Report Overview

Automotive Radar Market Report, Highlights

Automotive Radar Market Size:

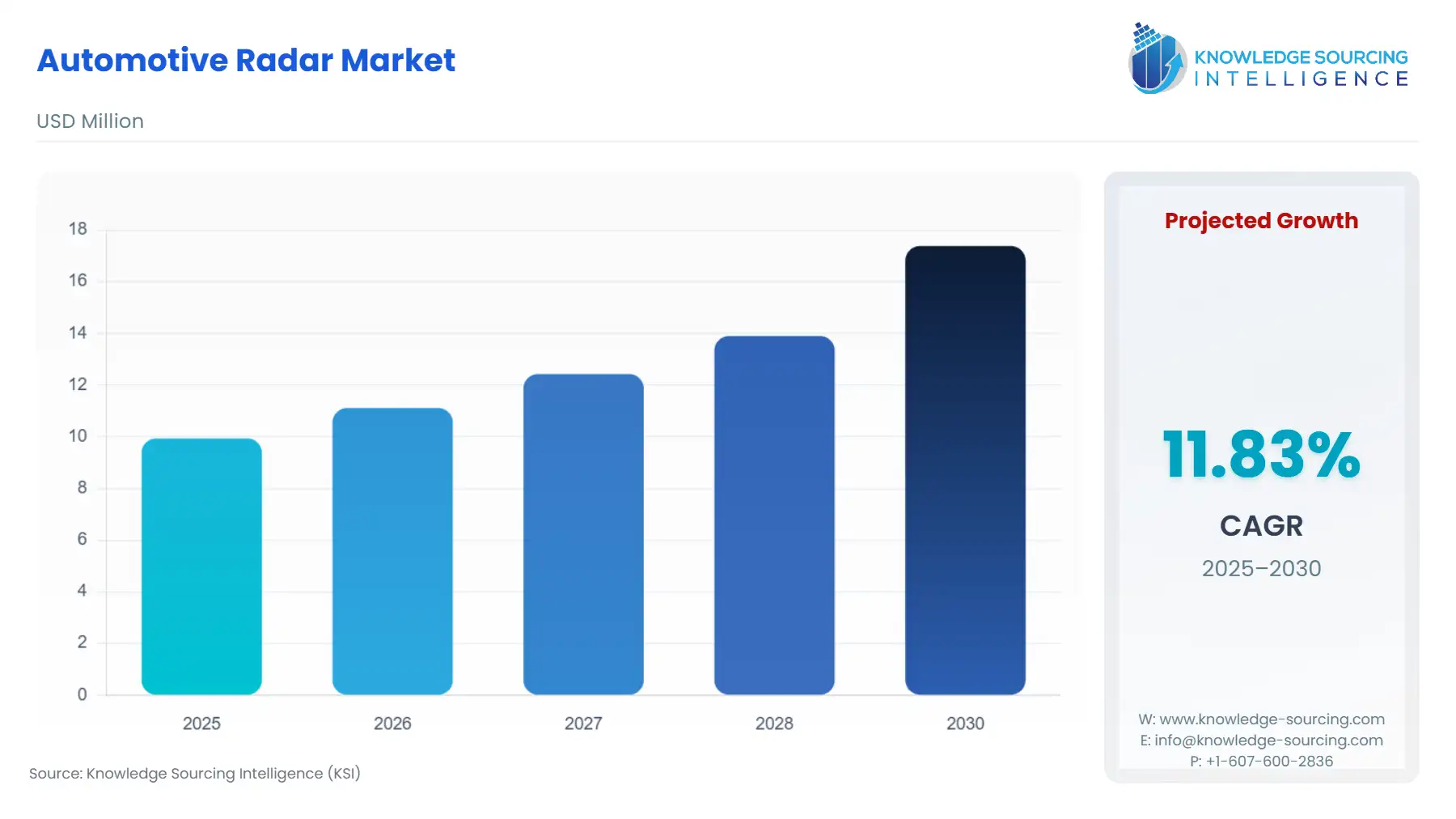

The automotive radar market is expected to increase at a CAGR of 11.83% during the forecasted period and is accounted for US$9.940 million in 2025, which is predicted to grow to US$17.388 million in 2030.

Automotive Radar Market Trends:

The automotive radar market is witnessing growth due to rising technological innovation in these radar sensors and the increasing requirement for autonomous vehicle sensor systems in vehicles. This is also attributed to consumer demand for safety and convenience, which is integrated into vehicles and fuelling the adoption of these radars. Governments and regulatory bodies are emphasizing road safety by implementing stringent safety regulations and standards, leading automakers to integrate safety features, and contributing to the rising demand for radars globally during the forecasted period.

Automotive Radar Market Overview & Scope:

The automotive radar market is segmented by:

- Range: The short radar range segment is expected to dominate the range segment, primarily due to its application in ADAS features such as blind spot detections, parking assistance, and lane change assistance, among others, which are rising in popularity among consumers purchasing the latest vehicles to increase their convenience and safety. The rise in urbanization and congestion in cities is also increasing this segment’s expansion, as demand for precise detection of surrounding objects at low speed is required.

- Application: The Adaptive Cruise Control holds a significant market share due to regulatory standards for safety, like NHTSA and Euro NCAP requirements. These standards demand safety, and the adaptive cruise control works in maintaining a safe distance among vehicles, increasing its integration in new vehicles, and contributing to the segment's growth.

- Vehicle type: The passenger vehicle segment is predicted to be the major contributing segment for the automotive radar market. This is due to its largest sales and production globally, and increased adoption of ADAS features contributing to the rise in the necessity of these radars.

- Region: The Asia-Pacific region is predicted to hold a growing automotive radar market due to a rising domestic manufacturing of automotive vehicles, with changing consumer preferences for the adoption of autonomous vehicle features.

Top Trends Shaping the Automotive Radar Market:

1. Integration of Radar Sensor with Cameras and LiDAR

- The incorporation of the radar sensor with LiDAR and camera systems is growing to increase the vehicle's perceptivity and enhance the vehicle's performance in diverse environments.

2. Miniaturization and Cost Reduction

- There is a growing trend witnessed in the miniaturization of diverse products installed in vehicles, such as semiconductors, which is leading to a decrease in the size of radars, along with reducing the manufacturing cost of radar manufacturing and development.

Automotive Radar Market Growth Drivers vs. Challenges:

Drivers:

- Rising Demand for Advanced Driver Assistance Systems (ADAS): The shift in consumer preferences towards automotive safety and comfort features such as automotive emergency braking, blind spot detection, adaptive cruise control, and lane keeping assistance is contributing to increased radar demand to meet this demand. These ADAS demand the presence of radar for successfully implementing these functions, like collision avoidance and precise object detection in vehicles. For instance, in January 2024, NXP Semiconductors announced the extension of its 28 nm RFCMOS radar one-chip products for providing software-based vehicles with the feature of ADAS architectures. The radar one-chip works by distributing the radar frequency, leading to a smooth change from smart to streamlined sensors.

- Growth of Electric Vehicles (EVs): There has been a rise in the adoption of EVs among consumers across the globe due to rising environmental concerns, stringent government policies, and tax exemptions for these vehicles. Presently, the growing trend of automation in vehicles is leading to the adoption of autonomous features in EVs, as they are sustainable and rising in demand. This will lead to an increase in automotive radars for real-time navigation and obstacle detection, which is extremely convenient in low-visibility surroundings. According to International Energy Agency (IEA) data, the electric car sales accounted for about 17 million in 2024, which was reportedly valued at 14 million in 2023. This was an increase of more than twenty percent annually in new purchases of electric vehicles. This is predicted to increase the requirement for radars.

Challenges:

- High Costs- The advancement of automotive radar development proves that its integration and final installation process are highly costly. Majorly, the increase in innovation, like high-resolution 4D radars, makes these more expensive. With the rise in vehicle prices, integrating these radars becomes difficult in mid-range vehicles due to limited budget, which could hamper the market growth.

Automotive Radar Market Regional Analysis:

- North America: The region is predicted to hold a major market share due to the increasing adoption of ADAS systems in countries like the USA and Canada, which is expected to propel radar demand. The presence of major automotive companies such as Tesla and General Motors leads to an increase in demand for advanced radar systems for their autonomous vehicles. The region's strict safety regulations, such as those of the National Highway Traffic Safety Administration (NHTSA), encourage technology integration for the protection of pedestrians and collision avoidance, which can lead to an increase in automakers adopting the integration of automotive radar in vehicles for safety features.

Automotive Radar Market Competitive Landscape:

The market is fragmented, with many notable players, including Continental AG, Robert Bosch GmbH, Texas Instruments Incorporated, NXP Semiconductors, Infineon Technologies AG, STMicroelectronics, Rohde & Schwarz, Indie, S.M.S. Smart Microwave Sensors GmbH, Analog Devices, Inc, Uhnder, Inc., OMNIVISION, among others.

- Product Launch: In May 2025, Indie Semiconductor, a provider of automotive solutions, partnered with GlobalFoundries to create a high-performance and advanced radar system on chip for ADAS and other industrial applications. They are produced on the GF’s 22 FDX platform and are manufactured to target the diverse frequency range with the lowest footprint generation. The global vehicle safety regulation for assessing new cars and rising consumer demand for convenience applications in vehicles support this partnership.

Automotive Radar Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Automotive Radar Market Size in 2025 | US$9.940 million |

| Automotive Radar Market Size in 2030 | US$17.388 million |

| Growth Rate | CAGR of 11.83% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in the Automotive Radar Market |

|

| Customization Scope | Free report customization with purchase |

Automotive Radar Market Segmentation:

By Range

By Application

- Adaptive Cruise Control

- Intelligent Park Assist

- Autonomous Emergency Braking

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Others