Report Overview

US 5G Base Station Highlights

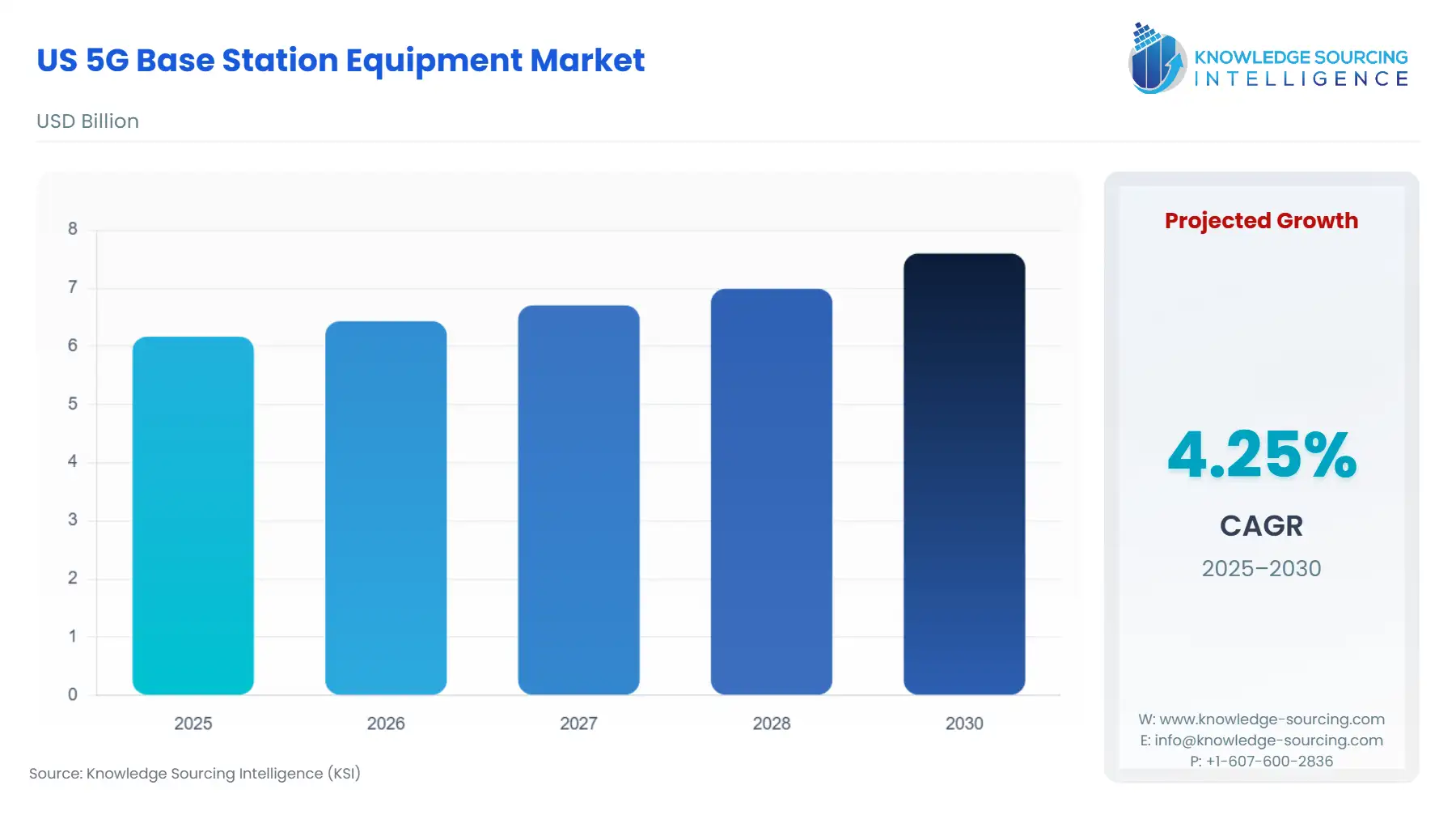

US 5G Base Station Equipment Market is estimated to advance from USD 6.170 billion in 2025 to USD 7.598 billion by 2030, achieving a CAGR of 4.25%.

US 5G Base Station Equipment Market Key Highlights

The U.S. 5G Base Station Equipment Market serves as the foundational layer of the nation's critical digital infrastructure, defined by a distinct deployment strategy and unique regulatory pressures not mirrored in other global markets. This landscape is characterized by high capital expenditure (CAPEX) on newly licensed mid-band spectrum and an unwavering government focus on network security and supply chain integrity. Consequently, demand is driven less by organic consumer uptake, and more by aggressive, federally-influenced infrastructure mandates set forth by the major MNOs to monetize their multi-billion dollar spectrum holdings. The market's complexity now stems from integrating software-defined networking (SDN) and Network Functions Virtualization (NFV) principles into traditional hardware deployment, marking a decisive shift away from monolithic vendor solutions towards more open, multi-vendor ecosystems.

US 5G Base Station Equipment Market Analysis

Growth Drivers

Spectrum availability stands as the primary catalyst propelling equipment demand. The conclusion of the C-Band auction, providing a crucial block of mid-band spectrum (3.7–3.98 GHz), compelled the winning MNOs (Verizon, AT&T, T-Mobile) to immediately initiate massive buildouts of new base stations. This action created direct, immediate demand for a new generation of mid-band-compatible Radio Units and Massive MIMO antennas capable of leveraging this prized frequency. Similarly, the ongoing densification of networks in metropolitan areas, necessary to support increasing mobile data traffic and Fixed Wireless Access (FWA) services, escalates demand for small cells, as macrocells alone cannot provide the required capacity and coverage in dense urban canyons. This infrastructure requirement necessitates the acquisition of smaller, more numerous cell sites and associated hardware.

Challenges and Opportunities

The capital intensity of 5G deployment presents a significant challenge, as MNOs must balance the high cost of spectrum acquisition (e.g., the ~$81 billion C-Band auction) with the substantial CAPEX required for new base station hardware and site leasing, lengthening the return on investment (ROI) horizon. This financial constraint can temper the pace of rural buildouts. Conversely, the opportunity lies in the burgeoning Open RAN movement, which offers a path to lower Total Cost of Ownership (TCO) over time by decoupling hardware and software. The U.S. government’s Public Wireless Supply Chain Innovation Fund (allocated ~$1.5 billion) explicitly supports this architectural shift, creating a guaranteed demand channel for open-interface compliant hardware and software solutions from new market entrants.

Raw Material and Pricing Analysis

The 5G base station equipment is an electronic hardware product, making it highly dependent on the global semiconductor supply chain. Radio Unit (RU) performance relies critically on Radio Frequency (RF) front-end components, which utilize specialized materials like gallium-arsenide and silicon-germanium. Global supply chain bottlenecks in these compound semiconductor materials introduce component lead-time and pricing volatility for manufacturers. Equipment pricing is further complicated by the architectural shift: while Open RAN aims for generic, commercial off-the-shelf (COTS) hardware to reduce unit costs, the initial high-value investment in proprietary, advanced Massive MIMO antenna arrays, which are critical for Mid-Band performance, maintains high overall system costs for the major Tier 1 vendors.

Supply Chain Analysis

The U.S. 5G base station equipment supply chain exhibits a high degree of geopolitical and geographical complexity. Key production hubs for high-value components, including advanced semiconductor fabrication, remain concentrated in Asia-Pacific economies, creating systemic reliance on single-region suppliers, a vulnerability highlighted in the U.S. Department of Commerce's supply chain assessments. Logistical complexities include ensuring the integrity and security of hardware components manufactured overseas before they are deployed in critical domestic infrastructure. The market attempts to mitigate these dependencies through strategic inventory buffering and, increasingly, via the establishment of regional final assembly and testing facilities to shorten the last-mile logistics and enhance security compliance for U.S.-bound equipment.

Government Regulations

| Jurisdiction | Key Regulation / Agency | Market Impact Analysis |

|---|---|---|

| United States | FCC C-Band Auction (Auction 107) | Directly generated a massive, concentrated demand spike for mid-band (3.7–3.98 GHz) capable base station equipment, particularly Massive MIMO RUs, by enabling MNOs to acquire the spectrum necessary for widespread 5G deployment. |

| United States | Secure 5G and Beyond Act of 2020 | This law, alongside FCC rules barring the use of Universal Service Fund (USF) subsidies for 'untrusted' vendors (e.g., Huawei, ZTE), drastically altered the competitive landscape, creating a de facto secure vendor list and guaranteeing demand for compliant suppliers. |

| United States | Public Wireless Supply Chain Innovation Fund | The National Telecommunications and Information Administration (NTIA) allocated approximately $1.5 billion to foster development and deployment of Open RAN and interoperable network technologies, creating direct demand for non-traditional, white-box radio units and cloud-native baseband software solutions. |

In-Depth Segment Analysis

By Frequency Band: Mid-Band

The Mid-Band segment (specifically the 2.5 GHz, 3.45 GHz, and C-Band) dictates the current demand profile for U.S. base station equipment. This frequency range is often referred to as the "sweet spot" of 5G, as it offers the optimal balance of propagation characteristics (coverage area) and available bandwidth (capacity), a critical combination for mass-market mobile broadband. The MNOs' need to deliver a perceptible improvement in user experience—faster speeds and lower latency—across broad geographic areas, unlike high-band (mmWave), which is restricted to dense, localized hotspots, drives this demand. The immense capital outlay for C-Band licenses created a financial and competitive imperative for carriers to rapidly deploy corresponding Mid-Band Massive MIMO Radio Units and upgrade existing baseband capacity to Standalone (SA) architecture. This shift ensures the licenses begin generating return traffic and competitive advantage immediately.

By End-User: Telecom Operators

Telecom Operators represent the single largest end-user segment, with their demand serving as the primary market volume driver. Their purchasing decisions are dictated by two core imperatives: scale and technology modernization. The scale requirement—the need to cover 90% or more of the U.S. population with Mid-Band 5G—fuels consistent, high-volume need for Macrocell Base Stations and their components (RUs, BBUs). The technology modernization driver, however, dictates the type of equipment purchased. The shift to virtualization (vRAN) and the migration from Non-Standalone (NSA) to Standalone (SA) architecture drive demand for software-centric solutions. Operators are prioritizing the replacement of legacy hardware with virtualized Baseband Units (BBUs) and open-interface Radio Units, positioning their networks to leverage network slicing and advanced 5G-enabled services for enterprise customers, thus sustaining demand beyond initial coverage buildout.

Competitive Environment and Analysis

The US 5G Base Station Equipment Market is characterized by a high barrier to entry due to regulatory constraints, immense CAPEX requirements, and the necessity of highly specialized technology. Following regulatory action against non-compliant vendors, the market is primarily a contest between Ericsson, Nokia, and Samsung, with newer entrants like Mavenir and Airspan leveraging the Open RAN ecosystem. Competition centers on technological leadership in Massive MIMO, energy efficiency, and the maturity of Cloud-RAN/vRAN software solutions. The major players compete not just on hardware cost but on the total cost of ownership over a ten-year cycle, including software licensing and operational efficiencies derived from their network management platforms.

Company Profiles

Ericsson AB

Ericsson's strategic positioning in the US market is defined by its deep relationships with major Tier 1 MNOs and its leadership in the Radio Access Network (RAN) domain. The company has aggressively pursued a strategy of software-led evolution, focusing on energy efficiency and AI-powered network optimization features within its 5G Advanced software suite. The company maintains a strong competitive edge by facilitating the complex transition from Non-Standalone to Standalone 5G Core networks, often managing the entire process for its carrier partners. Their key product, the Ericsson Radio System, is the flagship portfolio, which includes Massive MIMO RUs critical for Mid-Band C-Band deployments in the US.

Nokia Corporation

Nokia is positioned as a full-stack network provider, offering an end-to-end portfolio that spans the Radio Access Network, Core, and transport elements. Its competitive strategy in the US focuses heavily on the evolution of Open RAN (O-RAN) and Cloud RAN technologies, establishing a strong presence in the nascent virtualized architecture space. Nokia's official publications highlight its commitment to technological standards, particularly within 3GPP Release 18 (5G-Advanced), and the deployment of its AirScale Massive MIMO product family, which targets the high-capacity needs of urban and suburban Mid-Band coverage buildouts, offering MNOs a path to network modernization through open interfaces.

Fujitsu Limited

Fujitsu occupies a strategic niche in the US market as a leading O-RAN-compliant vendor, primarily focusing on advanced Radio Units and specialized software for network intelligence. The company's strategy is to enable vendor diversity by providing interoperable hardware and software solutions that fit into multi-vendor network environments advocated by the Open RAN paradigm. A key offering is their family of Open RAN Radio Units (RUs), which are compatible with various vendor Baseband Units (BBUs) via open interfaces. Furthermore, Fujitsu is investing in specialized applications, such as their AI-powered QoE (Quality of Experience) software, which offers MNOs tools for proactive network quality management and operational cost reduction.

Recent Market Developments

- October 2024: Ericsson announced the global launch of seven new 5G Advanced software products designed to empower Communication Service Providers (CSPs) with high-performing, programmable networks. This launch, which includes AI-powered RAN features and intent-driven network automation, provides a new monetization layer for MNOs by enhancing performance and operational efficiency. The software is compatible across purpose-built, Cloud RAN, and Open RAN architectures, representing a significant strategic product launch that focuses on network intelligence rather than just hardware capacity.

- October 2024: Fujitsu announced the global implementation of its world's first AI-powered application designed to prevent quality degradation in 5G wireless networks. The application operates on the O-RAN compliant Service Management and Orchestration (SMO) layer, providing real-time Quality of Experience (QoE) estimation and proactive redefinition of base station coverage areas. This product launch directly addresses the operational challenge of maintaining service quality during periods of high traffic and supports MNOs' ability to manage complex Open RAN networks with greater precision.

US 5G Base Station Equipment Market Segmentation

- BY TYPE OF BASE STATION

- Macrocell Base Stations

- Small Cells

- Open RAN Base Stations

- BY PRODUCT TYPE

- Radio Unit (RU)

- Baseband Unit (BBU)

- Massive MIMO Antennas

- Power Systems & Supporting Equipment

- BY DEPLOYMENT MODE

- Standalone

- Non-Standalone

- BY FREQUENCY BAND

- Low-Band

- Mid-Band

- High-Band

- BY END USER

- Telecom Operators

- Government & Defense

- Enterprise 5G Networks