Report Overview

Automotive Rain Sensor Market Highlights

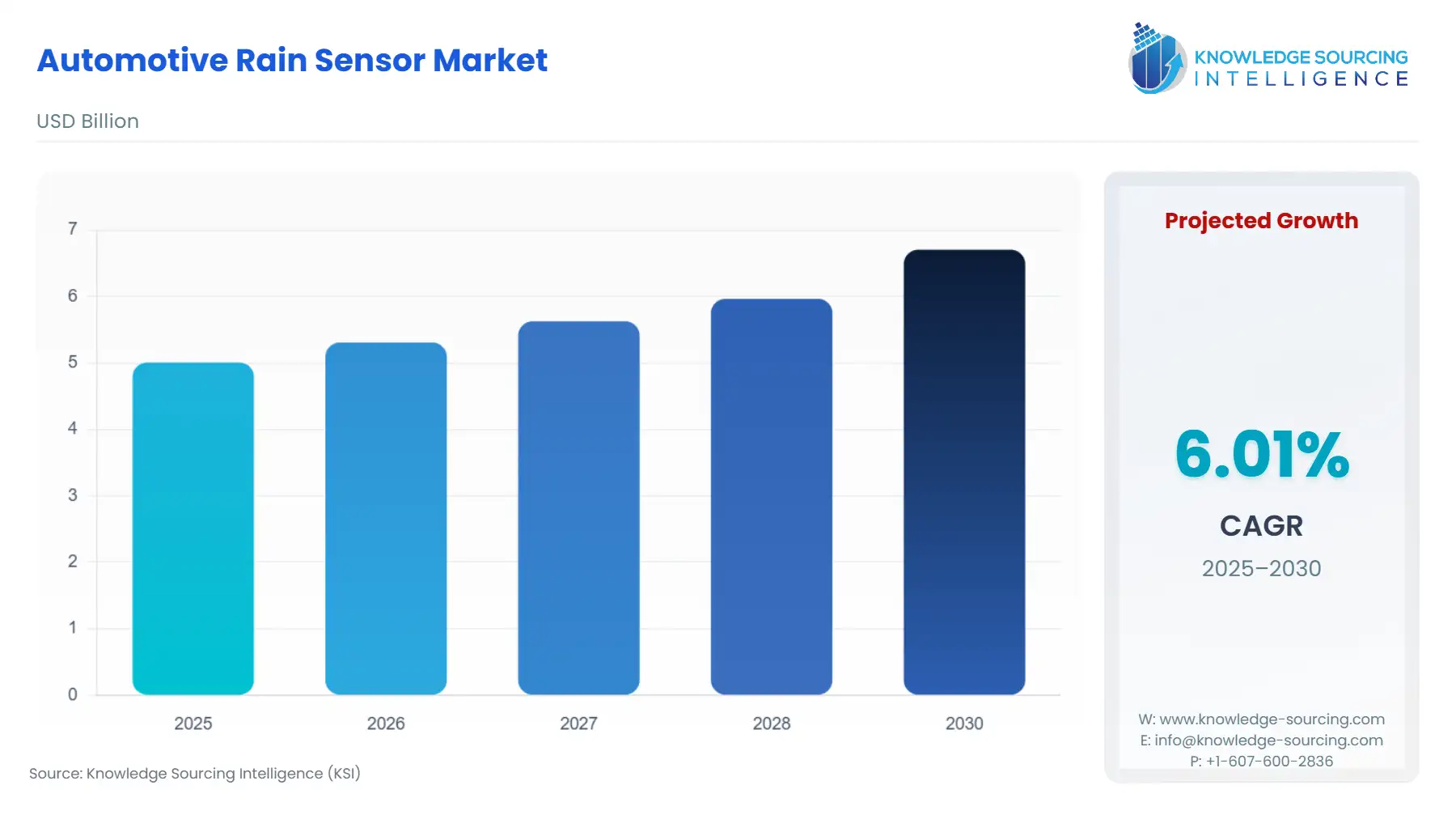

Automotive Rain Sensor Market Size:

The automotive rain sensor market is expected to grow from USD 5.008 billion in 2025 to USD 6.706 billion in 2030, at a CAGR of 6.01%.

Automotive rain sensors are devices that automatically detect the presence of raindrops on the windshield of a vehicle and prompt it to turn on the wipers automatically. Depending on the level of rain, the device also controls the speed of the wipers. Wiping the windscreen automatically improves the visibility of the driver instantly. It also allowed the driver to focus on driving by saving the time and effort of manually engaging the wipers. Thus, assuring the driver's safety and convenience.

Automotive Rain Sensor Market Trends:

The key factor contributing to the automotive rain sensor market is the increasing automation of the automobile. Further, the growing Original Equipment Manufacturer (OEM) market is contributing significantly to the automotive rain sensor. The increasing demand for electric vehicles EVs and eco-friendly cars, is expected to positively impact the automotive rain sensor market due to rising awareness and preventive steps toward climate change. However, the market is specific to areas prone to rainfall. Further, the overall cost of the vehicle increases with the integration of inbuilt sensors like automatic rain sensors. Regions like North America and Europe have a major market share due to strict regulation. However, the Asia Pacific region is expected to witness substantial growth due to the growing population and rising disposable income.

Automotive Rain Sensor Market Growth Factor:

The rise in the use of electric vehicles and eco-friendly vehicles With the rising concern for the environment and climate change, the demand for electric vehicles and eco-friendly vehicles has increased significantly. This increase in demand is expected to positively impact the automatic rain sensor market. Many nations, especially in the region of Europe and North America, are systematically imposing a ban on the use of fossil-fueled cars. For instance, Britain has set a target to become net-zero emissions by the year 2050. The country has further imposed a ban on the sales of new petrol and diesel cars and vans from 2030. Furthermore, the European Union has imposed a ban on new petrol and diesel cars from the year 2035. In the United States of America, the state of California proposes to ban new gasoline-powered passenger cars and trucks from 2035. With nations becoming more stringent toward global warming and climate change, eco-friendly vehicles are expected to drive the automotive rain sensor market.

- The growing OEM market

OEM, or original equipment manufacturer, is a company that manufactures and sells parts or components that are used in the final product of other companies. Various companies produce automotive rain sensors based on the requirements of automotive companies. Automotive OEMs are expected to have a positive impact on the rising demand for electric vehicles EVs and eco-friendly vehicles. Although recently, since 2018, the OEM sector has been plunging due to rising concerns by various nations about global warming and climate change, stringent actions taken are expected to curb the growth. Besides this, rising disposable income, better infrastructure, and low-cost vehicles have promoted consumer preferences for personal transport. Further, increasing automation in the automobile industry and innovative startups for car rental have contributed to the OEM market.

Automotive Rain Sensor Market Restraint:

- Specific to the areas prone to rainfall

Despite this fact, some countries recommend having an automotive rain sensor due to heavy rainfall. But there are regions where one might not need it at all. The Middle East and North Africa are regions that have a really low level of rainfall. Some countries, like Qatar, Saudi Arabia, UAE, Kuwait, and Egypt, have a really low level of precipitation, which diminishes the requirement for automatic rain sensors.

Automotive Rain Sensors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 5.008 billion |

| Total Market Size in 2031 | USD 6.706 billion |

| Growth Rate | 6.01% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Installation Type, Vehicle Type, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Rain Sensors Market Segmentation:

- By Installation Type

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

- North America