Report Overview

Ceramic Coating Market Size, Highlights

Ceramic Coating Market Size:

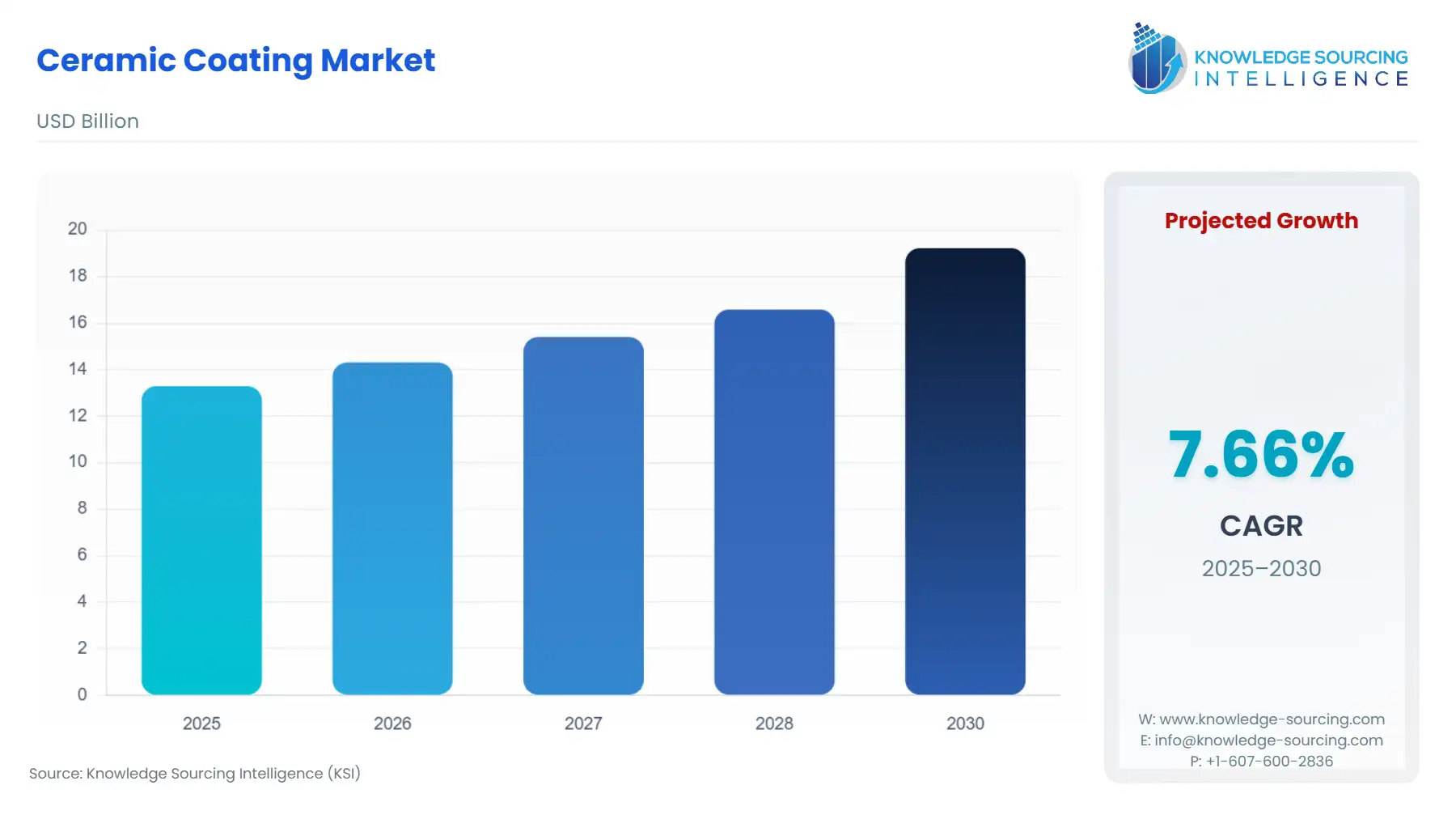

Ceramic Coating Market, with a 7.66% CAGR, is expected to grow to USD 19.226 billion in 2030 from USD 13.290 billion in 2025.

Ceramic coatings are advanced functional materials applied to substrates to impart superior surface characteristics, primarily resistance to extreme heat, wear, corrosion, and oxidation. These coatings, typically based on materials like alumina, zirconia, and various nitrides and carbides, are essential for extending the service life and enhancing the performance of critical components in high-stress, high-temperature operating environments. The market's structural imperative is defined by the direct correlation between a component's operating efficiency (e.g., fuel efficiency in a gas turbine) and the quality of its protective coating. The ceramic coating industry serves as a foundational technology for modernization across the energy, transportation, and healthcare sectors, providing solutions that enable lighter-weight, more durable, and more resource-efficient product designs that meet contemporary performance and regulatory demands.

Ceramic Coating Market Analysis

- Growth Drivers

The relentless push for increased energy efficiency in sectors like aerospace and energy generation creates an inelastic demand for ceramic thermal barrier coatings (TBCs). TBCs permit industrial gas turbines (IGTs) and jet engines to operate at significantly higher combustion temperatures, directly improving efficiency by several percentage points and necessitating the use of ceramic materials. Simultaneously, the global mandate to replace environmentally harmful traditional coatings, particularly hard chrome plating, due to regulations from agencies like the US EPA and REACH, compels automotive and manufacturing industries to adopt cleaner, ceramic-based alternatives. This regulatory pressure effectively converts a compliance cost into new, non-discretionary demand for ceramic solutions that meet both performance and sustainability criteria.

- Challenges and Opportunities

A critical constraint is the high initial capital expenditure and specialized technical expertise required for advanced deposition technologies like Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD), which limits widespread adoption by smaller manufacturers. This high barrier to entry restricts demand diversification. A major opportunity lies in the burgeoning electric vehicle (EV) market. Developing application-specific ceramic coatings engineered for EV battery casings and motor components is essential for thermal management, fire resistance, and improved energy density. Focused R&D on lightweight, thermally conductive ceramic formulations will unlock significant, high-growth demand in the automotive sector as EV production scales globally.

- Raw Material and Pricing Analysis

The raw material cost structure is fundamentally tied to the price volatility of advanced ceramic powders, including high-purity yttria-stabilized zirconia (YSZ), alumina, and titanium dioxide. YSZ, critical for TBCs, is subject to the supply stability of zirconium-based minerals and high-energy processing costs for spheroidization required for thermal spray. Oxide-based materials like alumina are comparatively cheaper and more readily available, making them cost-effective for high-volume industrial applications, which helps stabilize pricing in that segment. Geopolitical factors and tariffs on key metals and ceramic materials can influence pricing and compel manufacturers to adjust sourcing strategies or transfer production to tariff-free regions to maintain competitive pricing.

- Supply Chain Analysis

The ceramic coating supply chain is bifurcated into upstream material synthesis and downstream application services. Upstream is dominated by highly specialized chemical manufacturers that produce high-purity ceramic powders (e.g., YSZ, Cr2O3), primarily concentrated in North America, Europe, and Japan. The downstream segment involves service companies and end-user OEMs that perform the actual coating via thermal spray, PVD, or CVD processes. Logistical complexity is centered around the secure, high-precision transport of fine, expensive ceramic powders and the capital-intensive nature of the equipment, with production hubs often linked directly to major aerospace and industrial gas turbine manufacturing clusters in the USA and Germany.

Ceramic Coating Market Government Regulations

|

Jurisdiction |

Key Regulation / Agency |

Market Impact Analysis |

|

United States |

Environmental Protection Agency (EPA) / Occupational Safety and Health Administration (OSHA) |

Stringent regulations regarding hazardous air pollutants (HAPs) and Volatile Organic Compounds (VOCs) compel industries to shift from traditional, solvent-based coatings and hard chrome plating toward waterborne, powder, and high-performance ceramic alternatives, directly increasing demand for cleaner ceramic technologies. |

|

European Union |

Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) Regulation |

REACH enforces rigorous assessment of chemicals used in coatings, including heavy metals. This increases the regulatory burden for certain traditional materials but strongly accelerates the substitution effect, prioritizing the adoption of compliant, non-carcinogenic ceramic coating formulations. |

|

Global |

International Civil Aviation Organization (ICAO) / Fuel Efficiency Standards |

Global push for reduced carbon emissions and improved fuel efficiency drives mandatory operational mandates for aerospace components. This necessitates the use of high-efficiency TBCs on turbine components to enable higher operating temperatures, thus creating a continuous and growing demand for advanced ceramic coatings in new builds and MRO. |

Ceramic Coating Market Segment Analysis

- By Technology: Thermal Spray

Thermal spray technology, encompassing Plasma Spray and High-Velocity Oxygen Fuel (HVOF), constitutes the primary market segment, driven by its unparalleled versatility and scalability for high-volume, robust coating applications. The core growth driver is the ability of thermal spray, particularly Plasma Spray, to deposit a wide range of ceramic materials, such as complex YSZ formulations, onto large and geometrically complex components like industrial gas turbine blades and airframe structures. This process creates thick, durable coatings with high bonding strength and minimal porosity, which is mandatory for protective layers in severe industrial environments. The cost-effectiveness of plasma spray equipment relative to high-vacuum PVD/CVD systems, coupled with its proven reliability and ability to cover vast areas quickly, makes it the default technology for the high-volume aerospace and energy sectors, ensuring sustained, dominant market expansion.

- By End-User: Aerospace & Defense

The Aerospace & Defense sector is the single most critical driver of high-performance ceramic coating demand, characterized by non-negotiable performance specifications. The central demand factor is the need to enhance engine efficiency and component longevity under extreme operating conditions. Ceramic Thermal Barrier Coatings (TBCs) are essential for jet engine turbine blades, acting as a crucial insulator that allows the engine's hot section to withstand gas temperatures exceeding the melting point of the underlying superalloy. This capability is directly linked to fuel efficiency improvements and extended maintenance intervals for both commercial and military aircraft. Increased global defense spending, particularly on advanced aircraft and hypersonic programs, further stimulates demand for ultra-high-temperature ceramics (UHTCs) and stealth-enhancing coatings, where the high-performance requirement outweighs cost considerations, making demand highly inelastic.

Ceramic Coating Market Geographical Analysis

- US Market Analysis

The US market commands a dominant position, primarily due to its massive, technologically advanced Aerospace & Defense sector and robust Industrial Gas Turbine (IGT) manufacturing base. This requirement is structurally driven by consistent, high-level government defense spending and extensive R&D investment in next-generation aerospace programs, which require the highest-specification TBCs and specialized coatings. The presence of major ceramic coating providers and advanced application service facilities, coupled with a regulatory push for replacement of hard chrome plating in the automotive and industrial sectors, solidifies the sustained, high-value demand for advanced ceramic coatings.

- Brazil Market Analysis

The Brazilian market for ceramic coatings is emergent, primarily centered on the Energy & Power and Automotive industries. The primary local growth driver is the need for corrosion and wear resistance coatings for components within the oil and gas infrastructure, particularly in offshore exploration, and power generation turbines. Adoption is slower due to higher import costs for advanced coating equipment and specialized powders. However, local academic and research institutions are increasingly focusing on thermal spray technology development to enhance domestic industrial capabilities and reduce reliance on expensive foreign application services, signaling future institutional demand.

- German Market Analysis

Germany represents a cornerstone of the European market, characterized by a sophisticated industrial manufacturing base and strict environmental compliance mandates. This growth is strongly propelled by the country's world-leading automotive sector, which uses ceramic coatings extensively for engine components (to manage heat and reduce friction) and brake systems. Local demand is additionally driven by the energy sector for TBCs in IGTs and a strong adherence to REACH regulations, which incentivizes the adoption of eco-friendly ceramic solutions to replace legacy, non-compliant surface treatments in general manufacturing.

- Saudi Arabia Market Analysis

The Saudi Arabian ceramic coating market is predominantly driven by the Energy & Power sector, specifically the massive oil and gas infrastructure and power generation facilities. Local demand is critically tied to the need for high-performance corrosion and erosion-resistant coatings to protect pipelines, valves, and refinery equipment from the harsh, high-salinity operating environment. Government-led infrastructure and diversification projects further stimulate institutional demand for high-temperature coatings for new power plants and industrial complexes, where durability and reduced maintenance cycles are paramount.

- China Market Analysis

China exhibits massive, accelerating demand for ceramic coatings, fueled by rapid industrial expansion and ambitious national manufacturing strategies. The primary catalyst is the surging domestic automotive and aerospace manufacturing sectors, coupled with significant investment in advanced energy infrastructure, particularly high-efficiency power generation. Local factors include government-backed initiatives promoting domestic material substitution, creating huge volume demand for locally produced oxide and nitride ceramic powders, and the rapid adoption of PVD and CVD technologies in the fast-growing electronics and tooling industries.

Ceramic Coating Market Competitive Environment and Analysis

The ceramic coating market competition is defined by a dichotomy between large, diversified chemical/industrial conglomerates that supply raw materials and equipment, and specialized, technology-focused service providers that perform the coating application. Key competitive factors include proprietary powder formulations, application process efficiency (deposit rate, quality), and the ability to meet stringent aerospace and defense certification standards. Strategic acquisitions often occur as material suppliers vertically integrate into application services or vice versa, securing control over the critical value chain from powder to finished component.

- Saint-Gobain

Saint-Gobain is strategically positioned as a major integrated supplier, primarily through its Saint-Gobain Coating Solutions division, focusing on the upstream material and equipment segment. The company's core product portfolio includes high-performance Thermal Spray Powders (including various ceramics like yttria and alumina), PVD/EBPVD Materials, and the specialized Rokide® 2 flame spray gun and ceramic-based Flexicord products. By providing the foundational, certified materials and advanced equipment required for deposition, Saint-Gobain maintains a critical enabling role across aerospace, energy, and automotive markets, ensuring consistent demand from service applicators globally. The company's strategy emphasizes material science innovation for extreme operating conditions.

- Praxair S.T. Technology Inc.

Praxair S.T. Technology Inc. (a subsidiary of Linde plc) operates as a global leader in surface technologies, with a strong emphasis on both the supply of advanced coating materials and the provision of application services. Its strategic positioning is built on offering a comprehensive, integrated solution—from supplying high-performance ceramic powders and Thermal Spray equipment to executing complex coating applications. This end-to-end capability is highly appealing to major OEMs in the aerospace and industrial gas turbine sectors, which demand integrated material, process, and quality control. The company leverages its wide industrial gas infrastructure to enhance its thermal spray processes, driving demand for its services through demonstrated application expertise and reliability.

- MBI Coatings

MBI Coatings is strategically focused on the high-value, niche market of surface engineering and coating services, utilizing a variety of technologies, including Thermal Spray processes (Plasma Ceramics) and Fluoropolymers. MBI’s competitive strength lies in its one-stop-shop approach for surface enhancement, specializing in the refurbishing and upgrading of worn machine parts. The company offers customized hybrid coating systems that meet exacting blueprints and Mil specifications for arduous industrial and defense applications. This service-centric model ensures recurring demand from customers who prioritize part refurbishment, custom-engineered wear resistance, and the application of complex ceramic layers over generic, high-volume coating solutions.

Ceramic Coating Market Developments

- June 2025: Onyx Coating is set to launch Graphene Pure Ultra, a next-generation professional coating. It features multi-walled carbon nanotubes to achieve an industry-leading 10H hardness rating. This innovation aims for superior slickness and durability, pushing the boundary for professional detailers seeking extreme paint protection and performance against environmental damage.

- March 2025: Opti-Coat launched Optimum Hyper Shine, a new consumer-grade ceramic coating based on Silicon Dioxide (SiO?), or industrial quartz. It is promoted as an extremely easy-to-install, DIY-friendly option, eliminating high spots and featuring high gloss and slickness. This release broadens their product tier for the automotive aftermarket.

Ceramic Coating Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2026 | USD 13.290 billion |

| Total Market Size in 2031 | USD 19.226 billion |

| Growth Rate | 7.66% |

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Segmentation | Technology, Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Ceramic Coating Market Segmentation:

- BY TECHNOLOGY

- Thermal spray

- Chemical vapor deposition

- Physical vapor deposition

- Others

- BY TYPE

- Oxide

- Nitride

- Silica

- Carbide

- Others

- BY END-USER

- Healthcare

- Energy & Power

- Automotive

- Aerospace & Defense

- Textile

- Others

- BY GEOGRAPHY

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Thailand

- Others

- North America