Report Overview

Cell Separation Market - Highlights

Cell Separation Market Size:

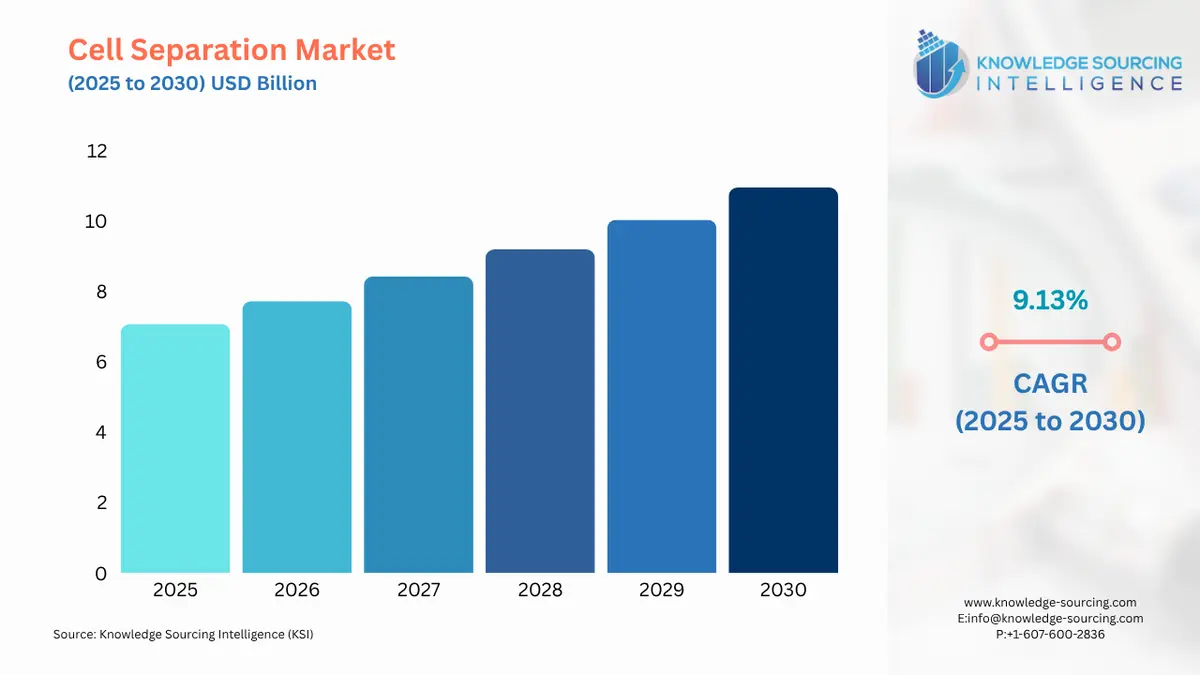

Cell Separation Market, with a 8.86% CAGR, is anticipated to reach USD 11.765 billion in 2031 from USD 7.071 billion in 2025.

The cell separation market is anticipated to grow at a steady pace throughout the forecast period. Cell separation refers to the process of separating specific types of cells from a mixture or population of cells. The growing prevalence of chronic diseases such as cancer and the expanding biopharmaceutical industry is a major growth driver of the cell separation market. Moreover, the increasing awareness and stem research projects along with the increasing investments in the cell separation market further propelling the cell separation market.

Cell Separation Market Growth Drivers:

Growing Burden of Chronic and Infectious Diseases

Chronic conditions including cancer, heart disease, and autoimmune illnesses continue to have a serious impact on world health. Techniques for separating cells are essential for understanding disease causes, finding illness biomarkers, and creating specialized treatments. Physicians can monitor how cancer patients respond to various therapies with a minimum of invasiveness by isolating and analyzing circulating tumor cells (CTCs). Therefore, the rising cases of chronic conditions such as cancer are contemplated to bolster the cell separation market. For instance, roughly 10 million deaths, or roughly one in six deaths, were caused by cancer in 2020, making it the top cause of death globally according to the WHO.

Growing Biopharmaceutical Industry

The biopharmaceutical industry is expanding, with increasing investments in research and development of novel therapies and biologics. Cell separation techniques are critical in the production of monoclonal antibodies, recombinant proteins, and cell-based therapies. The biopharmaceutical industry is 3rd largest sector in the world as per the National Investment Promotion & Facilitation Agency (India). The rising investment in the biopharmaceutical industry is directly boosting the cell separation market. For instance, Pharmaceutical Research and Manufacturers of America (PhRMA) reports that over $100 billion was spent on R&D by biopharmaceutical research businesses in the US alone in 2019. Moreover, the managing director of Sun Pharma announced an investment of $600 - $650 in research in February 2022.

Rising Awareness about Stem Cell Research

The study of stem cells has enormous potential for regenerative medicine, disease modeling, and medication development. Effective cell separation techniques are needed for the isolation and characterization of stem cells. The rising awareness about stem cell research and various studies are boosting the cell separation market. The Regenerative Medicine Innovation project was established by the 21st Century Cures Act which was concluded in 2021. The initiative was taken by NIH and FDA to accelerate progress in the field of stem cells. Moreover, the second Wednesday of October is celebrated as Stem Cell Awareness Day by the California Institute for Regenerative Medicine to share the thoughts, ideas, and progress they have made in stem cells and regenerative medicine.

Increasing Investment Initiatives and Government Support

The increasing investments and funding received by the companies involved in cell separation solutions are expected to propel the cell separation market in the coming years. For example, Nodexus Inc. raised $30 million in funding to advance and expand the commercialization of the NX One platform. The NX One platform is the world’s first adaptable system to sort and isolate single cells from biological samples. Moreover, government support and grants to advance cell separation solutions are further boosting the cell separation market. For example, Proteios Technology Inc. was awarded a $1.6 million grant from NIH to commercialize its multivariate cell isolation technology in September 2022.

Cell Separation Market Restraints:

The cell separation market has experienced growth and development, however, some restraints or challenges can impact its expansion. The specificity of cell separation may be constrained by the separation method employed. For example, non-target cells may be co-isolated using magnetic bead-based separation techniques as a result of non-specific binding. To use and comprehend the results of some cell separation techniques, such as fluorescence-activated cell sorting (FACS) or microfluidics, specialized technical knowledge is needed. The lack of experts in poor countries may hinder the cell separation market expansion in the regions. Some cell separation approaches could have throughput and scalability restrictions. This might be a limitation when processing big sample quantities.

Cell Separation Market Geographical Outlook:

North America is anticipated to grow considerably.

North America is expected to hold a significant share of the cell separation market during the forecast period. The factors attributed to such a share are the well-established pharmaceutical and biotech sectors as well as the widespread use of cutting-edge technologies in the US. For instance, the US president launched a biotechnology and biomanufacturing initiative in September 2022 to harness the full potential of biotechnology in the country. Moreover, the higher prevalence of chronic diseases in the region further indicates the need for cell separation products thereby boosting the cell separation market. For instance, cancer is the second-most leading cause of death in the US as per the CDC with around 1.9 million cases in 2021.

List of Top Cell Separation Companies:

Terumo Corporation is a Japanese multinational company that is involved in the development of a wide range of medical devices including products related to cell separation. Through its Terumo BCT (Blood Component Technologies) branch, Terumo provides a range of cell separation and processing technologies.

Merck KGaA is a global science and technology company headquartered in Germany. It provides a range of products and services linked to cell separation and adjacent industries. Estapor® Paramagnetic Microspheres are reagents that enable the isolation of desired cells or microorganisms using a straightforward magnet-based approach.

STEMCELL Technologies Inc. is a Canadian biotechnology company that focuses on the research, development, and provision of tools, reagents, and services for the fields of stem cell research, cell therapy, and regenerative medicine. Robosep™ - C Human T Cell Isolation Kit, and RoboSep™ -C Tubing Set are some of the products offered by the company as cell separation solutions.

Cell Separation Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Companies |

|

Report Metric | Details |

Cell Separation Market Size in 2025 | USD 7.071 billion |

Cell Separation Market Size in 2030 | USD 10.945 billion |

Growth Rate | CAGR of 9.13% |

Study Period | 2020 to 2030 |

Historical Data | 2020 to 2023 |

Base Year | 2024 |

Forecast Period | 2025 – 2030 |

Forecast Unit (Value) | USD Billion |

Segmentation |

|

Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

List of Major Companies in the Cell Separation Market |

|

Customization Scope | Free report customization with purchase |

Cell Separation Market Segmentation

By Product Type

Consumables

Instrument

By Method

Centrifugation

Filtration

Fluorescence-activated Cell Sorting (FACS)

Magnetic-Activated Cell Sorting (MACS)

Others

By Application

Biomolecule Isolation

Cancer Research

Stem Cell Research

Tissue Regeneration

In Vitro-Diagnostics

Others

By End-User

Pharmaceuticals & Bio-Tech Companies

Research & Academic Institute

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

Germany

France

United Kingdom

Spain

Others

Middle East and Africa

Saudi Arabia

UAE

Israel

Others

Asia Pacific

China

India

Japan

South Korea

Indonesia

Thailand

Others