of technologies like solar thermal and heat pumps. The industrial segment's requirement is therefore a strategic and financial decision, directly translating into demand for both on-site and off-site renewable energy solutions.

Renewable Energy Market Geographical Analysis:

- US Market Analysis: The United States market is defined by a complex interplay of federal and state-level policies that directly impact demand. The federal Inflation Reduction Act (IRA) has emerged as a monumental catalyst, extending and expanding tax credits that lower the cost of renewable energy projects for developers and consumers. This policy has created a strong demand signal for utility-scale solar and wind projects. At the state level, various Renewable Portfolio Standards (RPS) mandate that a specific percentage of electricity be generated from renewables, creating a sustained, policy-driven demand stream. The demand landscape is also shaped by robust corporate procurement of renewable energy, with tech giants and other large corporations signing long-term Power Purchase Agreements (PPAs) to meet their decarbonization goals. This diverse demand profile, from utilities, corporations, and residential consumers, makes the US one of the most dynamic renewable energy markets globally.

- Brazil Market Analysis: Brazil's market is characterized by a strong historical reliance on hydropower, but demand is increasingly shifting towards other renewable sources, particularly wind and solar. This transition is driven by the country's need to diversify its energy mix and reduce its vulnerability to hydrological variability and drought, which have impacted its hydropower capacity. Government energy auctions, which provide a guaranteed market for new projects, are a primary driver of demand for utility-scale wind and solar installations. The country's abundant solar irradiation and high-quality wind resources, especially in the northeast, make new projects economically attractive. The demand for renewable energy is also rising in the industrial sector, particularly in states with high energy consumption and a strong focus on sustainable manufacturing practices.

- German Market Analysis: Germany stands as a mature European market, where demand is a result of long-standing, robust climate policy and a strong public commitment to the Energiewende (energy transition). The phase-out of nuclear and coal power creates an urgent and significant demand for new renewable energy capacity to fill the energy gap. The Renewable Energy Sources Act (EEG) has historically provided generous feed-in tariffs, which stimulated early demand for solar and wind. While the regulatory landscape has evolved, the commitment to renewable energy remains a core policy. The market is now driven by competitive auctions for new capacity, a growing market for rooftop solar on residential and commercial buildings, and corporate PPAs. The high penetration of renewables also creates a distinct demand for grid infrastructure upgrades and battery storage to ensure system stability.

- South African Market Analysis: South Africa's renewable energy market is driven by the urgent need to address a persistent energy crisis and overcome the limitations of its coal-dominated grid. The Integrated Resource Plan (IRP) sets ambitious targets for new renewable energy capacity, creating a clear demand signal. The market growth is also catalyzed by the private sector, as a relaxation of licensing requirements for private power generation projects has allowed businesses to develop their own renewable energy plants. This change directly increases demand for solar and wind installations in the commercial and industrial sectors. The country's abundant solar resources make it a prime location for solar PV projects, and demand is accelerating as industries seek to secure a more reliable and cost-effective power supply.

- Australian Market Analysis: Australia's renewable energy market is primarily driven by a combination of federal and state policies and the exceptional quality of its solar and wind resources. The demand for renewable energy is strong in both the utility and residential sectors. On a utility-scale, the demand is fueled by the country's renewable energy target (RET) and the need to replace aging coal-fired power plants. The market for rooftop solar on residential homes is exceptionally high, driven by consumer demand for lower electricity bills and the favorable economics of solar PV in a country with abundant sunshine. This strong residential uptake creates a separate, consistent demand stream for solar products. Additionally, there is a growing demand for large-scale energy storage projects to support the high penetration of solar and wind on the grid, particularly in states like South Australia.

List of Top Renewable Energy Companies:

The competitive landscape of the renewable energy market is defined by a mix of established utility giants and specialized renewable energy developers and equipment manufacturers. The major players compete through a combination of technological innovation, project development expertise, and strategic acquisitions. The market is increasingly consolidating as companies seek to expand their project pipelines and geographic reach. Competition is fierce, with companies vying for contracts in government auctions, securing corporate PPAs, and optimizing their supply chains to achieve cost leadership.

- NextEra Energy, Inc.: NextEra Energy is a leading US-based energy company with a significant presence in renewable energy through its subsidiary, NextEra Energy Resources. The company's strategy is centered on developing and operating a large portfolio of utility-scale solar, wind, and battery storage projects. Their competitive advantage stems from their scale and operational excellence, which allows them to leverage economies of scale and secure competitive financing for large projects. NextEra Energy’s portfolio is expansive, with a focus on long-term, contracted renewable generation that provides a stable revenue base. Their strategic positioning as a major developer and operator of renewables directly supports the demand for new capacity, particularly from utilities and large corporate clients seeking to fulfill their clean energy targets.

- Iberdrola S.A.: Iberdrola, a Spanish multinational utility, has strategically positioned itself as a global leader in the clean energy transition. The company's strategy is focused on regulated networks and renewable generation, with significant investments in offshore wind, solar, and smart grids. Iberdrola’s competitive edge is its vertically integrated business model, which spans from project development to electricity generation and transmission. This allows the company to control more of the value chain and respond to diverse market requirements. The company is actively expanding its presence in key markets, including the US, Brazil, and the UK, by acquiring and developing new renewable assets. Their strategic focus on networks and renewables makes them a key player in enabling the broader energy transition.

- Vestas Wind Systems A/S: Vestas is a Danish company and a global leader in the design, manufacturing, installation, and servicing of wind turbines. The company's competitive strategy is focused on technological innovation, producing increasingly larger and more efficient turbines for both onshore and offshore applications. Vestas's product portfolio, which includes the V236-15.0 MW turbine, is designed to reduce the cost of energy for its customers. Their business model is centered on providing the core hardware for wind power projects, and their success is directly tied to the global demand for new wind energy capacity. The company's extensive service network also provides a critical source of revenue and a key differentiator in a competitive market.

Renewable Energy Market Recent Developments:

- December 2025: TotalEnergies signed a 21-year Power Purchase Agreement (PPA) with Google to supply 1 TWh of certified renewable electricity from its Citra Energies solar plant in Malaysia, supporting Google’s data center operations.

- December 2025: Iberdrola and Microsoft expanded their global renewable partnership, signing two long-term PPAs totaling 150 MW from Spanish wind farms, leveraging AI solutions and cloud integration.

- December 2025: Orsted sold a 55% stake in the Greater Changhua 2 offshore wind farm in Taiwan to Cathay, reinforcing capital structure and renewable asset deployment amid 2025 clean energy market activity.

- November 2025: TotalEnergies agreed on a 10-year contract to supply 610 GWh of renewable electricity annually to Data4’s data center campuses in Spain, strengthening its clean power portfolio.

- October 2025: Enel and Masdar completed their partnership for 446 MW of photovoltaic plants operating in Spain, adding significant solar capacity to their renewable energy portfolios.

Renewable Energy Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Renewable Energy Market Size in 2025 | USD 1.170 trillion |

| Renewable Energy Market Size in 2030 | USD 1.658 trillion |

| Growth Rate | CAGR of 7.22% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Tillion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Renewable Energy Market |

|

| Customization Scope | Free report customization with purchase |

Renewable Energy Market Segmentation:

- By Technology

- Hydropower

- Wind Power

- Solar Energy

- Bioenergy

- Geothermal Energy

- Ocean Energy

- By Application

- Electricity Generation

- Heating

- Transportation

- Cooling

- Industrial Processes

- By End-User

- Residential

- Commercial

- Industrial

- Utilities

- By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America