Report Overview

Global Biodegradable Plastic Packaging Highlights

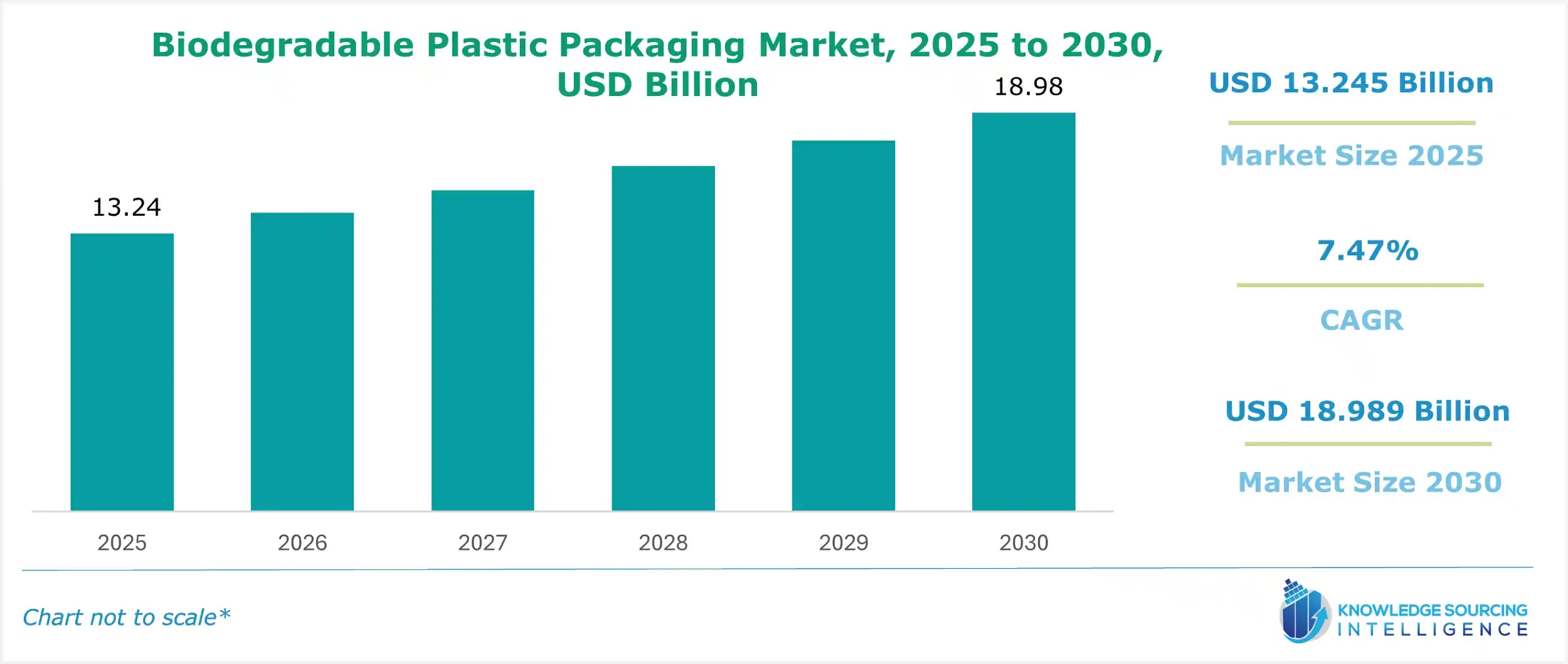

Biodegradable Plastic Packaging Market Size:

The global biodegradable plastic packaging market is expected to grow at a CAGR of 7.47%, reaching a market size of USD18.989 billion in 2030 from USD 13.245 billion in 2025.

Biodegradable paper and plastics are made from renewable sources such as sugar, corn starch, vegetable fats and oils, and other similar materials. They are available in different types of packaging, including corrugated boxes, paper bags, sacks, plastic boxes, bubble wrap, and more. They are also available as polyhydroxyalkanoates (PHAs), polylactic acid (PLA), kraft paper, sulfite paper, and cardboard paper. Major driving forces of the market's growth are government restrictions on single-use plastics and the increased public awareness of the detrimental effects of plastic waste.

Moreover, with the increasing industrial use of biodegradable plastic in agriculture and packaging, the segment is estimated to expand. Plastic, which does not break down, is a global problem. Governments worldwide are promoting biodegradable plastic and prohibiting single-use plastic to remedy this phenomenon. Since biodegradable plastic is eco-friendly, consumers are willing to pay more for it. All these factors are encouraging the global market’s growth.

Biodegradable Plastic Packaging Market Growth Drivers:

- Growing consumer and environment-friendly use of biodegradable plastics is contributing to the global biodegradable plastic packaging market growth

Biodegradable plastic reduces carbon dioxide emissions from 30% to 70% compared to synthetic plastic. The material is harmless to the environment because it is non-toxic and degrades quickly. The other side is that bioplastics produce very little greenhouse gas emissions during their degradation process. The amount of carbon emissions reduced using biodegradable plastic is approximately 42%. These innovative technology features and capabilities have drawn major companies like Ford, Nestle, Nike, and Coca-Cola into research and production activities about various biobased biodegradable plastic applications. Adopting bio-based and biodegradable plastic products is a growing trend among ever-more-aware consumers, reducing current environmental predicaments such as global warming.

Moreover, consumers are growing increasingly fond of bioplastics in various sectors, including packaging, agriculture, post-consumer waste management, auto-making, and catering. Naturally, degradable plastics are useful for organic farming. In this case, horticulturists and farmers use biodegradable mulching films.

- The increasing application in the food packaging industry is anticipated to boost the global biodegradable plastic packaging market.

Non-biodegradable plastic is gradually being replaced by less hazardous, biodegradable, decomposable, and eco-friendly plastic. Rising demand due to global legislation banning the usage of single-use plastic has also contributed to the increased popularity of biodegradable plastics. Biomass residues are used to produce several packaging products like bottles, loose-fill containers, cups, pots, bowls, flexible films, etc. This market is expanding as the demand for coatings and edible films grows rapidly. The usage of biodegradable plastics is now increasingly seen in dairy and meat-prepared foods, which is expected to grow rapidly in the market. Rising environmental awareness due to changing lifestyles, demographics, and population increases also boosts the biodegradable plastic packaging market’s growth.

- Growing CSR initiatives and reducing reliance on petroleum resources are anticipated to boost the global biodegradable plastic packaging market.

As consumers are becoming increasingly worried about their environment, businesses are increasingly converting their interest into an eco-friendly version of their brand-representing products. For example, the global brands of Coca-Cola and PepsiCo are focusing on using bio-based PLA, bio-PSA, and other bottles for beverage packaging. This crude oil price can also be linked to the increasing cost of therapy with heteroblastic treatments.

Increasing R&D and creating a declining dependence on petroleum reserves would be the solutions to the problem. Given its strong infrastructure and capital base, the industry is expected to follow a forward integration strategy in evolving its value chain. Thus, the "green" PET bottle from PepsiCo consists completely of biological materials but also has a similar molecular structure. Transitioning from petroleum to biobased resources is expected to provide various growth opportunities in the years ahead.

Biodegradable Plastic Packaging Market Restraints:

- High cost is anticipated to hamper the market growth

The high cost of biodegradable products is one of the major challenges that are being faced by the global market of biodegradable plastics. The cost of these biodegradable products is almost double the price of traditional petroleum-based plastics. Moreover, there are high R&D costs, small volumes of production, high costs of raw materials, and expensive construction costs of polymer plants. Manufacturers are investing high amounts of money in research and development to improve production efficiency. It is anticipated that with the increase in petroleum prices, some types of biodegradable plastic resins will become cheaper than conventional plastics. The biodegradable plastic resin costs around $3/Kg, while conventional plastic resin costs $1.2/Kg. High resin prices are also expected to inhibit overall market growth.

Biodegradable Plastic Packaging Market Geographical Outlook:

- North America is witnessing exponential growth during the forecast period.

North America is rapidly expanding its market due to the establishment of new plants. Even though supportive regulations and policies in the production and consumption of sustainable products are in place, growing awareness among consumers about environmental issues is contributing to manufacturers of synthetic plastics choosing to produce bio-based plastic materials. Customers prefer bio-based and biodegradable plastic for the packaging of their goods due to rising awareness about the environmental impacts of synthetic plastic packaging materials. In addition, it is expected that the legal and regulatory framework, well-educated consumers having strong purchasing power, and a high level of environmental awareness will continue to foster growth for the North American biodegradable plastic market.

Biodegradable Plastic Packaging Market Key Launches:

- In September 2024, Murdoch University and Australia's national science agency, CSIRO, announced the Bioplastics Innovation Hub, a $8 million partnership that will work with industry partners to create a new generation of plastic that is 100% compostable. By creating biologically derived plastic that decomposes in compost, land, or water, the Bioplastics Innovation Hub seeks to transform plastic packaging. The Hub will give the plastics industry the resources and know-how it needs to produce materials and keep promoting a plastic waste-free green economy, as concerns about plastic pollution and the depletion of fossil fuels are driving up demand for bioplastics.

- In March 2024, Beyond Plastic introduced the first completely biodegradable plastic bottle cap to the market. Polyhydroxyalkanoate (PHA), a biopolymer produced by bacterial fermentation, is used to make the closure. Even under the most delicate circumstances, the new, environment-friendly cap is recyclable, compostable, and biodegradable. It functions, feels, and looks exactly like conventional plastic caps made from petroleum, but offers revolutionary benefits. Unlike traditional plastics, the Beyond Plastic bottle cap has no microplastics and doesn't harm the environment.

Biodegradable Plastic Packaging Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| Biodegradable Plastic Packaging Market Size in 2025 | USD 13.245 billion |

| Biodegradable Plastic Packaging Market Size in 2030 | USD 18.989 billion |

| Growth Rate | CAGR of 7.47% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| List of Major Companies in Biodegradable Plastic Packaging Market |

|

| Customization Scope | Free report customization with purchase |

The global biodegradable plastic packaging market is segmented and analyzed as follows:

- By Type of plastic

- Oxo-Biodegradable Plastic

- Hydro-Biodegradable Plastic

- By Type of material

- Low-Density Polyethylene (LDPE)

- Polyethylene Terephthalate (PET)

- Polylactide (PLA)

- By Application

- Bottles And Jars

- Food Wraps

- Dry Cleaning Bags

- Others

- By End-user

- Food And Beverage

- Cosmetics

- Pharmaceuticals

- Others

- By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Others

- North America