Report Overview

Automotive Sensors Market - Highlights

Automotive Sensors Market Size:

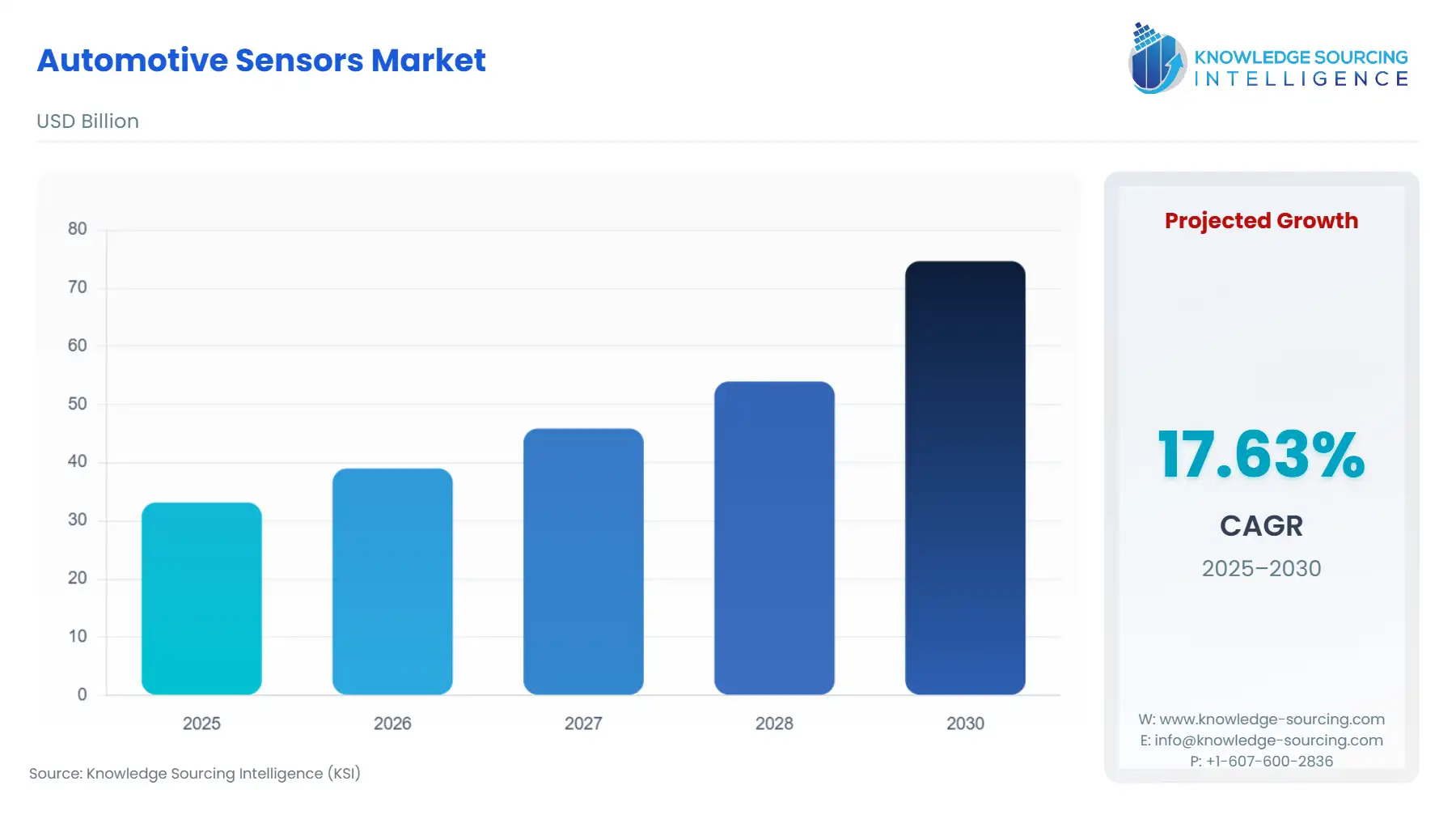

The automotive sensors market is expected to grow from USD 33.155 billion in 2025 to USD 74.675 billion in 2030, at a CAGR of 17.63%.

Automotive Sensors Market Trends:

Automotive sensors are components or devices that are used to process information, monitor, and control the proper functioning of different aspects or components in automobiles. The automobile sensors can facilitate different functions such as sensing oil pressure, sensing temperature, sensing wheel speed, sensing the proximity of obstacles in the path of the vehicle, tire pressure monitoring, and airflow into the intake valve, among a plethora of other functions. Ultrasonic waves are used by automotive sensors, either through radar or image sensors. The sensors can provide the sensed data for processing while also providing real-time information about the situation and condition right now. After processing, the electronic control module determines how to respond to the circumstance and what actions are necessary.

People's inclination to purchase autos is rising along with their disposable income. As a result, there is an increase in the demand for automobiles, which drives up automakers' need for automotive sensors and fuels a surge in the market's growth throughout the projection period. Moreover, with the increasing concern of people to have vehicles that are advanced and can mitigate any problem that might cause damage to the vehicles and their occupants, the market for automotive sensors is expanding as a result of the rising demand for these sensors.

However, the high expense of manufacturing some of these automotive sensors and the inability to fit some sensors that are only present in high-end vehicles, which are not affordable by a majority of the population, are factors that will restrain the growth of the market to some extent.

Furthermore, the market provides enormous opportunities for automakers and sensor manufacturers to upgrade sensing technologies, reduce sensor size, and lower R&D costs for advanced applications such as telematics, autonomous vehicles, and heads-up displays, among others, which will act as a growth opportunity for the market during the forecast period. The automotive sensors market has been divided into segments based on geography, distribution channel, vehicle type, and sensor type. By sensor type, the market has been segmented as wheel speed sensors, temperature sensors, pressure sensors, position sensors, and others. By vehicle type, the market has been segmented into passenger vehicles and commercial vehicles. Market segments by distribution channel include OEMs and aftermarkets.

Automotive Sensors Market Segment Analysis:

- The Wheel Speed Sensor accounts for the majority of the share by sensor type.

Wheel speed sensors are anticipated to have a sizable share of the market by sensor type for the reason that these sensors are vital for the functioning of safety features like ABS and EBD, which require the measurement of the speed of the wheels to take action. In conjunction, the government is also taking steps to make ABS mandatory in all vehicles, which would contribute to the increase in the market share of wheel speed sensors. Due to the fact that they are capable of detecting any temperature rise that occurs in the environment, temperature sensors are indeed anticipated to have a gain in market share throughout the projection period, and take action to stop the damage from occurring to vehicle components.

- OEMs dominate the distribution channel segment.

OEMs are estimated to hold a significant market share, as most of the sensors that are present in vehicles these days are offered in the vehicles themselves. If users so choose, they can add more sensors through aftermarket installation to their vehicles.

Automotive Sensors Market Geographical Outlook:

- Geographically, it is projected that considerable market shares are accounted for by North America and the Asia Pacific.

Based on geography, the Asia Pacific is expected to hold a healthy market share owing to the increasing automobile production in countries such as China and India. Additionally, two of the key centres for the production of automobile components are China and India.

Robert Bosch GmbH, STMicroelectronics, Delphi Auto Parts, STMicroelectronics, Continental AG, TGS GROUP, and Murata Manufacturing Co., Ltd. are a few of the significant firms discussed in this study.

Automotive Sensors Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 33.155 billion |

| Total Market Size in 2031 | USD 74.675 billion |

| Growth Rate | 17.63% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Sensor Type, Vehicle Type, Distribution Channel, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Automotive Sensors Market Segmentation:

- By Sensor Type

- Speed Sensor

- Temperature Sensor

- Pressure Sensor

- Position Sensor

- Others

- By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- By Distribution Channel

- OEMs

- Aftermarket

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

- North America