Report Overview

Transformer Less UPS Market Highlights

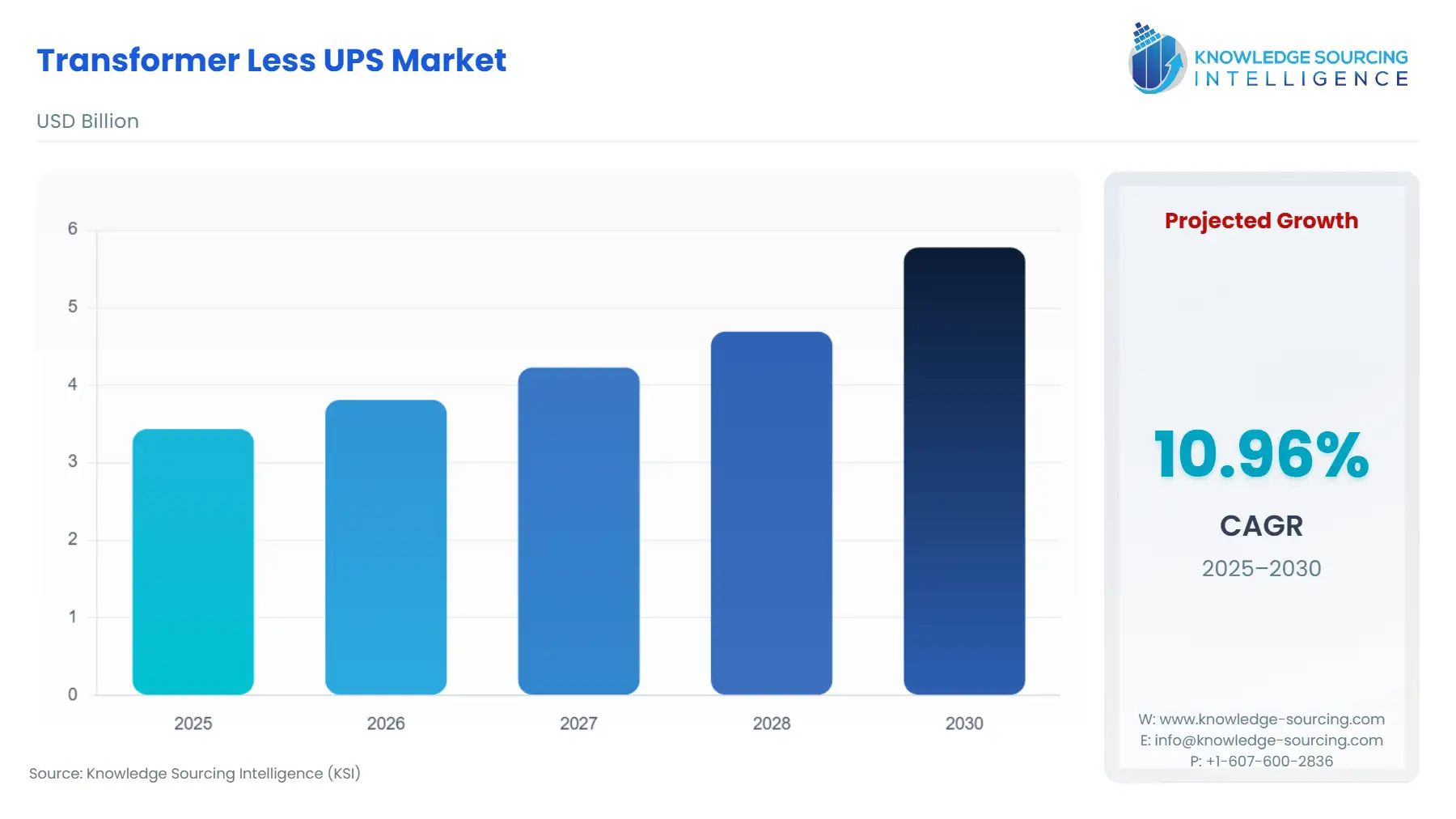

Transformer Less UPS Market Size:

The Transformer Less UPS Market will climb from USD 3.434 billion in 2025 to USD 5.776 billion by 2030, fueled by a 10.96% compound annual growth rate (CAGR).

The transformerless uninterruptible power supply (UPS) market is experiencing significant growth, driven by technological advancements, increasing demand for reliable power solutions, and stringent regulatory frameworks. This report provides an in-depth analysis of the market dynamics, focusing on demand drivers, challenges, opportunities, and regional insights.

Transformer Less UPS Market Analysis:

Growth Drivers:

- Digital Transformation Across Sectors: The rapid adoption of digital technologies in sectors such as manufacturing, healthcare, finance, and communications is increasing the reliance on uninterrupted power supply systems. Transformerless UPS systems, known for their compact design and efficiency, are becoming the preferred choice to support critical operations in these industries.

- Environmental Concerns and Energy Efficiency: With growing emphasis on reducing carbon footprints, industries are seeking energy-efficient solutions. Transformerless UPS systems, which eliminate the need for bulky transformers, offer higher efficiency and lower energy consumption, aligning with sustainability goals.

- Advancements in Battery Technology: The integration of lithium-ion batteries in UPS systems enhances performance, reduces maintenance costs, and extends operational life, thereby increasing the adoption of transformerless UPS solutions.

Challenges and Opportunities:

- Challenges: Despite their advantages, transformerless UPS systems face challenges such as susceptibility to harmonic distortions and electromagnetic interference, which can affect sensitive equipment. Additionally, the initial cost of these systems can be higher compared to traditional UPS systems, posing a barrier for small and medium enterprises.

- Opportunities: The growing demand for data centers, expansion of telecommunications infrastructure, and increasing reliance on cloud computing present significant opportunities for the adoption of transformerless UPS systems. Moreover, advancements in power electronics and battery technologies are expected to mitigate existing challenges, fostering market growth.

Supply Chain Analysis:

The global supply chain for transformerless UPS systems involves key components such as power electronic modules, battery systems, and cooling units. Manufacturers are primarily located in regions with advanced technological capabilities, including North America, Europe, and Asia-Pacific. Logistical complexities arise due to the need for specialized transportation and handling of sensitive electronic components. Supply chain disruptions, such as those caused by geopolitical tensions or pandemics, can impact production timelines and delivery schedules.

Transformer Less UPS Market Government Regulations:

Governments worldwide are implementing regulations to promote energy efficiency and reduce carbon emissions. These regulations influence the design and adoption of transformerless UPS systems by mandating higher efficiency standards and encouraging the use of environmentally friendly materials.

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

European Union |

EcoDesign Directive / European Commission |

Imposes energy efficiency requirements, driving demand for high-efficiency UPS systems. |

|

United States |

Energy Star Program / U.S. Environmental Agency |

Provides certification for energy-efficient products, influencing purchasing decisions. |

|

India |

Bureau of Energy Efficiency (BEE) |

Sets efficiency standards, promoting the adoption of energy-efficient UPS systems. |

Transformer Less UPS Market Segment Analysis:

- By Application – Data Centers:

Data centers are critical infrastructure requiring uninterrupted power supply to ensure continuous operation. The increasing demand for data storage and processing capabilities, driven by the proliferation of cloud computing and big data analytics, is propelling the need for reliable power solutions. Transformerless UPS systems, with their compact design and high efficiency, are well-suited to meet the power requirements of modern data centers, offering scalability and reduced energy consumption.

- By End-User – IT and Data Centers:

The IT and data center sector is a significant end-user of transformerless UPS systems. The exponential growth in data generation and the need for real-time processing are increasing the reliance on data centers. To maintain operational continuity and protect against power outages, these facilities require robust power backup solutions. Transformerless UPS systems provide the necessary reliability and efficiency, supporting the uninterrupted operation of IT infrastructure.

Transformer Less UPS Market Geographical Analysis:

- United States:

The U.S. market for transformerless UPS systems is expanding due to substantial investments in digital infrastructure and the rapid adoption of cloud and AI technologies. Modular UPS systems, which offer scalability and energy efficiency, are increasingly preferred in data centers and industrial applications. Government initiatives promoting energy efficiency further bolster market growth.

- Germany:

Germany's focus on renewable energy and energy efficiency drives the demand for transformerless UPS systems. The integration of solar power and other renewable sources necessitates reliable power backup solutions to ensure grid stability. Transformerless UPS systems, with their high efficiency and compact design, are well-suited to support the country's energy infrastructure.

- Brazil:

In Brazil, the expansion of telecommunications and IT infrastructure is increasing the demand for reliable power solutions. Transformerless UPS systems are being adopted to support critical operations in data centers and industrial facilities, ensuring continuity and efficiency.

- South Africa:

South Africa's industrial sector is experiencing growth, leading to an increased need for uninterrupted power supply systems. Transformerless UPS systems are being implemented to support manufacturing processes and data centers, providing reliable and efficient power backup solutions.

- India:

India's rapid digital transformation and expansion of IT infrastructure are driving the demand for transformerless UPS systems. The government's initiatives to promote energy efficiency and renewable energy adoption further support the market growth. Transformerless UPS systems are increasingly being used in data centers and industrial applications to ensure operational continuity.

Transformer Less UPS Market Competitive Environment and Analysis:

The transformerless UPS market is characterized by the presence of several key players, including Schneider Electric, EATON Corporation PLC, Emerson Electric Co., Delta Electronics Inc., and ABB Ltd. These companies are focusing on innovation, product development, and strategic partnerships to strengthen their market position. For instance, Schneider Electric offers a range of transformerless UPS systems designed for various applications, emphasizing energy efficiency and scalability. EATON Corporation PLC provides modular UPS solutions that cater to the growing demand for flexible and reliable power backup systems.

Transformer Less UPS Market Developments:

- October 2025: Schneider Electric announced the launch of its new transformerless UPS system, designed to offer higher efficiency and reduced footprint for data centers and industrial applications.

- August 2025: EATON Corporation PLC unveiled its latest modular UPS solution, providing enhanced scalability and energy efficiency for telecommunications and IT infrastructure.

- July 2025: Emerson Electric Co. expanded its product portfolio with the introduction of a compact transformerless UPS system, targeting the growing demand in commercial and industrial sectors.

Transformer Less UPS Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

Transformer Less UPS Market Segmentation:

- By Type:

- Single-Phase Transformerless UPS

- Three-Phase Transformerless UPS

- By Power Rating:

- Below 10 kVA

- 10–100 kVA

- Above 100 kVA

- By Application:

- Data Centers

- Telecommunications

- Healthcare

- Industrial

- Commercial

- Others

- By End-User:

- IT and Data Centers

- Manufacturing

- Healthcare

- Telecom

- BFSI

- Others

- By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Taiwan

- Others

- North America