Report Overview

China 5G Base Station Highlights

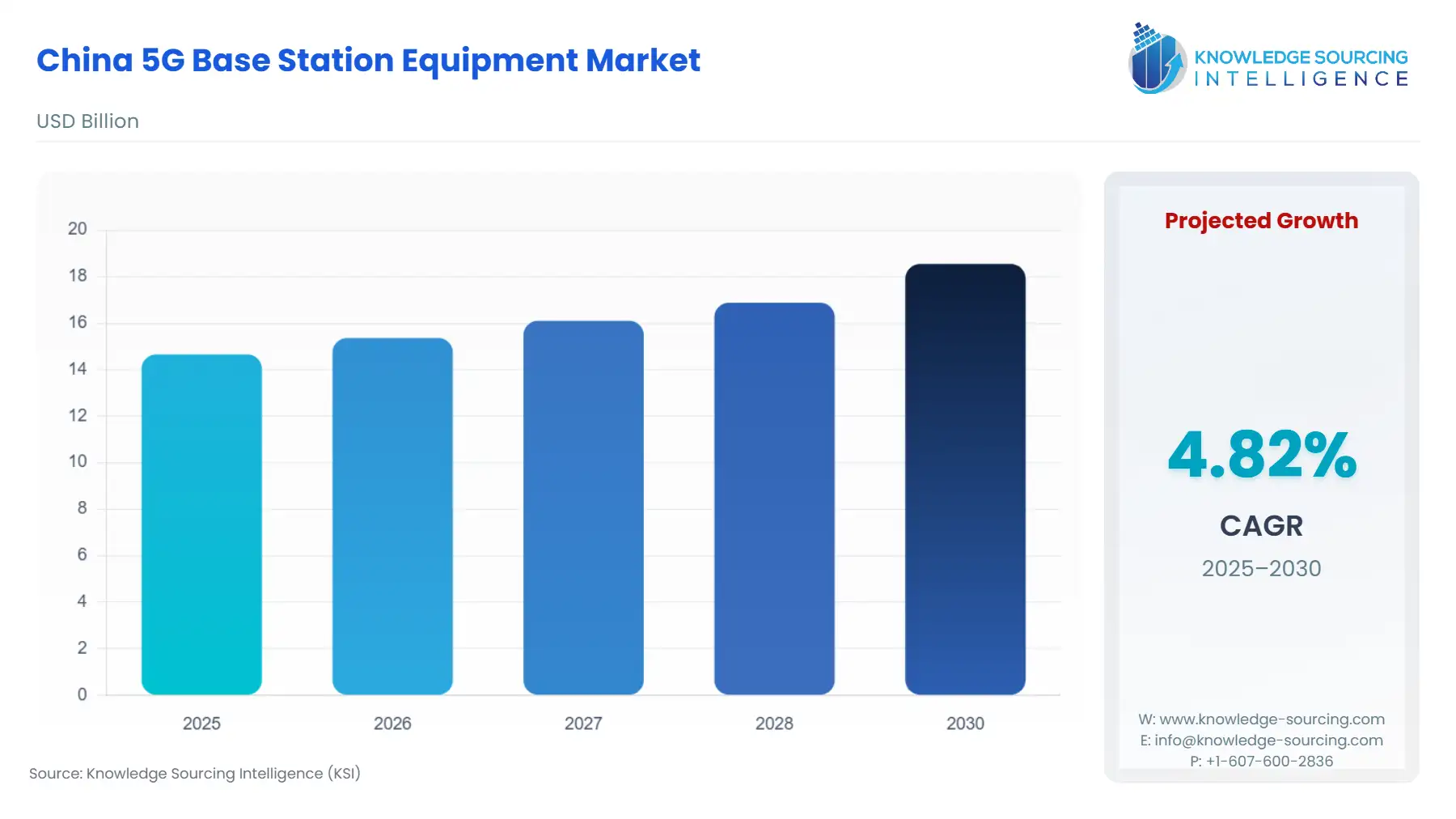

China 5G Base Station Equipment Market is forecast to grow from USD 14.656 billion in 2025 to USD 18.545 billion by 2030, registering a CAGR of 4.82%.

China 5G Base Station Equipment Market Key Highlights

The Chinese 5G Base Station Equipment Market is defined by unparalleled scale and a strategic government-led deployment mandate. China's proactive national approach has fostered a massive infrastructure foundation, making it the largest single market for 5G network hardware globally. The current market phase transitions from initial wide-area coverage—largely achieved by the nation's three primary telecom operators—to an intense focus on enhancing network density, capacity, and deploying next-generation 5G-Advanced (5G-A) capabilities. This shift is an explicit commercial and industrial imperative, moving beyond consumer-grade enhanced mobile broadband (eMBB) to enable high-value enterprise use cases in critical sectors like industrial manufacturing, smart cities, and government services, which in turn fuels the continuous demand for advanced base station equipment.

________________________________________

China 5G Base Station Equipment Market Analysis

Growth Drivers

Government mandates and operator network evolution directly compel increased base station equipment procurement. The MIIT's "Set Sail" action plan, which aims for 5G user penetration higher than 85% and over 75% of network traffic to be on 5G by 2027, establishes a clear deployment schedule for telecom operators. This national mandate creates non-discretionary demand for base stations to handle the projected traffic volume. Furthermore, the rapid commercialization of 5G-Advanced (5G-A) by major operators, including the deployment of networks in over 300 cities, drives the mandatory replacement and upgrading cycle. This transition requires high-performance, Massive MIMO-enabled base station Radio Units (RUs) and Baseband Units (BBUs) to support the 10Gbps peak speeds, deterministic latency, and higher connection density that 5G-A promises for industrial applications.

Challenges and Opportunities

A primary challenge is the significant capital expenditure (CAPEX) associated with maintaining a state-of-the-art national network of over 4 million base stations, which necessitates operators' continued heavy investment in new equipment despite potential slowdowns in overall CAPEX growth. This challenge, however, generates a critical opportunity: the demand for power-optimized base station equipment. As energy costs escalate and operators prioritize sustainability, the procurement priority shifts toward energy-efficient Radio Units (RUs) and integrated power systems, lifting refresh demand in the mature market. The opportunity also lies in the industrial sector, where the push for private 5G networks and RedCap (Reduced Capability) technology for Massive Machine-Type Communications (mMTC) creates a specialized demand for small cell base stations and minimalist core network solutions not served by the public macro network.

Raw Material and Pricing Analysis

5G base station equipment, being a physical product, depends heavily on advanced materials. Key components like Radio Units (RUs) rely on radio frequency (RF) front-end materials, including specialized ceramics, organic laminates, and Gallium Nitride (GaN) for high-power amplifiers. The price stability of these materials, particularly GaN components, directly influences the final cost and subsequent procurement volume of 5G RUs. Supply chain bottlenecks in the RF-front-end component sector, a constraint observed globally, pose a risk to the production output of Chinese equipment manufacturers. For operators, the adoption of power-optimized GaN-based base stations is increasingly prioritized, as the long-term operational savings on electricity bills outweigh the potentially higher initial component cost, thus subtly shifting demand toward premium, energy-efficient equipment.

Supply Chain Analysis

The Chinese 5G base station equipment supply chain is characterized by a high degree of domestic vertical integration, primarily centered around major Chinese Original Equipment Manufacturers (OEMs) like Huawei and ZTE. Production hubs are heavily concentrated within China, which provides logistical advantages and tight control over manufacturing processes. However, a critical dependency exists on the global supply of specialized semiconductor components, particularly for high-frequency Radio Frequency Integrated Circuits (RFICs) and GaN power amplifiers used in Massive MIMO antennas. Logistical complexities primarily involve the rapid, large-scale deployment to remote or less-developed areas of the country, requiring robust supply chain coordination between the equipment vendors and the three national telecom operators—China Mobile, China Telecom, and China Unicom.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| China | Ministry of Industry and Information Technology (MIIT) | MIIT's granting of 5G spectrum licenses and its co-construction/co-sharing policy (e.g., China Mobile and China Radio and Television's 700MHz agreement) accelerates deployment by reducing network construction costs for operators, thus increasing their capacity to purchase more base station units. |

| China | MIIT's Notice on Promoting the Evolution of 5G Lightweight (RedCap) Technology | This regulation fosters a new, specialized segment of demand for small, low-power base stations and modules tailored for industrial IoT and smart tourism applications, driving commercial development beyond traditional mobile broadband. |

| China | Radio Regulations of the People's Republic of China (Frequency Licensing) | The use of a licensing system rather than an auction system for mobile communication frequencies avoids high spectrum acquisition costs for operators, freeing up significant capital to invest directly in the physical deployment and purchase of base station equipment. |

________________________________________

In-Depth Segment Analysis

By Type of Base Station: Massive MIMO Antennas

Massive MIMO (Multiple-Input Multiple-Output) antennas are a foundational technology for the Mid-Band (Sub-6 GHz) 5G network in China, representing a significant portion of the installed base. The need for Massive MIMO is directly propelled by the necessity to address the immense network capacity required in dense urban areas and to fulfill the government's target for over 75% of network traffic to be carried on 5G. These units achieve high spectral efficiency, allowing a single base station to handle hundreds of active users simultaneously, a critical requirement for China Mobile, the world's largest mobile carrier by subscribers. The continuing demand is also fueled by the evolution to 5G-Advanced, as new Massive MIMO RUs integrate native-AI capabilities to dynamically optimize beamforming, further enhancing capacity and driving a continuous replacement cycle.

By End User: Enterprise 5G Networks

The Enterprise 5G Networks segment is the key long-term growth catalyst, shifting base station consumption from solely public carrier deployments to private industrial applications. Its growth is driven by major national initiatives to digitize core economic categories, integrating 5G technologies into 71 major economic sectors, including smart mines, intelligent factories, and logistics. This necessitates the deployment of dedicated, small-scale 5G base station infrastructure for private use. Enterprises, unlike Telecom Operators, require deterministic network capabilities—ultra-low latency and 99.999% reliability—to support mission-critical applications like industrial automation. This specific requirement fuels demand for highly specialized small cells, such as ZTE's MiCell micro stations, which integrate edge computing (NodeEngine) directly at the base station level to process data locally, bypassing the public core network and assuring performance.

________________________________________

Competitive Environment and Analysis

The Chinese 5G Base Station Equipment Market is dominated by powerful domestic technology conglomerates that control significant market share and possess deep R&D capabilities. This competitive landscape is characterized by constant innovation, a race to 5G-Advanced, and deep integration with the major state-owned telecom operators.

Huawei Technologies Co., Ltd.

Huawei is strategically positioned as a pioneer in 5G-Advanced (5G-A), leveraging its global leadership to shape the next generation of network standards. The company's strategy is driven by the imperative to transition networks from connection pipes to intelligent engines, exemplified by its launch of the 5G-A Pioneers Program with major Chinese and international operators in June 2024. Huawei's product portfolio includes advanced Massive MIMO Radio Units and integrated BBU solutions that support deterministic networking for complex industrial use cases. The company focuses on the synergistic benefits of AI and 5G-A, positioning its equipment to enable new B2B revenue streams for carriers in fields like industrial manufacturing and smart city infrastructure.

ZTE Corporation

ZTE Corporation maintains a strong strategic position by focusing on specialized solutions for the next phase of 5G deployment, particularly the integration of Artificial Intelligence directly into the RAN (Radio Access Network). Its AIR RAN architecture is centered on "intent-driven intelligent service models" and the commercial deployment of native-AI BBUs. Verifiable details from their official publications indicate a strategic focus on efficiency and performance, with their AI-enabled base stations validated to reduce video service quality issues by 80% and decrease daily energy consumption by over 12%. Furthermore, ZTE leads in specialized segments, having launched the world's first AI 5G Fixed Wireless Access (FWA) product, the G5 Ultra, in February 2024, targeting the growing demand for ultra-high-speed home and enterprise broadband access without fiber.

________________________________________

Recent Market Developments

March 2025: ZTE successfully showcased and promoted its minimalist private 5G-A solution, featuring the MiCell micro base station and NodeEngine computing engine, during MWC 2025. This development is significant as it validates the commercial readiness of a high-performance, low-latency private network architecture. This solution directly addresses the enterprise segment's need for uncompromised service quality, evidenced by achieving an average wireless air interface latency of just 4ms during a live broadcast application, proving its utility for mission-critical industrial and media broadcasting scenarios.

February 2024: ZTE Corporation announced the debut of the ZTE G5 Ultra, the world's first AI 5G Fixed Wireless Access (FWA) device, at MWC Barcelona 2024. The product integrates multidimensional AI network algorithms to achieve a 20% increase in bandwidth utilization and a 30% decrease in network congestion. This product launch strategically targets the consumer and small business market for high-speed internet access, offering an alternative to fiber while driving demand for 5G Advanced-ready outdoor FWA equipment that supports Sub6G and mmW Carrier Aggregation.

________________________________________

China 5G Base Station Equipment Market Segmentation

- BY TYPE OF BASE STATION

- Macrocell Base Stations

- Small Cells

- Open RAN Base Stations

- BY PRODUCT TYPE

- Radio Unit (RU)

- Baseband Unit (BBU)

- Massive MIMO Antennas

- Power Systems & Supporting Equipment

- BY DEPLOYMENT MODE

- Standalone

- Non-Standalone

- BY FREQUENCY BAND

- Low-Band

- Mid-Band

- High-Band

- BY END USER

- Telecom Operators

- Government & Defense

- Enterprise 5G Networks