Report Overview

Electronic Health Record (EHR) Highlights

Electronic Health Record (EHR) Market Size:

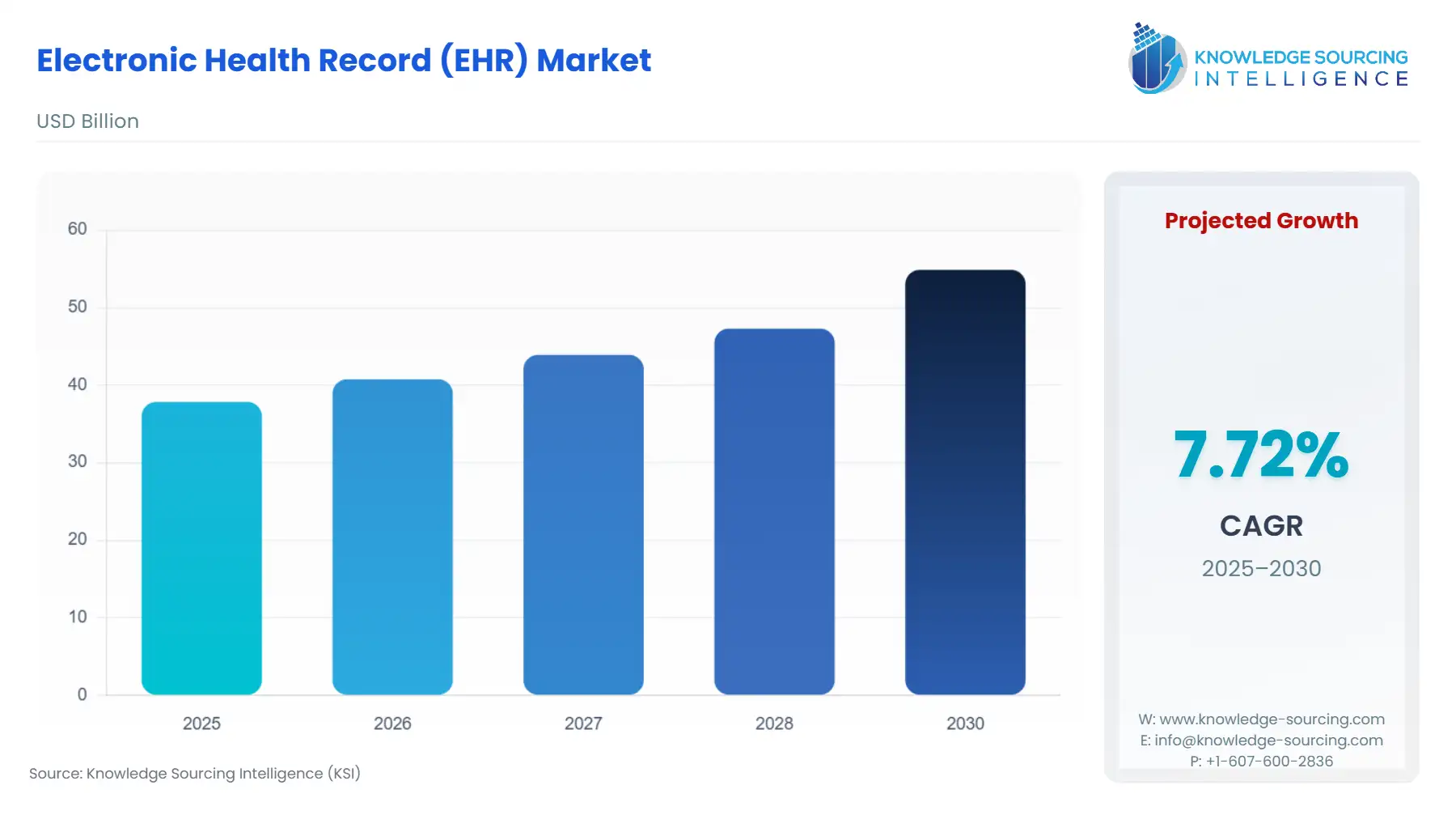

The Electronic Health Record (EHR) Market will reach US$54.884 billion in 2030 from US$37.838 billion in 2025 at a CAGR of 7.72% during the forecast period.

Electronic Health Records have become central to how healthcare systems operate. As a result of government initiatives aimed at creating a more advanced digital health infrastructure and improving interoperability and use of real-time data in healthcare systems, EHRs have become the backbone of how healthcare systems operate. Since the introduction of Federal Programs encouraging U.S. hospitals and physician practices to adopt EHR systems, there is nearly 100% penetration of EHR adoption among both types of providers. As a result, EHR systems have become highly commoditised, with market share primarily determined by compliance, performance, and integration capabilities. Likewise, as countries such as India continue to grow rapidly, with the Ayushman Bharat Digital Mission generating millions of Digital Health IDs and linking a growing number of records to national repositories, the demand for EHR systems that are compatible with government APIs, security regulations, and data-sharing requirements has increased significantly. NHS Digital Maturity Assessments in England illustrate that while most NHS digital organisations have implemented EHRs, many still need updating. Therefore, there continues to be room for growth and opportunity for the existing and emerging vendors in this marketplace. Overall, efforts led by governments represent the most significant drivers of vendor positioning and projected market share growth.

Electronic Health Record (EHR) Market Overview & Scope

The Electronic Health Record (EHR) Market is segmented by:

Product: The market is segmented by Product. In terms of Product type, the on-premises and cloud-based segment is rapidly expanding due to the cost advantages of hardware, simplification of upgrades, and allowing clinicians to work from a distance through remote access. Facilities are now able to scale up their digital workflows with less capital investment using a cloud-based solution.

Type: The Overall Type Segmentation consists of three major types of EHRs, namely Acute, Ambulatory, and Post-Acute. Acute EHRs are the most prominent because they entail a complete, integrated system that can accommodate a high volume of patient records, allows for emergency workflows, and provides real-time data exchange between departments. This market segment has become crucial within large technology-driven healthcare networks.

End-User Industry: The End Users of the EHR market have several categories: Hospitals, Clinics, Pharmacies, Laboratories and Others. Hospitals represent the largest segment of users within the market because of the need for advanced compliant systems which support multiple complex record keeping, including the diagnostics, imaging, and care coordination. As Hospitals continue to demand higher levels of interoperability and upgrade their digital maturity, the Acute EHR segment will become more firmly entrenched.

Region: Geographically, the market is expanding at varying rates depending on the location. North America currently represents the greatest market share due to government programs and the high level of digital readiness throughout the healthcare system, and virtually all hospitals use EHRs. Europe is next, driven by upgrades from national health systems, while the Asia Pacific region is rapidly growing as countries increasingly implement digital health infrastructure and adjust to utilising cloud-based infrastructure to support the influx of patients.

Top Trends Shaping the Electronic Health Record (EHR) Market

Shift Toward Interoperability and National Health Exchange Integration

One of the most significant trends is the shift towards interoperability and the integration of national health exchange systems with electronic health records (EHRs). Healthcare systems are increasingly requiring their EHR systems to be able to interface seamlessly with the various national digital health platforms, public registries, insurance databases, and diagnostic networks. As a result of this trend, the government has been establishing strict standards for APIs, security of data, and the ability to transport health records across organisational boundaries. This trend has changed how healthcare vendors will develop their products, as the focus of healthcare purchasers is now to have EHRs that will enable seamless exchange of data between hospitals, laboratories, pharmacies, and telehealth service providers in a non-fragmented manner.

Rapid Transition to Cloud-Based, AI-Enabled EHR Systems

A second trend that is accelerating is the move away from on-premise legacy EHR systems towards cloud-based, artificial intelligence-enabled EHR platforms that provide faster implementations, lower costs of servicing, and instant access. Vendors are integrating AI technology into their cloud solutions in order to automate record-keeping activities, reduce clinician workloads, flag risks, and provide enhanced clinical decision-making. As a result of this trend, there is an increasing need for scalable and secure cloud-based solutions that will meet the increasing volume of patient records and will support the continually changing requirements of the digital health space.

Electronic Health Record (EHR) Market Growth Drivers vs. Challenges

Drivers:

Growing burden of chronic diseases & rising demand for coordinated care: Rising Need for Effective Coordination of Care and Chronic Disease Burden. Chronic diseases such as diabetes, cardiovascular disease, and respiratory disease are increasingly prevalent throughout the world. Therefore, healthcare organisations are using EHR (Electronic Health Record) systems as tools for managing patients' continuous care, monitoring their health long-term, and providing preventative treatment. EHR software allows organisations to track patients' medications and labs, and monitor patients' health over time, including their family history, and perform clinical follow-ups. This allows healthcare organisations to better coordinate patient care and thereby be more reliable than paper records.

Government digital-health initiatives, regulation, and push for standardisation: EHR adoption is supported by governmental and regulatory initiatives through national digital health initiatives, incentive programs, and interoperability regulations. An example of such a regulatory framework is the recently implemented European Union Health Data Space regulation that encourages standardisation of health records. Furthermore, the Ayushman Bharat Digital Mission in India has introduced several million health ID cards and linked hundreds of millions of health records across the Indian public and private healthcare systems to support the widespread transition to using EHR systems by healthcare providers.

Challenges:

Data Interoperability Gaps: Many healthcare systems still struggle to exchange records smoothly across hospitals, clinics, labs, and pharmacies. Differences in standards, legacy software, and inconsistent API adoption slow down real-time data flow. This creates fragmentation, reduces care coordination, and forces providers to rely on manual workarounds.

Cybersecurity and Patient Data Protection: As EHR systems become more connected and cloud-based, the risk of breaches and unauthorised access increases. Healthcare providers must comply with strict privacy laws, invest in secure infrastructure, and maintain constant monitoring. Smaller facilities often lack resources, making them more vulnerable to cyber threats and operational disruptions.

Electronic Health Record (EHR) Market Regional Analysis

North America: North America is ahead of other regions in the world regarding EHR adoption due to the push by federal governments, funding bodies, and large public hospitals to have an early digitalisation of medical records. Almost all non-federal acute-care hospitals in the U.S. have now adopted some form of EHR, and the vast majority of office-based physicians are also utilising EHRs; thus, North America has a mature marketplace that focuses heavily on the three major components of interoperability, clinician workflow, and regulatory compliance. The new regulations introduced by U.S. agencies, CMS interoperability initiative, and the API/standards enforcement efforts are driving vendor priorities to move toward real-time exchange of data, patient access to their health information, and alignment with other EHR vendors and their respective networks. Therefore, from a global perspective, North America is considered both a demanding customer and a benchmark for product design among all EHR vendors.

Electronic Health Record (EHR) Market Key Development:

November 2025: Athenahealth Introduces AI-Native Clinical Encounter Experience Athenahealth launched its fall product release featuring 185 enhancements, including AI-enabled summaries of external documents and "Sage," a native assistant designed to surface critical patient insights within the EHR at the moment of care.

October 2025: Oracle Health’s AI-powered EHR achieved ONC Health IT certification (v25) and DEA EPCS compliance, making it ready for adoption by ambulatory practices in the U.S. with embedded AI and interoperability.

August 2025: Oracle Health launched its next-generation AI-driven Electronic Health Record (EHR) built natively with AI on cloud architecture, available for ambulatory providers and designed to streamline workflows and administrative tasks.

August 2025: Epic unveiled AI agents and foundational models for clinical charting, patient interactions, and revenue cycle management at UGM25, expanding its EHR platform with tools like Art for Clinicians, Emmie, and Penny.

March 2025: Epic announced new AI-enabled capabilities at HIMSS 2025, introducing generative and conversational AI features woven into its EHR platform to improve clinical workflows, documentation, and patient engagement.

Electronic Health Record (EHR) Market Scope:

| Report Metric | Details |

|---|---|

| Total Market Size in 2025 | USD 37.838 billion |

| Total Market Size in 2030 | USD 54.884 billion |

| Forecast Unit | Billion |

| Growth Rate | 7.72% |

| Study Period | 2020 to 2030 |

| Historical Data | 2020 to 2023 |

| Base Year | 2024 |

| Forecast Period | 2025 – 2030 |

| Segmentation | Product, Type, End-User, Geography |

| Geographical Segmentation | North America, South America, Europe, Middle East and Africa, Asia Pacific |

| Companies |

|

Electronic Health Record (EHR) Market Segmentation:

By Product

On-Premise

Cloud-Based

By Type

Acute

Ambulatory

Post-Acute

By End-User Industry

Hospitals

Clinics

Pharmacies

Laboratories

Others

By Geography

North America

United States

Canada

Mexico

South America

Brazil

Argentina

Others

Europe

United Kingdom

Germany

France

Italy

Others

Middle East and Africa

Saudi Arabia

UAE

Others

Asia Pacific

Japan

China

India

South Korea

Taiwan

Others