Report Overview

Global Infrared Motion Sensor Highlights

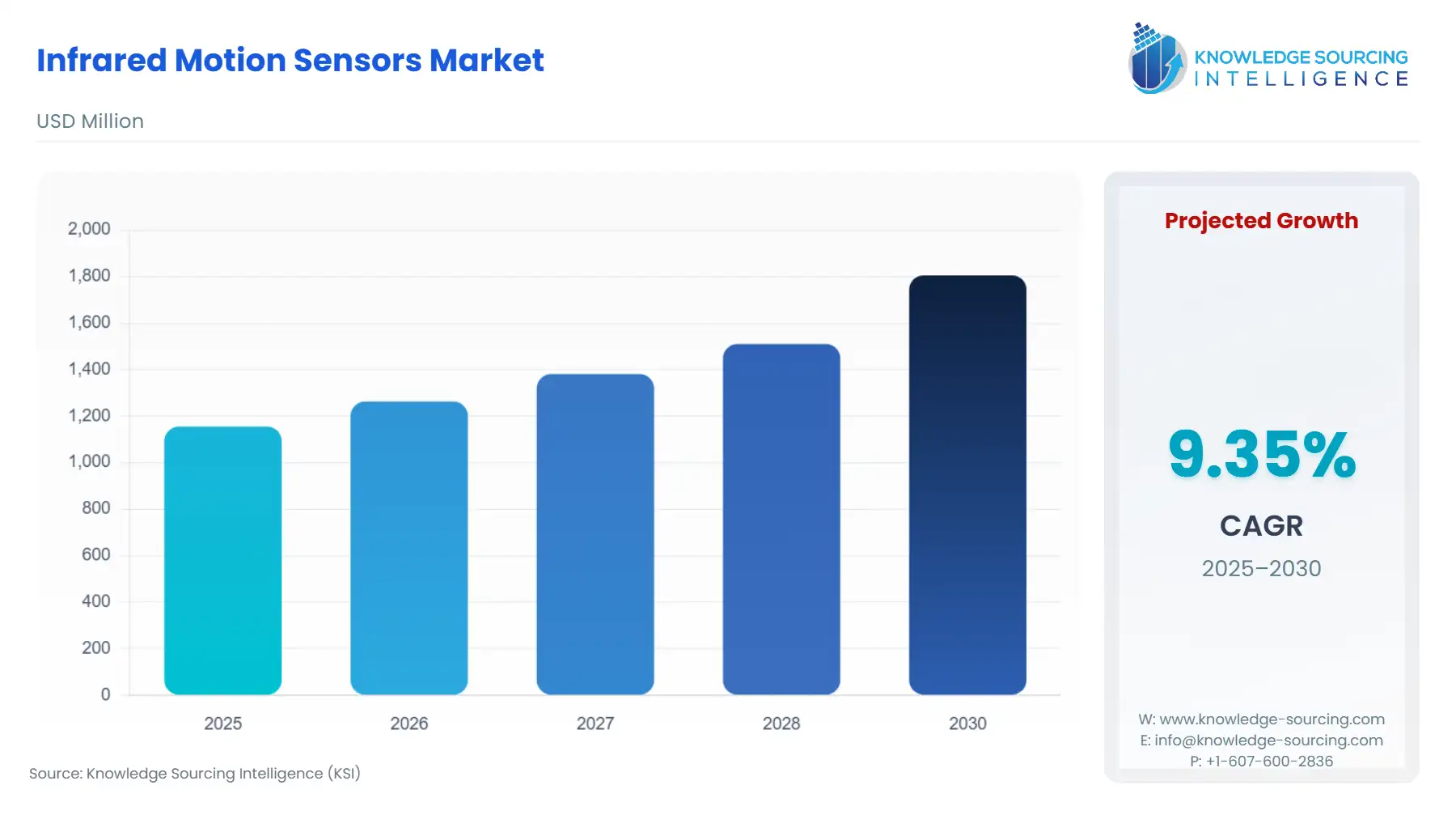

Infrared Motion Sensor Market Size:

The Infrared Motion Sensors Market is expected to grow from US$1,155.119 million in 2025 to US$1,806.049 million in 2030, at a CAGR of 9.35%.

Global Infrared Motion Sensors Market Analysis:

- Growth Drivers

Three verifiable forces create direct, measurable demand. First, building energy codes and standards that require automated lighting and HVAC controls increase procurement of occupancy sensors in commercial and institutional construction. Second, the IoT/Smart-Home shift raises demand for miniature, low-power digital PIR and thermopile modules that enable battery-operated devices and edge processing. Third, substitution of microwave and ultrasonic detectors with infrared sensors in privacy-sensitive indoor applications pushes commercial retrofit cycles. Each driver translates to concrete unit demand: code-driven specification (commercial projects), product redesign wins (consumer IoT devices), and replacement cycles where infrared sensors offer privacy or power-consumption advantages.

- Challenges and Opportunities

U.S. tariff actions on imported electronic components—particularly those subject to Section 301 duties on goods originating from China—continue to influence sourcing decisions for infrared motion sensors and their subassemblies. The Office of the United States Trade Representative (USTR) has maintained several tariff lines covering electronic circuits, sensors, and related assemblies, which can elevate the landed cost of PIR modules, thermopile detectors, and optical plastics when sourced from Chinese factories. These duties shift procurement behaviour toward tariff-exempt supply bases in Southeast Asia or Mexico, altering OEM purchasing patterns and lead-time planning. The resulting cost differentials encourage U.S. commercial and residential device manufacturers to pursue redesigns that consolidate components or adopt domestically stocked sensor modules, generating incremental demand for suppliers with North American distribution and tariff-compliant sourcing pathways.

Primary headwinds include semiconductor foundry capacity variability for MEMS and CMOS imaging elements, and certification delays across major markets (EU/US/China) that affect time-to-market. Price pressure on commodity optical elements and Fresnel lenses compresses margins for low-end PIR modules. Opportunities lie in system-level integration: sensors with embedded digital interfaces and wake-interrupt functions reduce BOM and enable direct MCU interfaces—this increases demand from OEMs seeking simplified integration. Second, energy-efficiency mandates in building codes provide a predictable specification channel for sensors. Third, expanding use of thermopile/MEMS IR detectors for stationary-object detection opens new commercial and industrial use cases beyond classic motion detection.

- Raw Material and Pricing Analysis

Infrared motion sensors depend on three classes of materials: (1) pyroelectric films (PVDF and PZT variants) or thermopile/thermoelectric stacks for infrared detection; (2) MEMS-compatible silicon, silicon-nitride and thin-film metallization used in thermopile micromachining; (3) optical elements (Fresnel lenses — acrylic/polycarbonate) and small metallic housings. Price volatility in specialty polymers (PVDF) and wafer-level MEMS processing capacity affects unit cost more than commodity passive parts. Increasing integration (digital SMD PIRs with on-chip ADCs) partially offsets raw-material inflation by lowering total BOM and assembly cost, but suppliers face capital intensity when scaling MEMS wafer runs.

- Supply Chain Analysis

Production splits along discrete semiconductor/MEMS wafer fabs, optical-component moulders, and EMS assembly houses. Key fabrication hubs are East Asia for MEMS and optics, and Europe for value-added imaging and CMOS sensor processing. Logistics complexity centers on small-part traceability, lead times for custom Fresnel tooling, and intermittent wafer slot availability at specialist MEMS fabs. Dependence on regional certification labs (local testing requirements for China/INMETRO, EU/CE) adds time and inventory buffers. Vertical integration (in-house MEMS or proprietary wafer contracts) materially reduces lead-time exposure and is a competitive differentiator for firms winning large commercial retrofit projects.

Infrared Motion Sensors Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

FCC Equipment Authorization (47 CFR Part 15) |

RF-enabled infrared motion products (wireless occupancy sensors, microwave hybrids) must meet FCC equipment authorization; compliance requirements increase design lead time for wireless variants and push OEMs to use pre-certified RF modules. |

|

European Union |

RoHS / Waste & Electronic Equipment rules (European Commission) |

RoHS substance restrictions require material selection and may limit certain legacy components (e.g., leaded finishes) — drives demand for RoHS-compliant sensors and can increase qualification testing for suppliers. |

|

China |

China Compulsory Certification (CNCA / CQC; CCC) |

Mandatory product certification and local test requirements create market access steps and can extend approval timelines; manufacturers often hold regional inventory or local representation to meet CCC rules. |

Infrared Motion Sensors Market Segment Analysis

- Passive Infrared Sensors (By Type) — Detailed analysis

Passive infrared (PIR) sensors remain the default architecture for cost-sensitive occupancy and lighting control. Their principal demand driver is energy-management specification: building standards require automatic lighting reduction and vacancy sensing in specific space types, and PIR sensors fulfill that at low cost with adequate detection range for room-scale applications. Recent technology trends (integration of on-chip amplifiers, ADCs, and digital I²C/interrupt outputs) reduce the system BOM and enable direct microcontroller wake-on-motion behaviour; this materially increases adoption in battery-operated smart-home endpoints and wireless mesh lighting controls. PIR also retains advantage in privacy-sensitive segments (offices, healthcare) where camera-based presence detection is undesirable. Constraints come from inability to reliably detect stationary occupants in some scenarios—this has opened a niche for uncooled thermopile or MEMS IR modules for combined moving-and-stationary presence detection, which demands higher unit cost but unlocks premium retrofit and commercial installations.

- Commercial (By End-User) — Detailed analysis

Commercial buildings (offices, retail, hospitality) drive fixed-volume procurement through code compliance, tenant fitouts, and retrofit energy-efficiency projects. Specifiers increasingly require certified, low-power occupancy sensors that integrate with building automation systems (BACnet, DALI, wired/wireless gateways). The principal demand vector is prescriptive or performance-based energy code language (lighting control requirements in ANSI/ASHRAE standards and federal guidance), which forces architects and MEP engineers to include occupancy sensing in design documents; that converts directly into unit orders for sensor modules and integrated luminaires. Commercial customers value reliability, certification, and long-term spare-part availability—criteria that favour established suppliers with global certification footprints. The retrofit market also presents consistent demand as building owners pursue operational cost reductions, creating recurrent replacement cycles that benefit high-quality, longer-lifetime thermopile and digital PIR modules.

Infrared Motion Sensors Market Geographical Analysis

- US Market Analysis

Code changes (ANSI/ASHRAE) and federal facility guidance drive specification of occupancy sensors in new commercial construction and federal retrofits, creating stable procurement channels for certified sensors.

- Brazil Market Analysis

INMETRO and national energy efficiency programs promote smart lighting and metering in public and commercial buildings, certification and local testing influence supplier selection and inventory strategy.

- Germany Market Analysis

The Buildings Energy Act (GEG) emphasizes building automation and efficiency; smart sensor adoption is reinforced by stringent energy-performance and retrofit incentives.

- UAE (Middle East) Market Analysis

Green building regulations (Dubai Green Building Regulations, Estidama) and large-scale commercial development pipelines push integration of occupancy sensing in new projects and premium commercial buildings.

- Asia-Pacific Market Analysis (China)

China’s CCC and updated implementation rules require local certification; China’s fast construction cycles and municipal energy programs create volume demand but require local compliance and testing.

Infrared Motion Sensors Market Competitive Environment and Analysis

Major companies (from Table of Contents) include Murata Manufacturing, STMicroelectronics, Honeywell, Panasonic, Bosch, Elmos Semiconductor, Arrow Electronics, plus regional specialists. Company profiles (selected):

- Murata Manufacturing — product positioning: Murata sells compact SMD pyroelectric and integrated digital PIR modules and has publicly announced low-power digital SMD pyroelectric product introductions targeting IoT and smart-home endpoints. The company’s strategy targets miniaturized, integrated sensors that reduce BOM and enable battery-powered designs.

- STMicroelectronics — product positioning: ST has introduced uncooled infrared MEMS/thermopile sensors and human-presence detection solutions optimized for stationary and moving-object detection; ST couples its sensor chips with in-house analog and STM32 processing ecosystems to target laptop, monitor and industrial applications.

- Honeywell International Inc. — product positioning: Honeywell provides certified PIR motion detectors and integrated occupancy sensors for building automation and security, leveraging global channel and certification coverage to serve large commercial and institutional customers.

Infrared Motion Sensors Market Developments

- Sept 2025 — Murata Manufacturing: public product launch of a digital-output SMD pyroelectric infrared sensor targeted at low-power motion/occupancy detection for IoT and smart-home devices. (company newsroom)

- Jun 2025 — STMicroelectronics: announcement of Human Presence Detection (HPD) technology for PCs and displays, delivering >20% daily power reduction in typical use cases (company press release).

Infrared Motion Sensor Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Infrared Motion Sensor Market Size in 2025 | US$1,155.119 million |

| Infrared Motion Sensor Market Size in 2030 | US$1,806.049 million |

| Growth Rate | CAGR of 9.35% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Million |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Infrared Motion Sensor Market |

|

| Customization Scope | Free report customization with purchase |

Global Infrared Motion Sensors Market Segmentation:

By Type:

- Active Infrared Sensors

- Passive Infrared Sensors

By Distance Range:

- Up to 10 Meters

- 10 To 30 Meters

- Greater than 30 Metres

By End-User:

- Residential

- Commercial

- Industrial

By Geography:

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others