Report Overview

China Antimony Market - Highlights

China Antimony Market Size:

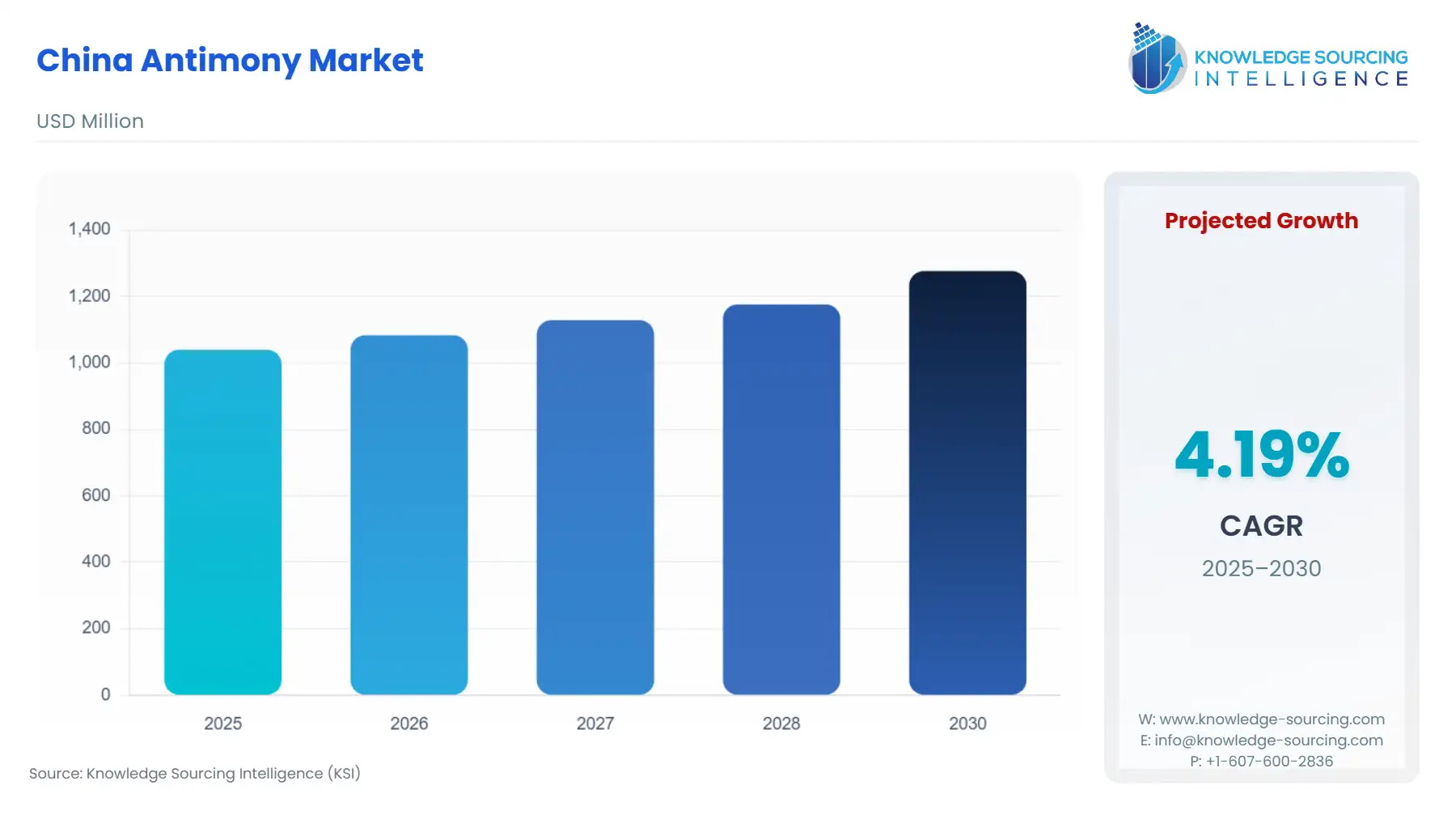

The China Antimony Market is expected to grow at a CAGR of 4.20%, reaching USD 1.277 billion in 2030 from USD 1.040 billion in 2025.

China Antimony Market Key Highlights:

- China controls the majority of global antimony production and refining capacity, giving it significant influence over international supply chains.

- Export restrictions and quotas by China have caused global price volatility, emphasising the strategic importance of diversifying supply sources.

China has established itself as the preeminent global producer and refiner of antimony, and that is important because by controlling the majority of production and refining capacity, China holds enormous potential leverage over international supply chains for antimony, which is a critical mineral used in flame retardants and lead-acid batteries, semiconductors, solar panels, and defence technologies. In recent years, Beijing has increased export restrictions and export licensing requirements, compromising the global supply of antimony and contributing to price spikes. These actions have elevated the critical status of antimony and highlighted the vulnerability of countries relying on imports of a critical mineral subject to export control regulations. In response to China actions, supply chain actors are on their way to developing new non-Chinese sources of antimony, new recycling technologies, and substitution technologies as they work to reduce their reliance on antimony from China. Antimony is used in applications from energy storage to electronics to national security technology, and as a result, China policies on antimony have implications far beyond the antimony economy.

The globalisation of trade in antimony and other critical minerals has implications beyond US-China relations and trade tensions. It now hinges on China domestic regulations and the pursuit of a domestic economic and foreign policy strategy, which will remain front and centre as nations consider their critical mineral supply chains.

China Antimony Market Overview & Scope:

China antimony market dominance in the global supply chain analysis is segmented by:

- Type: Market segmentations include antimony ore, antimony trioxide, antimony alloys and others. Antimony trioxide has the greatest market share of these segments, due to its involvement primarily as a flame-retardant synergist. Antimony trioxide assists in increasing the fire resistance of plastics, textiles, and electronics. This is significant for industries needing to meet fire safety compliance. The bulk of global antimony trioxide refining occurs in China, meaning international supply chains directly relate to Chinese production policies, making any restriction on exports or fluctuations in production have immediate global effects on the availability of flame-retardant materials and prices.

- Application: Market applications include flame retardants, lead-acid batteries, semiconductors, solar panels and others. Of these, flame retardants are the largest application where management of antimony trioxide is required in compliance with international fire safety regulations for construction and consumer products. China is the dominant global antimony supplier and will continue to be the primary in meeting worldwide demand for flame-retardant production.

- End-User Industry: The end-user industry segment includes electronics, automotive, construction, energy, and others. Electronics is the highest value end-user industry as antimony-based materials are critical in supplying circuit boards, semiconductors and other products requiring thermal stability. China export policies for antimony minerals directly affect the electronics supply chain because many manufacturers around the world rely on importing refined products to support production.

- Region: Geographically, the market is expanding at varying rates depending on the location.

Top Trends Shaping China Antimony Market:

- Rising demand for flame retardants

The Antimony exports from China are primarily used in flame retardants for electronic and construction use. With increasing global fire-safety regulations, reliance on China antimony trioxide increased, and consequently, concern over its supply will be a key driver of the global market. - Integration with renewable energy storage

Antimony alloys are important for lead-acid batteries used for solar and backup energy systems. The demand for antimony will continue to grow as the adoption of renewables increases. This will further strengthen China position as the supplier for global clean energy supply chains.

China Antimony Market Growth Drivers vs. Challenges:

Drivers:

- China dominance in reserves and refining: China holds a firm grip on most of the world antimony reserves and all refining capability globally. This means that China can dictate domestic consumption and exports, limiting non-Chinese businesses from using antimony in production, and shaping global market conditions. By maintaining this superiority, there is a continuous reliance on Chinese antimony, which China is then able to exert influence over prices and trade flows.

- Expanding demand in energy storage and semiconductors: Increased demand for energy storage systems and semiconductors. There are antimony alloys in lead-acid batteries for durability, even in electric vehicles, grid storage, and renewable energy systems. There are also antimony-based compounds in semiconductors to improve heat resistance and facilitate performance. The increasing dependence in both sectors is a driving global demand. China stands alone within its capacity to service this need; as a result, China will remain central within the context of these applications and will be able to influence the prices of antimony at a global level.

Challenges:

- Global dependence on Chinese supply: The entire world relies on China for antimony. Any form of restrictions instituted by China on our supply, such as quotas, export bans, or reductions in production, would drive prices to levels where production would cease in many global industries.

China Antimony Market Regional Analysis:

- Asia-Pacific: China is growing steadily in both antimony production and refining throughout the Asia-Pacific region, supplying local markets domestically. China export policies and quotas affect the availability and costs of antimony in neighbouring countries. Antimony is used in key industrial sectors such as electronics and the electrical industry, automotive, construction, and energy, in fire retardants, batteries, and semiconductor materials. The reliance on China for antimony creates supply chain uncertainty for the region, driving some nations, such as India, Japan, and South Korea, to explore local production, recycling, and alternative materials. These efforts to mitigate reliance on China continue; however, China remains the largest supplier of antimony in the Asia-Pacific region, and its domestic policies impact local markets in the region and influence trade relationships between countries worldwide.

China Antimony Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| China Antimony Market Size in 2025 | USD 1.040 billion |

| China Antimony Market Size in 2030 | USD 1.277 billion |

| Growth Rate | CAGR of 4.20% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in the China Antimony Market | |

| Customization Scope | Free report customization with purchase |

China Antimony Market Segmentation:

- By Type

- Antimony Ore

- Antimony Trioxide

- Antimony Alloys

- Others

- By Application

- Flame Retardants

- Lead-Acid Batteries

- Semiconductors

- Solar Panels

- Others

- By End-User Industry

- Electronics

- Automotive

- Construction

- Energy

- Others