Report Overview

Central Inverter Market Size:

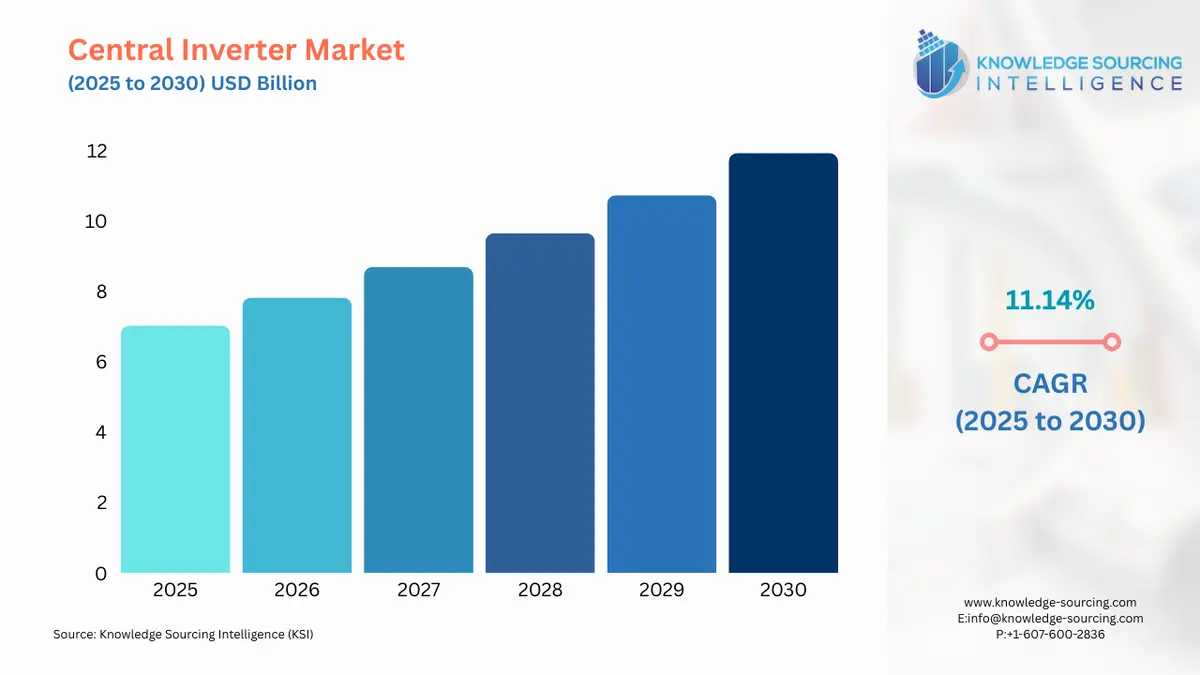

Central Inverter Market is expected to grow at a 11.14% CAGR, attaining USD 11.926 billion by 2030 from USD 7.033 billion in 2025.

A central inverter is a type of inverter that is used in solar modules to convert DC electricity from solar panels into AC power. Installing central inverters is easier and less difficult than installing multiple smaller inverters and also microinverters are less successful at converting DC to AC than central inverters as central inverters can handle greater power. Central inverters enable consistent and continuous output and are commonly used in large commercial installations, industrial locations, or utility-scale solar farms. The expanding population, along with other environmental concerns, is putting pressure on the limited energy supplies, which is likely to drive increased demand for central inverters for residential and industrial applications throughout the forecast period. According to the International Energy Association, renewable energy sources will have the fastest increase in the electrical industry, increasing from 24% in 2017 to roughly 30% by 2023, this shows that the market for central inverters used in solar PV will grow in the coming years during the forecasted period.

Central Inverter Market Growth Drivers:

- The increasing energy demand is expected to boost the market growth.

The demand for renewable energy is expected to rise due to several important causes, including a growing population, as a major driver with fast industrialization, urbanization, and increased infrastructure construction due to population increase. Additionally, according to the United Nations in mid-November 2022, there were 8.0 billion people on the planet, up from 2.5 billion in 1950, 1 billion since 2010, and 2 billion since 1998. The expected increase in global population over the next 30 years is nearly 2 billion, from 8 billion now to 9.7 billion in 2050, with a potential high of roughly 10.4 billion in the middle of the 1980s. According to IEA, between 2019 and 2030, it is predicted that India's energy demand would rise by about 35%, and during the next 20 years, India's urban population is expected to grow by another 270 million people. According to the U.S Energy information administration (EIA), In 2021 the total primary energy used in the United States was equivalent to 97 quadrillion BTUs (British thermal units). This concludes that as energy consumption is going to rise the demand for solar energy will also rise at a rapid pace due to which the central inverters market is expected to boost during the forecasted period.

- The replacement of old fossil fuels with solar energy will boost the central inverter market growth

When the government replaces fossil fuels like coal with solar power to generate energy to conserve natural resources, the need for a central inverter will rise, boosting market development. According to the International Energy Agency, the global renewable electricity capacity is anticipated to increase by more than 60% from 2020 levels to over 4,800 gigawatts (GW) by 2026, equating the total global power capacity of fossil fuels and nuclear power put together, moreover, solar PV is predicted to continue to drive development in renewable energy, with capacity additions has increased by 17% in 2021 to a record-breaking level of about 160 GW. Solar energy had been used to generate renewable electricity energy for many years now and to convert that energy from DC to AC energy central inverters play a major role which lead to a definite need for new generating capacity all over the world to satisfy the rising demand which is anticipated to boost the central inverters markets.

Central Inverter Market Geographical Outlook:

- During the forecast period, the Asia-Pacific region will see a boost in market growth

The market for the central inverter is predicted to be dominated by Asia-pacific due to the region's rising environmental consciousness, and government backing, which will drive the central inverter installation in industrial and residential end users. For instance, In January 2022, Sungrow power a Chinese company launched a brand-new central inverter, this new device, known as the 1+X modular inverter, is installed by merging eight units to provide 8.8MW of power which has a DC/ESS interface for connecting energy storage devices. According to the World Energy headlines, in January 2021, the joint venture took place between Bangladesh-based business Spectra Engineers Limited and Hong Kong-based Shunfeng Investments Ltd, which is known as the “35 MW Spectra Solar Park Limited”, and it has officially launched a plant in 85 km west of Dhaka in Bangladesh which contains 12 Sungrow central inverters, each with a 3.125 MW rating, which is used to power the 137,520 panels spread throughout the site's plant. The engineering, procurement, and construction of the plant were handled by the Chinese business Sungrow Power (Singapore). These developments in the Asia-Pacific region will lead the central inverter market to grow during the forecasted period.

Segmentation

- CENTRAL INVERTER MARKET BY PHASE TYPE

- Single-Phase

- Three-Phase

- CENTRAL INVERTER MARKET BY POWER OUTPUT

- Up to 500 kW

- 500 to 1,000 kW

- Greater than 1,000 kW

- CENTRAL INVERTER MARKET BY END-USER

- Residential

- Commercial

- Industrial

- CENTRAL INVERTER MARKET BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Taiwan

- Others

- North America