Report Overview

China Electronic Health Records Highlights

China Electronic Health Records (EHR) Market Size:

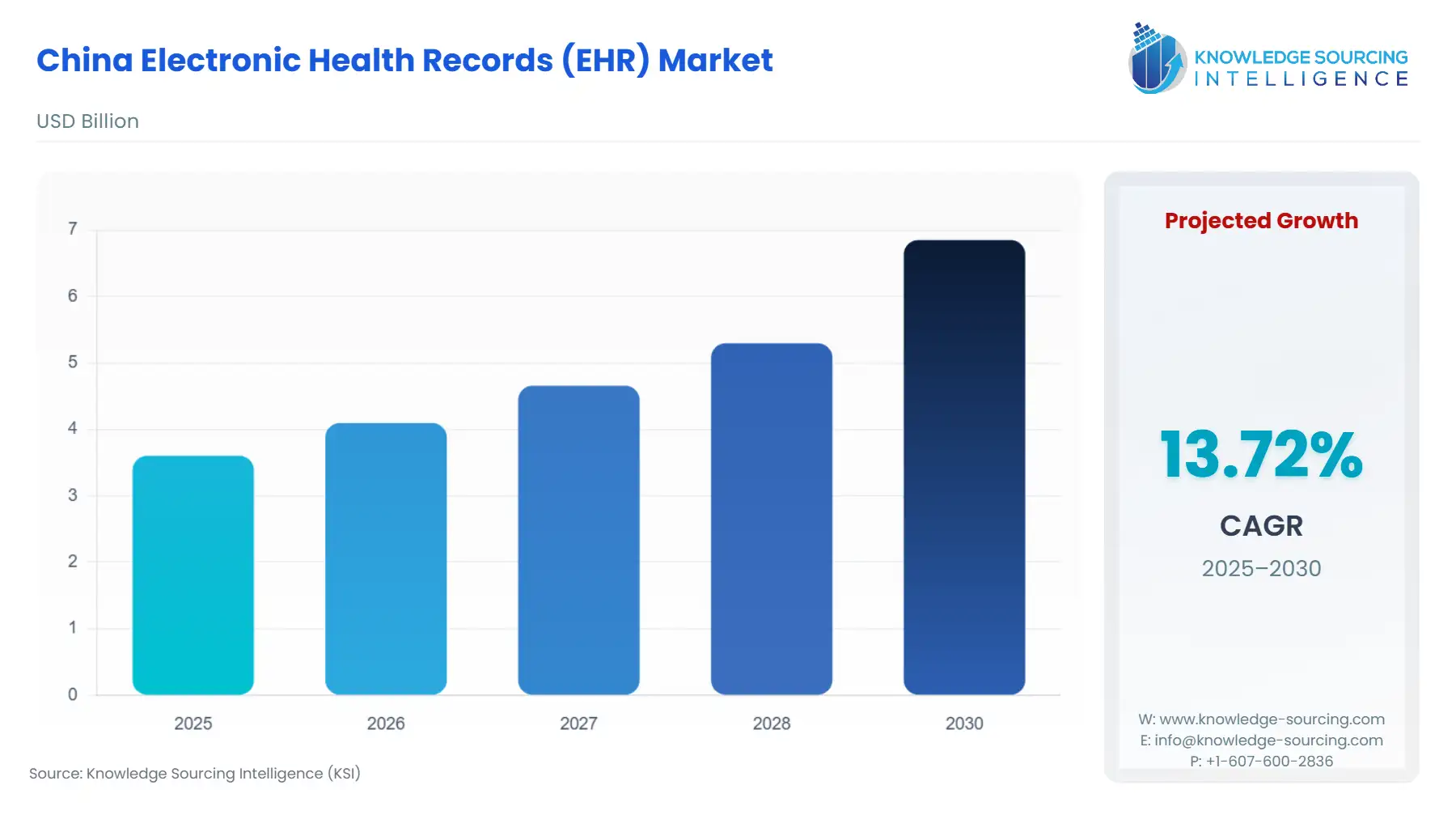

The China Electronic Health Records (EHR) market is estimated to grow at a CAGR of 13.71% during the forecast period, reaching a market size of USD 6.851 billion in 2030, from USD 3.603 billion in 2025.

China Electronic Health Records (EHR) Market Key Highlights:

- China is a key dominant market in the Asia-Pacific region. The market is driven by the growing government policies for digitalization, the development of smart hospitals, and higher hospital adoption.

- The market is growing at a rapid rate, driven by increasing government focus, adoption by end-users, and increasing focus on efficiency in operations.

Key factors such as government mandates, large patient volume, demand for effective data management, coupled with growing adoption of digital solutions by the end-users themselves, such as growing AI adoption, are significantly driving the EHR adoption by the end-users, driving the Chinese electronic health records market. As per JMIR, between 2007 and 2018, the number of hospitals that adopted EHRs in China exceeded 16,000, which was 3.3 times that of the 4814 nonfederal US hospitals.

China Electronic Health Records (EHR) Market Overview & Scope

The China Electronic Health Records (EHR) Market is segmented by:

- Product: By product, cloud-based EHR and on-premise EHR are the two major types of products. Cloud-based EHRs are the dominant product adopted in the market, driven by their benefits such as accessibility from any location, cost-effectiveness by drastically reducing the upfront costs, and hardware and IT staff costs. On the other hand, on-premise EHR holds significance, particularly among organizations requiring complete control.

- Type: By type, acute, ambulatory, and post-acute are major categories. Acute EHRs are specifically designed for electronic documentation of a patient's medical information during the acute care settings, such as in an emergency room. These are in demand due to their real-time updates, integration with other systems, and help in maintaining workflow. The ambulatory EHR is designed for outpatient healthcare settings. They comprise a significant share due to their demand for managing patient interactions, utilising patient portals, and supporting billing and coding. Post-care EHR is also a growing segment.

- End User: Hospitals, clinics, pharmacies, laboratories, and others mainly demand these electronic health records. Hospitals are the dominant segment due to the higher volume of demand for electronic health records systems.

Top Trends Shaping the China Electronic Health Records (EHR) Market

- Demand for cloud-based EHR

- The demand for cloud-based EHR is growing in this market, driven by the growing demand for cost-effective and scalable solutions.

- The growth of the Chinese economy has grown healthcare facilities, leading to the growing demand for cloud-based EHR among small and medium-sized organizations.

China Electronic Health Records (EHR) Market Growth Drivers vs. Challenges

Drivers:

Challenges:

- Interoperability Issues: One of the key factors impacting the China EHR market is the interoperability issues. China has a lack of standardized data formats and policies for the standardization of EHR, resulting in different healthcare facilities adopting different formats, making interoperability difficult.

China Electronic Health Records (EHR) Market Competitive Landscape

The market is moderately fragmented, with the dominance of local and regional EHR vendors. Some of the major players operating in the China Electronic Health Records (EHR) market include Goodwill E-Health Info, Neusoft Corporation, Winning Health Technology, B-Soft, DHC Software, iSoftStone, Oracle Health, and Epic Systems.

China Electronic Health Records (EHR) Market Scope:

| Report Metric | Details |

|---|---|

| Study Period | 2021 to 2031 |

| Historical Data | 2021 to 2024 |

| Base Year | 2025 |

| Forecast Period | 2026 – 2031 |

| Report Metric | Details |

| China Electronic Health Records (EHR) Market Size in 2025 | USD 3.603 billion |

| China Electronic Health Records (EHR) Market Size in 2030 | USD 6.851 billion |

| Growth Rate | CAGR of 13.71% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Forecast Unit (Value) | USD Billion |

| Segmentation |

|

| List of Major Companies in the China Electronic Health Records (EHR) Market |

|

| Customization Scope | Free report customization with purchase |

China Electronic Health Records (EHR) Market Segmentation:

- By Product

- On-Premise

- Cloud-Based

- By Type

- Acute

- Ambulatory

- Post-Acute

- By End-User

- Hospitals

- Clinics

- Pharmacies

- Laboratories

- Others

Our Best-Performing Industry Reports:

- Healthcare Natural Language Processing (NLP) Market

- Healthcare Compliance Software Market

- Healthcare Data Storage Market