Report Overview

Automotive Logistics Market Size, Highlights

Automotive Logistics Market Size:

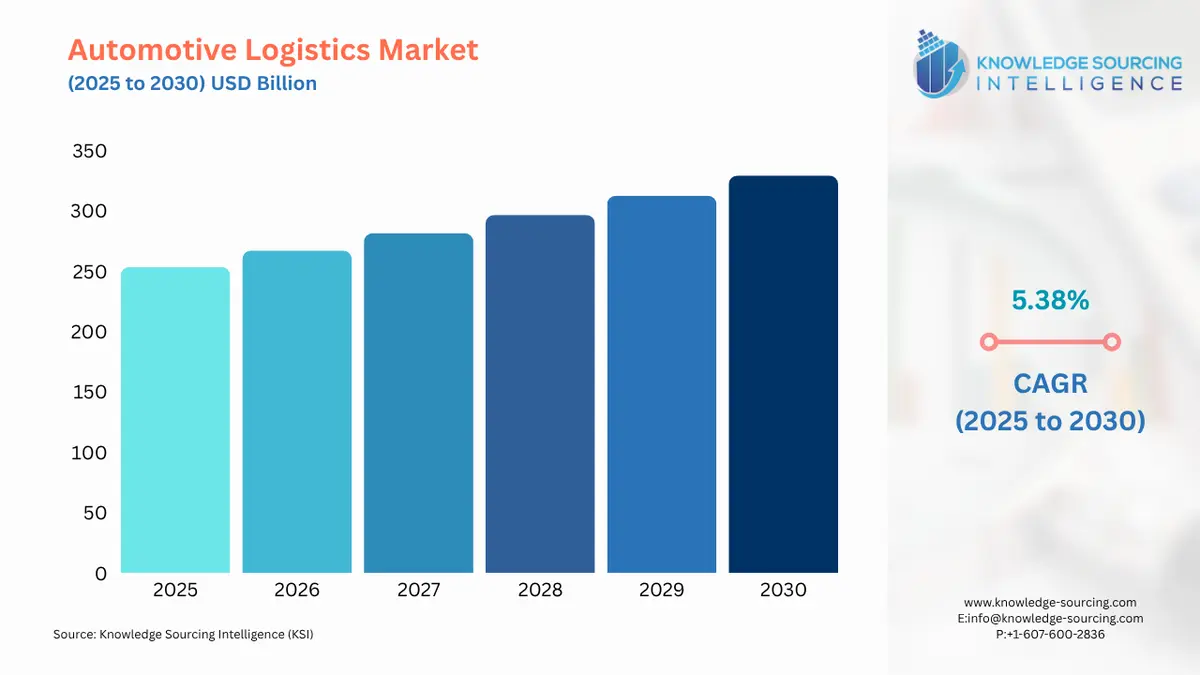

The Automotive Logistics Market is expected to grow at a CAGR of 5.38%, reaching USD 329.338 billion in 2030 from USD 253.470 billion in 2025.

The automotive logistics market is an essential component of the global automotive industry, facilitating the complex movement of raw materials, components, and finished vehicles across a vast network of suppliers, manufacturers, and dealerships. This sector is characterized by its arduous requirements for precision, speed, and reliability, as it directly supports the just-in-time and just-in-sequence manufacturing processes that define modern vehicle production. The market's evolution is intrinsically tied to the automotive industry's own transformations, including the shift toward electric and autonomous vehicles, the globalization of production networks, and the increasing focus on supply chain resilience.

Automotive Logistics Market Analysis:

- Growth Drivers

The automotive logistics services market is a direct consequence of the automotive industry's operational model and its global expansion. A primary driver is the growth and diversification of global automotive production networks. As vehicle manufacturers establish assembly plants in new regions to access local markets and reduce costs, they create an immediate and sustained demand for both inbound and outbound logistics. Inbound logistics services are critical for ensuring that thousands of components from a multi-tiered supplier base arrive at assembly lines precisely when needed to support lean manufacturing. This just-in-time model makes logistics a non-negotiable operational imperative. For instance, the expansion of production hubs in Southeast Asia and Latin America directly increases the demand for cross-border transportation, warehousing, and customs brokerage services.

The accelerating transition to electric vehicles (EVs) is another powerful catalyst for demand. EVs introduce new logistical complexities that traditional internal combustion engine (ICE) vehicles do not, particularly concerning the transport and handling of high-voltage batteries. These batteries are large, heavy, and require specialized handling, temperature control, and compliance with stringent safety regulations for transport. The movement of these sensitive components from cell manufacturers to battery pack assemblers and then to vehicle production lines creates a new, high-value demand stream for specialized logistics services. Furthermore, the global expansion of the aftermarket for vehicle parts is a significant and growing driver. The immense and aging global vehicle fleet generates a consistent need for replacement parts. The rise of e-commerce in the auto parts sector, which allows consumers and independent repair shops to order parts online, creates a direct demand for last-mile and parcel delivery services for a diverse range of components, from brake pads to complex electronic control units.

- Challenges and Opportunities

The automotive logistics market is navigating significant challenges that are simultaneously creating new avenues for growth and innovation. The most immediate challenge is supply chain volatility, which has been highlighted by recent component shortages, particularly of semiconductors. These disruptions can stall entire assembly lines and create a backlog of partially completed vehicles, leading to a complete breakdown of just-in-time logistics. This challenge places a premium on logistics providers that can offer enhanced supply chain visibility, risk management, and alternative routing solutions. It has also compelled vehicle manufacturers to rethink their dependency on single sourcing and to invest in more agile, diversified supplier networks, thereby generating new demand for logistics services that can manage a wider range of global and regional partners.

This volatility, however, presents a clear opportunity for companies that can leverage technology to offer a higher level of service. The market is seeing an increased demand for real-time tracking, data management, and predictive analytics. These technologies allow logistics providers to anticipate and mitigate disruptions, optimize routes, and manage inventory more efficiently. This shift transforms logistics from a simple transportation service into a technology-enabled, value-added service. The imperative to achieve sustainability and reduce carbon emissions also creates opportunities. Regulations and corporate commitments are compelling manufacturers to innovate more environmentally friendly logistics solutions. This is driving demand for services that utilize alternative fuels, optimize routing to reduce mileage, and create a more efficient, less carbon-intensive supply chain. Companies that can demonstrate a clear path to lower emissions are gaining a competitive advantage and capturing new business.

- Supply Chain Analysis

The automotive logistics supply chain is a multi-tiered, global ecosystem. The chain begins with the procurement of raw materials such as steel, plastics, and rubber from Tier 3 and Tier 4 suppliers. These materials are then transformed into components and sub-assemblies by Tier 2 and Tier 1 suppliers, which may be located anywhere in the world. The role of logistics here is to manage the complex flow of these components to vehicle manufacturing plants. This inbound logistics segment is defined by strict scheduling and sequencing requirements, where the failure of a single delivery can halt production. Key production hubs are concentrated in major vehicle manufacturing countries, including China, the US, Germany, and Japan, which are supported by a dense network of suppliers.

Outbound logistics, the movement of finished vehicles from assembly plants to dealerships and consumers, presents its own set of complexities. This segment requires specialized transport modes, such as car carriers (for road), rail wagons, and specialized roll-on/roll-off (Ro-Ro) vessels for sea transport. The global distribution network is a dependency of both the manufacturing hubs and consumer markets, with ports and rail yards serving as critical transshipment points. The supply chain is also increasingly dealing with the challenge of reverse logistics, the management of end-of-life products like vehicle parts and EV batteries for recycling or disposal. This creates a new logistics flow in the reverse direction, requiring specialized handling and compliance with environmental regulations.

- Government Regulations

Government regulations across the globe are directly shaping demand within the automotive logistics market, primarily by influencing production and trade flows and setting standards for environmental performance. These regulations can create new logistics requirements and alter established supply chains.

- United States: Environmental Protection Agency (EPA) Emissions and Corporate Average Fuel Economy (CAFE) Standards, National Highway Traffic Safety Administration (NHTSA)

These regulations mandate higher fuel efficiency and lower emissions, which directly influence vehicle design by compelling manufacturers to use lighter materials and to produce more EVs. This creates an increased demand for specialized logistics for components like batteries and for the transport of lighter vehicles. The NHTSA's safety standards also impact logistics by requiring specific handling and tracking of safety-critical components and finished vehicles. - European Union: The European Green Deal, Vehicle Emission Standards, and End-of-Life Vehicle (ELV) Directive

The Green Deal's ambitious climate targets and the ELV Directive create direct demand for logistics services that support a circular economy. The ELV directive mandates the recycling and reuse of a high percentage of vehicle components by weight, which generates a new, regulated flow of parts and materials through the reverse logistics channel. Vehicle emission standards also incentivize the production of low-emission and electric vehicles, thereby increasing the demand for EV-specific logistics. - China: "Made in China 2025" and New Energy Vehicle (NEV) Mandates

The "Made in China 2025" initiative aims to build a robust domestic automotive industry, shifting production from a low-cost manufacturing hub to a high-value industrial powerhouse. This policy directly increases demand for complex, high-precision inbound logistics to support local manufacturing. The NEV mandates compel automakers to produce a certain percentage of EVs, creating a surge in demand for the specialized logistics required to transport batteries and electric components within the country.

Automotive Logistics Market Segment Analysis:

- By Service: Outbound Logistics

Outbound logistics represents a critical and high-value segment of the automotive logistics market, encompassing the movement of finished vehicles from manufacturing plants to dealerships and end-users. New vehicle sales and the geographic dispersion of production and consumption directly drive the necessity of outbound logistics. As global vehicle production increases, so does the volume of finished vehicles that need to be transported. The market's growth is highly sensitive to production schedules and consumer sales cycles. This segment is characterized by a need for specialized and high-capacity assets, including Ro-Ro vessels for international maritime transport and dedicated rail and road carriers for domestic distribution. The rise of multi-modal transportation solutions is a key driver within this segment, as manufacturers seek to optimize costs and delivery times by combining sea, rail, and road transport. The shift toward electrification further shapes demand, as logistics providers must adapt their fleets and handling procedures to accommodate the transport of EVs, including managing charging infrastructure at terminals and yards. The growth of direct-to-consumer sales models by some automakers is also creating new demand for specialized last-mile delivery services for finished vehicles, bypassing the traditional dealership model.

- By Vehicle Type: Electric Vehicles

The emergence of electric vehicles (EVs) as a major vehicle type has fundamentally reshaped demand within the automotive logistics market. The unique characteristics of EVs and their components create a distinct set of logistics requirements that drive demand for specialized services. The most significant of these is the transport of lithium-ion batteries. These batteries are classified as hazardous materials and are subject to stringent regulations regarding packaging, handling, and transportation. This regulatory environment creates a clear demand for logistics providers with certified expertise and dedicated infrastructure, including temperature-controlled warehouses and specially equipped transport vehicles. The demand for reverse logistics for EVs is also a growing segment. As the first generation of EVs reaches end-of-life, there is a new imperative to collect, diagnose, and transport batteries for recycling or second-life applications. This creates a new, complex logistics flow that did not exist for ICE vehicles. The EV logistics sector is also propelled by the need for a global supply chain for raw materials like lithium and cobalt, which are often sourced from politically sensitive regions, thereby increasing the demand for resilient and transparent logistics management.

Automotive Logistics Market Geographical Analysis:

- US Market Analysis: The US automotive logistics market is one of the largest and most complex globally. A combination of domestic manufacturing and a vast consumer market drives its expansion. The presence of numerous assembly plants, both for domestic brands and foreign OEMs, generates significant inbound and outbound logistics flows. A key local factor influencing demand is the country's extensive rail and road network, which enables efficient cross-continental transport of finished vehicles and components. However, this also creates logistical challenges, such as congestion and the need for seamless intermodal transfers. The growth of the electric vehicle market, particularly the expansion of EV manufacturing facilities in the southern and midwestern states, is a primary catalyst for demand for new logistics infrastructure and services. The US market is also a significant hub for aftermarket parts distribution, with a massive fleet of aging vehicles creating consistent demand for a robust logistics network to serve repair shops and e-commerce customers.

- Brazil Market Analysis: Brazil's automotive logistics market is the largest in South America, with demand tied to its role as a regional manufacturing and export hub. The market is primarily fueled by the country's domestic vehicle production and consumption. Its specific challenges and growth drivers are linked to its geographical vastness and infrastructural constraints. The dominance of road transport due to a limited rail network and port congestion presents logistical complexities that increase costs and transit times. However, this also creates a consistent demand for efficient and reliable road freight services. The market's demand is sensitive to economic conditions and political stability, which directly impact consumer purchasing power and, by extension, new vehicle sales. As Brazil’s automotive industry matures, there is an increasing demand for more advanced logistics services that can support more complex supply chains and enhance efficiency to remain competitive.

- Germany Market Analysis: The German automotive logistics market is a European powerhouse, reflecting the country's status as a global leader in automotive manufacturing and engineering. The market is highly sophisticated and driven by a strong focus on high-performance vehicles and complex supply chains. The market is characterized by a high degree of integration between OEMs and logistics providers, with a strong emphasis on just-in-sequence delivery and value-added services. The country's extensive and highly efficient rail network is a key growth driver for the inter-European transport of components and finished vehicles. German environmental regulations are a significant local factor, pushing demand for sustainable logistics solutions, including electric trucks and optimized routing. The logistics infrastructure in Germany is also highly developed to support the complex after-sales market, with a focus on quick and reliable parts distribution to a dense network of dealerships and independent repair shops.

- Saudi Arabia Market Analysis: Saudi Arabia's automotive logistics market is emerging as a critical component of its economic diversification under the Vision 2030 initiative. The market is driven by a combination of domestic consumption and the country’s ambition to become a regional manufacturing and export hub. The market's expansion is currently dominated by inbound and outbound logistics for finished vehicles, which are primarily imported. However, the government's plans to build new automotive manufacturing plants, such as the Ceer joint venture, are creating new, high-growth demand for complex inbound logistics to support local production. The country's strategic location in the Middle East and its investments in port infrastructure, like DP World's expansion at Jebel Ali, are positioning it as a transshipment hub, thereby increasing demand for international and regional logistics services. The market's growth is tied to the success of these long-term industrialization plans, which will create a sustained demand for a fully integrated automotive supply chain.

- Japan Market Analysis: Japan's automotive logistics market is defined by an extreme focus on efficiency, precision, and a lean manufacturing model. The market expansion is rooted in the country's globally dominant automotive manufacturing base and a highly integrated, multi-tiered supplier network. The logistics ecosystem is designed to support a just-in-time production system, where components are delivered in small, frequent shipments. This creates a high and constant demand for meticulous and reliable inbound logistics. A local factor driving demand is the country's advanced technological infrastructure, which enables the widespread adoption of automation and data management tools in logistics. This pushes demand toward logistics providers that can offer sophisticated, technology-enabled services. Furthermore, the Japanese market is a leader in hybrid and electric vehicle technology, creating a demand for specialized logistics for batteries and other advanced components. The country’s stringent quality control standards also place a high demand on logistics services to ensure the integrity of parts and finished vehicles throughout the supply chain.

Automotive Logistics Market Competitive Analysis:

The global automotive logistics market is highly fragmented but led by a group of large, multinational third-party logistics (3PL) providers. Competition is based on a combination of global reach, technological capability, and the ability to offer a full suite of services across the entire automotive value chain.

- Kuehne + Nagel: A major global logistics provider with a strong presence in the automotive sector. Kuehne + Nagel's strategic positioning is based on its extensive global network, which enables it to manage complex, multi-modal supply chains for OEMs. The company has invested in digital platforms and data analytics to offer enhanced visibility and efficiency. Its recent collaborations and capacity additions, such as the new logistics center in Quito, Ecuador, and an expanded partnership with Airbus in Spain, demonstrate a clear strategy of expanding its geographic footprint and serving the specific needs of major industrial clients. The company is actively focusing on sustainability and the digital transformation of its services.

- Ryder System, Inc.: A significant player in the North American market, specializing in fleet management, dedicated transportation, and supply chain solutions. Ryder's competitive advantage lies in its asset-based model and its ability to provide comprehensive, end-to-end logistics solutions, particularly for finished vehicles and aftermarket parts. The company's strategic focus is on leveraging technology to enhance its services, as evidenced by its e-commerce studies, which inform clients on how to optimize their supply chains to meet evolving consumer demands. Ryder's offerings, which include contract packaging and last-mile delivery, position it to capture demand from the growing e-commerce segment of the automotive aftermarket.

- Dachser SE: A German-based logistics provider with a strong European presence and a growing global network. Dachser's strategic positioning is rooted in its highly integrated European road logistics network and its focus on industrial and consumer goods. The company's recent acquisition and integration of acquired businesses demonstrate a strategy of expanding its service portfolio and geographic reach. Dachser is actively investing in sustainable solutions, such as the deployment of new electric trucks, which aligns with the demand from European OEMs for green logistics. The company's "Retail Box" reusable packaging solution is an example of its focus on providing innovative solutions that address specific industry needs and environmental concerns.

Automotive Logistics Market Developments:

- September 2025: CEVA Logistics launched a new reverse logistics solution for electric vehicle (EV) batteries, which includes transport, storage, and processing of end-of-life batteries. The service, which will be supported by a network of dedicated logistics centers, is designed to help automakers manage the circular value chain for EV batteries. This development directly addresses the growing demand for specialized logistics services for EV components.

- August 2025: DP World announced a major capacity expansion at its Jebel Ali port in Dubai, adding a new storage yard and a dedicated quay for roll-on/roll-off (Ro-Ro) vessels. This capacity addition is a direct response to the rising demand for vehicle imports and transshipment in the Middle East and Africa and strengthens the port's role as a regional automotive hub.

- April 2025: DSV acquired DB Schenker for $14.3 billion, a move that created a larger, more powerful logistics platform. The acquisition directly impacts the competitive landscape by consolidating two major players and creating an entity with a broader global network and multimodal service offerings. This merger is a strategic response to the increasing demand for end-to-end supply chain management solutions from OEMs.

Automotive Logistics Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Logistics Market Size in 2025 | USD 253.470 billion |

| Automotive Logistics Market Size in 2030 | USD 329.338 billion |

| Growth Rate | CAGR of 5.38% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Logistics Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Logistics Market Segmentation:

- By Service

- Inbound Logistics

- Outbound Logistics

- Aftermarket Logistics

- Reverse Logistics

- By Technology

- Fleet Management

- Warehouse Management

- Freight Management

- Data Management and Analysis

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Electric Vehicles

- By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa