Report Overview

Barium Fluoride Market - Highlights

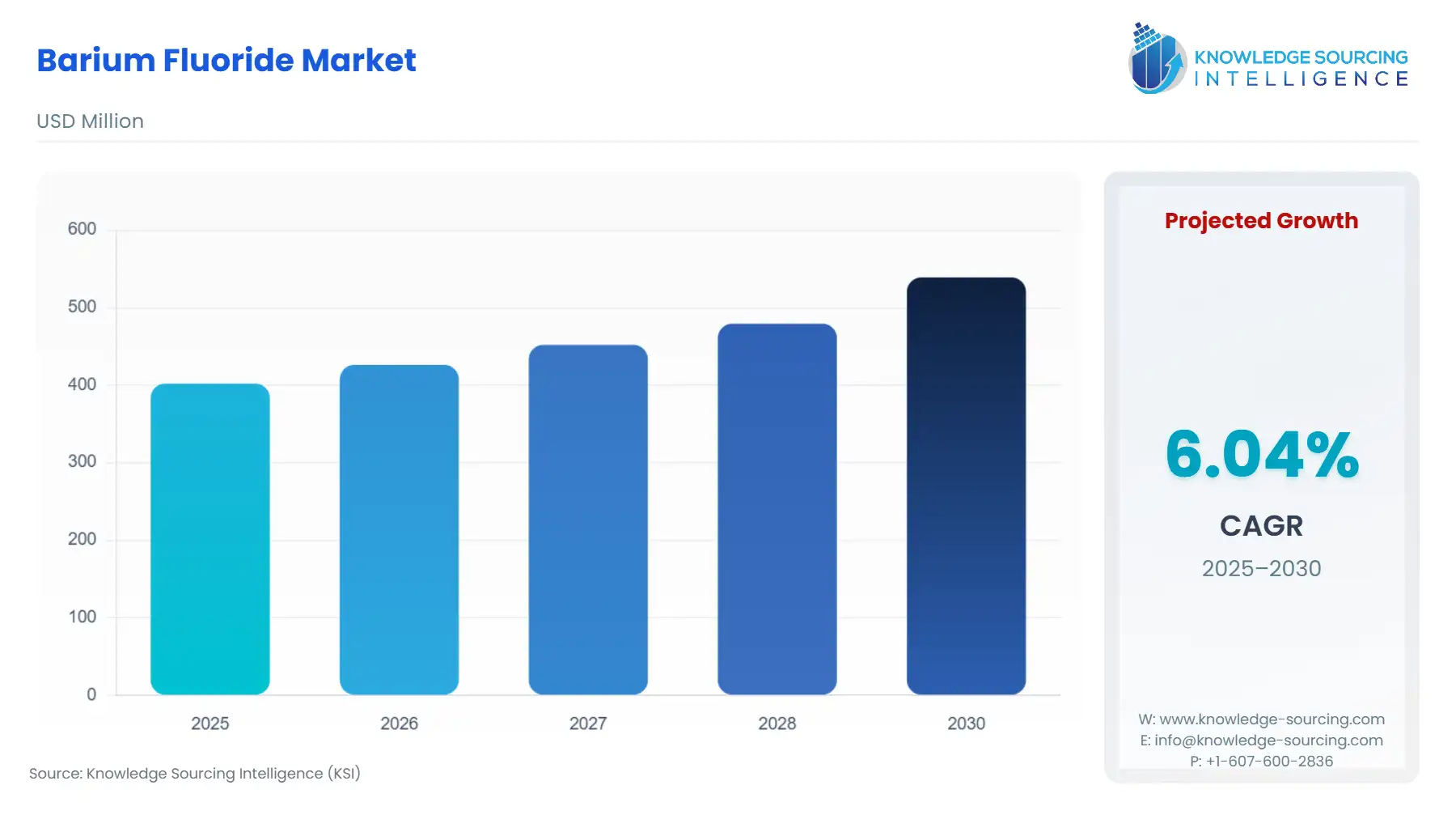

Barium Fluoride Market Size:

Barium Fluoride Market, growing at a 6.03% CAGR, is projected to achieve USD 538.792 million by 2030 from USD 402.057 million in 2025.

Barium fluoride is a crystalline inorganic compound with the chemical formula BaF2. It is commonly used as a flux in the production of aluminum, as well as in the manufacturing of optical components such as lenses, prisms, and windows due to its excellent transparency in the ultraviolet and infrared spectra. Barium fluoride also has applications in the production of scintillation detectors, which are used to detect and measure ionizing radiation, and in the production of welding agents.

The global market for barium fluoride is driven by its wide range of applications in various industries such as aerospace, automotive, electronics, healthcare, and defense. The increasing demand for optical components in these industries, coupled with the growing adoption of barium fluoride in the production of scintillation detectors, is expected to drive market growth in the coming years. The barium fluoride market is expected to witness steady growth in the coming years, driven by its diverse range of applications and its unique properties that make it a valuable material for various industries.

Anti-Caking Agents Market Growth Drivers:

- The barium fluoride market is driven by growing demand for optical components, increasing use in aluminum production, and rising adoption of barium fluoride in scintillation detectors.

Growing demand for optical components- Barium fluoride is widely used in the production of optical components such as lenses, prisms, and windows due to its excellent transparency in the ultraviolet and infrared spectra. With the increasing demand for high-quality optical components in various industries such as aerospace, automotive, electronics, and healthcare, the demand for barium fluoride is expected to increase significantly.

Increasing use in aluminum production- Barium fluoride is commonly used as a flux in the production of aluminum, which is widely used in various industries such as aerospace, automotive, and construction. With the growing demand for aluminum in these industries, the demand for barium fluoride as a flux is also expected to increase. According to a report by the International Aluminum Institute, global aluminum production reached 66.3 million tons in 2020, an increase of 1.9% from the previous year. With the growing demand for aluminum in various industries such as aerospace, automotive, and construction, the demand for barium fluoride as a flux is also expected to increase.

Rising adoption of barium fluoride in scintillation detectors- Barium fluoride is also used in the production of scintillation detectors, which are used to detect and measure ionizing radiation. With the growing demand for radiation detection equipment in various industries such as healthcare, nuclear power, and defense, the adoption of barium fluoride in scintillation detectors is expected to increase, which would drive market growth.

- Competition from alternatives, environmental concerns, stringent regulations, and high manufacturing costs hinder the barium fluoride market growth.

Barium fluoride faces competition from other materials that offer similar properties and performance. For example, some manufacturers are using synthetic materials to replace barium fluoride in certain applications, such as in the production of fiber optic cables. The manufacturing and disposal of barium fluoride can have negative impacts on the environment, such as contributing to air and water pollution. As a result, manufacturers must invest in sustainable practices to minimize their environmental footprint, which can add to their costs.

The barium fluoride market is subject to stringent regulations due to its toxicity and potential harm to human health and the environment. This can increase compliance costs for manufacturers and limit the availability of certain products. The production of barium fluoride requires specialized equipment and processes, which can be expensive to maintain and operate. This can make it difficult for small and medium-sized manufacturers to compete with larger players.

Anti-Caking Agents Market Geographical Outlook:

- North America accounted for a significant share of the barium fluoride market.

Based on geography, the barium fluoride market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. North America is one of the major regions in the global Barium fluoride market, owing to the presence of prominent manufacturers and increasing demand for high-quality optics in various end-use industries. Barium fluoride is used in the manufacturing of semiconductors and optical fibers, which are critical components in the electronics industry. The growing demand for electronic devices such as smartphones, tablets, and laptops is expected to boost the demand for barium fluoride in North America. Barium fluoride is also used in medical equipment such as X-ray machines and CT scanners. With an aging population and an increasing prevalence of chronic diseases, the demand for medical equipment is expected to rise, thereby driving the demand for barium fluoride in North America. The construction industry is a significant consumer of barium fluoride, as it is used in the manufacturing of glass and ceramics. With governments in North America increasing investments in infrastructure development, the demand for barium fluoride is expected to rise.

Barium Fluoride Market Segmentation:

- BARIUM FLUORIDE MARKET BY FORM

- Powder

- Granule

- Crystal

- BARIUM FLUORIDE MARKET BY APPLICATION

- Optical & Spectroscopic Components

- Additves

- Welding Agents

- Others

- BARIUM FLUORIDE MARKET BY END-USER

- Metallurgy

- Electricals & Semiconductors

- Medical & Healthcare

- Oil & Gas

- Others

- BARIUM FLUORIDE MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America